CBRE Cambodia is pleased to announce the launch of Q1 2023 Market Insights that providing key updates on Phnom Penh’s Commercial (Office, Retail & Industrial) and Residential sector in real estate industry.

We launch our Q1 2023 Market Insights event, “in the context of rising constraints in the global economy whether it be rising interest rates, western economies on the brink of recession impacting exports, the conflict in Ukraine and the Chinese real estate market under pressure, in a Cambodia more globalized than ever, we face a great number of headwinds that are expected to persist into the short to mid-term" said Lawrence Lennon, Managing Director of CBRE Cambodia.

"At a more micro level, the Phnom Penh real estate market is currently the most competitive and challenging it has ever been. We urge all players to update their “playbook” to that of the 2023 context, understanding the coming years are not going to necessarily reflect those of the preceding decade - the game has fundamentally changed as supply continues to rise and demand remains lackluster," Lennon added.

Hospitality

The number of international tourist arrival in Cambodia rebounded to 2.3 million in 2022, which is 35% of the previous peek in 2019. This year it is forecasted that the number will double to 4 million, on the back of the SEA Games 2023 and ASEAN Para Games. On top of these international events, the Cambodian Government focuses on sport activities to drive local tourism in major provinces including bike races and marathons.

In terms of hotel supply, the first three months of 2023 saw increased activities of new hotel completions in Phnom Penh. There were 4 new notable completions, all in the 4-star classification including international brands such as Fairfield, Fraser and Accor’s Ibis. Throughout 2023, the market expects to welcome over 1,500 keys in the 4 and 5-star categories to be completed, pushing the total supply by 11%.

Room rates and occupancy rates recover gradually with the return of international travellers although at a slow speed. The budgeted hotels have been seen to pick up quicker than the higher-end ones.

Office

New office supply is expected to continue to climb up this year with an addition of 203,000 sqm of office space to be complete by the end of 2023, pushing the total supply by 21% to over 1,150,000 sqm. In the first quarter of 2023, approximately 61,000 sqm of this amount is added to the existing supply with the completion of 4 office buildings.

Average occupancy rate for centrally owned buildings improved slightly from the previous quarter to 73%. However, for strata-titled offices, the occupancy rate is almost halved of centrally owned buildings’ at only 39%. Overall, the average occupancy rate across all office types is 65%.

Although, quoting office rents across all grades in central business district and non-central business districts increased between 1% to 5% quarter-on-quarter, achieved rents still stabilized. This signals the market not having any significant improvements yet compared to 2022. With the upcoming supply over the rest of 2023 and the fewer business expansions, thus low new demand of office spaces, we expect further pressure on office rents and occupancy levels throughout 2023.

“Whilst the current office market has not shown signs of recovery to the pre-pandemic level, this market will continue to favour tenants, creating opportunities to relocate to higher-quality office space in central locations with more competitive fees and other non-financial benefits from landlords,”– said Daluch Chin, Senior Manager, Valuation & Advisory of CBRE Cambodia.

Retail

Following the lineup of new launches and completions of multiple retail projects in 2022, Q1 2023 saw only one new completion of Prince International Plaza, and no new launch. However, new retail supply is expected to grow further by about 18% with over 119,000 sqm remained to complete by the end of the year. The southern part of Phnom Penh City is the hot spot for new retail projects with 5 newly completed projects and 8 upcoming projects, adding up to almost 30% of the total retail supply in the city in terms of Net Leaseable Area.

The average occupancy rate stabilized compared to the previous quarter at 70.2%. High streets become more popular as brands choose to expand to high streets for better prominence and easier accessibility for both customers and delivery agents. This is reflected in the increased quoting rents for Prime High Streets in the city.

“The slowdown in new retail supply this quarter is a healthy sign to allow the heated market some time to cool down”– said Daluch Chin, Senior Manager, Valuation & Advisory of CBRE Cambodia.

“However, with the expected supplies by the end of the year, combined with high inflation rate, we still forecast the occupancy rates and rental rates to continue to experience downward pressure over the rest of this year” – added Daluch.

Residential

Following an aggressive expansion over the past few years, the residential real estate market in Q1 2023 is facing a tough competition in sales, coupling with weakened demands. Only a few condominiums and landed property projects in prime locations managed to maintain or slightly grow their asking price. The majority of developers continue to offer discounts and more favorable payment terms.

The first three months of 2023 saw two new condominium launches introducing 1,300 units to the pipeline, and five project completions adding 3,900 units to the total supply. By the end of this year, the condominium supply is expected to accumulate to nearly 58,000 units, a 20% increase Y-o-Y.

An average asking price for high-end condominium is stagnant at US$2,609/sqm of net salable area, while asking price for mid-range and affordable condominiums dropped by 0.4% and 0.1% respectively. “For the remainder of 2023, we expect see the condo sale prices stabilize as new launches slow and the market taking the time to absorb the remaining stocks” – said Kinkesa Kim, Deputy Managing Director of CBRE Cambodia.

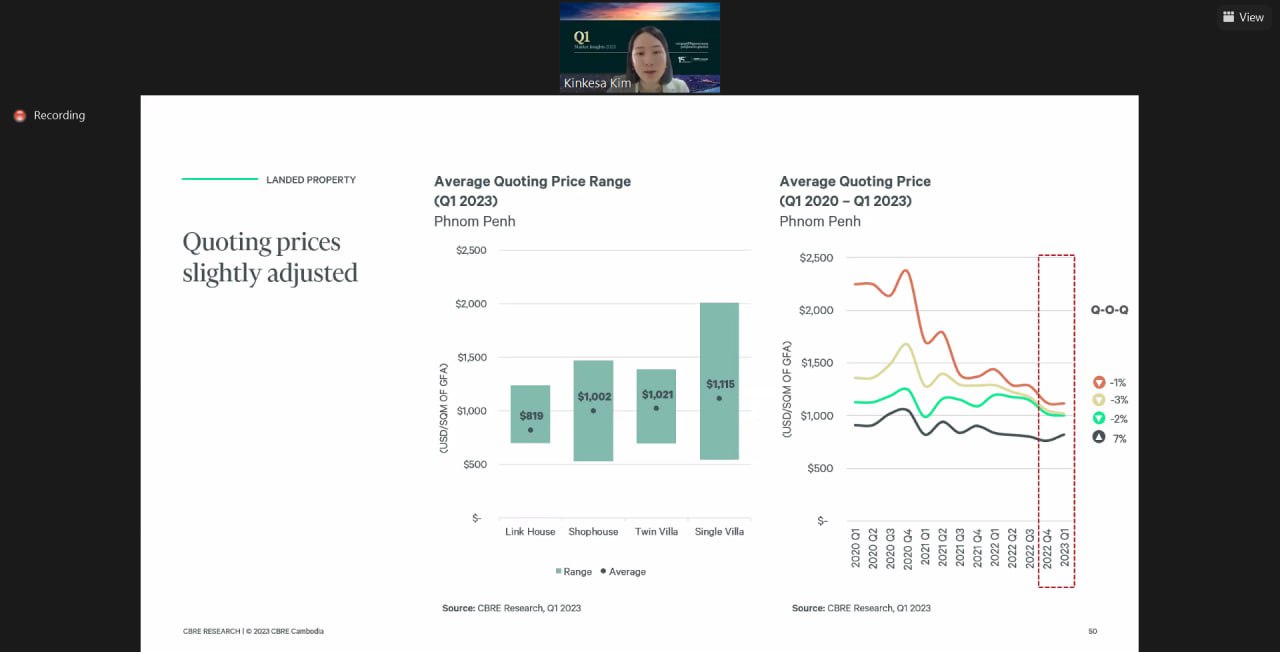

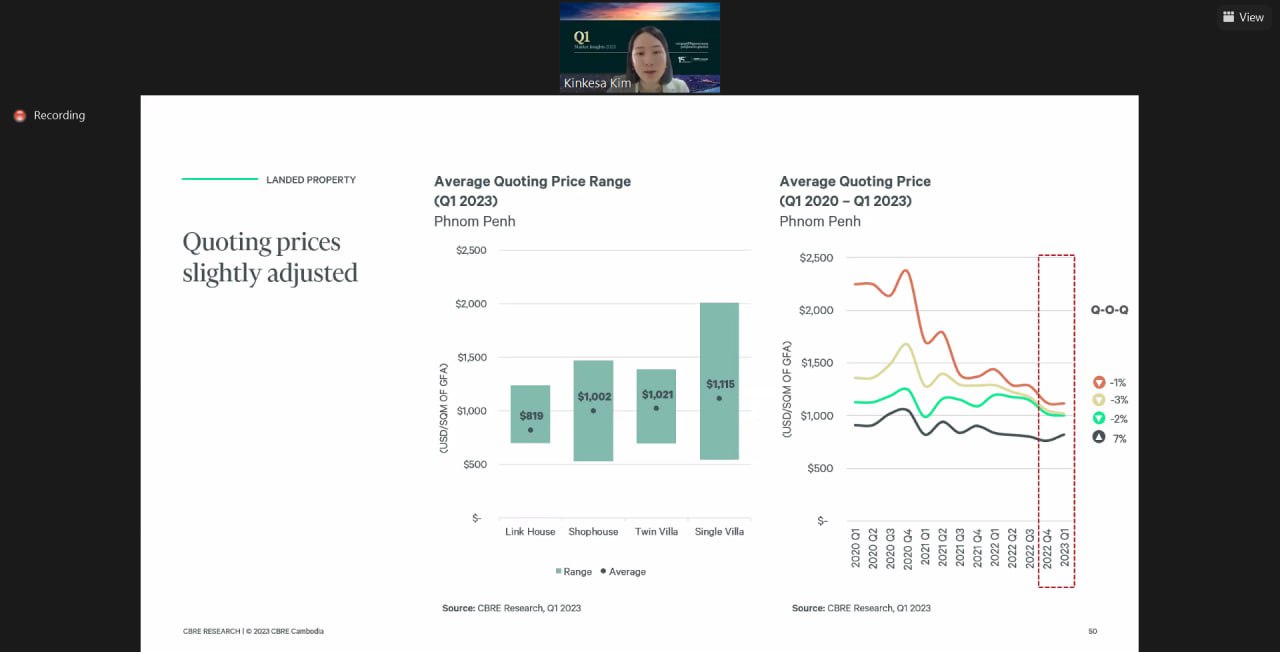

As for landed property, the first quarter of 2023 was the slowest quarter in terms of project launches in the past 5 years. There were only 4 new launches and 7 completions, whereas historically, there were between 20 to 30 new launches per quarter. This shows early signs of cooling down after a prolonged period of aggressive selling activities.

Quoting sale prices slightly adjusted downward quarter-on-quarter between 1% to 3% for all unit types except for linked houses. Linked houses saw an increase of 7% in quoting sale price over the same period. This is due to the lower ticket price for this house type and is most suitable for a wider pool of local home buyers.

“The slow down in the landed property market is a result of rising interest rates and tighter financial options from banks and financial institution,” said Mrs. Kinkesa Kim. “Developers have to provide longer payment terms to make their products more affordable. Therefore, handover time also got extended from the usual period of 24 months to 36 months as a reflection of slower cash inflow from buyers.”

Click here to view and download the report.