Full border reopening with mainland China, the scrapping of all quarantine controls and COVID-related curbs have been the positive aspects of the first quarter of 2023 that gave a boost to the property investment market, with both the hospitality and retail sectors being the first to benefit, according to Savills in its Market in Minutes - Hong Kong Investment report for Q1/2023.

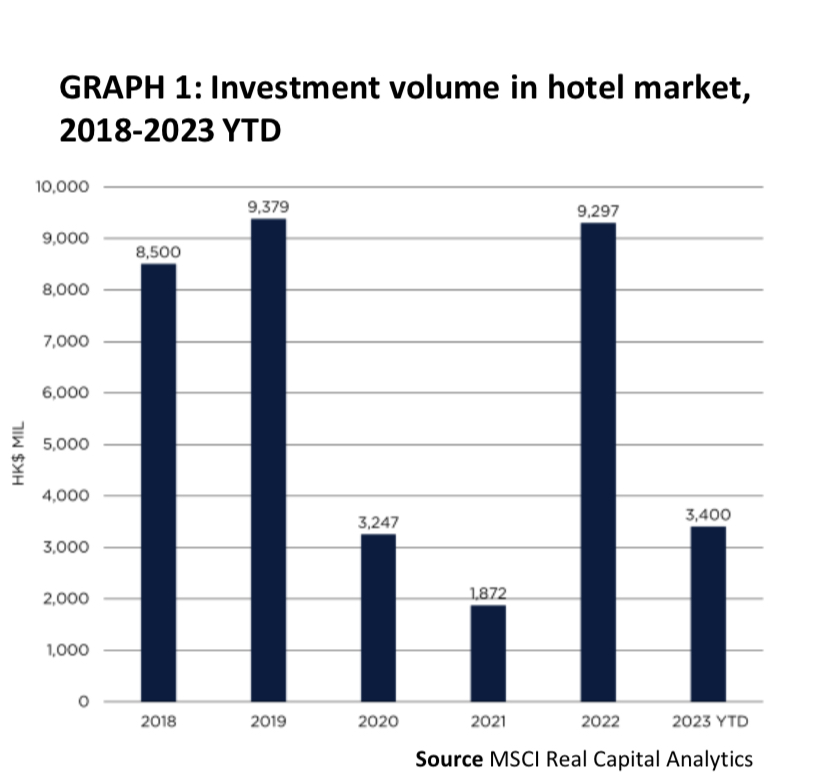

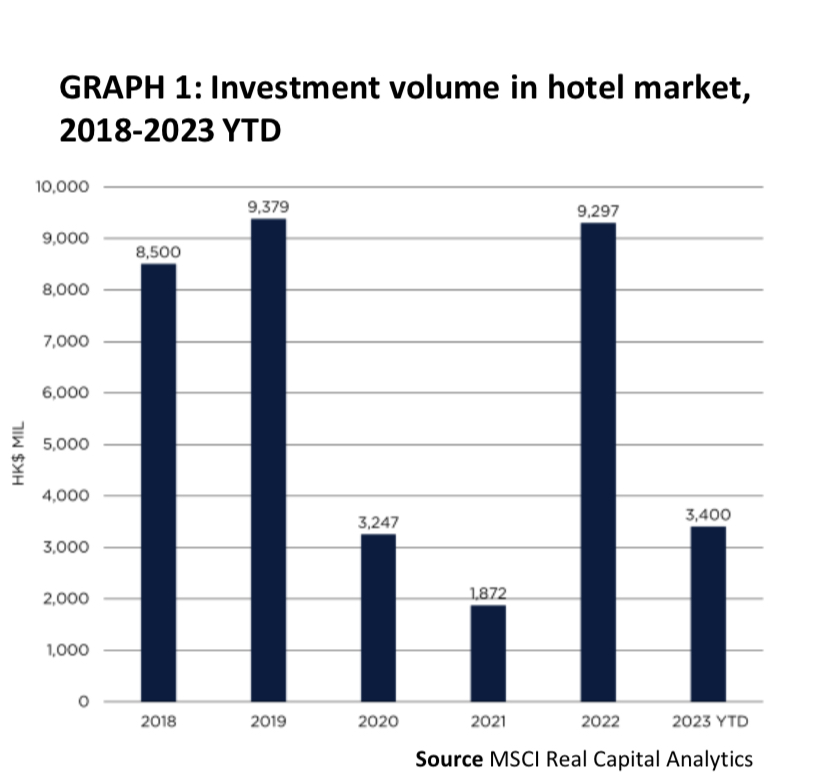

Surging interest in hotel investment

The hotel sector saw an instant rebound after border reopening. Both the occupancy and the average daily rate improved significantly in the first two months of 2023 to an average of 72% and HK$1,103 per night respectively, with the revenue per available room surging to HK$797 per night, up 49% year-on-year. Hotel investment has already heated up from last year with 7 hotels being sold for HK$9.3 billion (up 397% year-on-year), over half of which were acquired by PERE funds. PRC buyers entered the frame this year with China Tourism Group purchasing the Kimberley Hotel in Tsim Sha Tsui for HK$3.4 billion (HK$6.28 million per key). Buoyed by continuous deal flows and a recovering tourism sector, around 30 hotels were made available to the market, with some vendors already firming up on asking prices.

Retail investment activity strengthened in Q1

With the return of Mainland tourists and other visitors, which amounted to 4.4 million in the first three months of 2023, cosmetics and drugstore retailers, for one, were actively vying for expansion opportunities in tourist areas. Local investors bought a prime shop on Nathan Road in Tsim Sha Tsui for over HK$300,000 per square foot, a recent high, while the suburban retail continued to attract long-term investors, as illustrated by the transactions of retail podiums of West 9 Zone and One Kai Tak (I & II) with yields of over 5%. The active market reflected the changing appetite for investors in the era of high interest rates.

Rising interest rates overshadow investment prospects

With the 3-month HIBOR standing at 3.5% by mid-April, cost of funds for property investors could easily reach 5% to 6%. Given the Fed is likely to increase rates further by 0.25% to 0.5% over the rest of 2023, the escalating cost of funds will be an obstacle for investors despite the improving business and market sentiment.

Office price trends to be undermined

In Q1, the tender sale of Sai Yee Street in Mong Kok was closed for HK$4.729 billion, or for an accommodation value (AV) of HK$3,103 per square foot, after the cancellation of three consecutive tenders in the same quarter. The AV of the 320-metre landmark development was the lowest among similar landmark developments in Kowloon over the past decade, and was even lower than the AV of two industrial sites in Kwai Chung and Fanling being tendered last year. Such a low pricing benchmark, though for a specific landmark project with multiple development conditions, would inevitably affect future commercial asset valuations, which are already on the low side after the sales of Goldin Financial Global Centre for an average price of HK$6,569 per square foot early this year.

Office prices may therefore continue to drift in the near term, though there may be reviving demand from local end users and old families, as well as new source of demand from the new wealthy generation in the Mainland, in particular those from the Greater Bay Area, after border reopening. Savills expects the prices of Grade A office will continue to drop by another 5% to 10% in 2023, contrast with a forecast growth of 10% to 15% for prime street shops.

Mr. Jack Tong, Director, Research & Consultancy of Savills said: "While buoyant hotel sentiment induces around 30 vendors to test the market, high cost of capital reaching 5% to 6% remains a major stumbling block to the rebound in volume."

Mr. Peter Yuen, Managing Director, Investment & Sales of Savills commented: "Compared with the lack-lustre sales of office, retail transactions are heating up in the quarter on the back of border reopening and improved business sentiments, and investors are expected to act fast to seize the opportunities."