Savills 2023 Korea Retail Market Outlook Report

Contact

Savills 2023 Korea Retail Market Outlook Report

While rents in Seoul’s major retail districts have drifted sideways in 2022, future rental growth will be determined in part by the attractiveness of the physical store in providing customer experiences.” Says 2023 Korea Retail Market Outlook Report by Savills, Simon Smith Savills Regional Head of Research & Consultancy Asia Pacific and JoAnn Hong Savills Director of Research & Consultancy Korea.

While rents in Seoul’s major retail districts have drifted sideways in 2022, future rental growth will be determined in part by the attractiveness of the physical store in providing customer experiences.” Says 2023 Korea Retail Market Outlook Report by Savills, Simon Smith Savills Regional Head of Research & Consultancy Asia Pacific and JoAnn Hong Savills Director of Research & Consultancy South Korea.

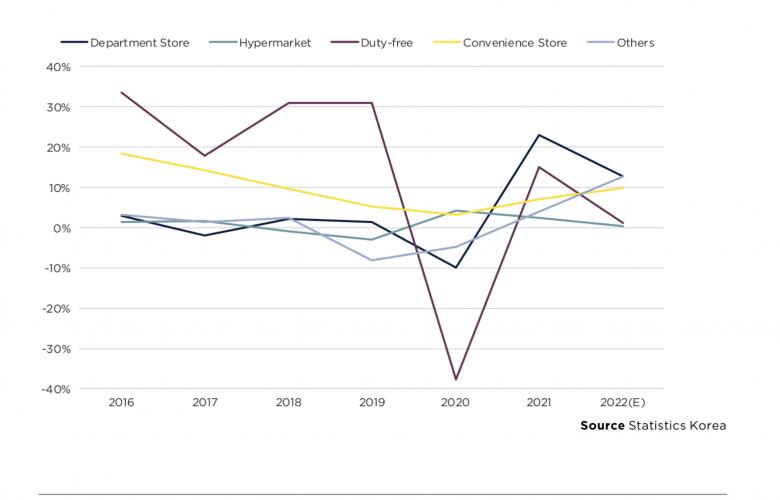

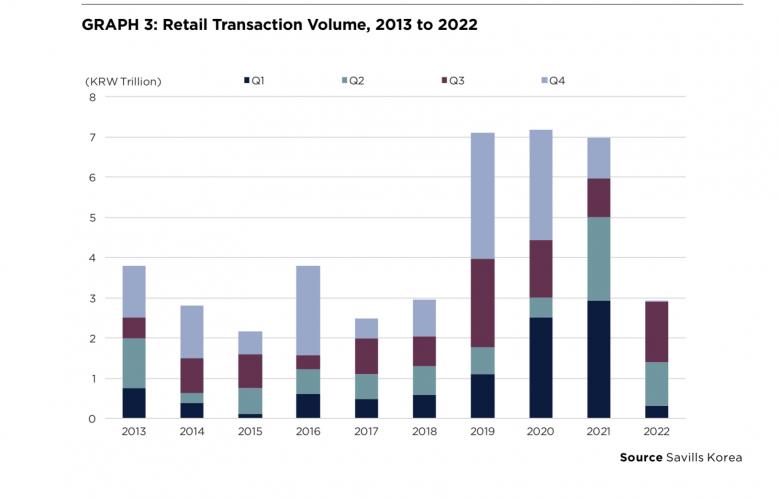

Retail sales have increased at an estimated rate of 7% YoY. Consumer sentiment, suppressed by the pandemic over the past two years, has turned finally positive, and department store sales recorded double- digit growth of 13% YoY in 2022, following 23% YoY in 2021.

In contrast, hypermarket sales growth has dwindled from increasing at year-on-year rates of 4% in 2020 to 2% in 2021 and to 0.3% in 2022 on the combined effects of people’s tendency to avoid crowds and the demographic shift to single-person households.

On the other hand, convenience stores (“CVS”) expanded by 7% YoY in 2021 and 10% YoY in 2022, supported by government subsidies and the increased popularity of short-distance delivery services.

CVS operators in Korea are reportedly making substantial investments in e-commerce, in the forms of order reservations and delivery services through mobile applications as well as by extending the selection of private brand products and alcoholic beverages.

Key Findings:

- Total retail sales rose by 7% year-on-year in 2022, of which convenience stores have expanded at a rate of 10% on the back of government subsidies and the popularity of short-distance delivery services.

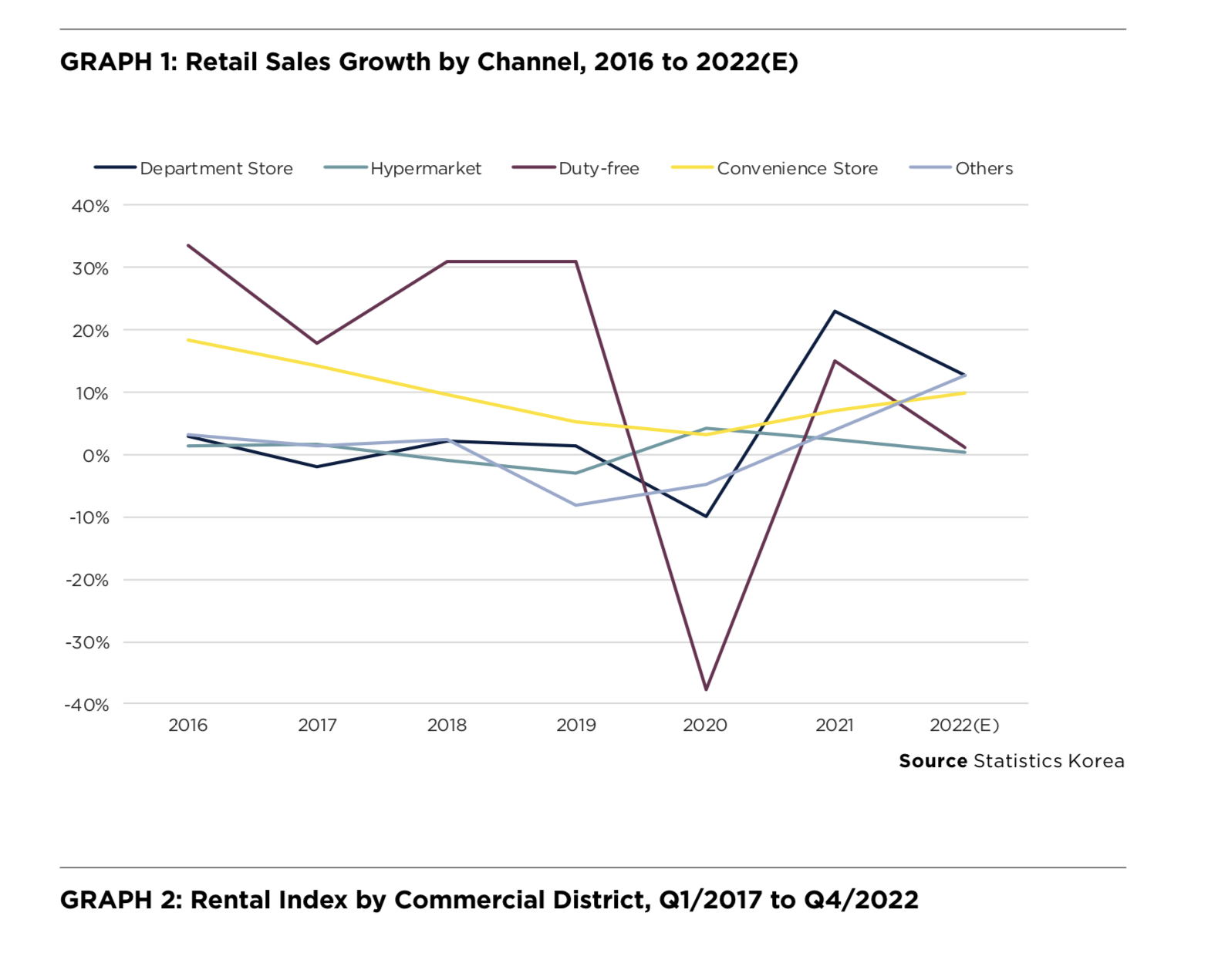

- Headline rents for Seoul’s main commercial districts slid 3% during the spread of the pandemic, turning around to a gradual recovery in the second half of 2022.

- Operators will continue efforts and new strategies to maximize in-store experiences to improve repeat visits, stay times and brand loyalty, since the longterm benefits of successfully attracting people to the offline stores outweigh an increase in sales.

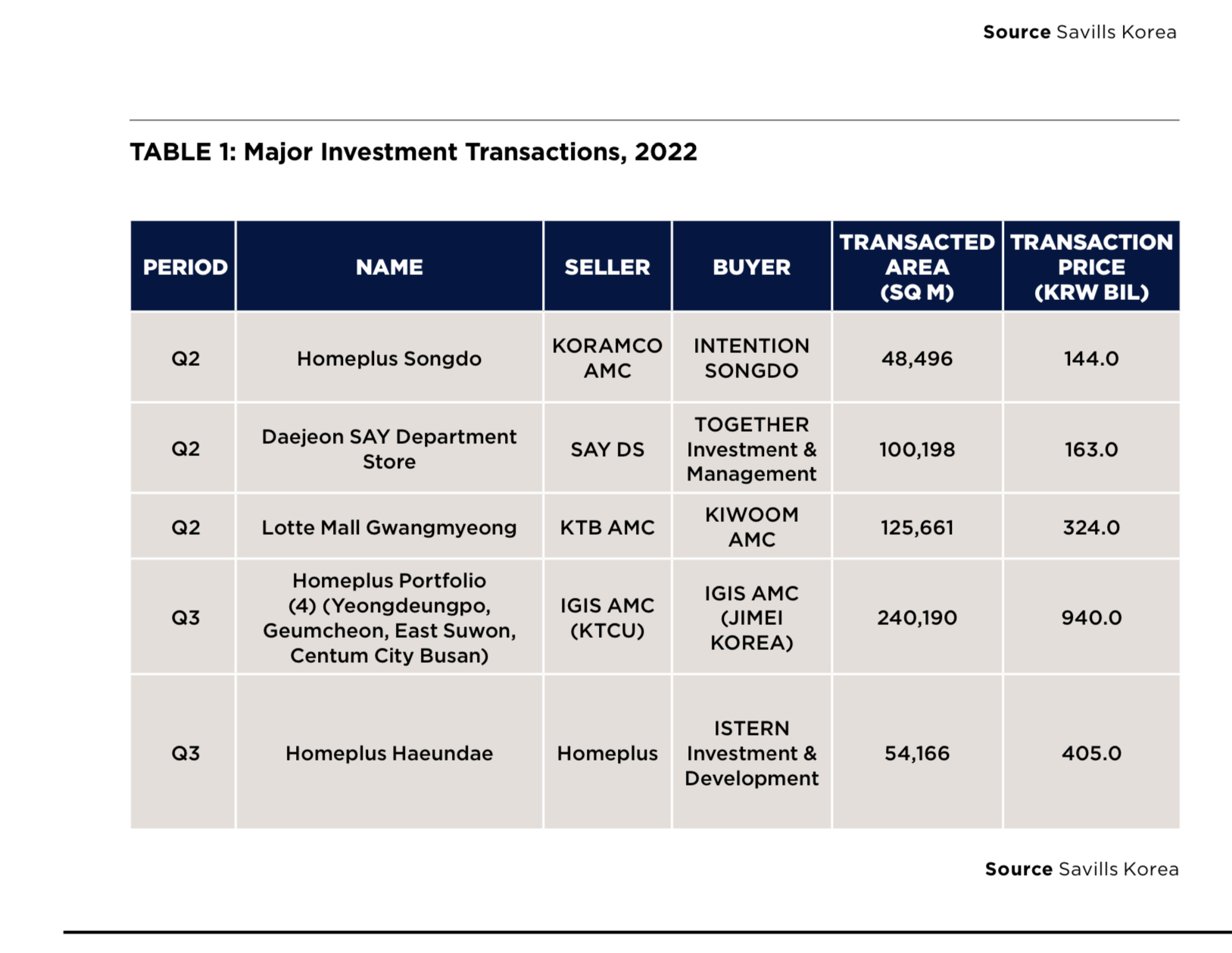

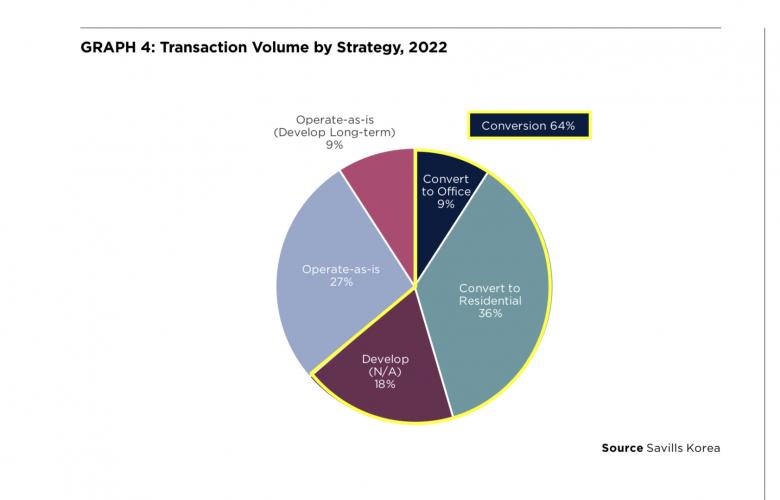

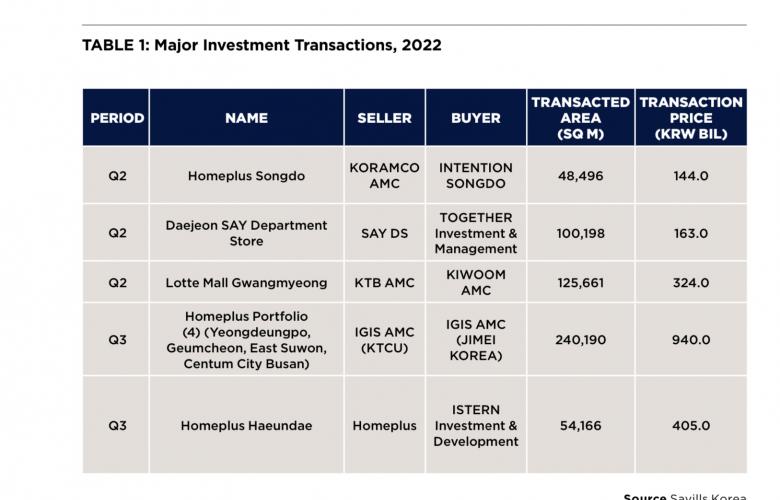

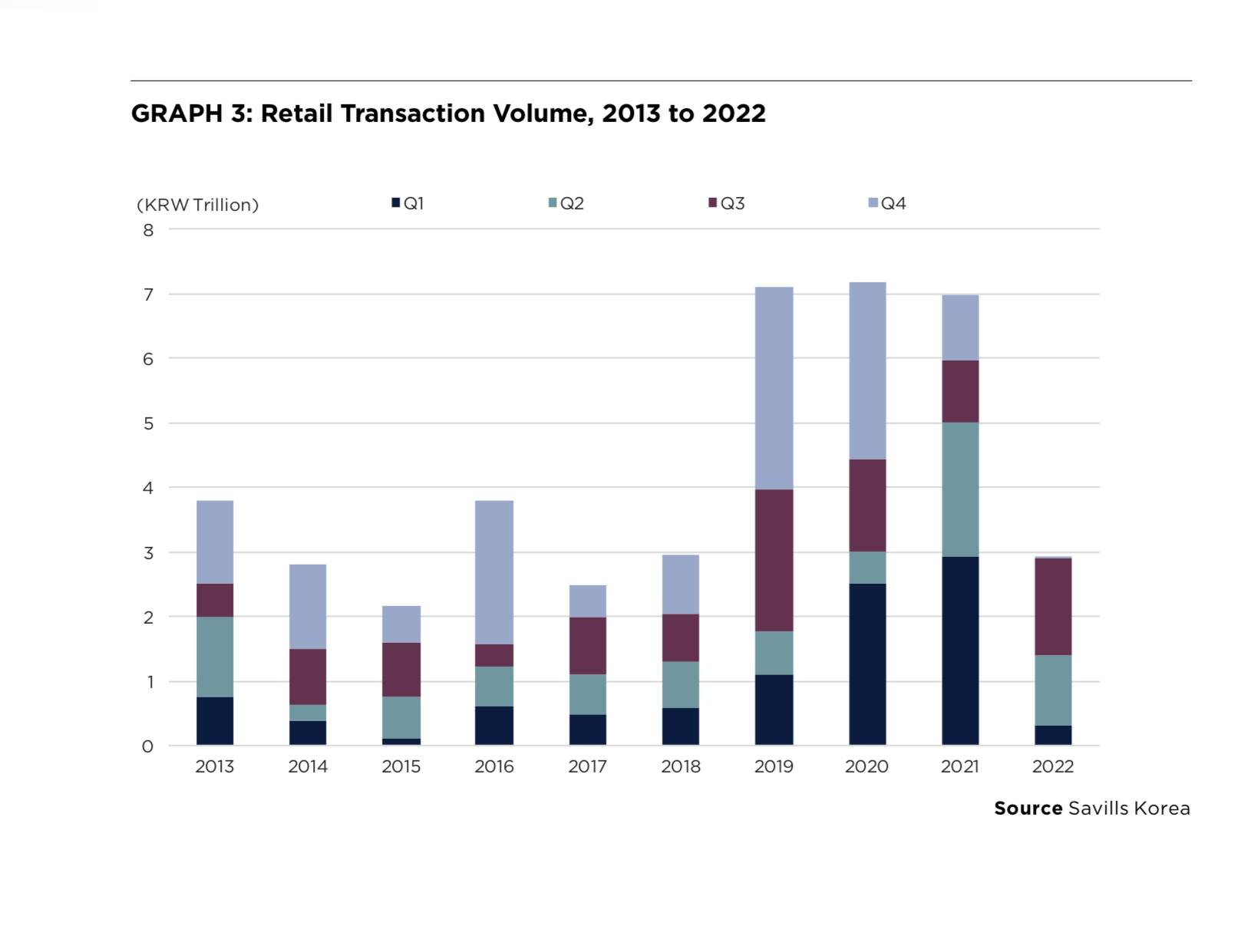

- The retail transaction volume for 2022 is estimated to be KRW 3 trillion, of which 64% is reported to be for conversion of use.

Click here to download a pdf of Savills 2023 Korea Retail Market Outlook Report