Although commercial real estate transaction volume*1 declined by 20% y-o-y globally in 2022, investment volume in Japan remained largely unchanged, with only a 2% fall from the previous year. This resilience was largely due to the Bank of Japan (BoJ) maintaining its easy monetary policy, in contrast to most of the other major central banks pursuing a monetary tightening policy to counteract inflation.

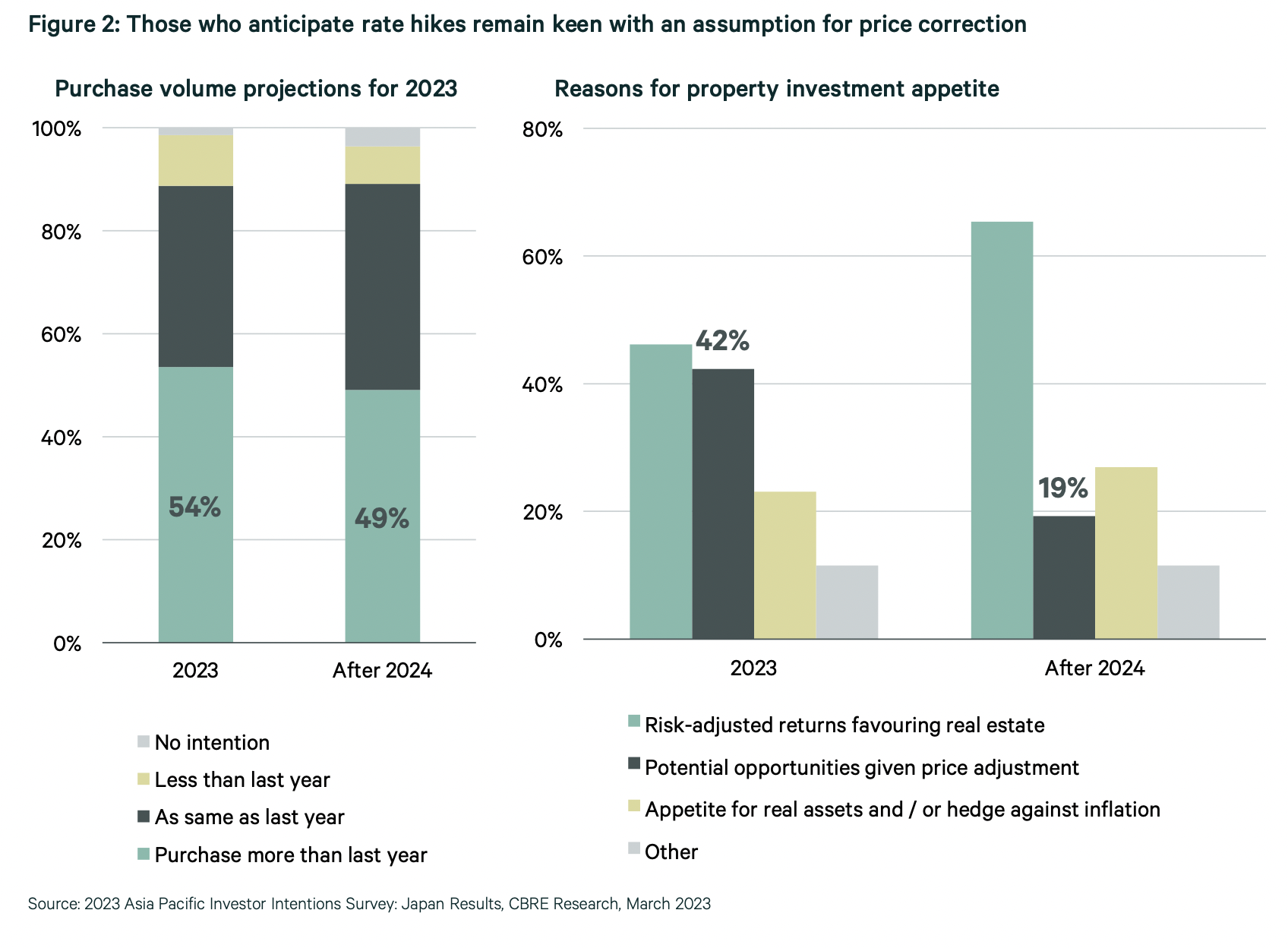

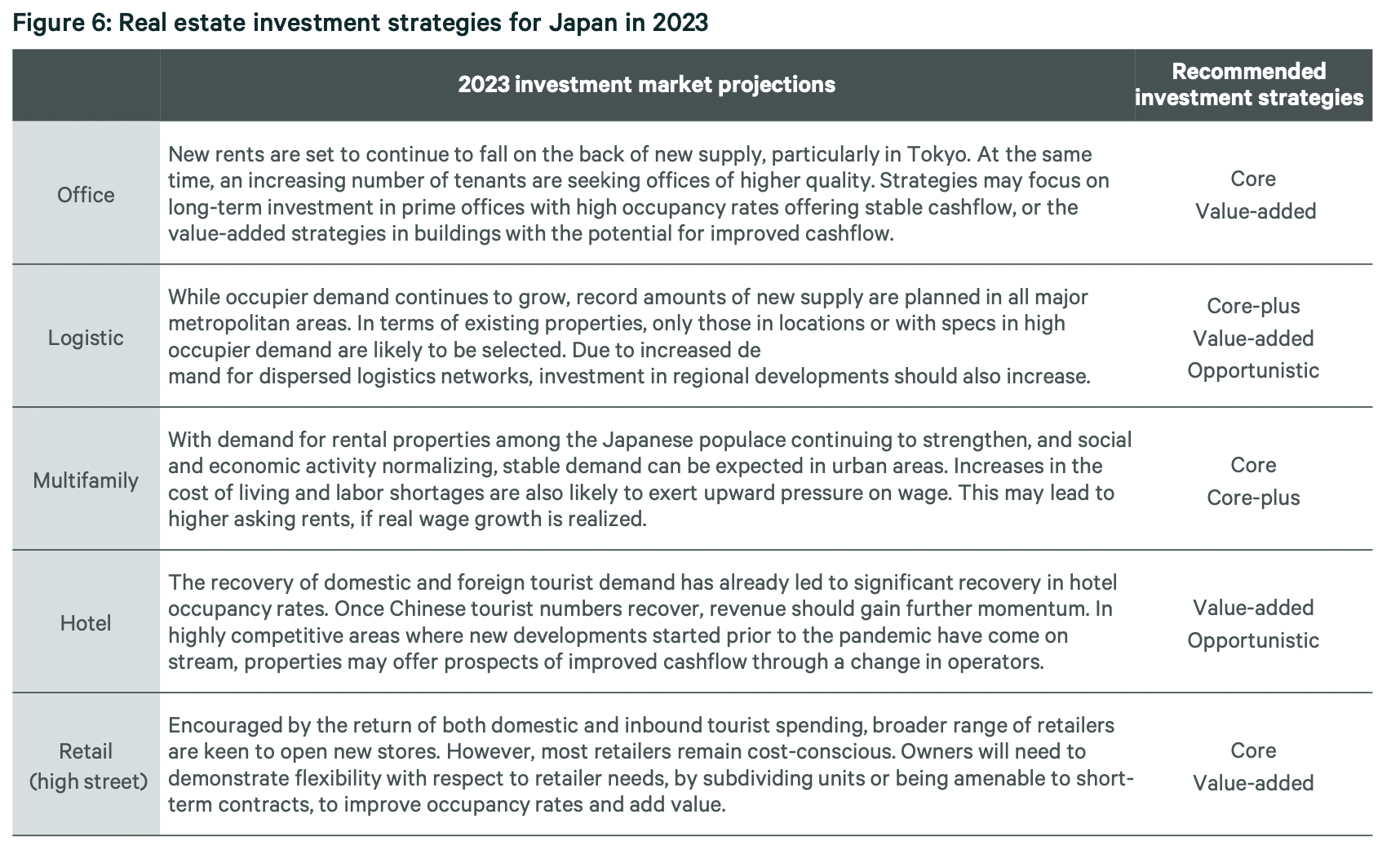

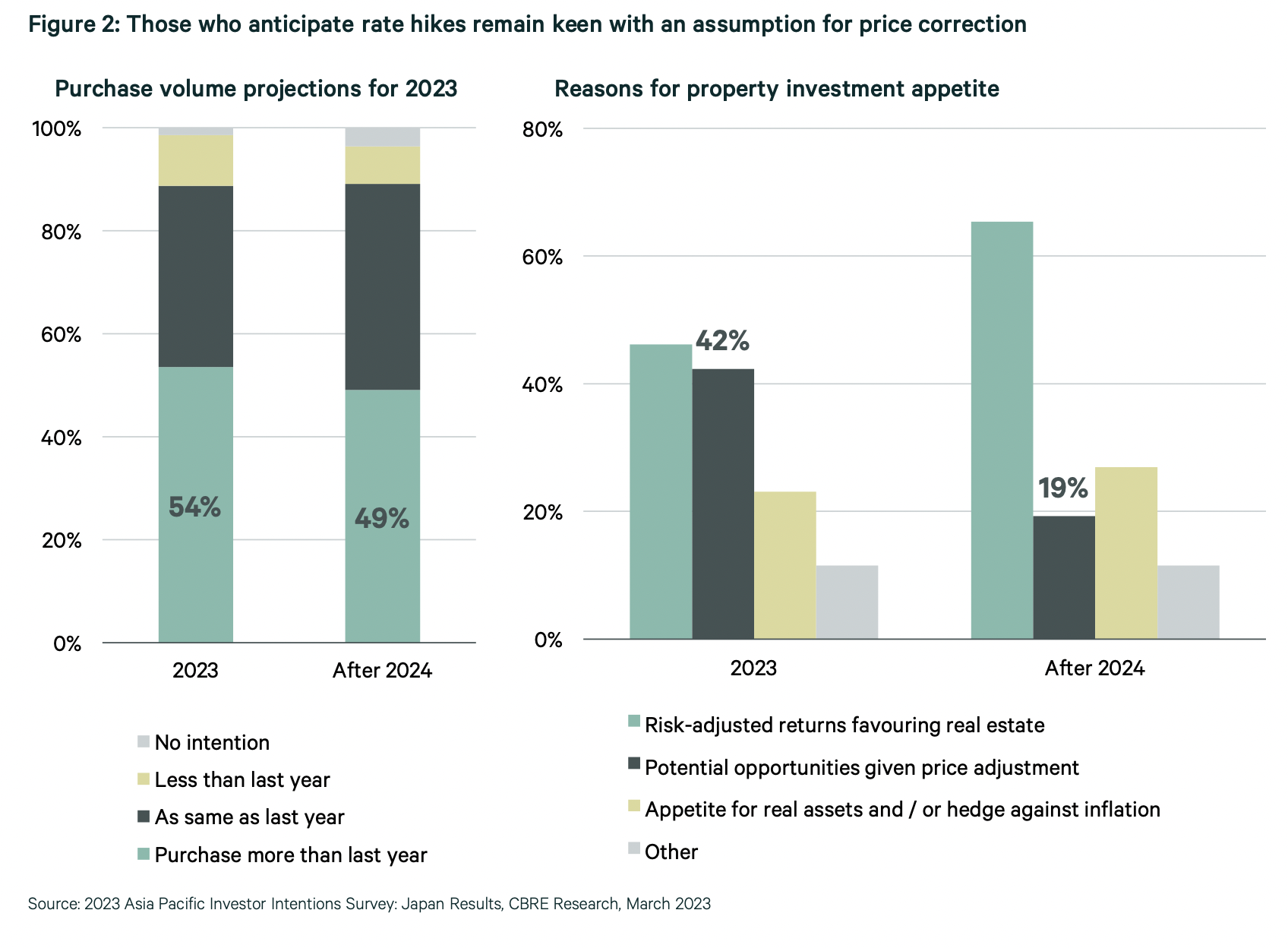

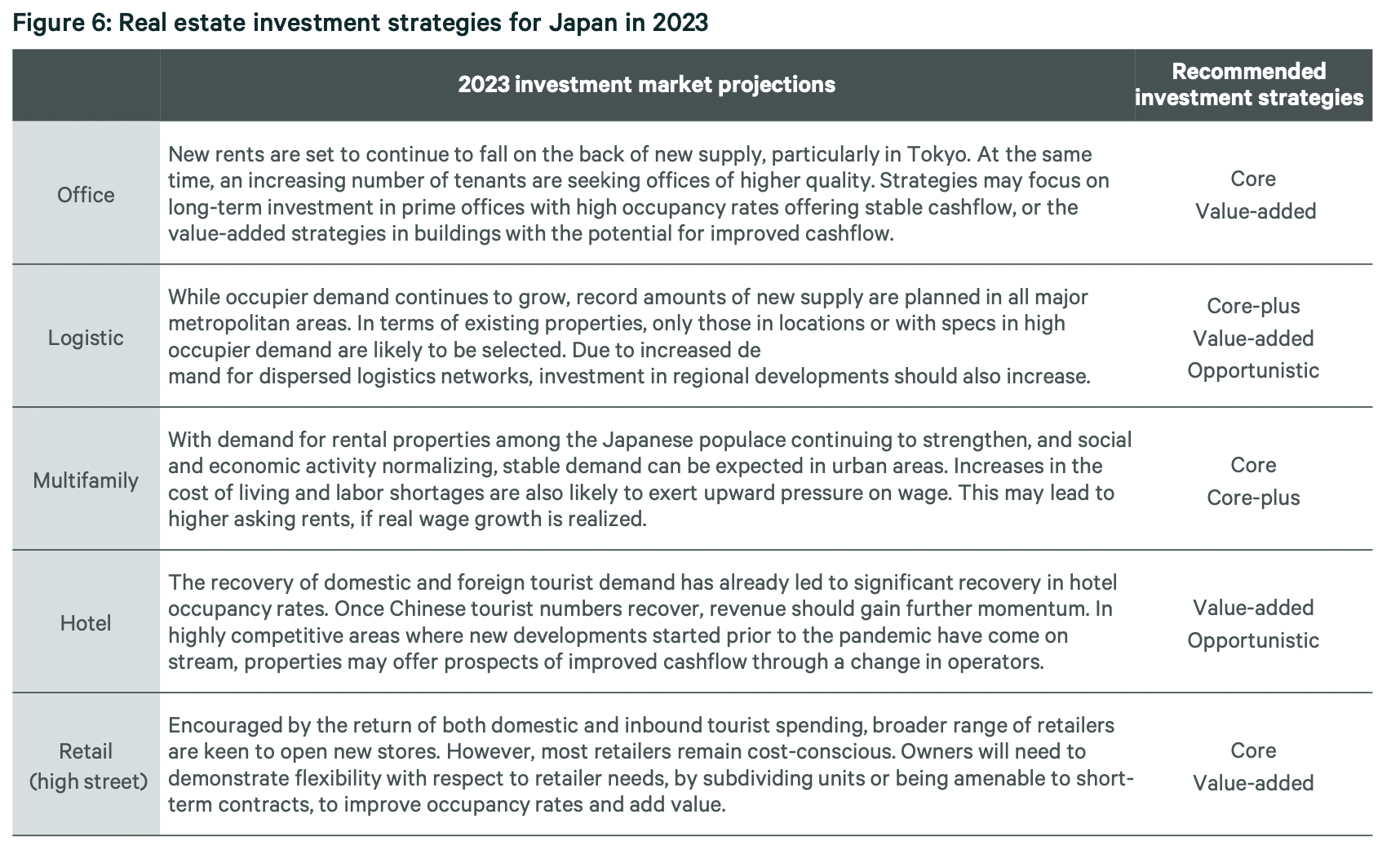

Conducted in November 2022, CBRE’s 2023 Asia Pacific Investor Intentions Survey*2 found more than half of the investors active in the Japanese market (including overseas-based investors) expect the BoJ to raise interest rates in 2023. Despite this assumption, appetite for investment in Japanese real estate shows no signs of weakening. However, more investors expect prices for some asset types to decline as a result of higher interest rates, while other asset types are attracting stronger interest due to potential upside in cashflow. It therefore appears that while many investors foresee interest rates rising, they plan to take the opportunity to calibrate their investment strategies based on the specific market situations of each asset type.

Based on the findings of CBRE’s 2023 Asia Pacific Investor Intentions Survey, this report analyses the strategies investors intend to utilise in the Japanese real estate market this year and assesses the effects of a possible change in monetary policy by the BoJ.

Some of the main points from the survey results are as follows:

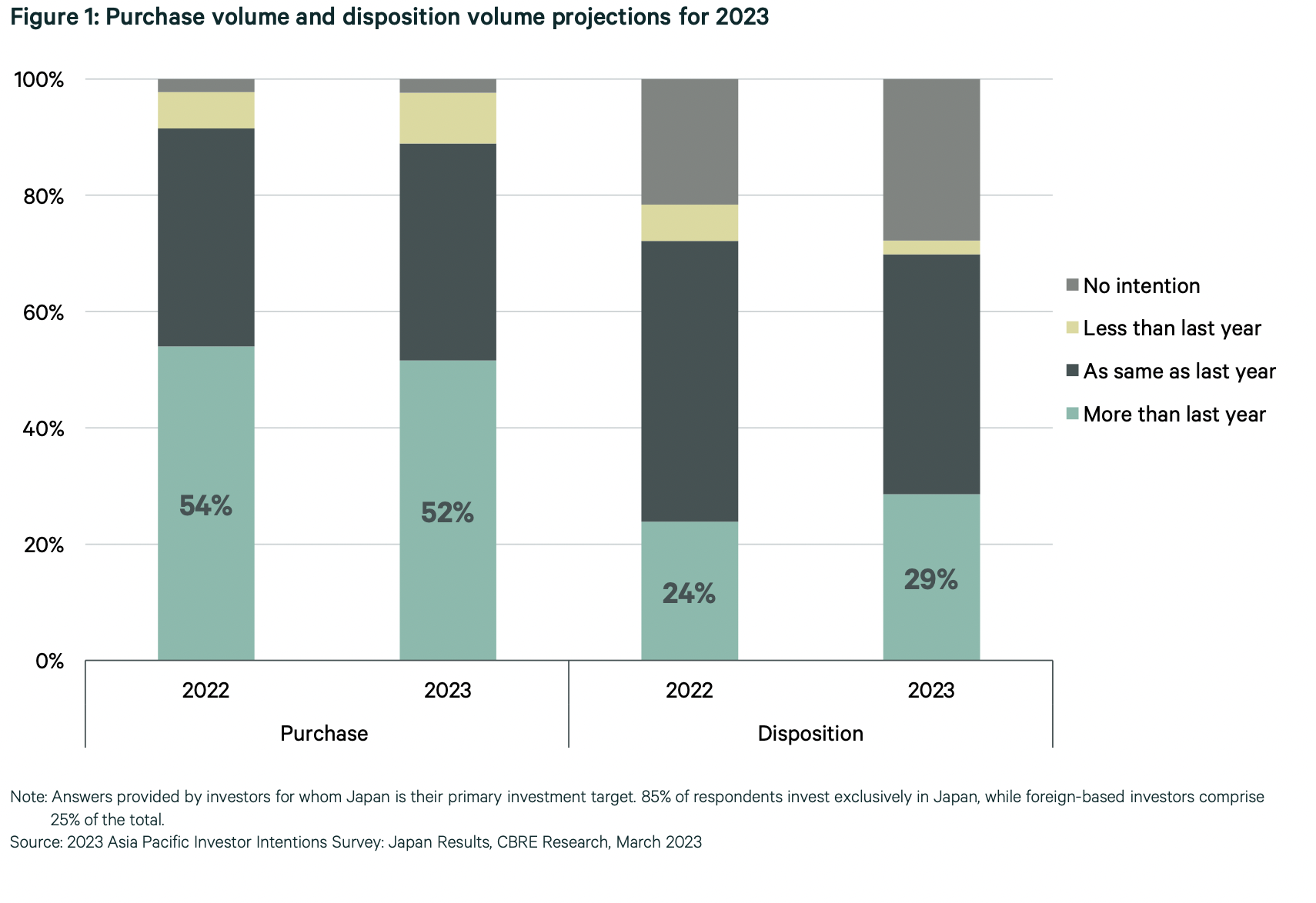

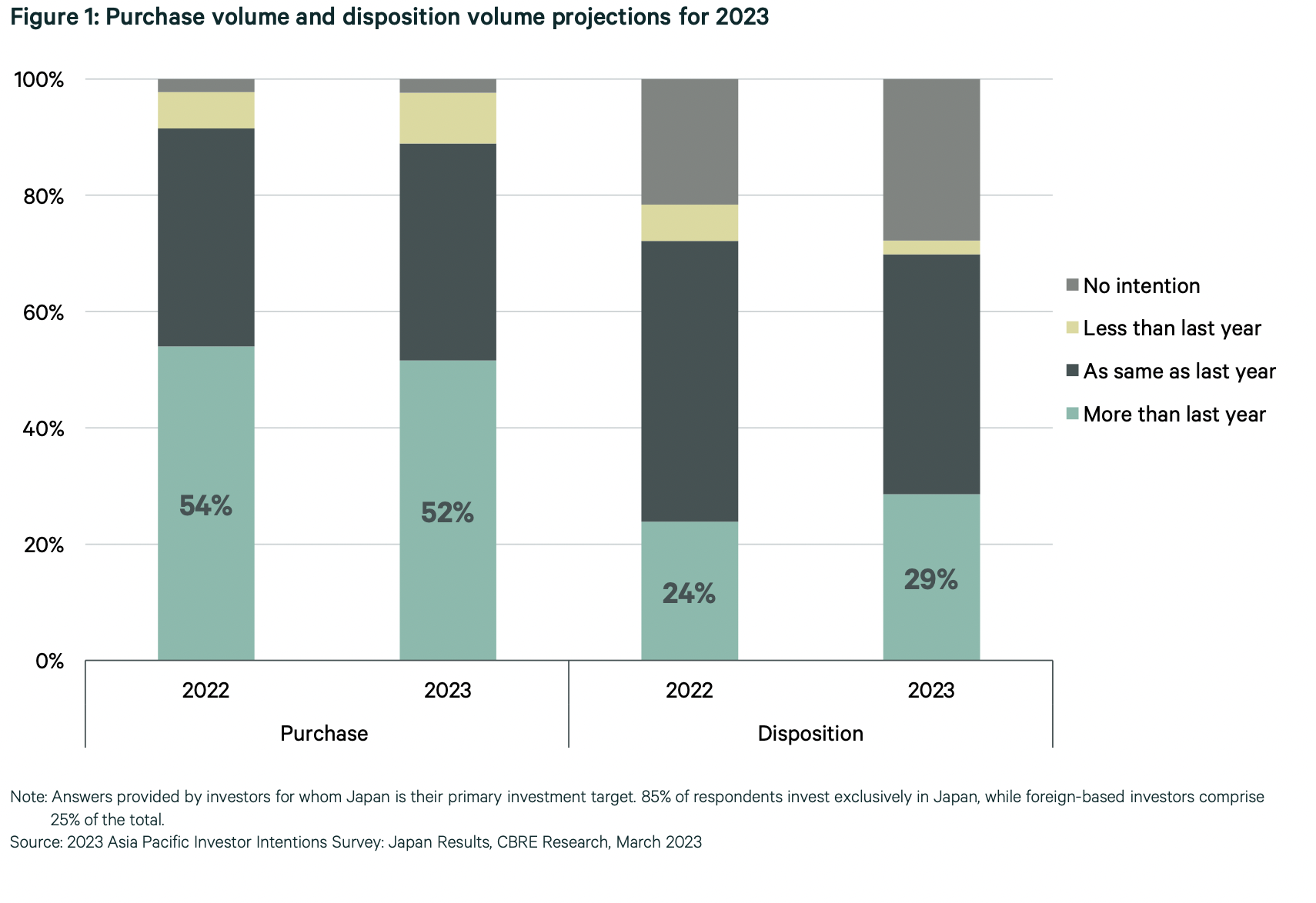

- 52%ofinvestorsanticipatethattheirinvestmentvolumein2023willexceedthatofthepreviousyear,onlya slight decline from the 54% who said the same in 2022.

- 56%anticipatethattheBoJwillraiseinterestratesduring2023,while42%expectanyincreasetocomein 2024 or beyond.

- Whileofficesremainthemostpreferredassettype,thenumberofinvestorsselectingofficesastheirprimary focus declined from the previous year, with increases seen for residential as well as hotels & resorts.

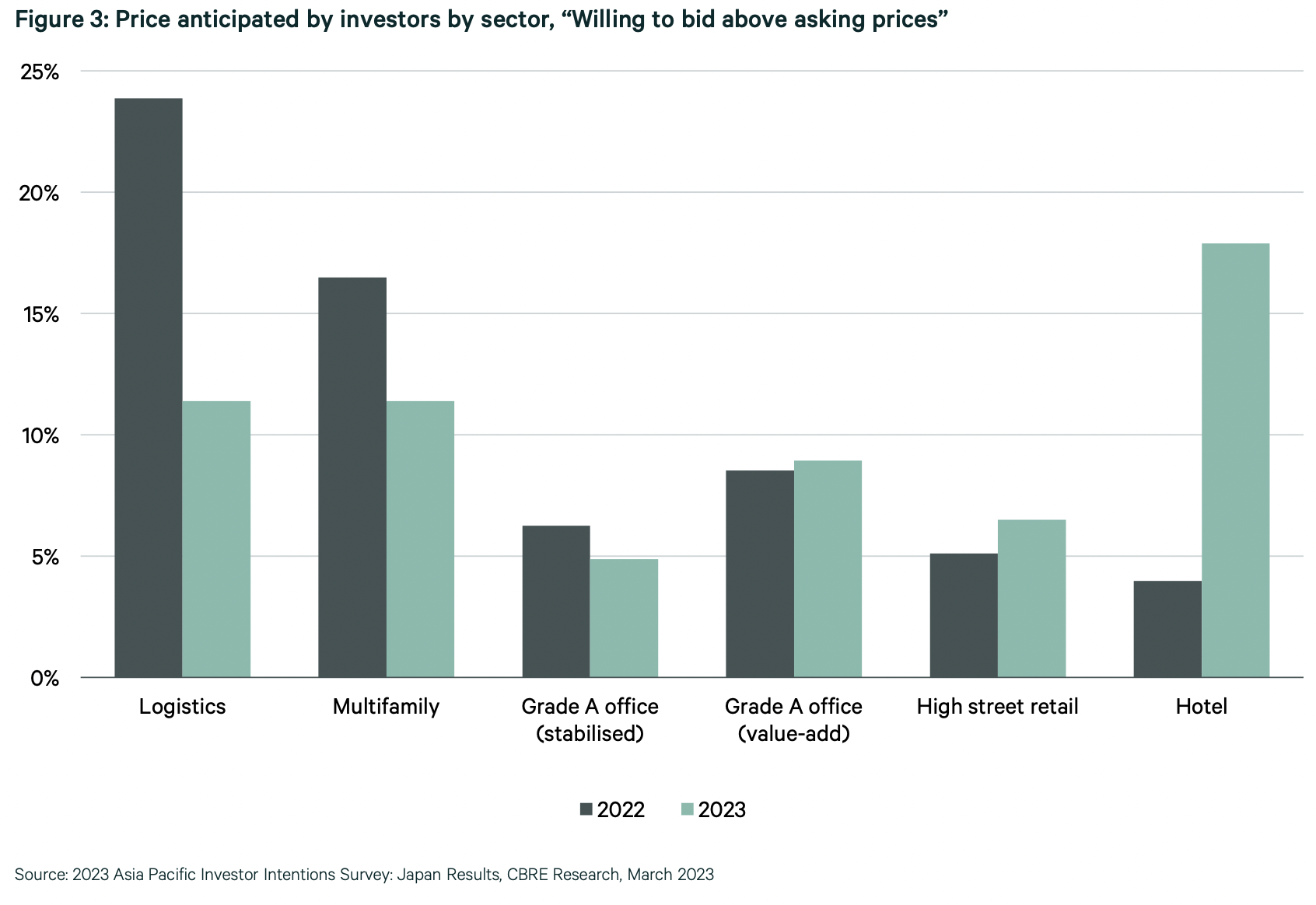

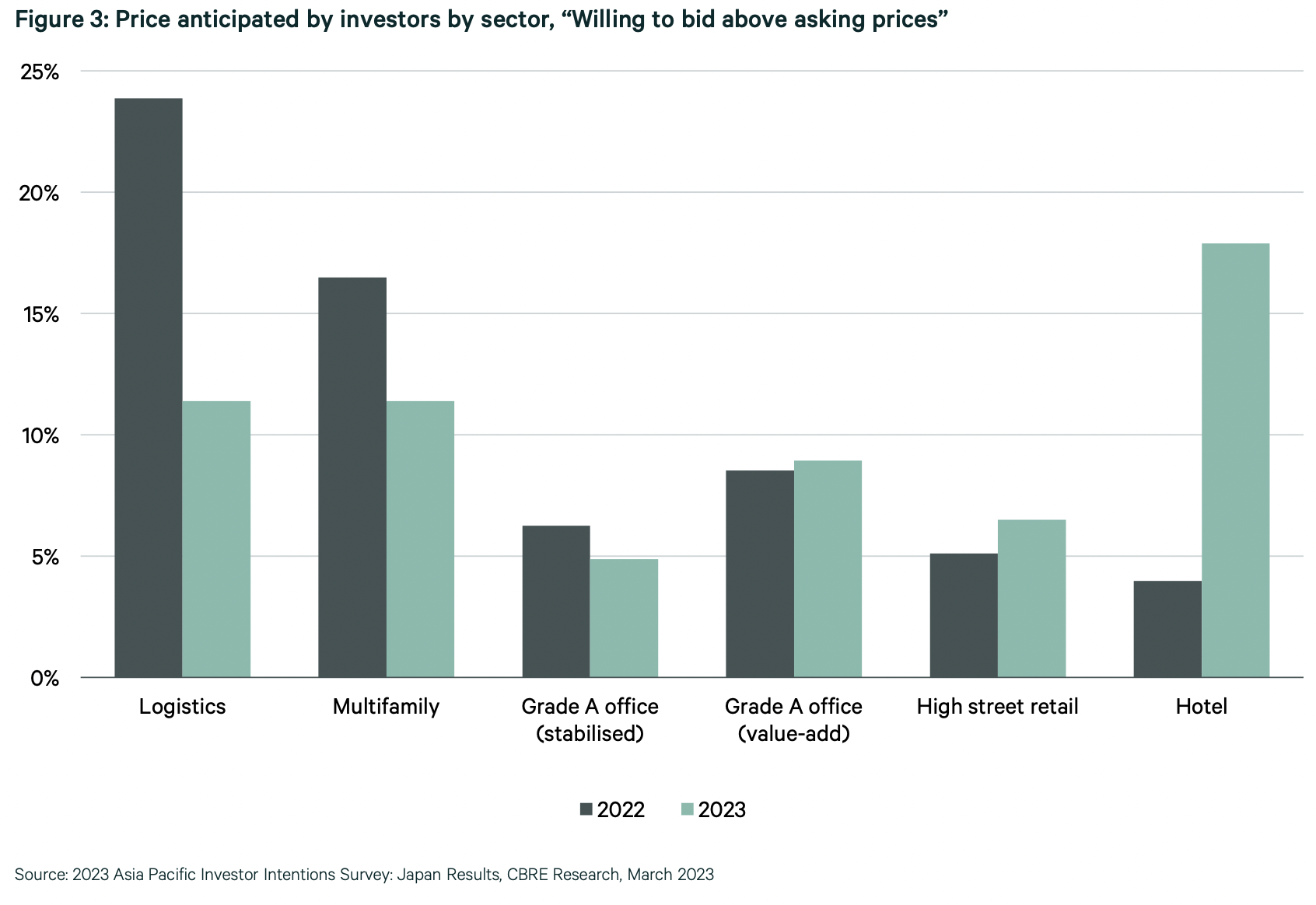

- Whenaskedwhichassettypewasmostlikelytoseetransactionpricesexceedsellers’askingprices,hotels were the most selected answer. The number of investors selecting logistics facilities, last year’s leader in this category, declined.

- While“core”remainsthemostpopularinvestmentstrategy,interestinthisapproachfellslightlycomparedto the previous year. In contrast, “opportunistic” showed a significant surge, being selected by twice as many investors as last year and emerging as the second most preferred strategy (compared to fourth place last year, behind core, value-added, and core-plus).

Click here to download a pdf of 2023 Asia Pacific Investor Intentions Survey: Japan Results

*1 Global Investment Declines Sharply in Q4 2022, February 8, 2023

*2 2023 Asia Pacific Investor Intentions Survey: Japan Results