Leading diversified professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) today releases its Q4 2022 Industrial Market Report and Outlook.

Key highlights include:

- Approximately 5.4 million sq ft of new industrial premises came on stream during the quarter with net absorption at 2.89 million sq ft.

- Overall occupancy saw a marginal decline in Q4 2022 to 89.4% from 89.7% in Q3.

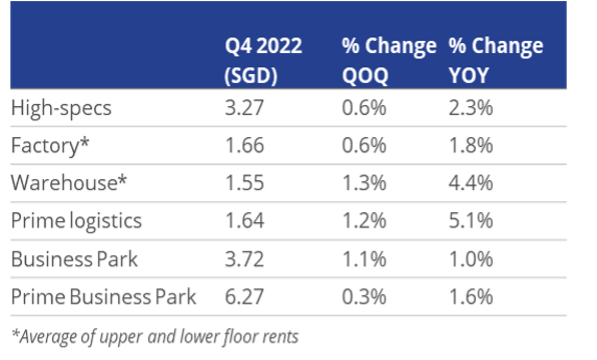

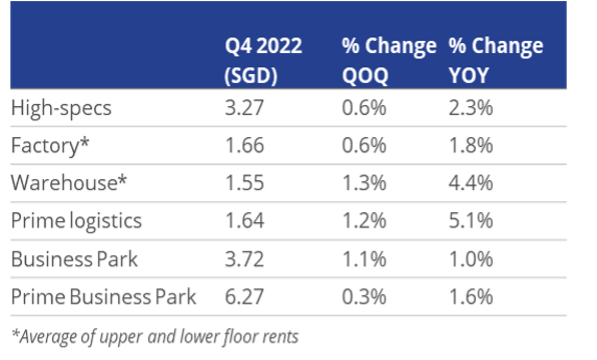

- The rental index rose by 2.1% QoQ, maintaining the same pace as previous quarter. This marks a 6.9% annual growth for 2022, making it the fastest YoY rental growth since Q3 2013.

- The price index rose by 1.7% QoQ, easing from the 2% QoQ growth registered for Q3. This marks an 8.5% annual growth for 2022 – the fastest YoY price growth since Q2 2013.

- Rental growth is likely to moderate by 1 to 3 per cent in 2023.

- Prices are anticipated to increase at a higher clip in the range of 3 to 5 per cent, on the back of sustained interest in this asset class due to higher yields and limited availability.

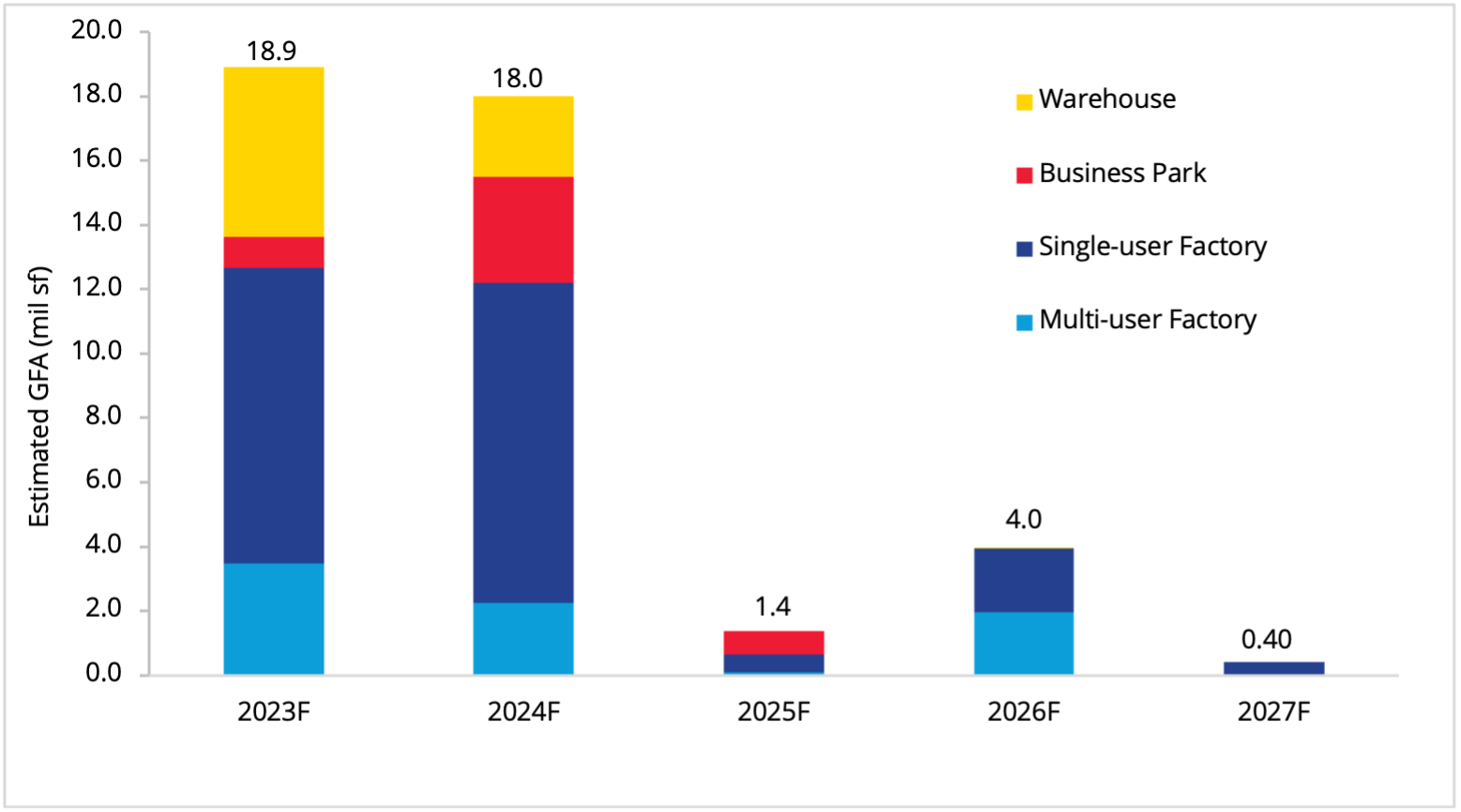

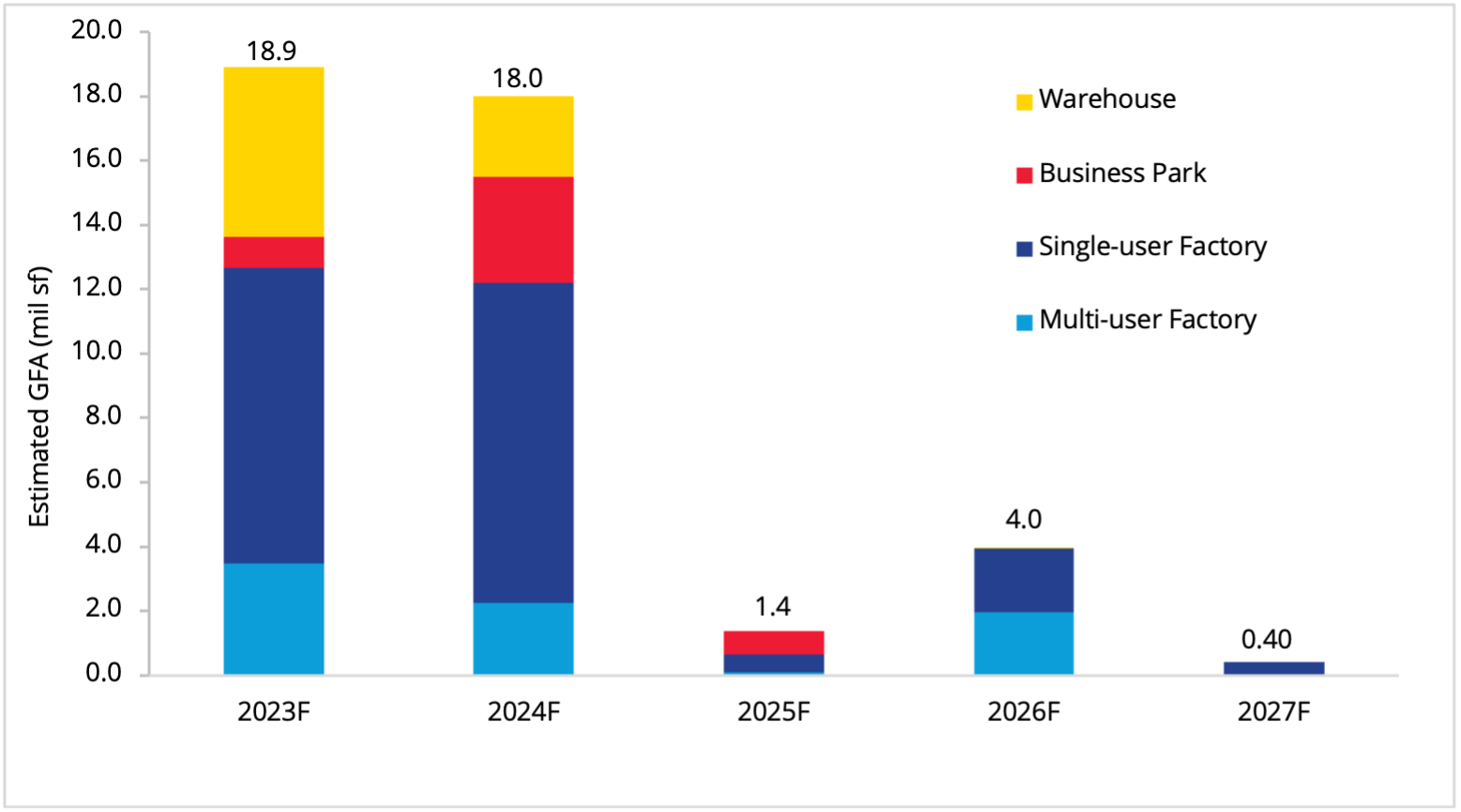

Singapore’s industrial market is likely to experience an ample supply situation in the next three years with an average of 1 million sq m of new supply expected to enter the market annually from 2023 to 2026. In comparison, the market saw an average 0.8 million sq m of annual new supply over the past three years.

Supply is likely to outstrip demand and weigh on rental growth in the next two years. An exception would be the warehouse segment as there appears to be a dearth of supply post 2024, and where pre-commitment to existing pipeline supply is high.

Upcoming New Supply

Source: Colliers, JTC

Average Industrial Rents

Source: Colliers

Mr Lynus Pook, Executive Director and Head of Industrial Services, Singapore at Colliers says, “The consistent growth seen for industrial rents has caught the attention of institutional investors who are constantly on the lookout for high quality developments as well as assets with high yields to inject into their portfolio hence, propping up demand for industrial assets. This trend is anticipated to continue in the current environment of higher interest rates and inflation, as the value of industrial assets could continue to grow due to their limited availability.”

A recent survey carried out globally by Colliers to establish investors’ outlook in 2023 saw 60% of the respondents indicating their preference to invest in industrial & logistic assets in 2023.

“The low vacancy rates seen across most industrial assets have helped to underpin capital values and support income growth. Industrial & logistics real estate will continue to draw investors‘ interest in 2023, with increased appetite in prime logistic assets where the capital values and rents for this asset type is likely to experience continuous annual growth in the range of 4 to 5 per cent, brought about by the changing requirements to improve on up-stream supply chain.

“Clean room and semi-conductor related facilities will be the other asset type that will appeal to buyers, predominantly from China, given the need to be less reliant on western made advance electronic products due to the embargo imposed by the United States. Additionally, we are mindful that there is a glut in semiconductor inventories, specifically on the NAND and DRAM (memory chips), where a rebalance in the inventories to equilibrium level could take place only in the second half of 2023. On the contrary, the automobile industry is still facing a shortage of semiconductor chips. Given that it takes a considerable amount of time to manufacture semiconductor chips, it is now timely for companies who are embarking on capital investment to ride the wave of the next upturn,” adds Mr Pook.

Against the backdrop of inflationary pressures and rising interest rates which lead to higher capital costs, industrialists are likely to be more cautious when considering their leasing plans. Rental growth is forecast to moderate to between 1 and 3 per cent in 2023. Warehouse rents might, however, continue to outperform on the back of tight supply.

Ms Catherine He, Director and Head of Research, Singapore at Colliers says,” The reopening of China’s economy could provide a silver lining for Singapore’s trade-related industries but may not be sufficient to compensate for the anticipated drop in demand from developed economies such as the US and EU. This is likely to extend into the first half of 2023 as macroeconomic uncertainties persist. However, industrial demand could still be bolstered by the aviation and transport, as well as food-related sectors with the lifting of travel restrictions and the recovery of the hospitality sector.”

Sign up here to receive our INDUSTRIALIST newsletters and breaking news sent straight to your inbox.

Click here to view more articles on The INDUSTRIALIST