While the adoption of hybrid work continues to have a major influence on where consumers are choosing to work and live, more people in Asia Pacific are actually planning to move closer to city centres, according to CBRE’s Asia Pacific Live-Work-Shop Report.

CBRE polled more than 9,000 people across Asia Pacific—representing multiple generations from Baby Boomers to Gen Z—to understand how their live, work and shop preferences will influence the future of commercial real estate.

LIVE

LIVE

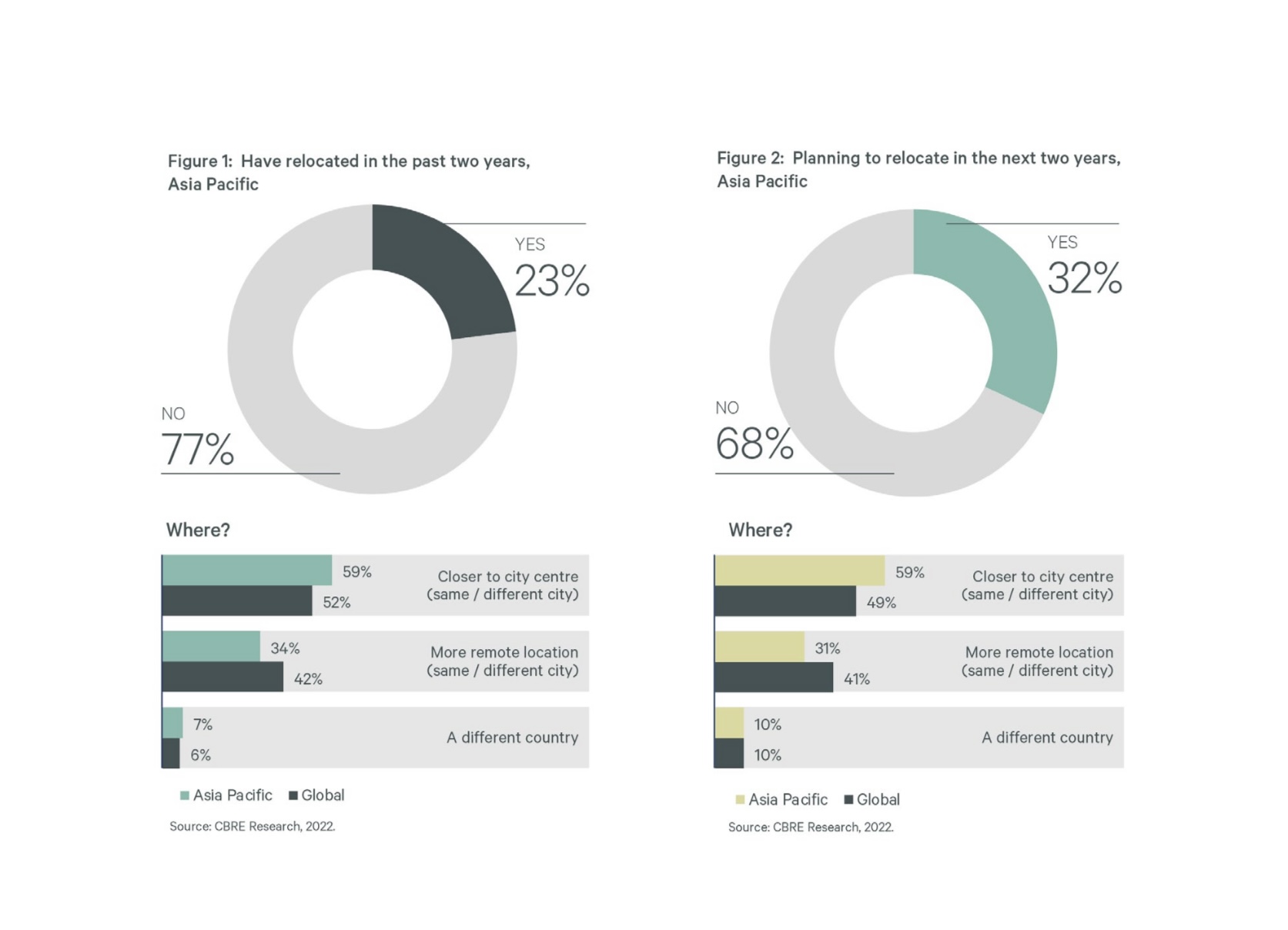

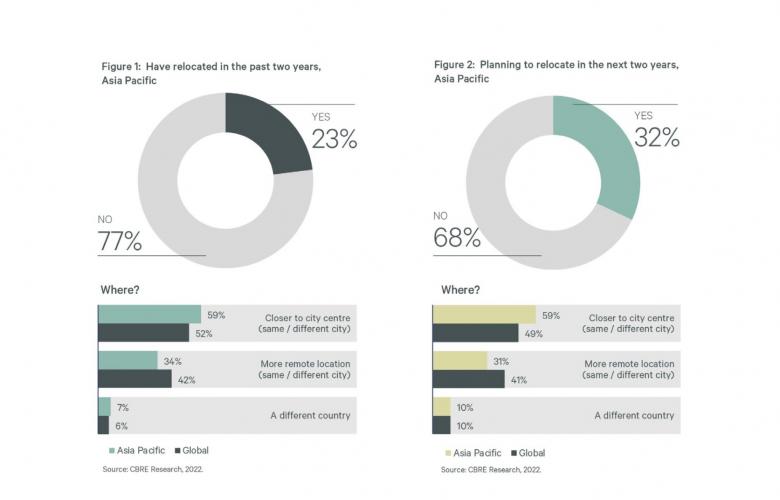

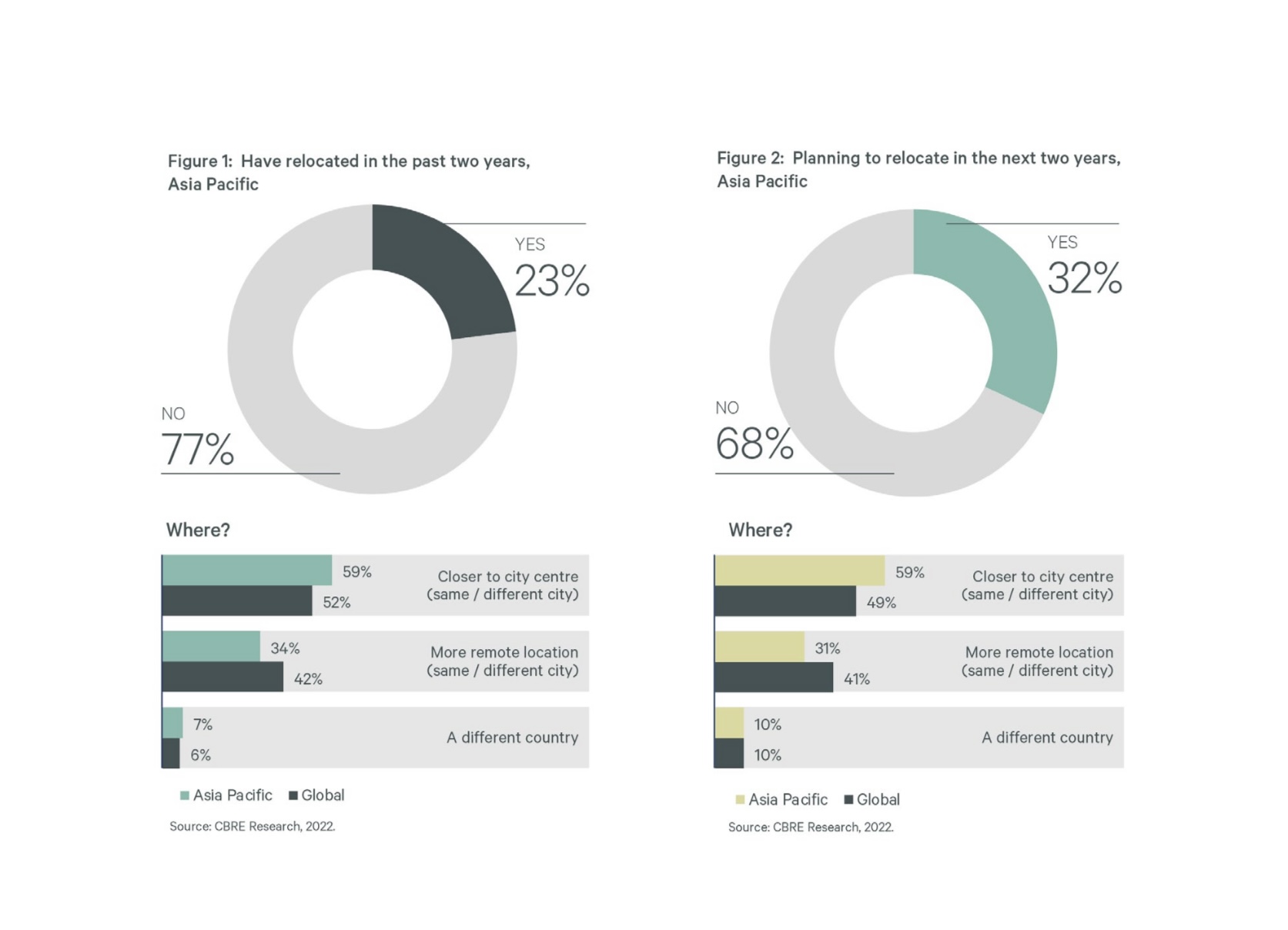

The survey reveals that one-third of people in Asia Pacific want to move their home in the next two years—a significant increase from the 23% who have relocated in the past two years. Of the Asia Pacific respondents who are planning to move, 59% want to move closer to city centres, contrary to the widely held belief that people are seeking to move out of urban areas as they no longer need to commute daily to the office. This contrasts with the widely held belief that most people are seeking to move out of urban areas as they no longer need to commute regularly to the office under hybrid working arrangements.

Almost half of Gen X and late millennials (aged 33 or less) plan to move their home in the next two years, compared to only 21% for baby boomers, indicating that new housing demand will be primarily driven by younger generations. All generations displayed a higher preference for city centres.

“Areas close to a city center remain most sought after among those planning to move, especially for younger generations. Locations close to business districts can meet demand for easy access to offices, and leisure activity locations,” said Dr. Henry Chin, Global Head of Investor Thought Leadership & Head of Research, Asia Pacific for CBRE.

WORK

WORK

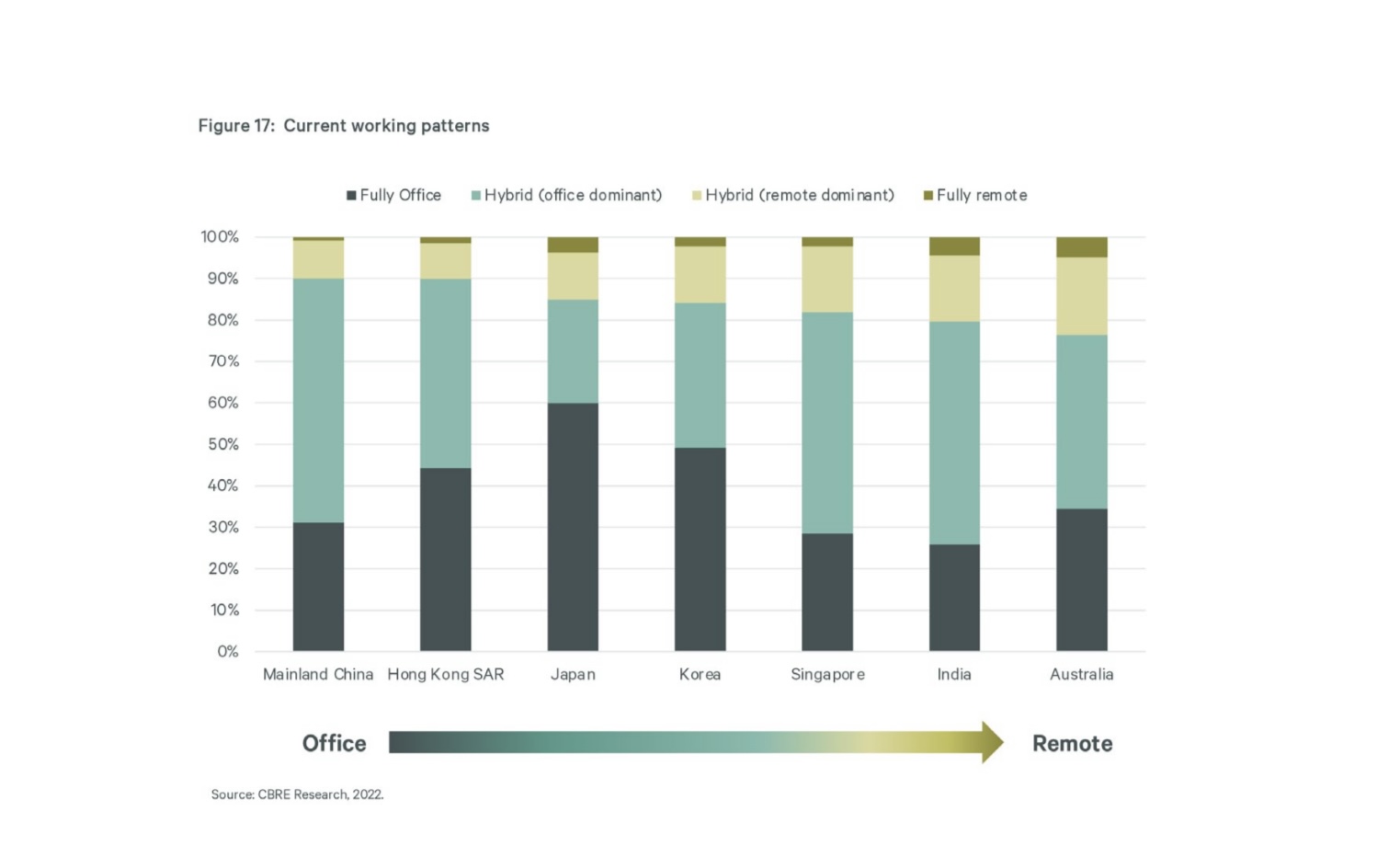

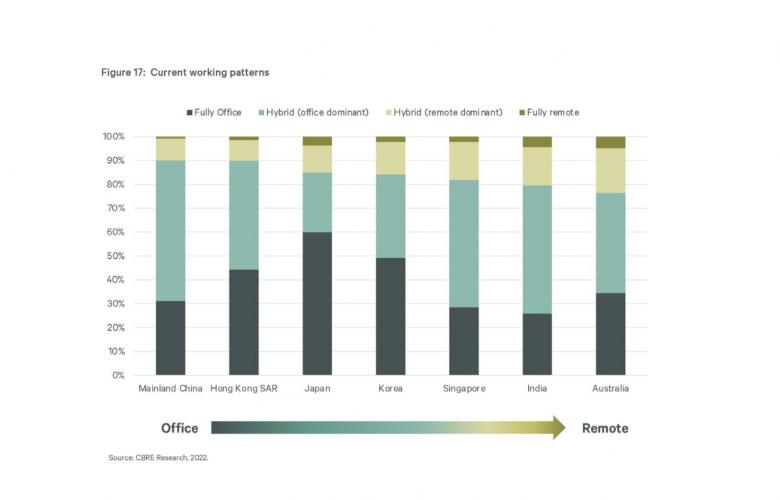

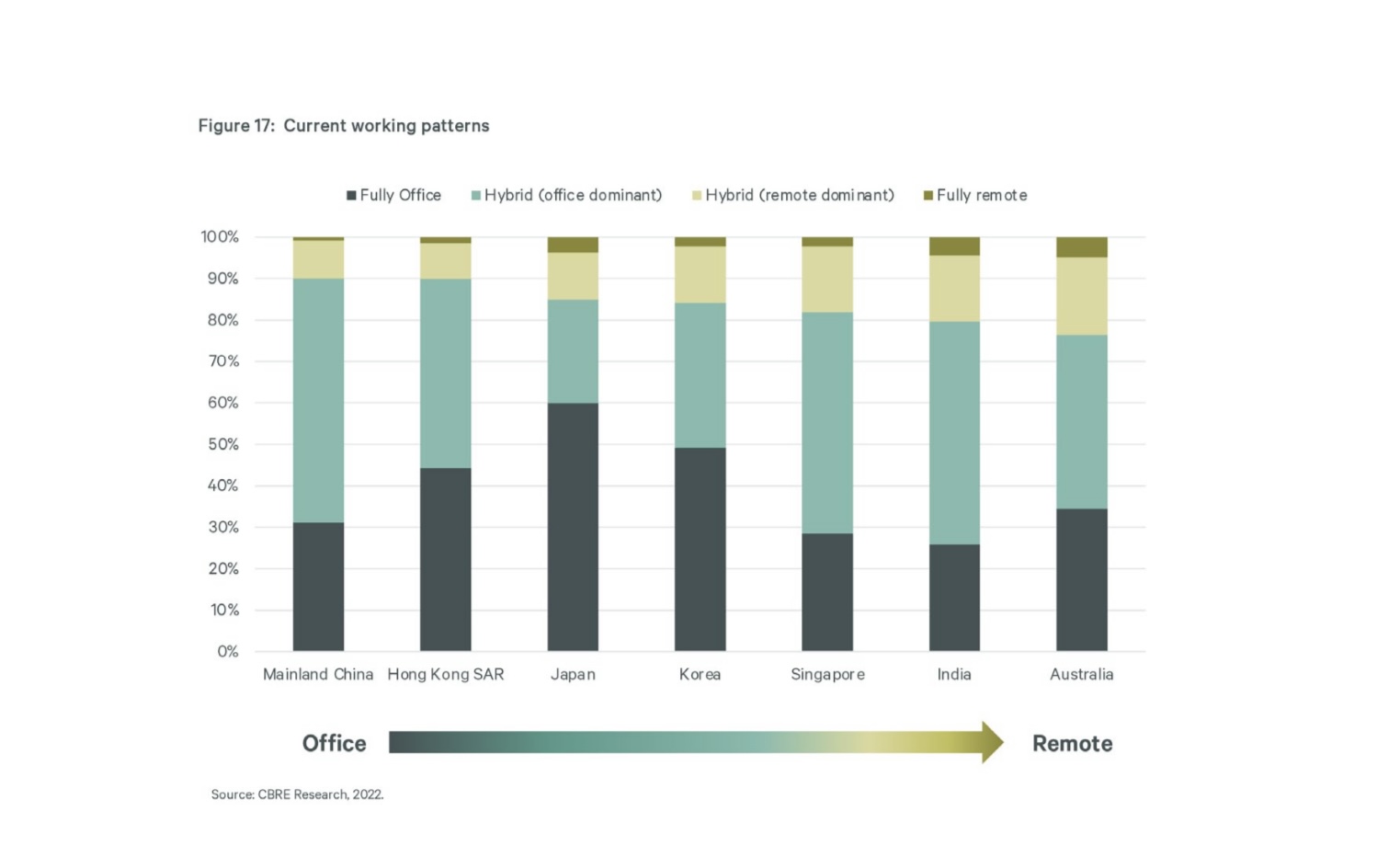

While hybrid working has been more widely adopted across Asia Pacific, 85% of respondents spend at least three days per week working at the office. Commute time is a major factor when deciding whether to go into the office, with around 70% wanting to reach their offices within 30 minutes.

Nearly 70% of office-based workers said they place more importance on the quality of their workplace environment, with ‘health and wellness’, ‘location’, ‘space design’ and ‘technology’ named as the most important factors drawing people to the office.

Employees working in city centres are generally more satisfied with their office (75%), particularly regarding transportation and amenities, than those working in other business districts and suburbs (55%).

“Although employees want to spend more time working remotely, office-based working will remain the norm in Asia Pacific. Office-based workers feel they are productive and better connected with colleagues when they are in the office. At the same time, office-based employees frequently lack a suitable home environment or technology support for effective remote working,” said Dr. Chin.

“Employee preferences for offices in core locations, particularly those well-served by public transport and with car parking spaces, will exert a strong influence over occupiers’ building selection in the future. Investors are advised to retain a strong focus on purchasing prime offices in CBDs, while seeking-out opportunities on micro-markets that are highly accessible,” he added.

SHOP

SHOP

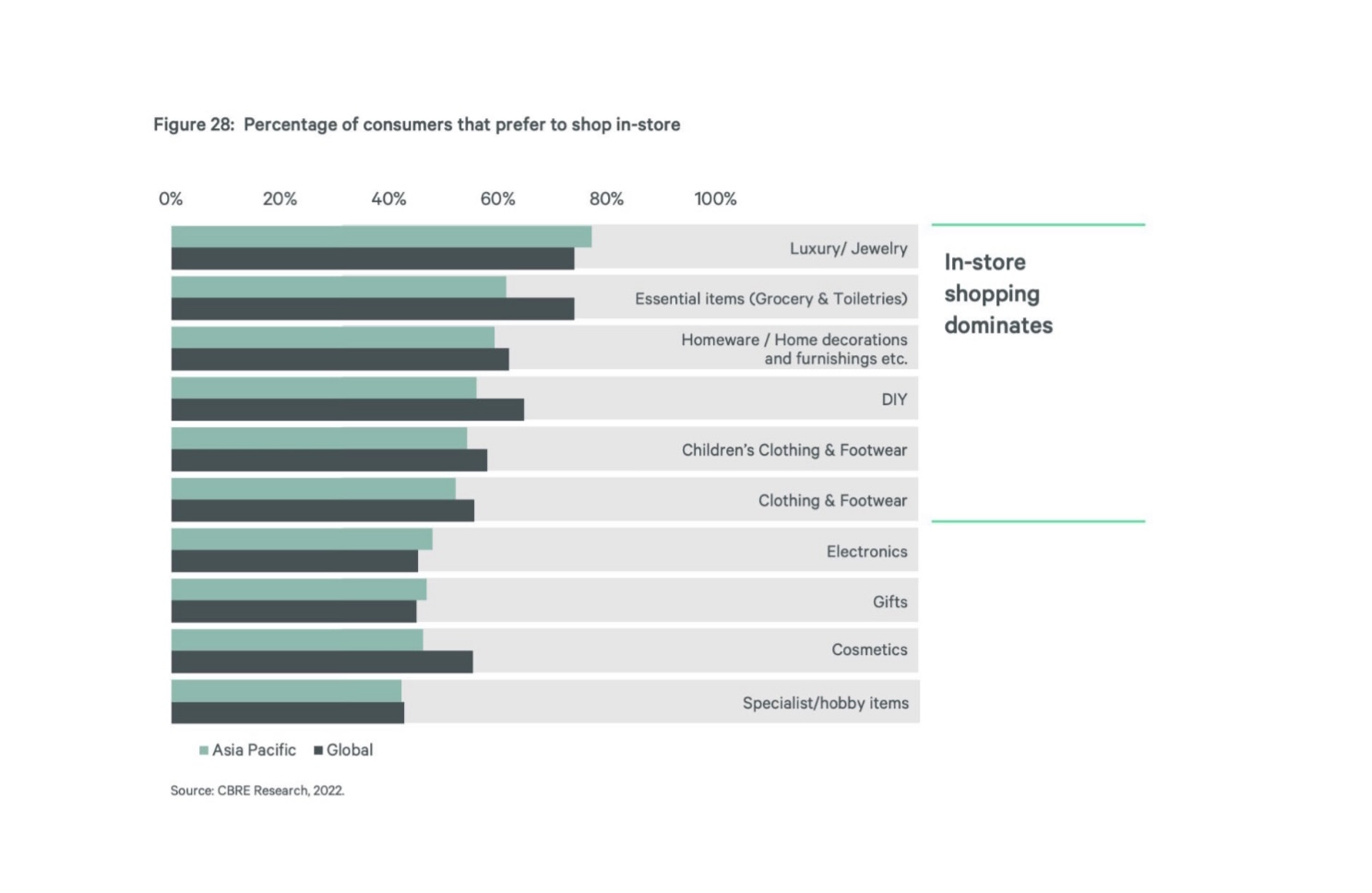

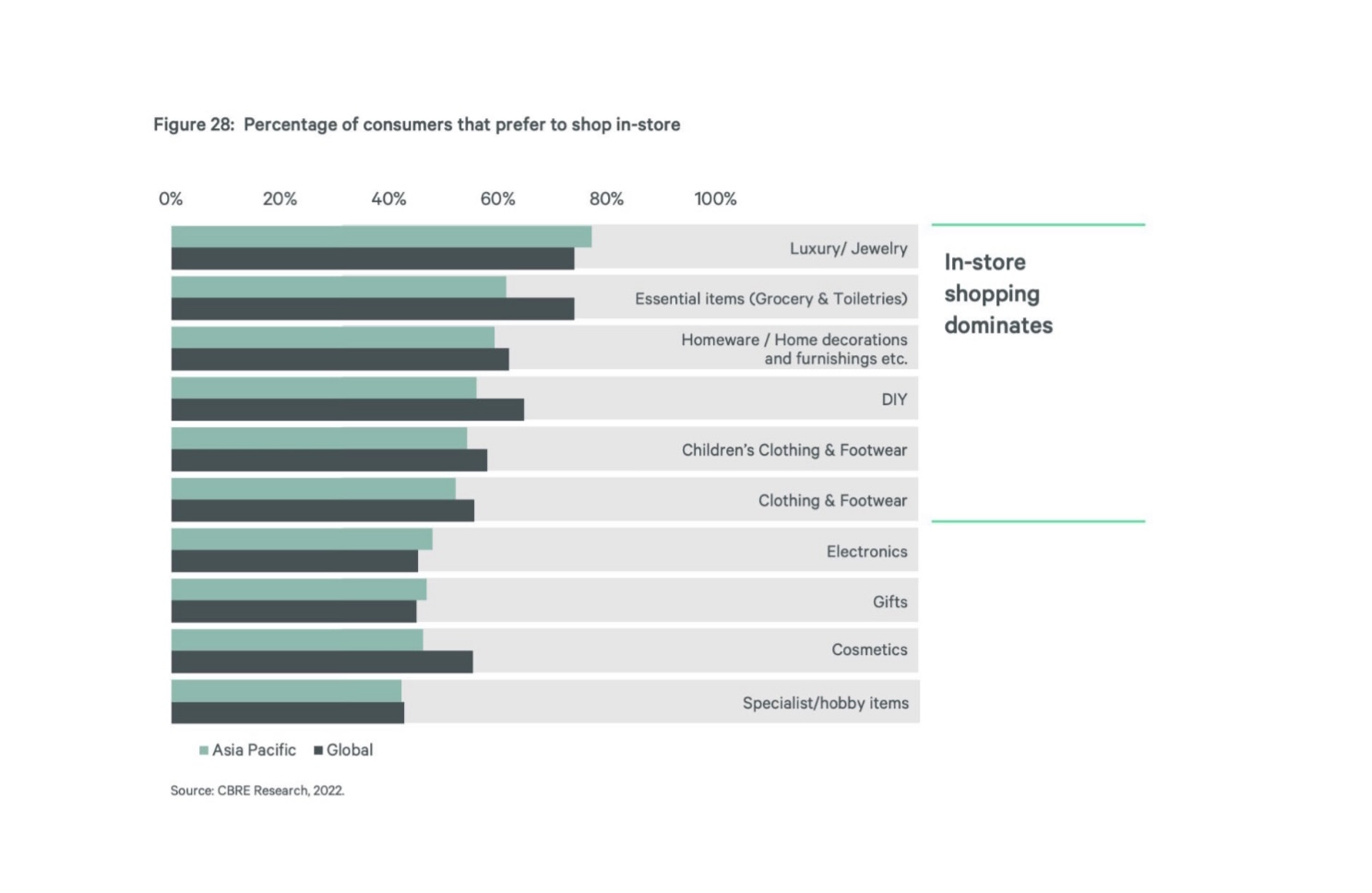

Most consumers in Asia Pacific still prefer to buy items in-store, despite the surge in e-commerce over the past few years. Half of consumers in Asia Pacific make more than 50% of their purchases in store, with only 5% considered pure online shoppers.

Physical stores play an important role in facilitating online spending, with 61% of Asia Pacific consumers preferring to see a product in-store, then ordering online. Despite many retailers promoting click-and-collect, 40% of respondents still prefer their orders to be delivered to their home. Nearly half of Asia Pacific consumers (45%) prefer to return online orders in-store.

“While online shopping offers convenience and increasingly rapid delivery times, many Asia Pacific consumers believe that in-store shopping offers a superior experience. Retailers should consider how their physical stores can be more efficient and support non-traditional uses that are becoming popular among shoppers, such as in-store returns, click-and-collect and ‘showrooming’— trying on an item in person before buying online,” said Ada Choi, Head of Occupier Research, Asia Pacific for CBRE.

Here are some highlights from the report:

Live

- 32% of respondents want to move their home in the next two years, with 59% want to move closer to city centres.

- 66% of respondents want to buy instead of rent.

- 66% of respondents regard health and safety is a more important factor than price when selecting a home.

Work

- 85% of employees currently spend at least three days per week working at the office.

- 75% of respondents are satisfied with their city centre offices but only 55% of those working in suburbs stated the same.

- 69% of office-based workers attach greater importance to the quality of their workplaces.

Shop

- Half of consumers in Asia Pacific make more than 50% of their purchases in store, with only 5% considered pure online shoppers.

- 61% of Asia Pacific consumers preferring to see a product in-store, then ordering online.

- 40% of respondents still prefer their orders to be delivered to their home.

Click here to download a pdf of the CBRE Asia Pacific Live-Work-Shop Report 2022

LIVE

LIVE WORK

WORK SHOP

SHOP