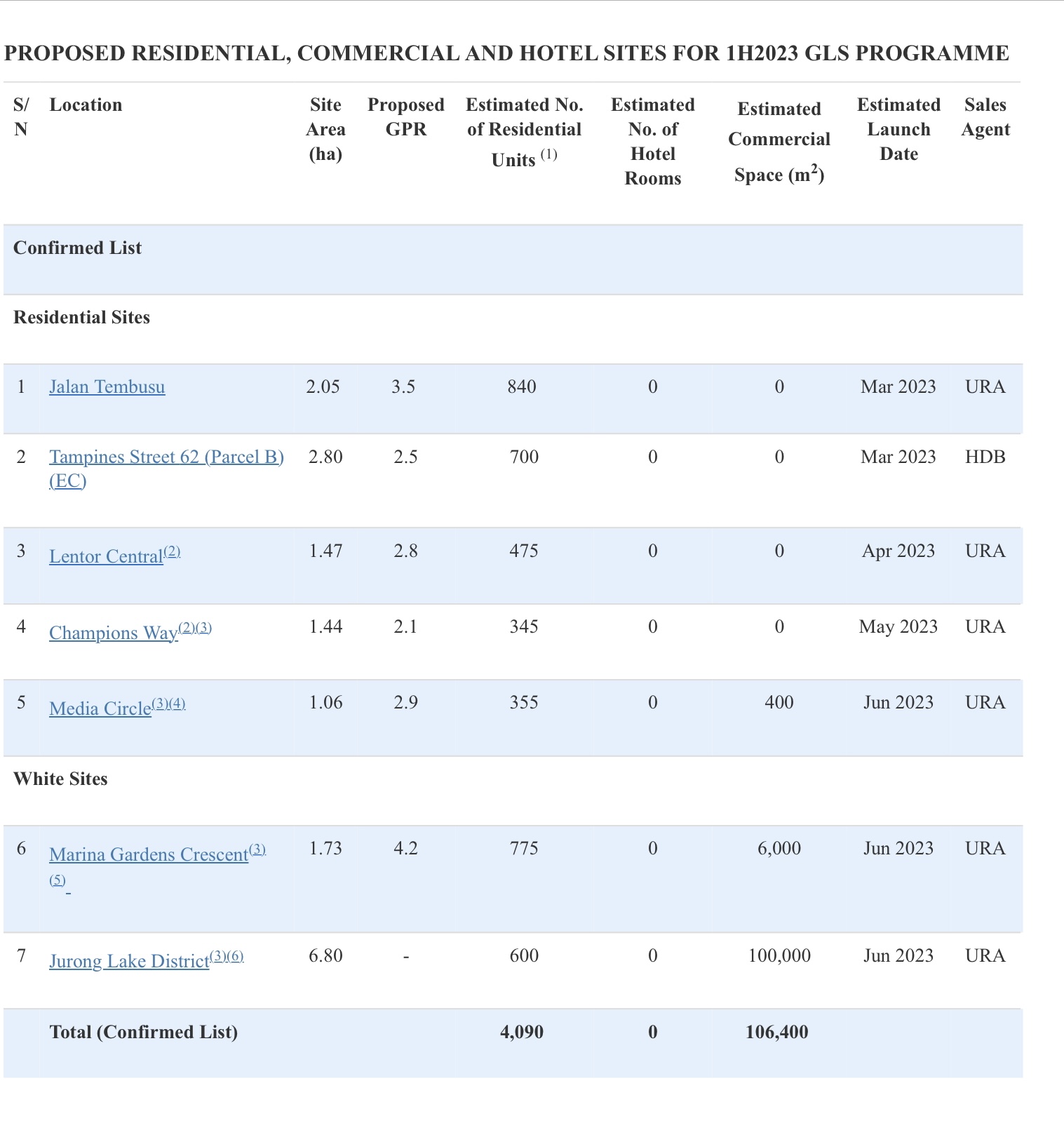

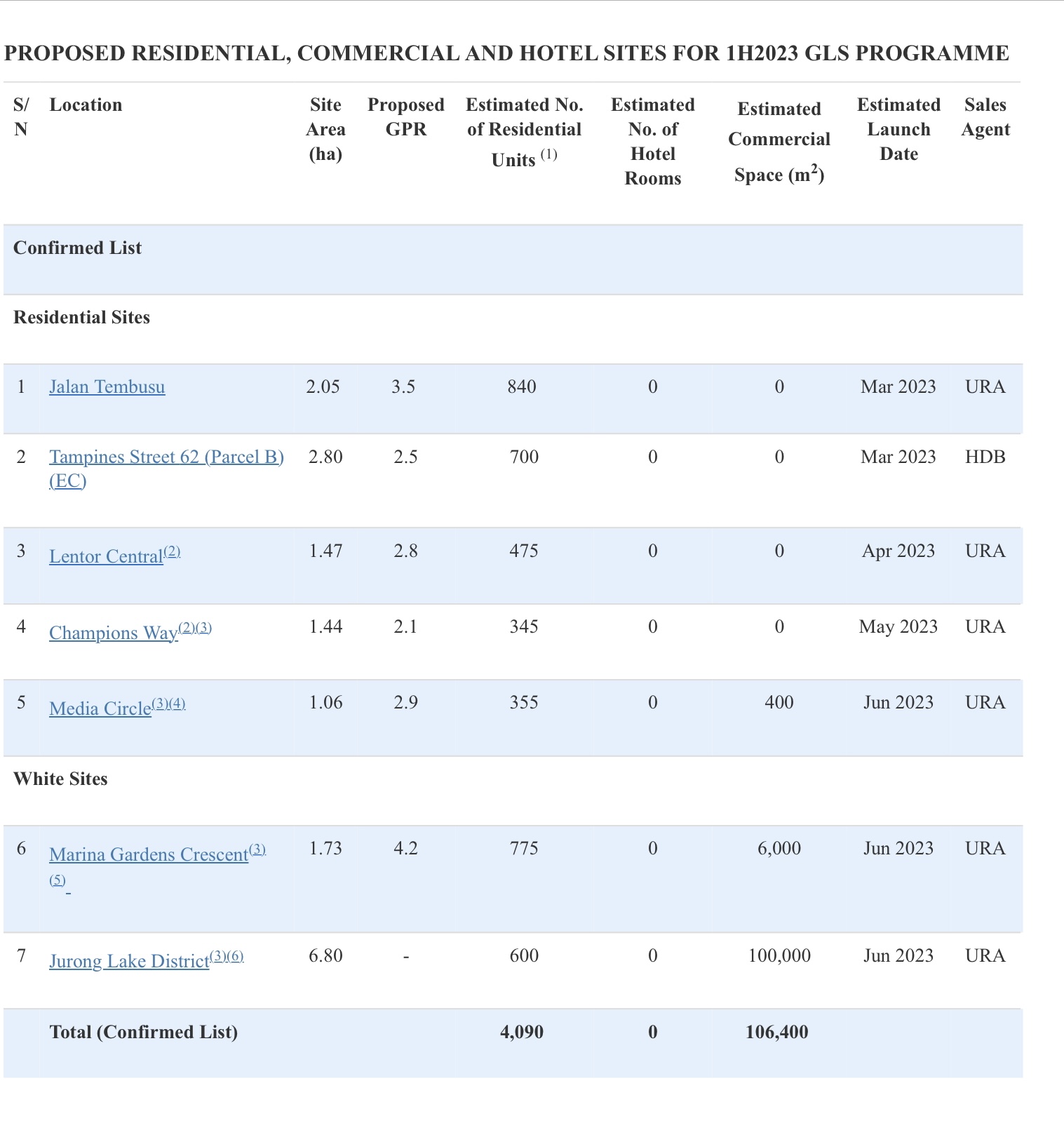

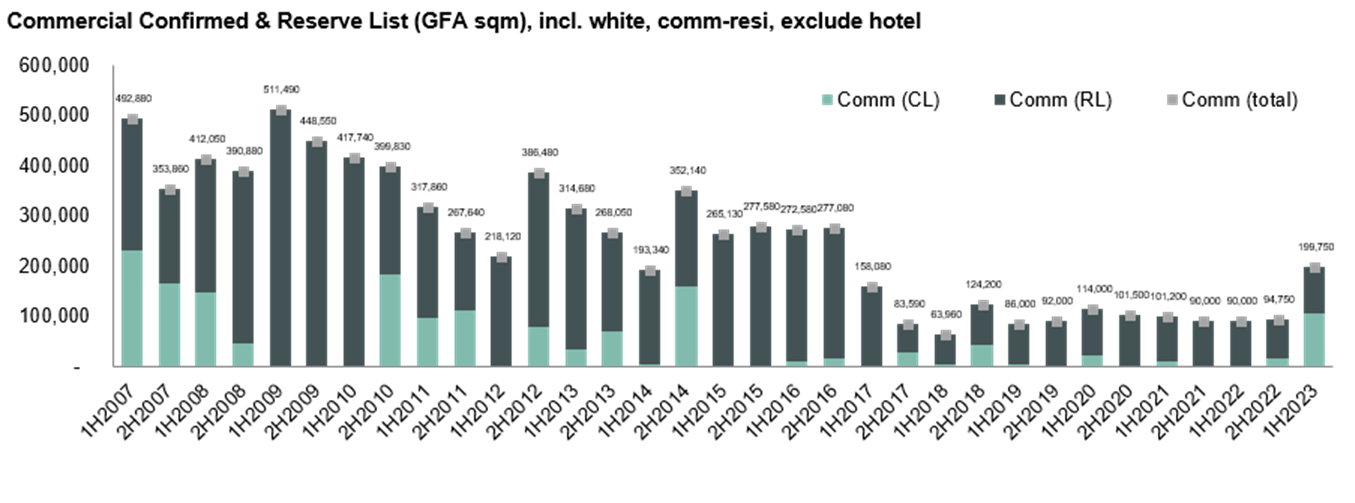

The latest Government Land Sale (GLS) program saw the government bump up the office supply significantly, the largest increase since 2016. The Government will be releasing, via the 1H2023 Confirmed List, a 6.8 hectare White site in the Jurong Lake District for sale to a Master Developer. This comprises three plots of land linking the Jurong East MRT interchange station and the future Jurong Lake District station of the Cross Island Line.

The intention is for a single developer to comprehensively master plan the site and use district-level urban solutions (such as a district cooling system) that will be integrated within the mixed-use development. With a potential yield of about 150,000 sqm (1.615 mil sqft) of office space, 1,760 private residential units and 75,000 sqm GFA of complementary uses such as retail, hotel or community uses, the proposed integrated development will be progressively developed over the next 5 to 10 years to cater to market demand. The successful tenderer will be required to build at least 70,000 sqm GFA of office space and 600 private housing units as part of the first phase of the development, but will have some flexibility to phase out the remaining supply according to market demand.

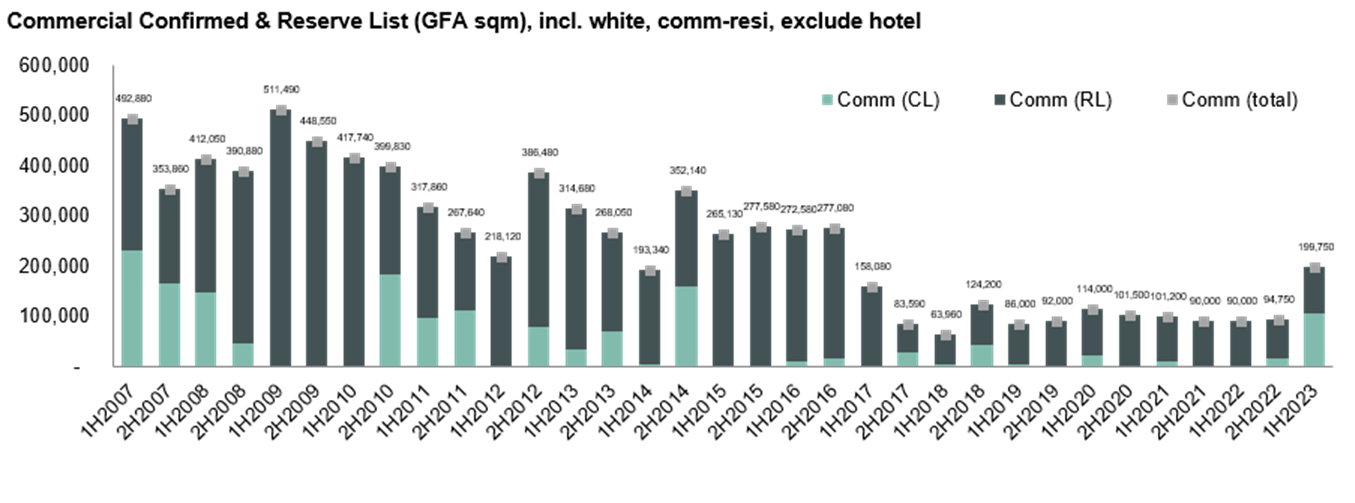

This marks the largest GLS office space supply since 2016, and the largest in a decentralised location. The most recent greenfield sites with such sizeable office component that were sold via GLS were in the CBD, namely: Guoco Midtown site, which was sold on Oct 2017 for S$1.622 bn or S$1,706 psf ppr, and yielding over 700,000 sqft of office space, and the IOI Central Boulevard Tower site, which was sold on Nov 2016 for S$2.569 bn or S$1,689 psf ppr, yielding 1.26 mil sqft of office space.

This move is widely anticipated given the government’s vision of Jurong Lake District as Singapore’s largest business district outside the city centre to cater to business needs and support decentralisation. CBRE’s proprietary Live, Work, Shop survey finds that the CBD remains the most sought-after office locations for employees, due to its established transport infrastructure and amenities. So a decentralised work place will have to be designed and planned well, targeted at the right occupier groups, and should offer cost advantages to attract occupiers. The Jurong Lake District already had laid plenty of groundwork – with significant retail and office developments as well as residential projects since 2008. By 2028, a new Jurong Region Line station and an Integrated Transport Hub comprising offices, community spaces and retail amenities will be built next to the Jurong East MRT interchange station. It will be a model sustainability district with a goal to achieve net-zero emissions for new developments around 2045.

Pending more details on the site, we believe this development land cost could be at least S$1,300 psf ppr. The sheer size of the project would mean over S$2 bn in land cost, and we expect developers to form consortiums or JVs to tender for this project. Based on the targeted release date of June 2023 on GLS and assuming 3-6 months of tender period, we expect the earliest office completion will likely be in 2028. With this focus on decentralised office development, we believe there should be limited new greenfield office sites in the CBD made available via the GLS in the near future. Going forward, the CBD will see rejuvenation via ageing office assets being redeveloped into mixed-use developments.

Source: CBRE Research, MND. Comm : Commercial. CL: Confirmed List. RL: Reserve List.

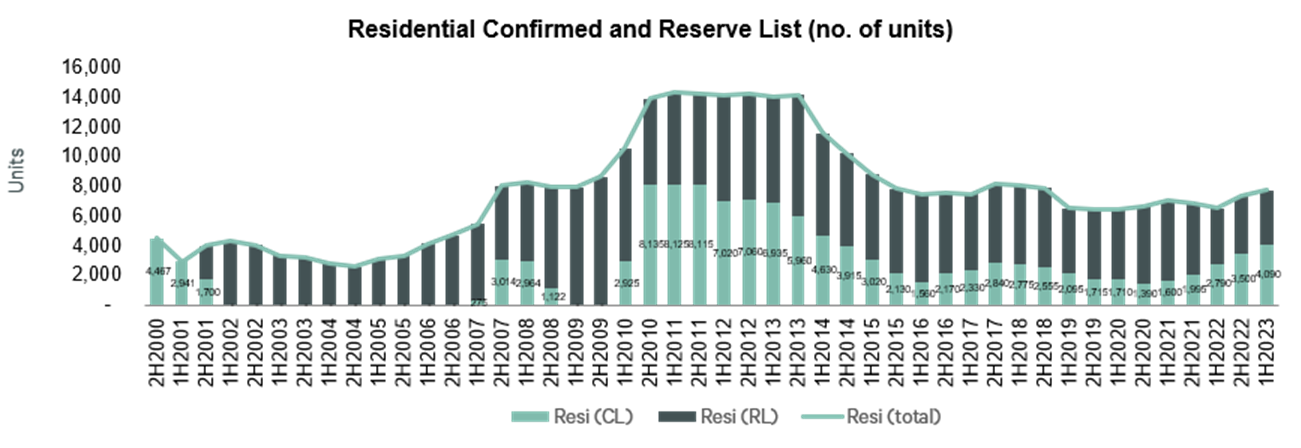

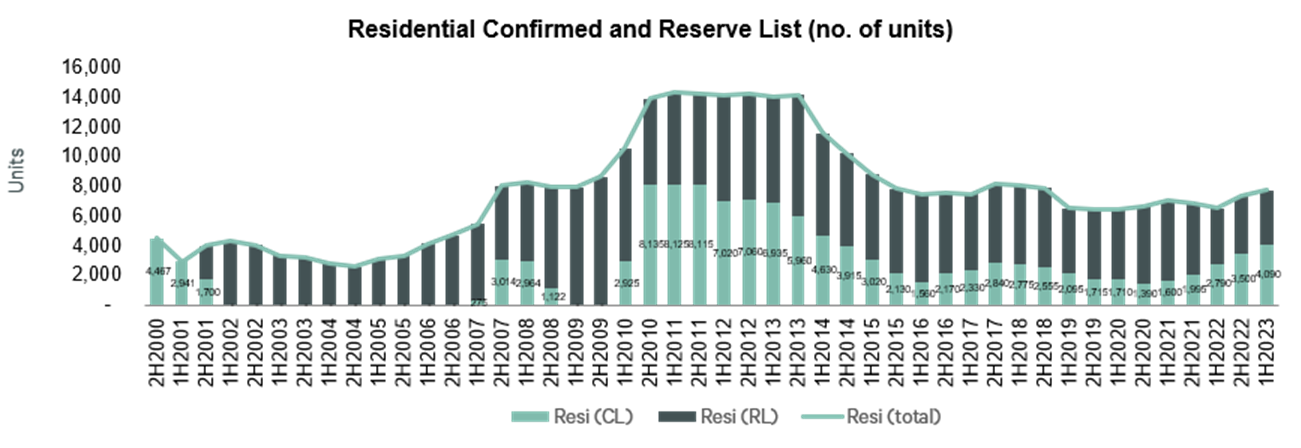

Residential supply on the Confirmed List increased moderately

The latest Government Land Sale (GLS) program saw the government increase the number of housing units on the Confirmed List by about 17% to 4,050 units, from 3,500 units released in the 2H 2022 GLS Confirmed list. Over the past two years, the Government has progressively ramped up the supply of private housing on the Confirmed List of the GLS Programme to cater to strong demand from homebuyers. This annualised 8,100 units would be better-matched with the estimated new private home sales of 7,500 units in 2022, though will still be below the 10-year (2013-2022) annual average of about 9,750 new private home sales.

Source: CBRE Research, MND. Resi : Residential. CL: Confirmed List. RL: Reserve List.

Which are the most attractive new sites on GLS 1H 2023?

The two new residential sites on the Confirmed List are: a 345-unit site at Champions Way near Woodlands South MRT and a 355-unit site at Media Circle near Mediapolis. We think both sites are of palatable size, and should see decent interest. The Media Circle site could cater to the growing one-north work population, but is located at the fringe on one-north and further away from the MRT stations.

Besides Jurong Lake District, the other White site on the Confirmed List is Marina Gardens Crescent site, which is adjacent to the Marina Gardens Lane site just released for tender on the Confirmed List for 2H 2022 GLS Programme on 5 Dec. This new site has a lower plot ratio, and probably will have a lower height than the prior site, can be built up to 775 dwelling units, with a retail cap of 6,000 sqm. We expect this site to take the cue from the response to the first site whose tender will close on 27 June 2023.

Among the new sites in the Reserve List, we find the most attractive site and could be triggered for tender is the new Lorong 1 Toa Payoh site, as there has been no new private residential land tender in the mature estate since Jun 2015, which saw 14 contenders bid for the adjacent site which now stands GEM Residences. While it was not that near a MRT station, it should enjoy upgraders demand from a mature largely public housing estate, and for its city fringe location and proximity to popular primary schools.

There is yet another new Lentor Gardens site on the Reserve List (500 units), which marks the 7th site in the Lentor area that has been put out since the first Lentor Central site was sold in July 2021. The 7 sites at Lentor could collectively build up to 3,500 private homes eventually. Given the abundant supply, we think this site is unlikely to be triggered from the Reserve List.

There is also a new Plantation Close EC site on the Reserve List, which is just next to the Tengah Plantation Loop EC site that will be released for tender on the Confirmed List 2H 2022 in Dec 2022. We believe it is unlikely to be triggered for sale soon given the over 1,000 potential units on the site in aggregate.

As part of the Government’s efforts to support decentralisation and cater to demand for workspaces near homes, the Government will be making available, via the 1H2023 Reserve List, a commercial site in Punggol Walk, with a 30-year lease tenure and a potential yield of about 8,400 sqm of office space. The release of such sites on shorter lease allows our land uses to be refreshed in shorter cycles to support businesses in adapting their operations more nimbly to changing economic trends. While this site is near the Punggol MRT, we think the 30-year leasehold is likely to deter developers. It could appeal to owner-occupiers who specifically want to be in Punggol.