You often hear about wealthy Chinese families investing in Singapore, but far more Chinese buyers favour Thailand.

How to explain this riddle? It’s simple economics. Singapore is a popular investment destination for wealthy Chinese from the mainland and Hong Kong, but the city-state is too expensive for most cross-border buyers.

In Thailand, on the other hand, an upper-middle-class family from Shanghai can afford to buy a condo near the beach. Prices for such homes start as low as US$100,000.

Singapore is the third-most-expensive city in Asia at US$14,373 per square meter (after Hong Kong and Tokyo), according to data from Juwai IQI’s partner Global Property Guide.

And it’s not just home prices. Singapore’s 35 per cent stamp duty on overseas property investors adds to the expense of already high prices.

For all its appeal, Singapore is affordable only to the wealthy.

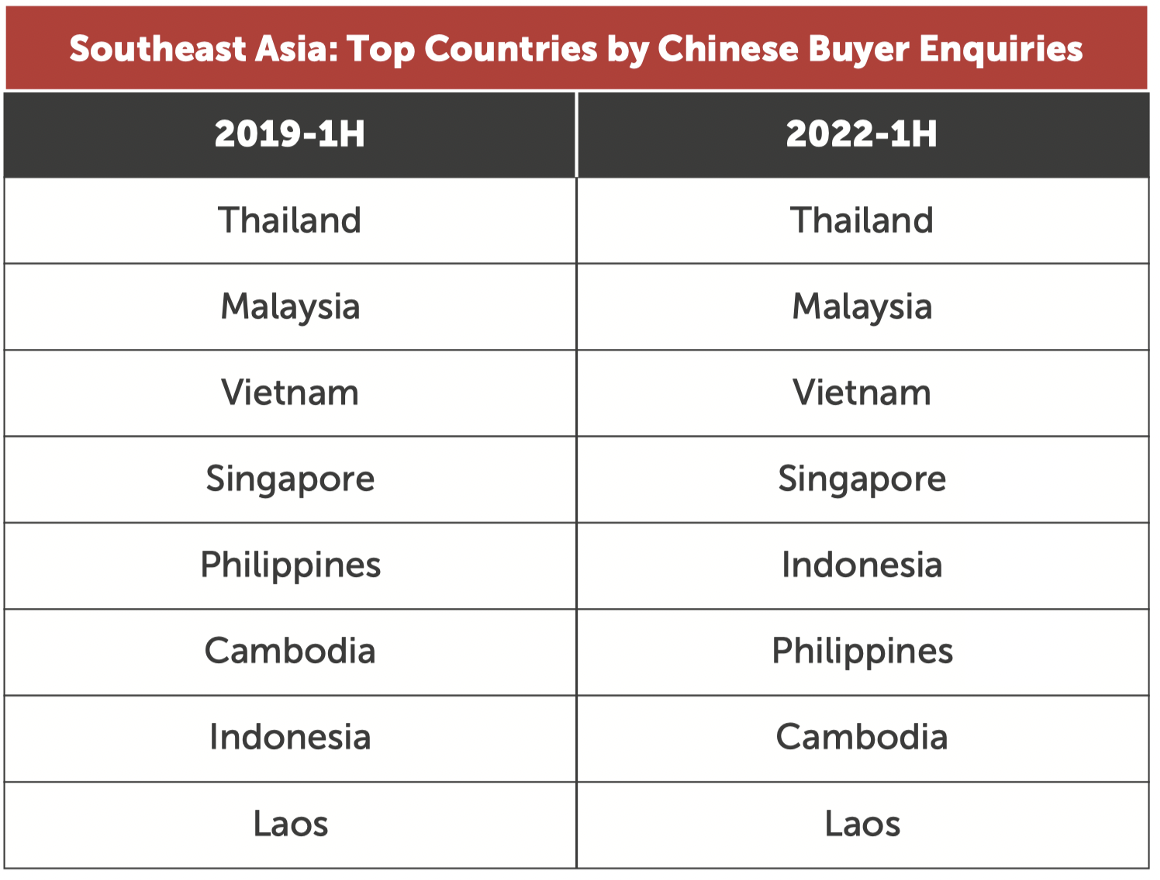

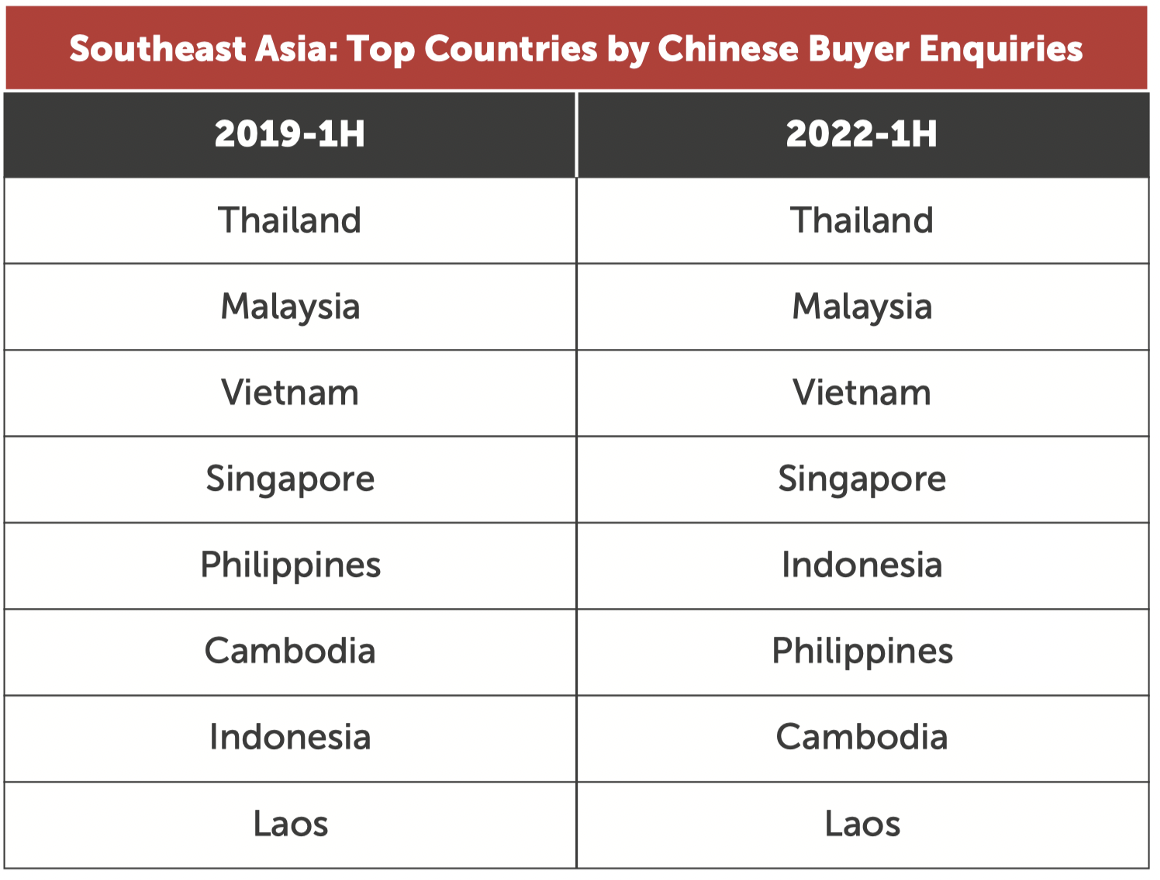

That is why Thailand, Malaysia, and Vietnam lead the list of top Southeast Asian destinations for Chinese buyers of overseas residential property. We generated these rankings from buying enquiries made through Juwai IQI’s online portals, Juwai.com and Juwai.asia, and network of more than 27,000 agents.

Indonesia is the big mover in the top-10 list this year. It advanced past the Philippines and Cambodia to arrive in the fifth rank.

What is so special about Thailand that it has been almost unchallenged as the most popular destination for Chinese buyers since 2018?

Key factors include Thailand’s appealing lifestyle, affordable luxury property prices, beach second home destinations such as Pattaya and Koh Samui, and proximity to China. Thailand is also the top tourist destination for Chinese travelers.

It’s also true that the Thai development industry has been very savvy in targeting Chinese buyers with a wide range of products. Chinese buyers there may be families for whom spending US$100,000 for a Thai condo is a financial stretch. Or they may be investors whose multi-million-dollar Thai homes are merely one of many they own around the globe.

Malaysia is nearly as appealing as Thailand. It’s doing well economically. Malaysia’s 2022 GDP growth is likely to reach 5.5%. Many Chinese buyers believe Malaysia’s market will recover from its current weakness and reward investment.

And in Vietnam, Greater Chinese buyers make up the largest foreign buyer group in Ho Chi Minh City.

Like in all overseas buying destinations, demand in Vietnam has been hit by China's closed borders. Yet, luxury rental yields often reach 8%, and prices start at US$5,000 per square meter. That compares favourably to US$6,500 in Bangkok.

We see excellent post-reopening potential.

By Juwai IQI Co-Founder and Group CEO Kashif Ansari.