Phuket luxury and upscale Hotel Market in the first half of 2022 - Knight Frank

Contact

Phuket luxury and upscale Hotel Market in the first half of 2022 - Knight Frank

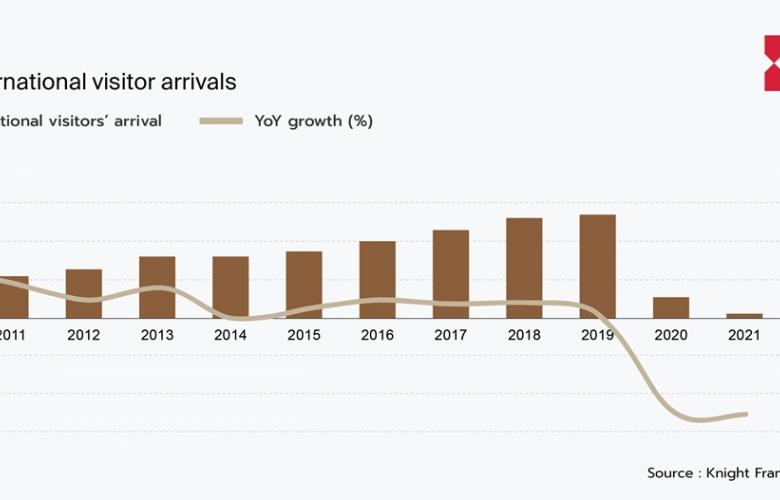

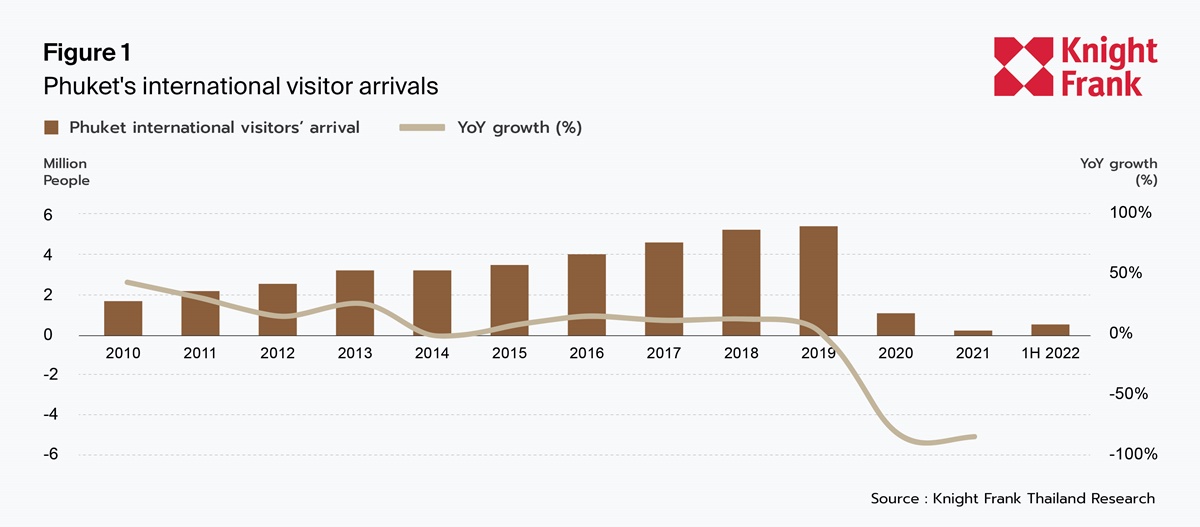

Knight Frank Thailand said the number of international arrivals totaled circa 512,000 in the first half of 2022 thanks to the further loose of travel restrictions. It represents a modest 19% of the pre-pandemic level in 1H 2019.

Mr. Carlos Martinez, Director of Research and Consultancy, Knight Frank Thailand said the number of international arrivals totaled circa 512,000 in the first half of 2022 thanks to the further loose of travel restrictions. It represents a modest 19% of the pre-pandemic level in 1H 2019, but a rebound from less than 1,000 foreign arrivals in 1H 2021.

Phuket’s hotel industry was the hardest hit by the pandemic in Thailand due to its high reliance on foreign visitors. The Thai government prioritized Phuket’s market recovery with the first pilot program to re-open the country in July 2021, which followed several changes in travel rules based on the development of the number of Covid-19 infections. Amid the devasting market situation, hotel operators in Phuket struggled to remain afloat. With inbound tourism at its lowest, many hotel operators had to readjust their business models and switch their focus to domestic tourism.

In the first half of 2022, 39% of the total number of international visitors were from East Asia, led by visitors from Malaysia, and Singapore. Visitors from Europe represented 30%, mainly from the UK, Germany, France, and Russia. Indian visitors represented 11%. Chinese visitors, the main market feeder before the pandemic, remained absent as traveling to and from China is strictly limited due to its zero-Covid strategy.

SUPPLY AND DEMAND

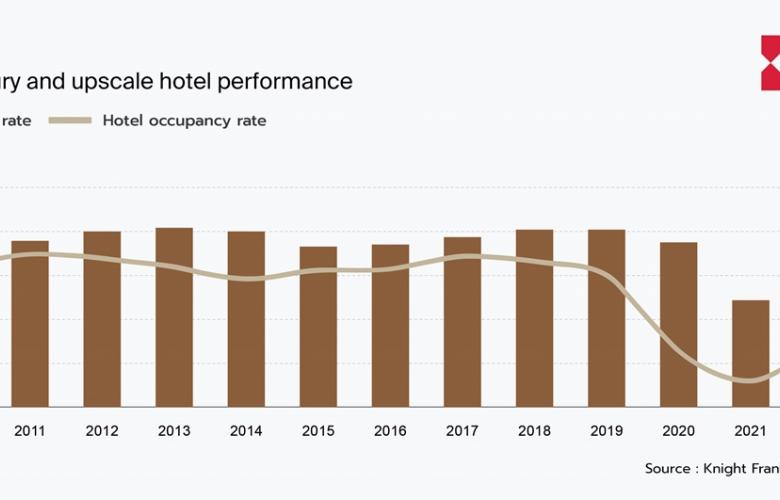

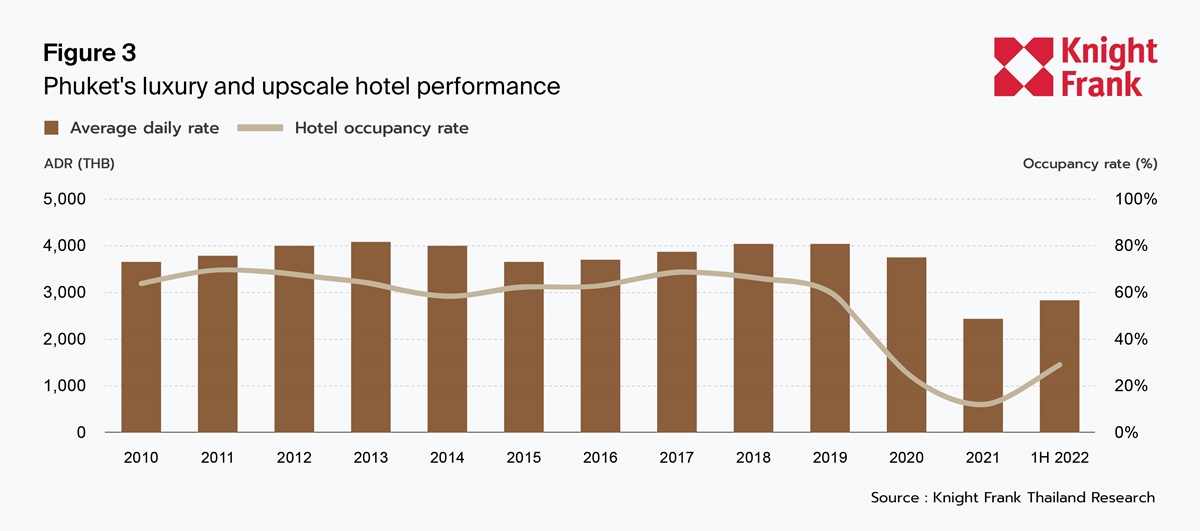

In the first half of 2022, the Phuket hotel industry improved after being severely wounded by the pandemic with largely non-existent foreign arrivals due to the strict travel restrictions coming into force across Thailand and the main market feeders.

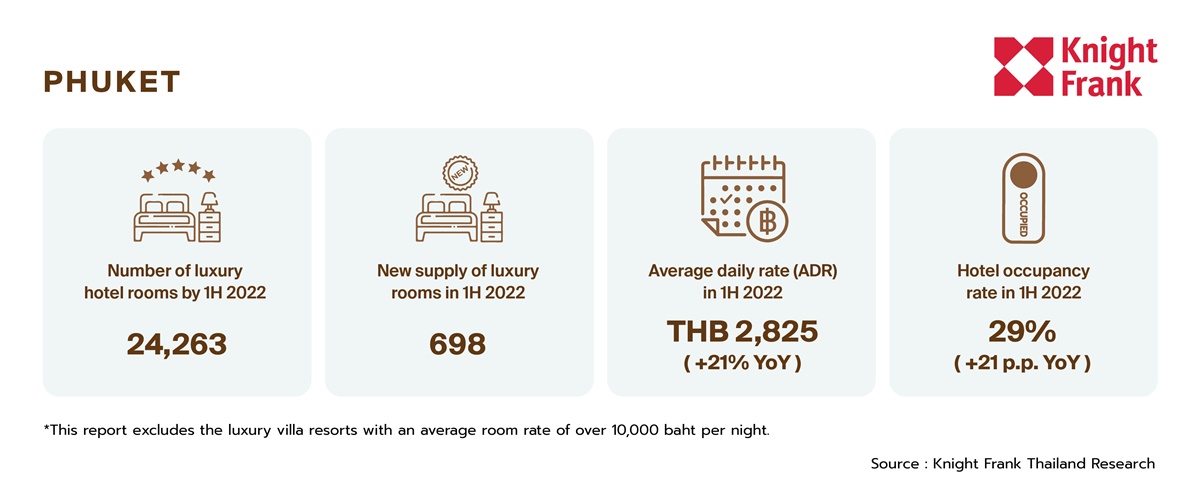

The Average Daily Rate (ADR) of luxury and upscale hotels rebounded from its bottom in 1H 2021 by 21% YoY to THB 2,825 as a result of the growth in foreign arrivals in the first half of the year. Yet, room rates remained 30% lower than those before the pandemic.

The average occupancy rate is still modest at 29%, nevertheless, it represents a significant recovery from 8% in 1H 2021, a 21 percentual points higher as a result of an increasing number of both domestic and international visitors.

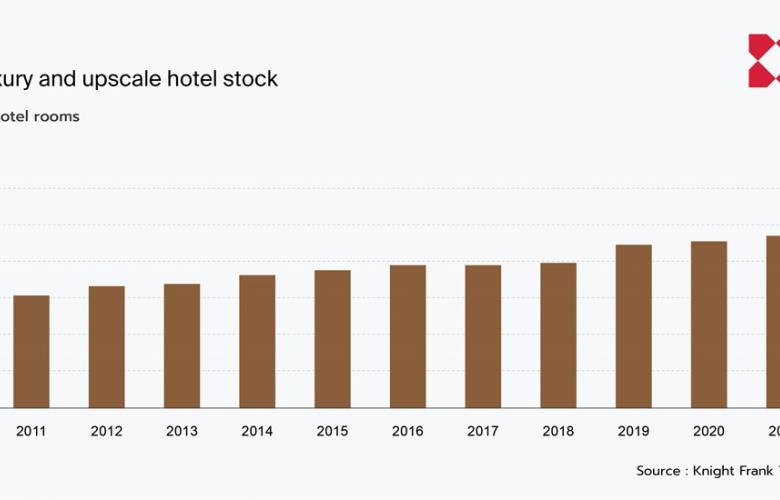

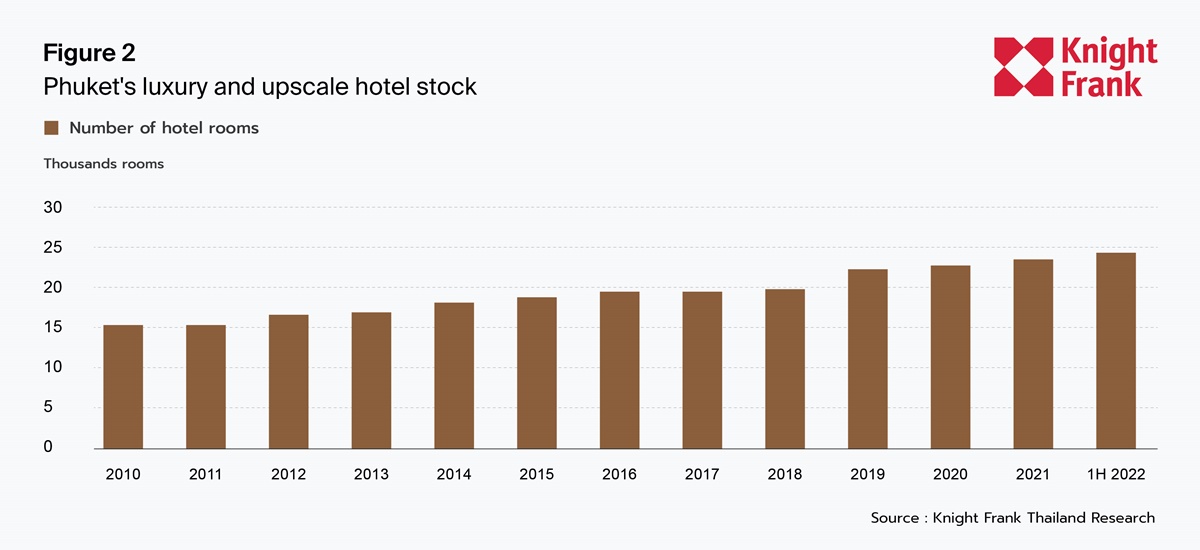

The total stock of luxury and upscale hotels reached 24,263 at the end of June 2022, with 698 new rooms in 1H 2022. New hotel openings in the upper-tier segments include Melia Phuket Karon Residences (73 rooms), Wyndham Garden Platinum Bay Phuket (420 rooms), and Wyndham Chalong Phuket (80 rooms), Dhawa Phuket Residences (33 rooms), and Utopia Mai Khao (92 rooms). Hotels in the pipeline comprise over 12,200 keys by 2024, some of them might be postponed or canceled based on their stage of development.

The largest supply of hotel rooms in Phuket is located in Patong beach (26%), followed by Karon (18%), Bang Tao (12%), Kata (11%), and Kamala (10%).

OUTLOOK

While foreign arrivals represented 59% of arrivals in Phuket airport before the pandemic, this figure was only 35% in the first half of the year, indicating the still high reliance of hoteliers on domestic tourism as it was during the pandemic. With the fully reopening of Thai borders in July 2022, we expect to see a continuation of the market recovery up to a certain extent as it is unlikely to reach significant levels of foreign arrivals this year, without the Chinese and Russian visitors.

China’s borders will probably remain sealed for the remaining of the year as the country continues to pursue a zero-tolerance approach to Covid-19 which in most countries are taking steps toward declaring it an endemic disease. Moreover, the Russia-Ukraine war not only has effects on the loss of the Russian tourism market but as a whole as oil prices could feed through into flight prices, stretching the recovery period. With all, the outlook for Phuket’s hotel industry remains uncertain in the short term.

The average hotel RevPar will likely continue to increase at a slow pace mainly led by ADR as a result of the continued growth in the number of foreign arrivals for the remaining of the year, but, will still be far from reaching pre-pandemic levels which are not expected to be seen before 2024 as the earliest in the most optimistic scenario. Thus, plans for new hotels are likely to be revised or postponed. Existing hotels will continue to struggle in the short term which might force some hotel owners to put their properties up for sale.

Download here for the full report.