Leading diversified professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) releases its Q2 2022 Investment Market Report. Key highlights include:

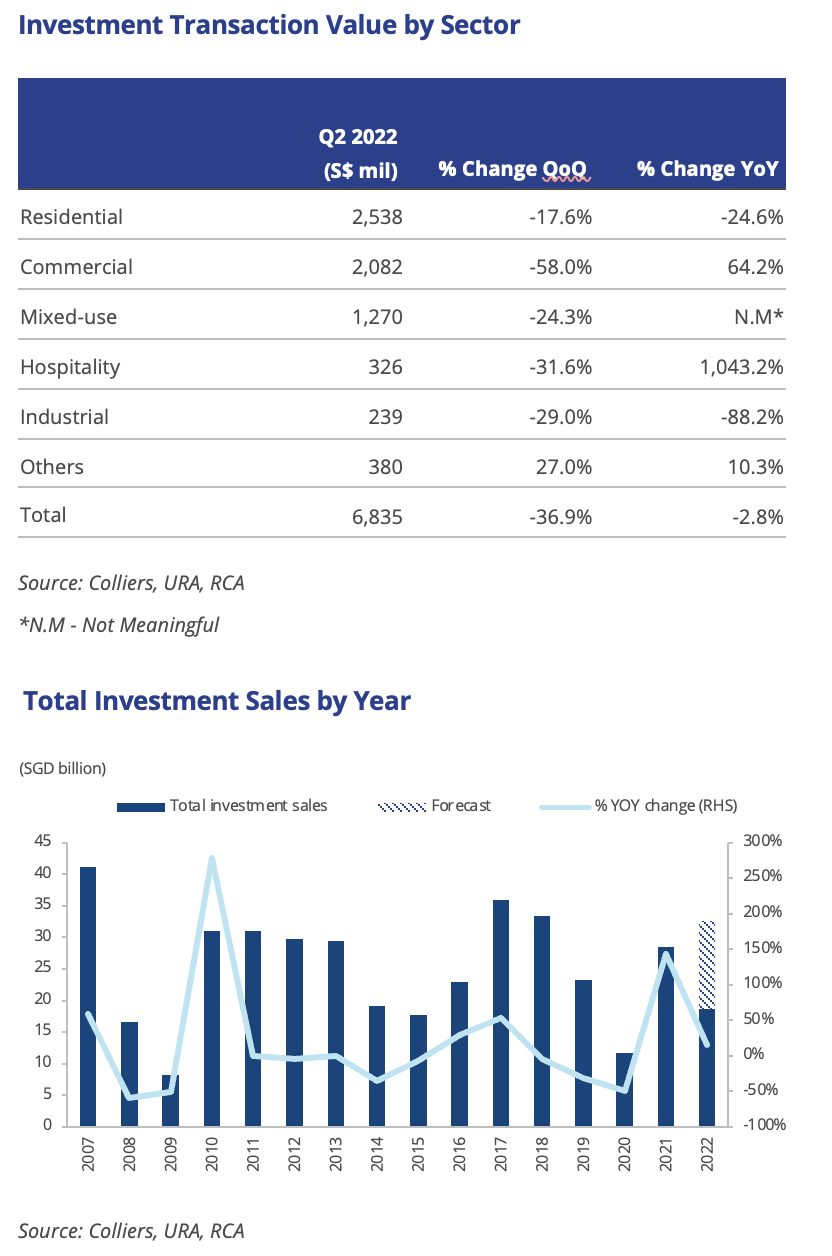

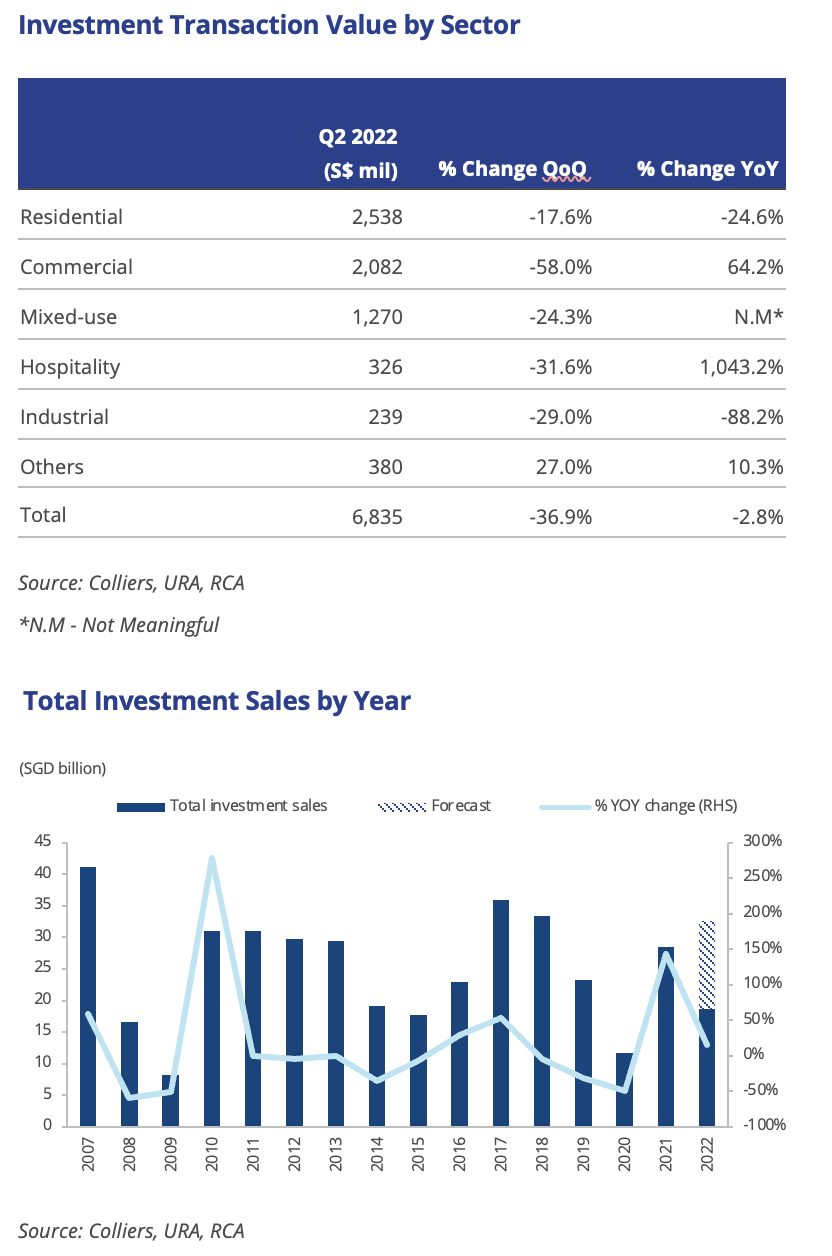

- Total Q2 2022 investment sales declined by 36.9% quarter-on-quarter (QoQ), following a strong performance in 1Q 2022. Nonetheless, the market is likely to register a 15.0% year-on-year (YoY) growth for 2022, with total transaction value forecast to reach S$32.6 bil.

- Transaction value for the commercial sector declined by 58.0% QoQ. The volume in the second quarter was supported by the sale of Comcentre and Westgate Tower.

- Residential sales declined 17.6% QoQ. Land and collective sale made up the bulk of the transactions during the quarter.

- Industrial sales declined by 29.0% QoQ. Logistics assets will continue to be well-sought after.

- Mixed-used developments continued to attract keen interest during the quarter with the successful sale of Golden Mile Complex and 28 & 30 Bideford Road.

- Capital values for prime office remained flat, while that of industrial and retail assets saw a moderate increase.

Investment value for Q2 2022 declined by 36.9% to S$6.8 bil, after a strong performance seen for Q1 2022. The quarter’s performance was largely attributed to government land sales, collective sales and office sales. On a year-to-date performance, total investment value was S$17.7 bil for the first half of 2022. This is a 46.3% YoY increase which reflects improving demand and growing investor confidence.

Ms Tang Wei Leng, Managing Director and Head of Capital Markets & Investment Services, Singapore at Colliers says, “The market is flushed with much liquidity as many investors are highly and well capitalised.

Savvy investors will navigate through the current uncertainties of supply chain disruptions, rising inflation and interest rates as well as increasing exchange rate fluctuations, seizing unprecedented opportunities sensibly and scaling up their AUM.

Short term fluctuations will not deter investors who see long term value in Singapore’s stability, well-managed economy and good urban planning. We see opportunities in good quality office assets underpinned by strong occupier demand and tight supply as well as older buildings with strong redevelopment attributes. As borders continue to open, investors should also start exploring retail and hospitality assets. We expect investment volume to roll with the punches as investors continue to put their abundant capital to work,” adds Ms Tang.

Investment momentum is expected to continue and investors, to hedge against the uncertainties, are more inclined to pursue recession-proof assets such as prime office space, logistics assets and suburban retail premises.

Ms Catherine He, Director and Head of Research, Singapore at Colliers says, “Despite the geopolitical headwinds and external uncertainties that continue to plague the economy, Singapore’s safe haven status, as well as investors’ confidence in Singapore as a competitive and attractive business destination will continue to lend support to the market. Based on our current observations, we expect full year 2022 transaction volume to register a growth of 15 - 20% from the previous year.”