Singapore tops sustainability index for APAC - Knight Frank

Contact

Singapore tops sustainability index for APAC - Knight Frank

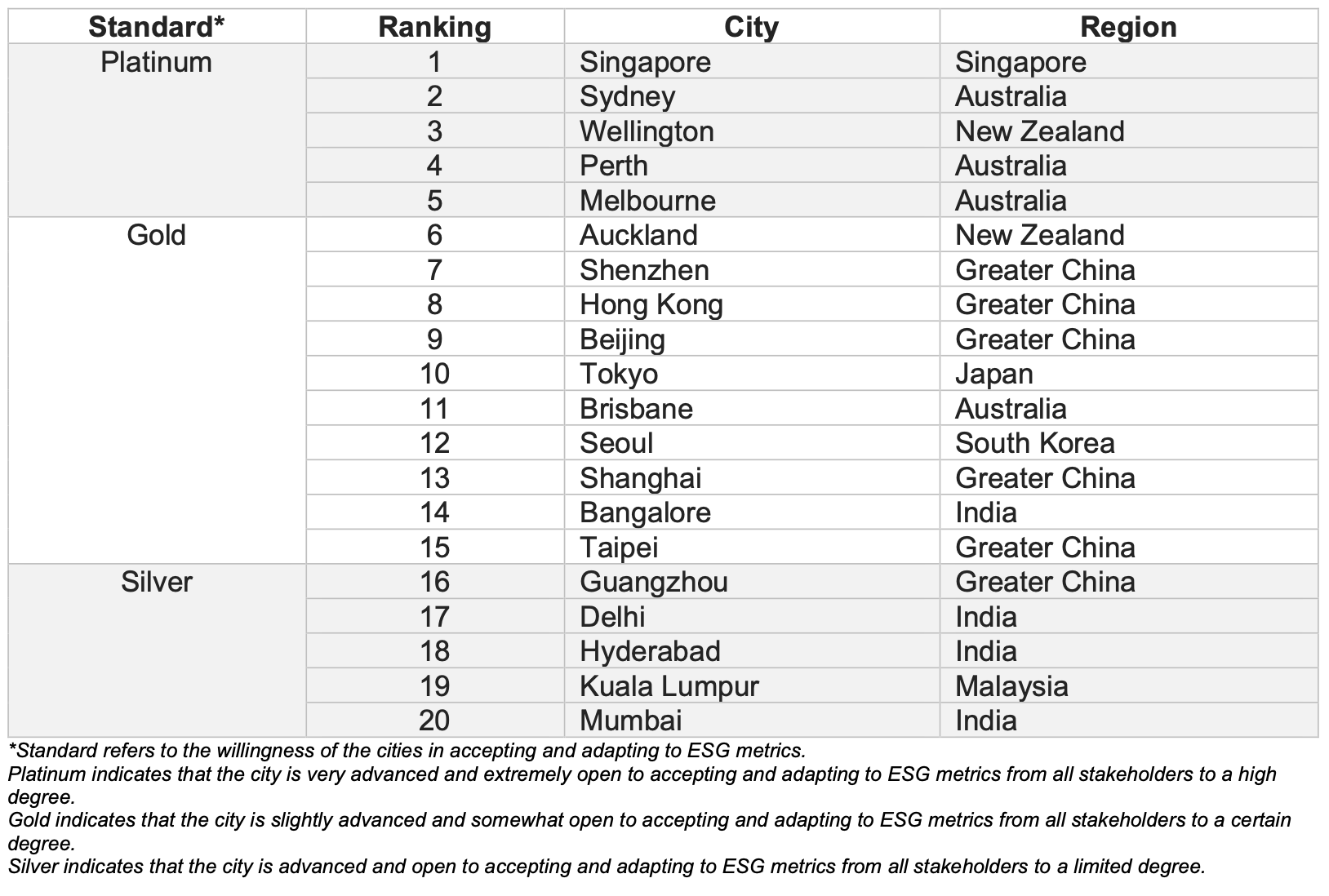

Knight Frank’s APAC Sustainably Led Cities Index rates 36 cities on urbanisation pressure, climate risk, carbon emissions and government initiatives. Sydney, Perth and Melbourne appear in the Asia-Pacific’s top five green-rated cities for commercial real estate.

Knight Frank research has identified Singapore, Sydney, Wellington, Perth, and Melbourne as the Asia-Pacific’s top five green-rated cities for commercial real estate. The top ranked cities all share common traits - low carbon emissions per person, ample green spaces, and low urbanisation pressures - according to a report by Knight Frank, Rising Capital in Uncertain Times. However, the report also highlights the region’s vulnerability to extreme weather, particularly cities located close to the equator.

Christine Li, Head of Research, Asia-Pacific, said: “While the real estate sector in APAC is adapting to the risks of these events, investors should still brace themselves for the impact of climate risks and erratic weather changes on their investment portfolios.

“The Index is closely aligned to what investors are interested in when benchmarking their portfolio and individual buildings. For example, the number of green buildings in the green score reflects the willingness and proactiveness of the local government and organisations in pushing for a more sustainable built environment. It also highlights those cities with an established market of investible green assets.”

Three factors common to the top 10 cities include the amount of green space; the availability of sustainably rated commercial buildings; and urbanisation pressures.

“Singapore stands out due to a comprehensive green building certification scheme and an ambitious plan to become a low-carbon built environment. Liveable cities like Sydney and Wellington boast ample green spaces that have been critical for inhabitants during prolonged lockdowns, providing a reprieve from highly urbanised lifestyles,” Li noted.

Awareness of the impact of climate issues is gaining traction in the region, with more tenants opting for buildings with green features. However, as demand currently outstrips supply, landlords can command up to a 10% premium on sustainably-rated buildings. In response, developers are likely to expedite the development of sustainable buildings to capture the rising demand for green buildings, according to the research.

Neil Brookes, Head of Global Capital Markets, said: “Investors are placing more emphasis on strategies that maximise their returns from their ESG efforts. We have seen a swift uptake of ESG metrics benchmarking in the APAC region in recent years, motivated by the imminent need to curtail climate risks.”

“With debt cost soaring, yield-seeking investors will also be compelled to move up the risk curve to secure the desired spreads. Many will gravitate to more active asset management strategies, such as repurposing and value-add plays, to generate alpha. Adopting sustainable measures not only enhances portfolio security but has been proven to add a positive price premium to assets,” Brookes concluded.