Transparency gains make Asia Pacific real estate more attractive to investors, says JLL

Contact

Transparency gains make Asia Pacific real estate more attractive to investors, says JLL

Asia Pacific’s commercial real estate sector is better positioned to attract increased capital in the coming years due to measurable improvements in market transparency. According to JLL (NYSE: JLL) and LaSalle Investment Management’s Global Real Estate Transparency Index, real estate markets across Asia Pacific.

Asia Pacific’s commercial real estate sector is better positioned to attract increased capital in the coming years due to measurable improvements in market transparency. According to JLL (NYSE: JLL) and LaSalle Investment Management’s Global Real Estate Transparency Index, real estate markets across Asia Pacific – driven by gains in regulation, sustainability and access to enhanced data – continue to mature and become more accommodating for investors and occupiers planning expansion in the region.

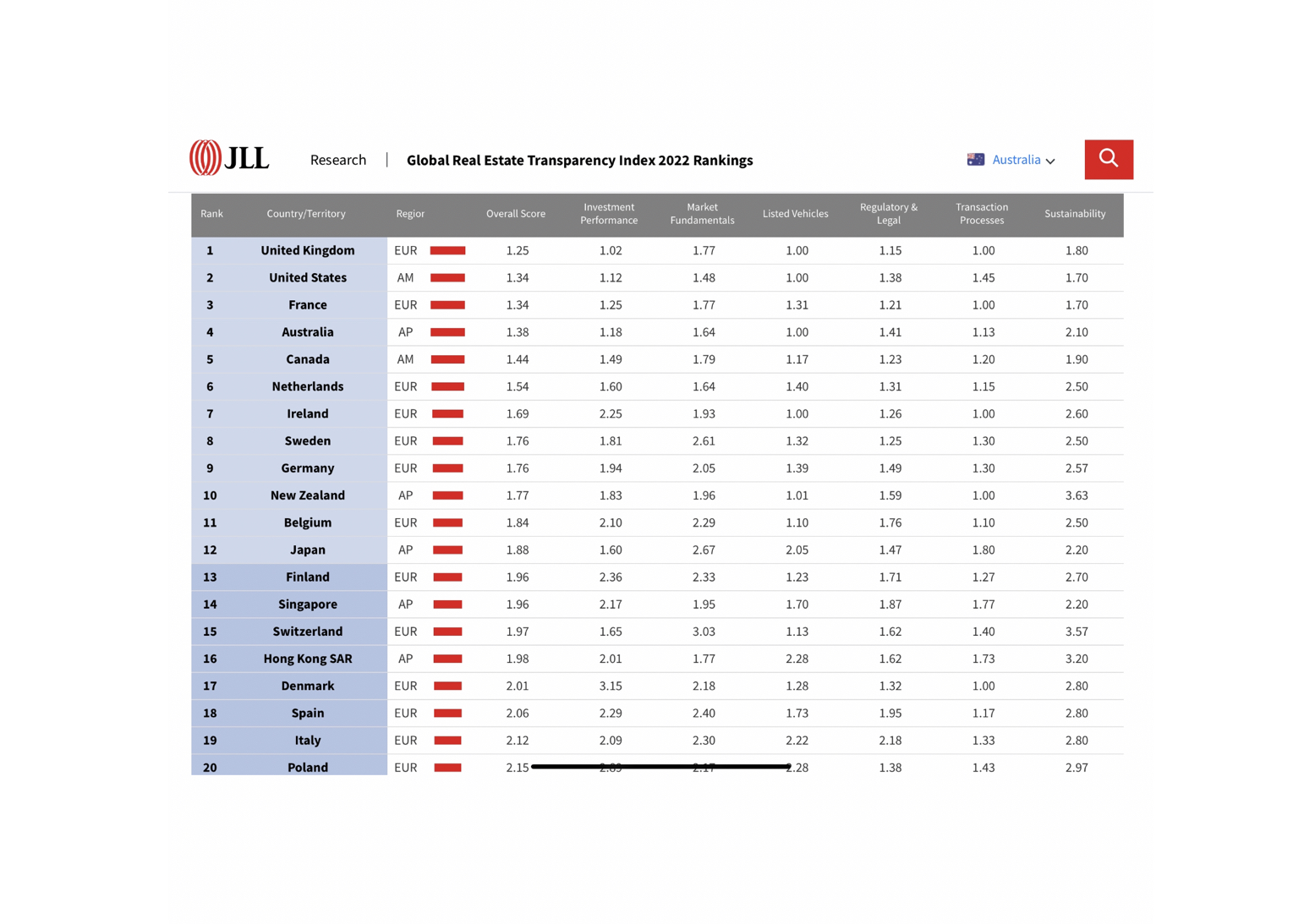

The biennial index, published by JLL and LaSalle Investment Management, provides a unique benchmark of market transparency for property investors, developers and corporate occupiers. A transparency ranking is assigned based on the availability and quality of performance benchmarks and market data, governance structures, regulatory and legal environments, transaction processes and sustainability markers to help investors and occupiers make informed, risk-based decisions.

While markets are changing at different rates, the data reveal an overall uplift in real estate transparency regionally. In 2022, Japan joins the ‘Highly Transparent’ category for the first time on the back of advances in net zero commitments, the introduction of more sustainability focused building standards, and enhanced transparency around climate risk reporting. Singapore moved closer to the ‘Highly Transparent’ category with deeper data coverage and clear sustainability commitments.

Elsewhere India registers among the top global improvers, with increased institutional investment and the maturing real estate investment trust (REIT) segment helping to increase the quality and availability of market data. Meanwhile, new building efficiency, heightened emissions standards, and better processes and data for sales transactions in Shanghai and Beijing have helped China cement its position in the ‘Transparent’ tier.

“The strides toward greater transparency in Asia Pacific will intensify investor interest and bolster occupier confidence in this region. As a result, we expect to see more capital deployed into those markets that can demonstrate consistent efforts to make accurate data available, enforce legal protections for property ownership, and enhance the regulatory environment to facilitate the transactions,” says Anthony Couse, Chief Executive Officer, Asia Pacific, JLL.

“This year, we’ve observed a shift in terms of the role sustainability plays in the decision-making process. The encouraging progress and implementation of broad net zero carbon plans and strategies will place resilient and sustainable real estate at the core of the longer-term attractiveness of this region for investors and occupiers,” he adds.

According to JLL’s findings, an increasing number of Asia Pacific countries and cities have followed up on previously announced climate commitments by establishing mandatory energy efficiency and emissions standards for buildings, aligning with broader net zero carbon goals. The report also found more widespread adoption of green and healthy building certifications, with leading markets beginning to mandate sustainability reporting from companies and collecting public building-level information on energy efficiency and emissions.

Diversification remains a core theme for many investors in Asia Pacific. Institutional capital, such as that controlled by asset managers, pension funds and sovereign wealth funds, is active in alternative real estate sectors in nearly two-thirds of the markets tracked. That means expectations for transparency across niche property types like lab space, data centres or student housing have grown.

“As data availability rises to meet demand, we expect over $200 billion in direct investment into Asia Pacific in 2022. Investors continue to diversify their capital across traditional and alternative property sectors, albeit investors are showing a little more caution given current global challenges. They will continue to choose core assets such as offices and shopping centres, but will also incorporate more healthcare, data centres and logistics assets, aided by detailed market information and analysis,” says Roddy Allan, Chief Research Officer, Asia Pacific, JLL.

JLL and LaSalle's Global Real Estate Transparency Index is published every two years and is a unique benchmark of market transparency for property investors, developers and corporate occupiers. The index evaluates the legal and regulatory environment, enforcement mechanisms and data availability and provides a global comparison of operating conditions across a wide range of geographies. This year’s 12th edition includes 254 individual indicators to assess market transparency across 94 countries and territories and 156 cities globally.

For further information please visit the JLL and LaSalle's Global Real Estate Transparency Index report via the website link in contact form below.