Asia Pacific life sciences sector to provide upside to landlords: JLL Research

Contact

Asia Pacific life sciences sector to provide upside to landlords: JLL Research

As competition for high-quality and specialized space intensifies, owners of and investors in life sciences real estate have the opportunity to play a role in incubating the next phase of the sector’s growth,” says Tim Graham, Head of Capital Strategies, Asia Pacific, JLL.

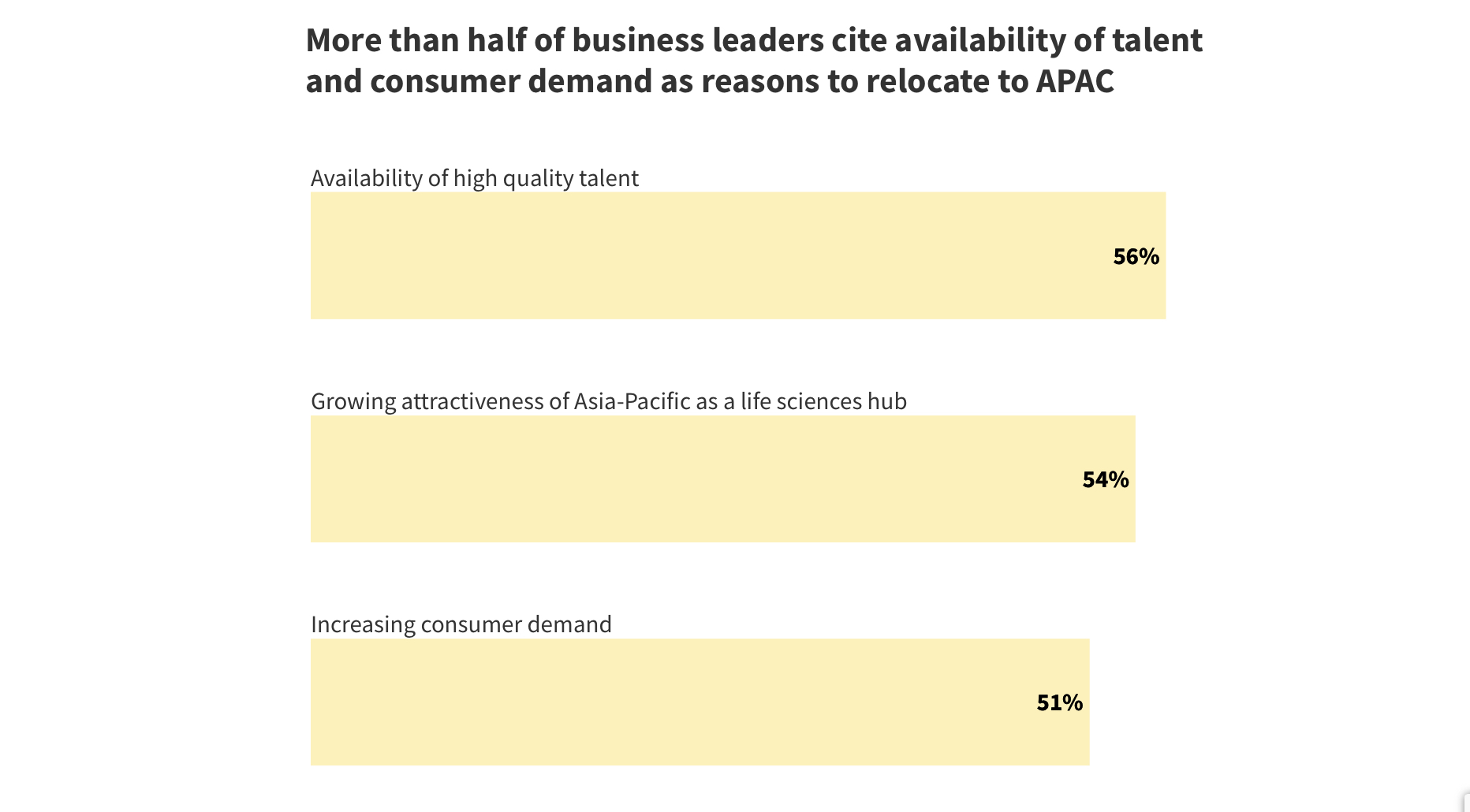

Rapid expansion in the life sciences sector will provide substantial opportunities for commercial property owners and developers in Asia Pacific, as real estate becomes a priority for companies that provide health and medical products and services.

According to global real estate consultant JLL, life sciences-focused companies in Asia Pacific are primed to expand significantly between now and 2025, with access to highly specialised spaces – including research and development (R&D) labs and medical offices – seen as a catalyst for unlocking the sector’s growth potential.

JLL interviewed real estate and facilities management professionals in life sciences companies across Asia Pacific and found that more than three-quarters (76%) believe that the operational performance of the sector will improve in the next three years. Respondents stressed that new income streams, including the development and roll-out of Covid-19 vaccines, the production and supply of personal protective equipment (PPE), ventilators, therapeutic treatments and testing, have been transformational for the sector. The demand for research and innovation to address existing public health issues continues at pace, providing a longer-term growth driver for the life sciences sector and fueling its real estate demands.

“The future success of the Asia Pacific life sciences sector is linked to the depth of the commercial real estate offering in the market. As competition for high-quality and specialized space intensifies, owners of and investors in life sciences real estate have the opportunity to play a role in incubating the next phase of the sector’s growth,” says Tim Graham, Head of Capital Strategies, Asia Pacific, JLL.

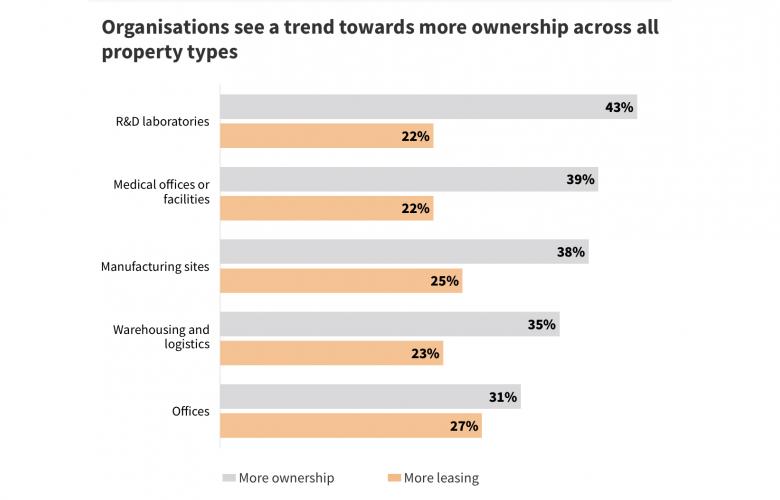

However, only one in three of those interviewed says it’s straightforward to find real estate that meets their requirements in terms of space, location, and quality fit-out. JLL found that to secure high-quality space, life sciences companies are more willing to commit to longer leases over short-term flexibility with one-third of respondents now looking for longer leases compared to five years ago.

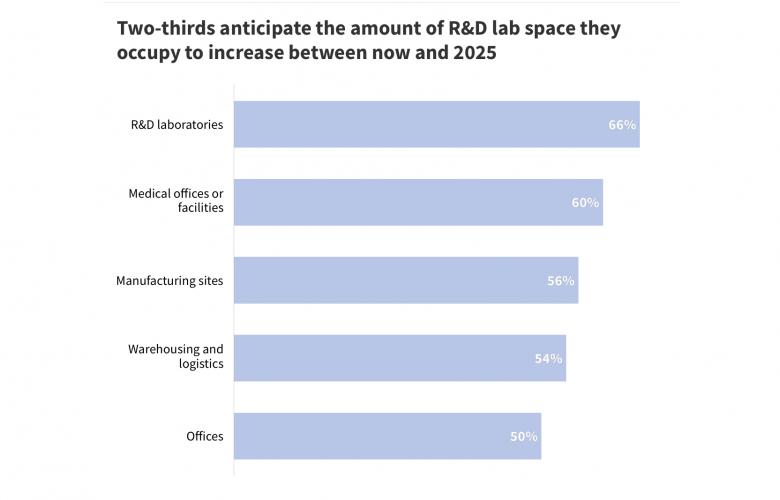

Specifically, occupier demand is likely to be highest for R&D facilities and medical offices as the sector matures in the region. Two-thirds of respondents believe they will require more R&D space between now and 2025 to meet their business objectives; 60% of respondents will need more medical offices while 56% require space for manufacturing sites.

“Life sciences occupiers will increasingly require innovative spaces in order to meet business objectives. However, the biggest challenge they will face is the lack of specialized real estate capable of facilitating the growth potential of the sector. Our conversations with clients lead us to believe that the solution will require more partnership between life sciences occupiers, landlords and developers to tailor real estate to meet the sector’s changing demands,” says Richard Cheeseman, Head of Life Sciences, Asia Pacific, JLL.

According to life sciences real estate professionals, partnership between occupiers and landlords will become more critical between now and 2025. Over three-quarters (76%) of respondents wanted to work more closely with landlords and developers on bespoke builds or fit-outs for R&D spaces with 66% open to increased partnership when designing office space.

Methodology

JLL surveyed 150 corporate real estate and facilities management professionals working in life sciences organisations across the Asia Pacific region. Respondents represent multinational and domestic life sciences industries operating in Asia Pacific, including healthcare, biopharmaceuticals, pharmaceuticals, and medical devices.