Prime Logistics Properties Continues to Outperform, Rising By 3.0% qoq in Q1 2022 Cushman & Wakefield

Contact

Prime Logistics Properties Continues to Outperform, Rising By 3.0% qoq in Q1 2022 Cushman & Wakefield

Based on C&W’s basket of industrial properties, steady rental increases were observed across the board during the first quarter of this year, except for outlying business park space. Prime logistics properties continued to outperform, rising by 3.0% qoq in Q1 2022.

Based on C&W’s basket of industrial properties, steady rental increases were observed across the board during the first quarter of this year, except for outlying business park space. Prime logistics properties continued to outperform, rising by 3.0% qoq in Q1 2022.

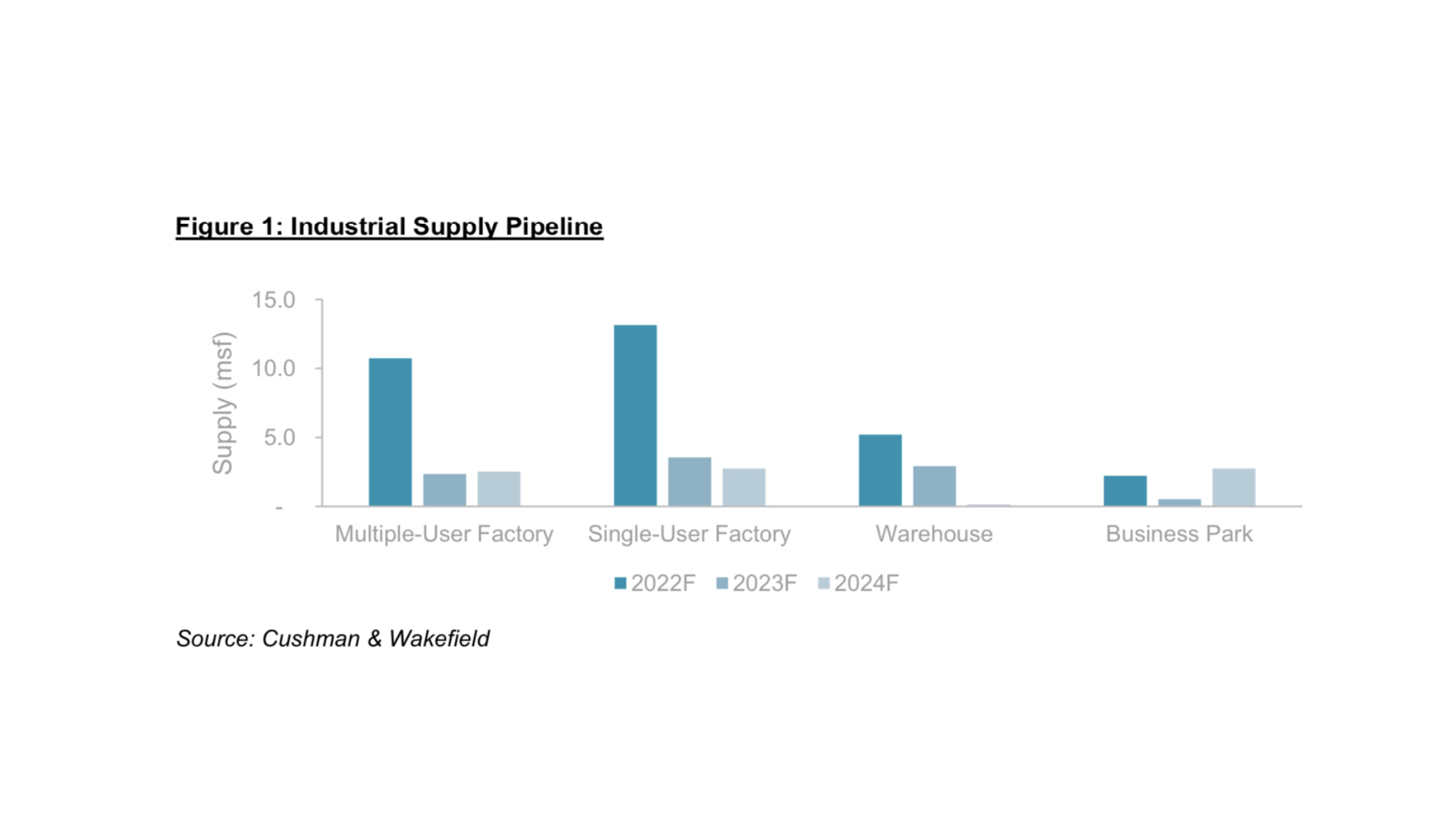

Similarly, high-tech properties also experienced stable growth during the quarter. Rents of factories rose gradually in the first quarter of 2022 given relatively tight vacancy rates as the bulk of supply is only expected to come onstream in the latter part of the year. City fringe business park continued to experience steady growth amidst tight vacancy. On the other hand, outlying business parks rents edged lower during the quarter as vacancy rates remain elevated.

Broad-based growth in rents is expected across different types of industrial properties this year despite rising downside risks. Specifically, rents for business parks in both the city fringe and outlying areas are projected to increase in 2022 with the former experiencing higher growth rate due to their limited supply.

“Continued healthy demand is expected for high-tech, prime logistics and warehouse properties amid ongoing expansion from the biomedical, technology, manufacturing and logistics sectors, fueled by the exponential growth in e-commerce and business digitalization,” said Wong Xian Yang, Head of Research, Singapore at Cushman & Wakefield. “Ample supply of factory space coming onstream this year could add downward pressure on occupancy rates. Nevertheless, overall factory rents are still expected to rise in 2022, albeit at gradual rates as continued expansion in the manufacturing and logistics sectors would underpin healthy demand for factory space.”

A very tight supply situation has sent prime logistics rents soaring, rising 3.0% qoq in Q1 2022. According to C&W’s basket of prime logistics properties, vacancy rates have fallen to below 5%.

A very tight supply situation has sent prime logistics rents soaring, rising 3.0% qoq in Q1 2022. According to C&W’s basket of prime logistics properties, vacancy rates have fallen to below 5%.

Brenda Ong, Executive Director and Head of Industrial & Logistics, Singapore at Cushman & Wakefield said, “Third-party logistics players and end-users are actively looking for prime logistic space to meet stronger consumption demand and a ramp up of manufacturing production especially for semiconductors amidst Singapore’s re-opening of economic activities and a global shortage of semiconductor chips. With little available supply, tenants are biting the bullet and accepting significant rental increases. Future supply of prime logistics assets remains limited in 2022 with only a few major projects in the pipeline such as 2PS1, LOGOS Tuas Logistics Hub and LOGOS Penjuru Logistics Centre, among others. These projects are also substantially pre-committed. The current demand supply mismatch for prime logistics space could accelerate rental growth this year.

To request a copy of the research report please contact via the contact details below.