The relative performance of Asia Pacific’s (APAC) industrial and retail sectors has come into focus over the past few years, as investors deliberate on their investment strategies.

For these investors, listed REITs provide a compelling alternative performance benchmark to the direct market indices, offer a high degree of liquidity, and exhibit pricing metrics based on sentiment and forward-looking expectations.

APAC Industrial REITs an investment darling in the recent years

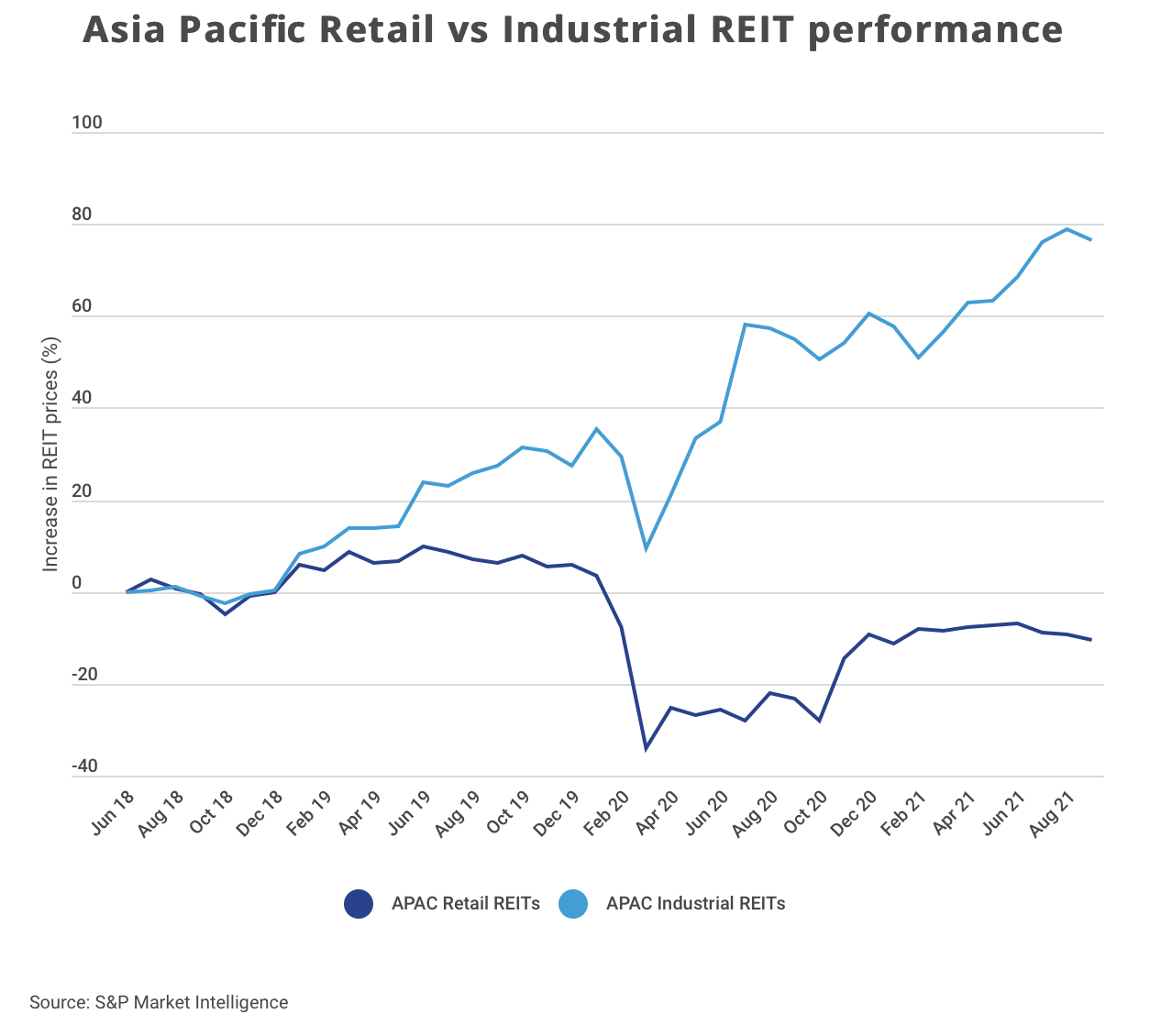

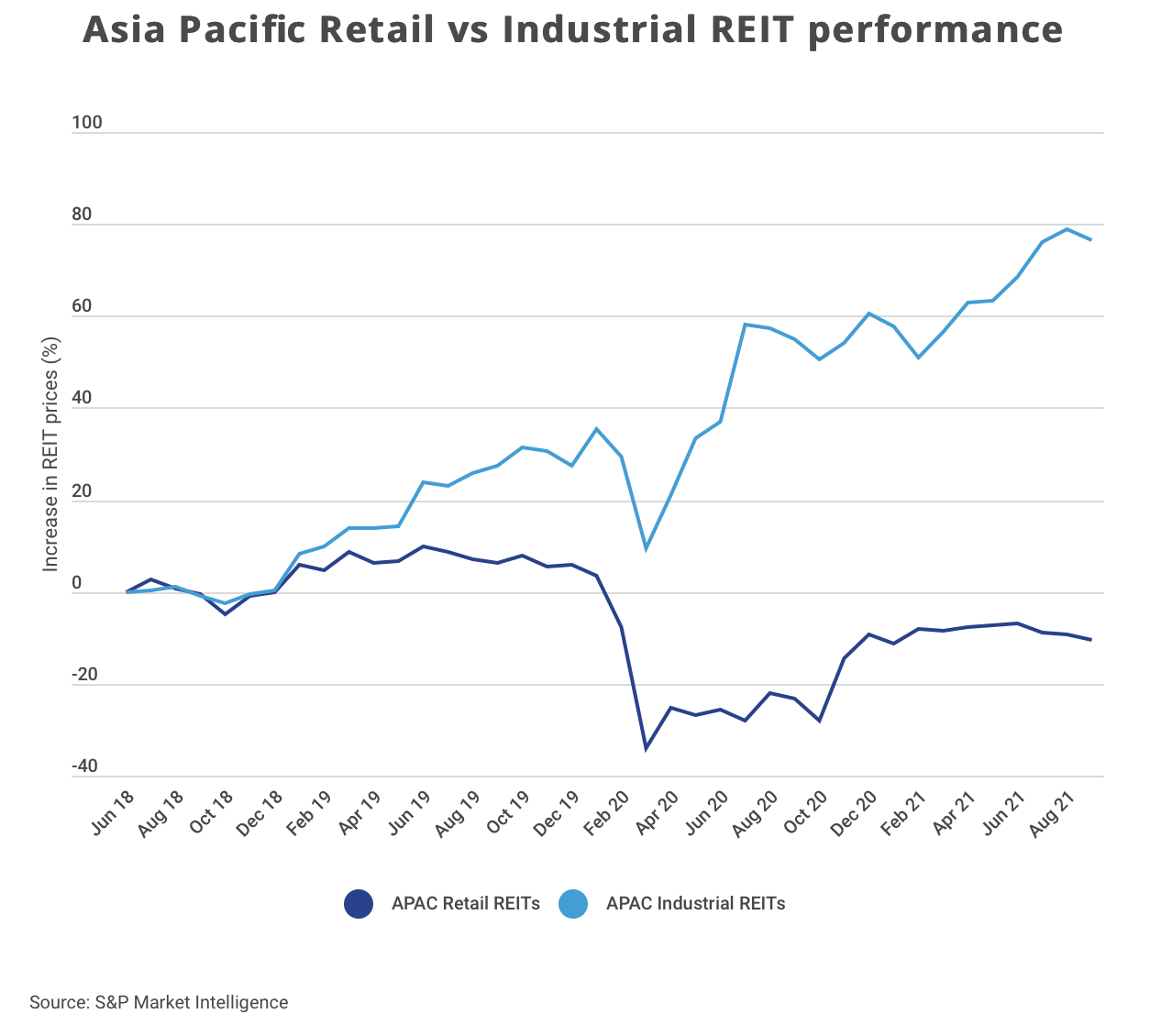

Over the past three years, there has been a significant divergence between the performance of APAC industrial and retail REITs. Across the region, prices of industrial REITs have climbed 77%, whereas in a stark contrast, retail REITs have posted negative returns over the same period.

In terms of valuations, on a weighted market capitalisation basis, APAC industrial REITs are now trading at a 35% premium to underlying valuations, while APAC retail REITs are trading at a 10% discount.

This implies that investors appear to be happy paying market premiums to gain investment exposure to the APAC industrial real estate sector, while even ‘on sale’, the APAC retail REITs struggle to find takers.

Tighter yields could signify higher expected rental growth to come

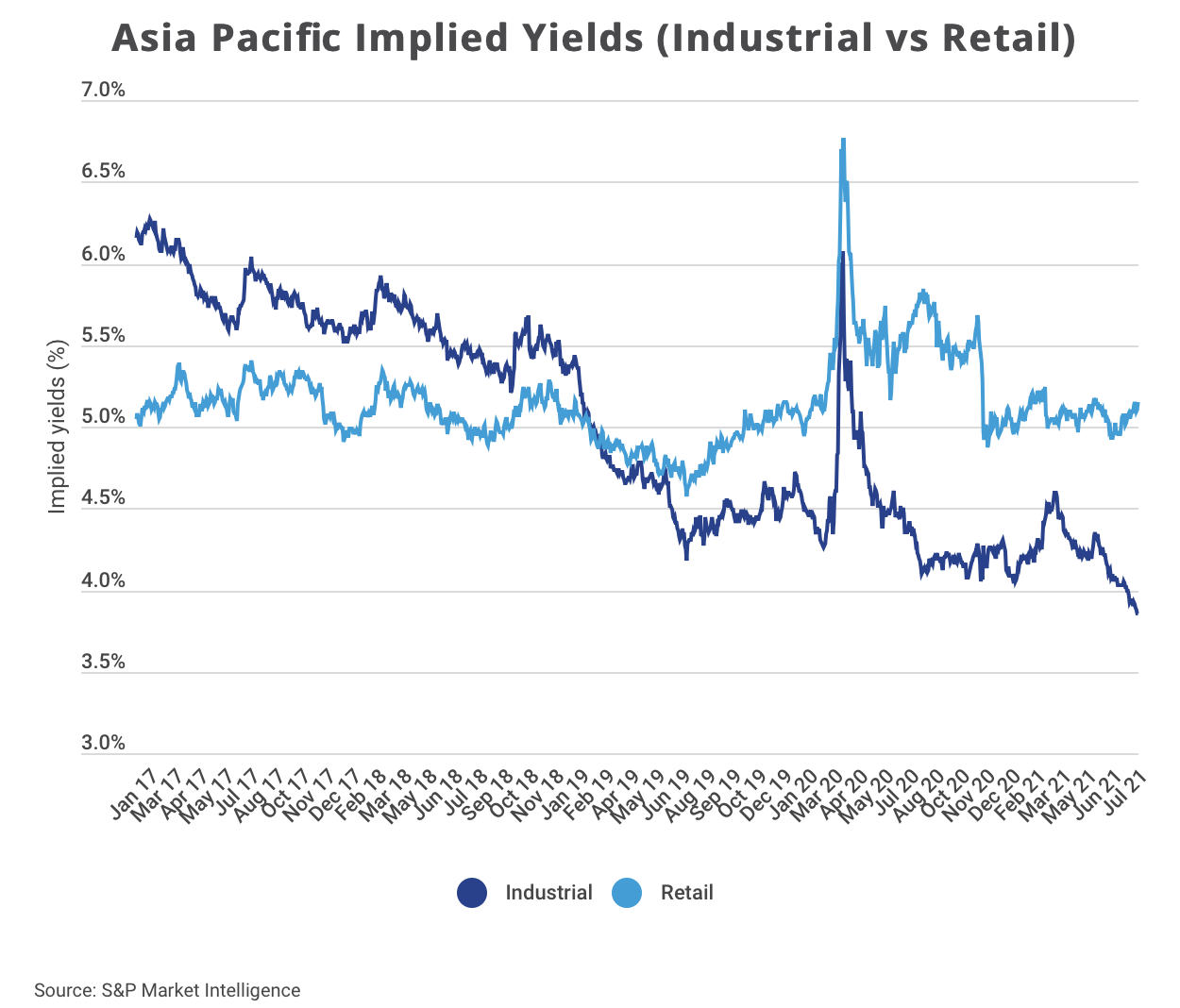

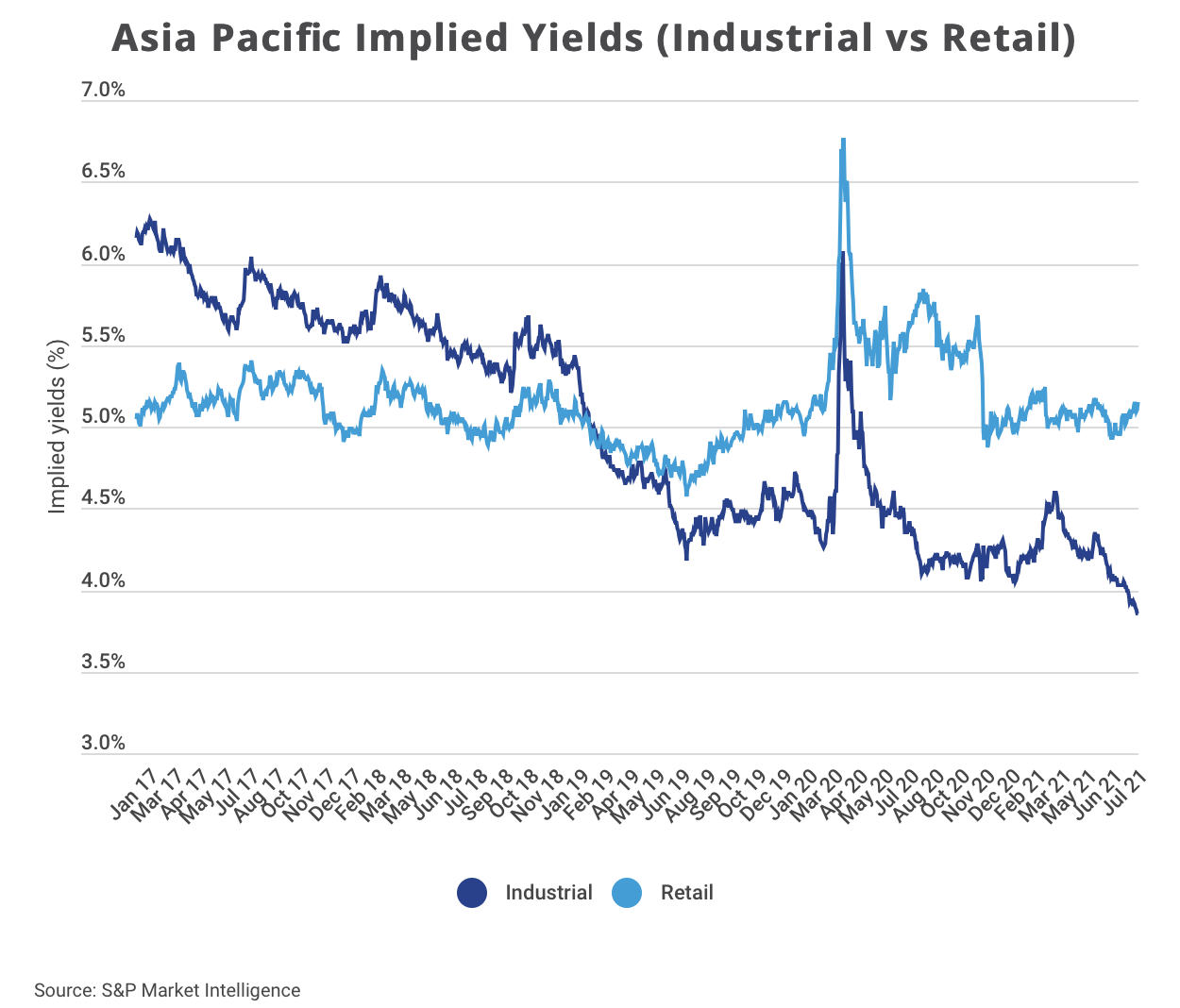

One of the key metrics that help to tell the relative story around the performance of industrial or retail REITs is the implied yield.

Implied yields show operating income of a REIT (i.e., EBITDA) relative to the enterprise value of a REIT - that is, the value given to the portfolio on the listed level (i.e., market capitalisation plus debt, minus cash).

Historically, both implied yields and market yields in the region’s industrial sector were at a premium to those in the retail sector. However, implied yields of APAC industrial REITs have gone on a one-way downward path over the past five years and are now below 4% for the first time on record, compared to 6% back in 2017.

In contrast, APAC retail REITs have an implied yield of over 5%, which is generally in line with their five-year average.

Direct market yields in the APAC industrial sector have also compressed by more than those in the other asset classes over the same timeframe. However, the premium seen in the industrial REITs has exacerbated this trend, when looking at the implied yields.

This suggests that the market is either expecting a continued market-level cap rate compression, an outperformance of rental growth – or a combination of both – when it comes to industrial real estate assets.

Investor interest in APAC industrial real estate assets still has legs

Some market observers have noted that the pricing of industrial land and completed assets are starting to look on the expensive side. Others have expressed their reservations about the potential for continued outperformance despite the generally accepted growth in underlying demand from the occupier side.

Certainly, the significant premiums applied to the listed markets would suggest that direct industrial real estate assets have the potential to outperform listed industrial REITs over the medium term. However, with such high listed price premiums, it could well be easier for industrial REITs to acquire assets on a yield-accretive basis, which will also raise the prospect of more secondary capital-raising and more Initial Public Offerings (IPOs) of industrial portfolios.

All these suggest that there is still a strong and sustained investor interest in APAC industrial real estate assets, and investors should still make room for these assets in their investment portfolios.

For more research insights or a detailed discussion on pricing and investment opportunities in the industrial real estate sector email Nicholas Wilson or Terence Tang of Colliers via the contact form below.

This article was originally published in Colliers.com.