Mr. Nattha Kahapana, Deputy Managing Director and Head of Phuket Operation, Knight Frank Thailand, said that the overall condominium market in the first quarter of 2021 remained contracted, compared to the previous quarter. This is mainly due to concerns and economic impacts of the Covid-19 epidemic; the virus continued to spread throughout 2020 to the current new wave of infections. As a result, the purchasing power for condominiums from both Thai and foreign buyers has declined. Major operators have thus had to postpone or delay the launches of new projects. They turned their focus to the development of low-rise projects to increasingly cater to the buyer group with real demand for residences.

Amidst an unfavourable situation, the management of vaccinations against Covid-19 marks an important factor that can reduce and control future outbreaks and bring the economy, including the real estate market, back to normal once again.

Supply

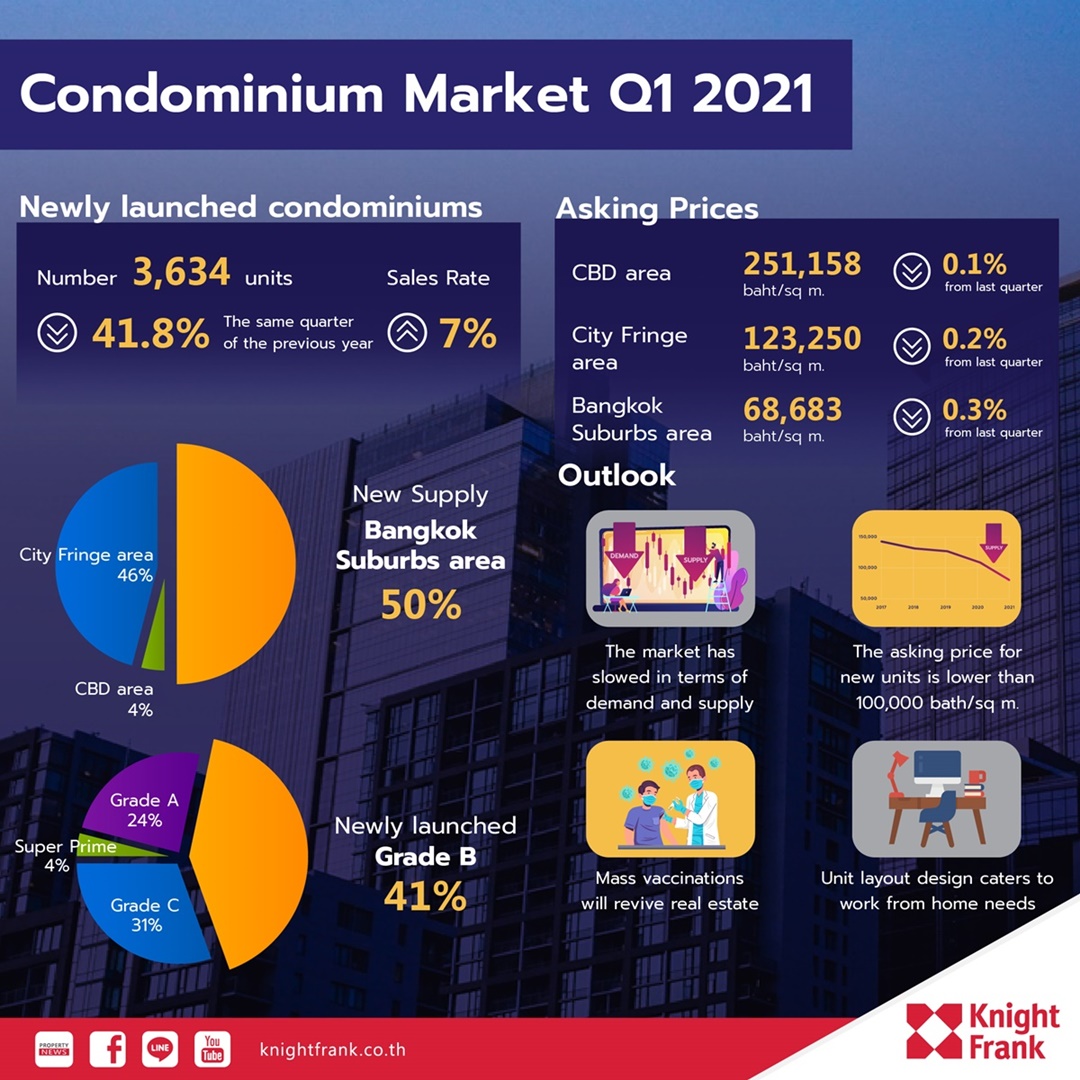

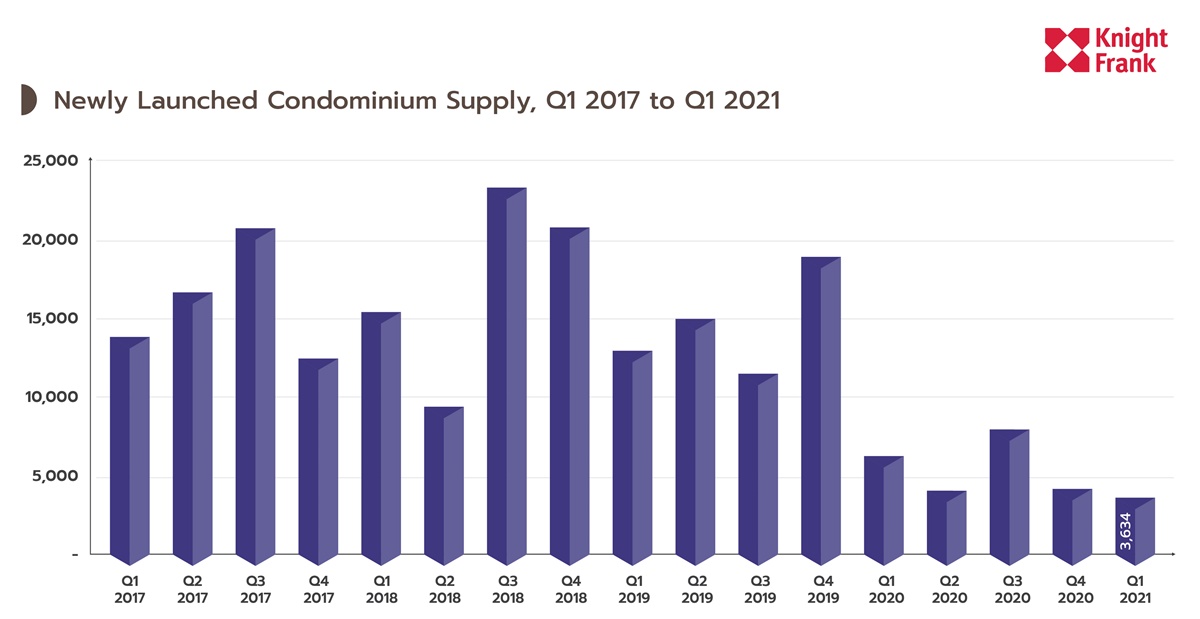

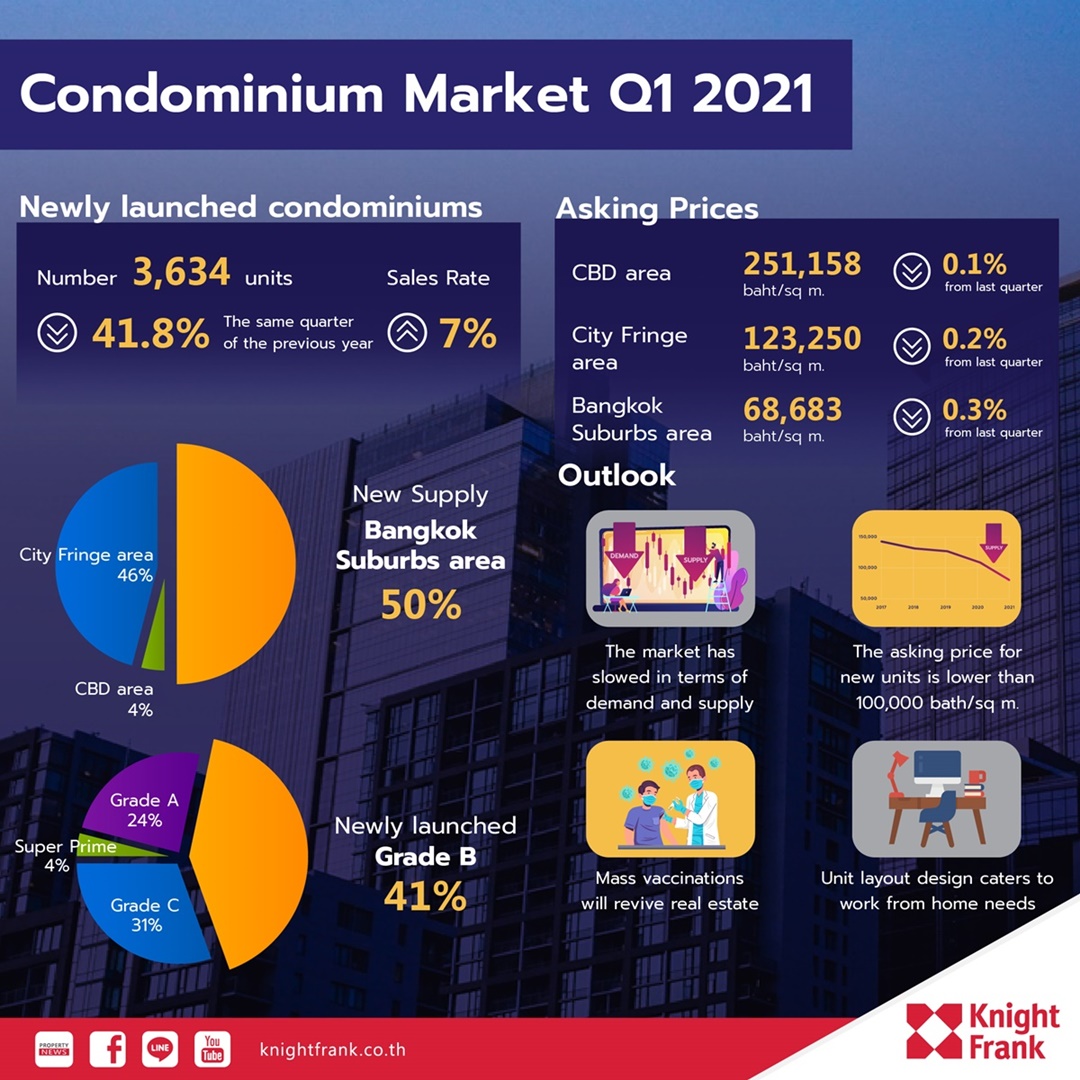

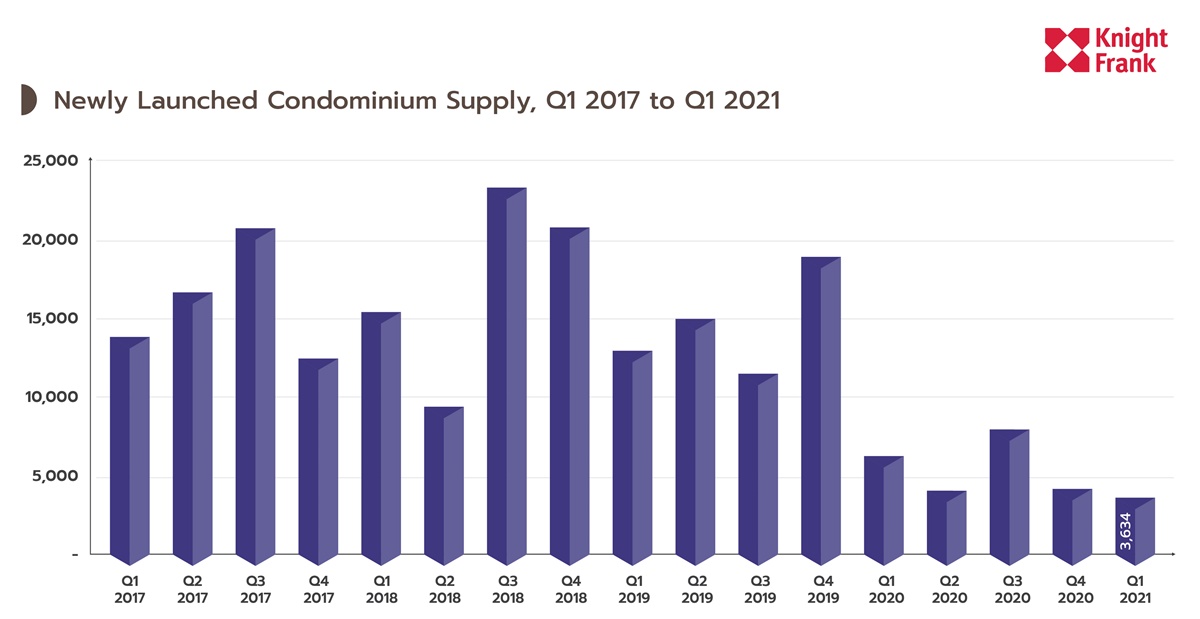

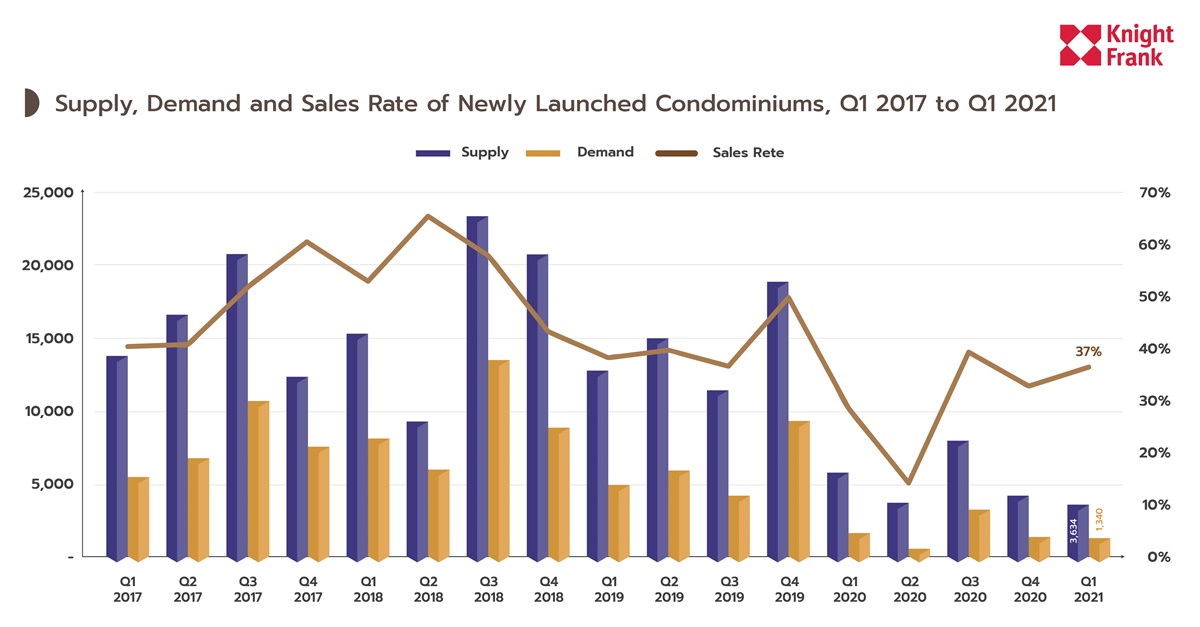

According to research conducted by Knight Frank Thailand, the condominium market in the first quarter of 2021 has slowed down in terms of the supply of new condominium units. There were 3,634 new condominium units launched, representing a decrease of 41.8 per cent compared to the same quarter of the previous year. This was mainly due to the Covid-19 epidemic that continues.

Even though vaccinations against Covid-19 started this past March, the efforts are not enough to help lower the infection rates. As a result, operators decided to reduce the launch of new projects while trying to speed up the sales of their remaining units.

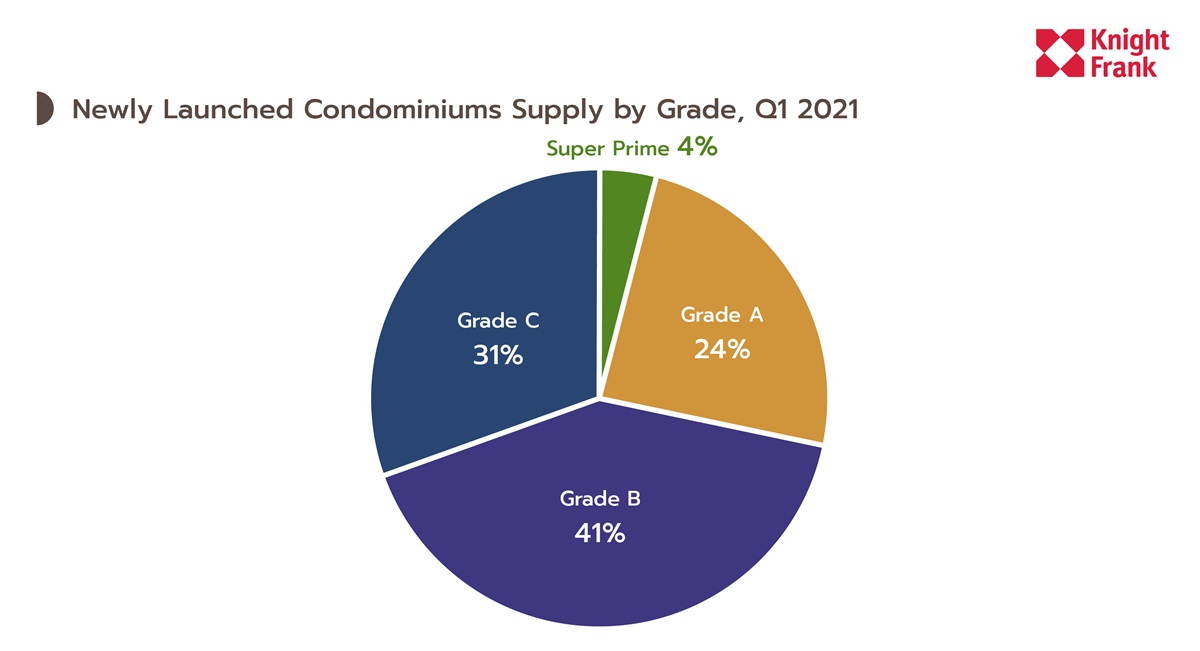

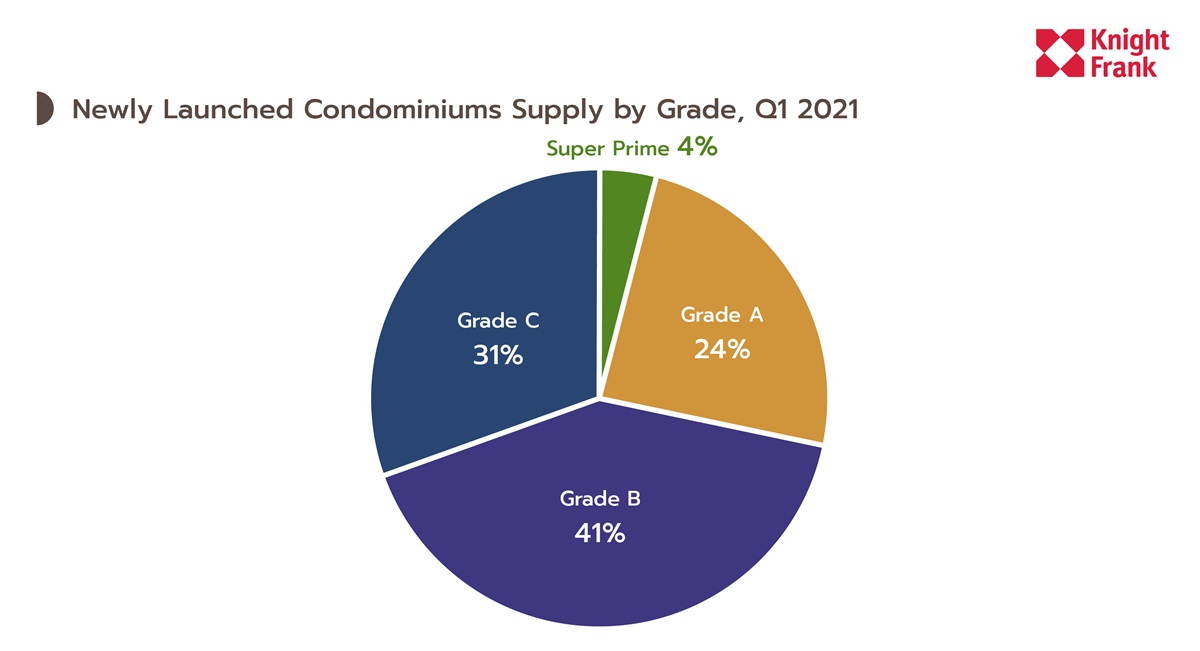

Most of the new condominiums launched in the first quarter of 2021 include Grade B condominiums with a selling price per sq m. of 80,000 to 150,000 baht, which account for 41 per cent of the total launches.

This is followed by Grade C condominiums with a selling price below 80,000 baht per sq m. at 31 per cent, and Grade A condominiums with a selling price of over 150,000 baht per sq m. at 24 per cent. Super Prime condominiums only comprise 4 per cent of the newly launched supply.

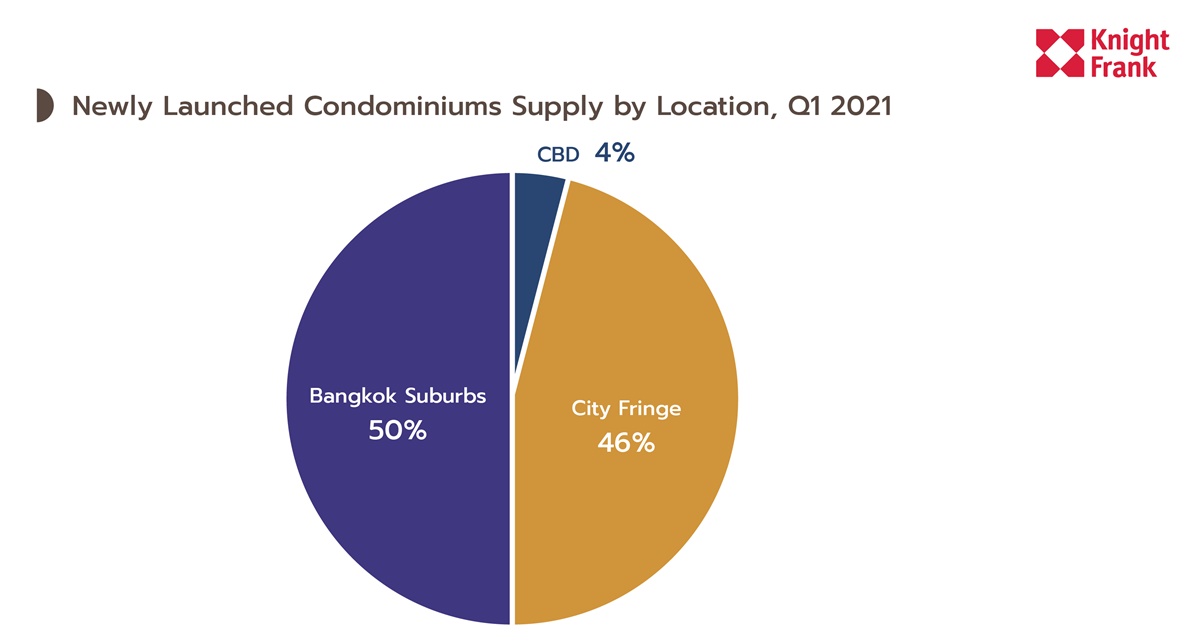

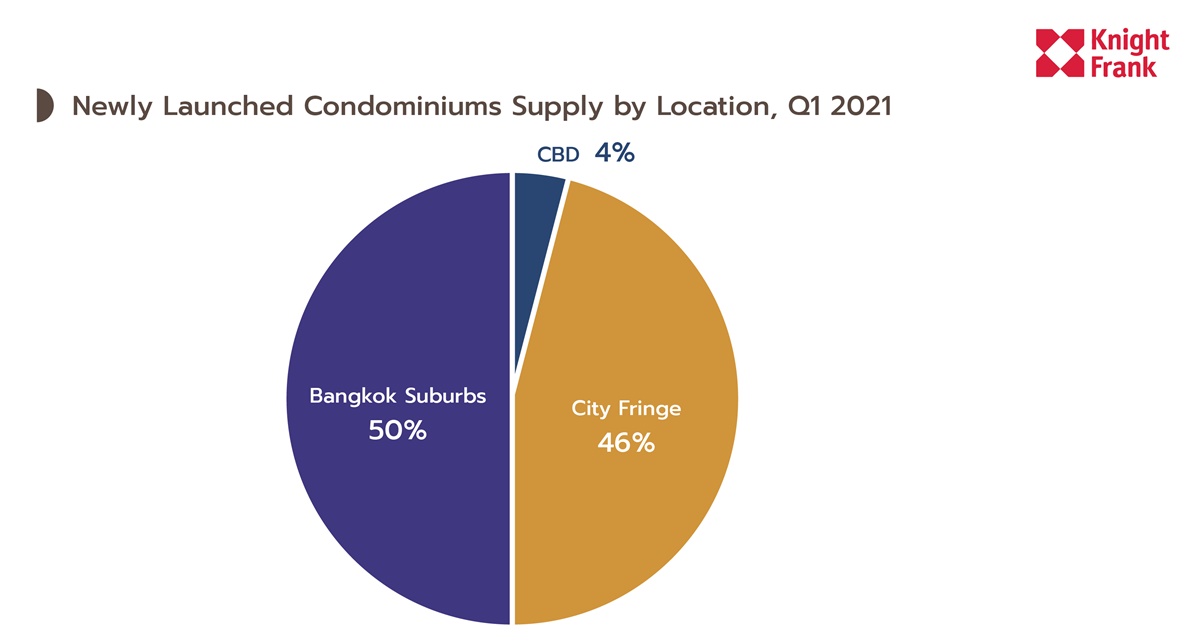

In terms of location, 50 per cent of the newly launched condominiums are located in the suburbs of Bangkok, followed by condominiums located in the City Fringe and the Central Business District (CBD) at 46 per cent and 4 per cent, respectively.

Demand

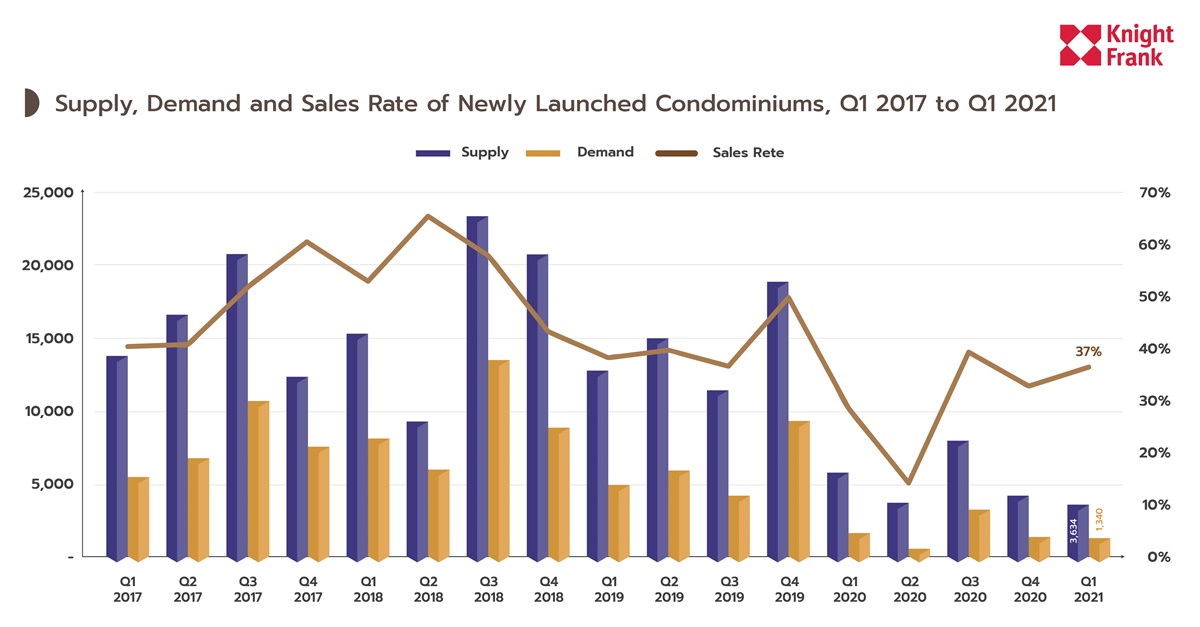

During the ongoing Covid-19 epidemic to the first quarter of 2021, it was found that purchasing power remained sluggish as most buyers stayed more cautious about their spending. In the first quarter of 2021, there were 1,340 new units sold from a supply of 3,634 new units, representing a 37 per cent sales rate.

The sales rate increased by 7 per cent compared to the same period in 2020 and by 4 per cent compared to the fourth quarter of 2020. This quarter's increase in condominium sales rates was because the demand for condominiums has started to shift slightly due to the number of people who continuously visited the projects this past March. Along with the newly launched supply with relatively moderate prices, some projects have achieved sales of up 80 per cent (in some locations). This reflects that low-priced and attractive projects can still generate buyer demand.

Selling Prices

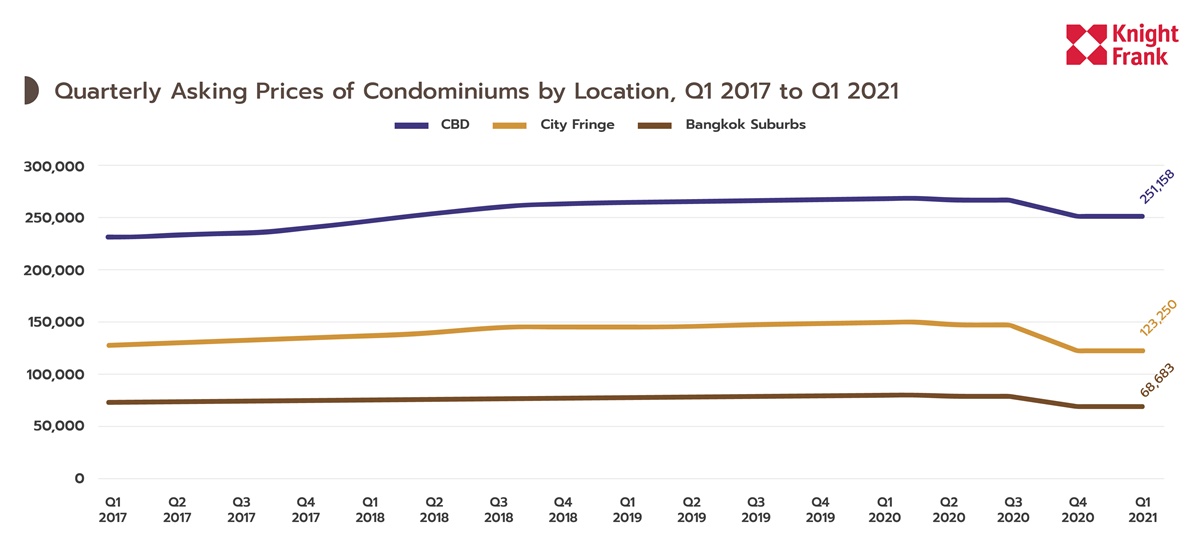

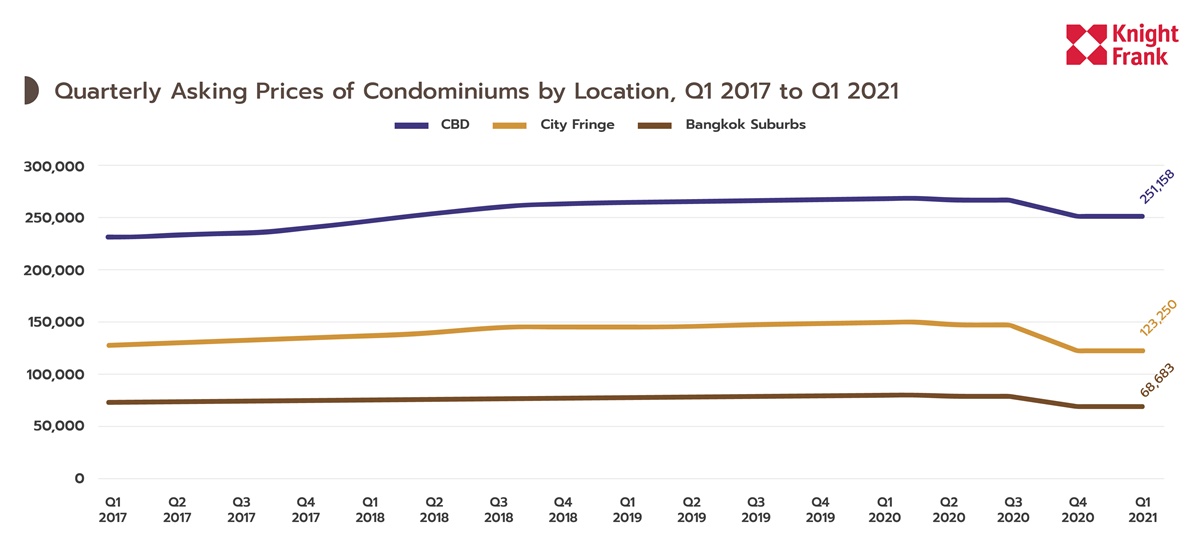

The asking price level of condominiums in the first quarter of 2021 remained relatively stable or slightly adjusted downward. As of the first quarter of 2021, the asking price of a condominium in the Central Business District is 251,158 baht per sq m., decreasing by 6.3 per cent when compared to the same period in 2020, or by 0.1 per cent compared to the fourth quarter of 2020. The asking price of condominiums in the City Fringe area is 123,250 baht per sq m., which dropped by 17.6 per cent compared to the same period in 2020, or by 0.2 per cent when compared to the fourth quarter of 2020. The asking price of condominiums in the suburbs of Bangkok is 68,683 baht per sq m. It is down 15.3 per cent compared to the same period in 2020 or down 0.3 per cent compared to the fourth quarter of 2020.

While the asking prices in the first quarter of 2021 showed just a slight decline due to the situation that has not improved, we expect prices to remain unchanged in the second quarter as there are still a lot of units remaining. Although in the past, operators have tried to adjust their plans to offer attractive promotions to expedite sales and transfers, they will not be able to reduce the available units faster because the anticipated purchasing power is starting to become diluted due to the negative effects of Covid-19. The latter has continuously affected income for a prolonged period, and the economy cannot recover, which causes buyers to stop making purchases and investments in housing, including requesting to delay the transfer of ownership or, in some cases, to cancel the transfer because funds must be diverted to fulfil other necessary obligations.

Outlook

Mr. Nattha expects that, in the second quarter of 2021, the condominium market will continue to slow in terms of new demand and supply due to the Covid-19 epidemic, which remains the biggest negative factor. In the first quarter, some projects were able to generate good sales, but only in certain locations. The new projects launched in the second quarter of this year are expected to be similar to that of the same period in 2020, and there will be approximately 3,000 to 4,000 new condominium units launched by major property developers. Smaller operators may develop fewer new projects as they would be exposed to greater investment risks compared to the large operators.

Newly launched condominium projects will have an asking price of less than 100,000 baht per sq m., which represents a price level that operators are focusing on. They are interested in developing condominiums at a lower price level, with convenient transportation options, larger room sizes and increased work areas at home, in order to meet the housing needs of 2021. The asking prices will be set to make the units more accessible, with a focus on customer groups with real demand and a low salary base. The asking prices would be approximately 1 to 3 million baht, and new projects are expected to be mostly scattered throughout the suburbs.

What is worrying about the completed condominium project is that, although operators will try to adjust their plans to offer attractive promotions, they may not sell their remaining stock more quickly because purchasing power is beginning to weaken. This is the reason that affects demand for condominiums, and it may take 1 to 2 years for the condominium market to return to a state of equilibrium as there are still almost 70,000 units remaining for sale in Bangkok.

At any rate, the key market stimulus is the most widespread and rapid distribution of vaccinations. This would increase the chances that the country can open for inbound and outbound travel without worrying about the epidemic, as well as the chances of economic recovery, which would be an important factor for the revival of the condominium market.

Similar to this:

Asia-Pacific prime residential prices continue to rise amid the COVID-19 pandemic, not despite it

Opportunities in Philippine real estate - Santos Knight Frank

Neil Brookes appointed Global Head of Capital Markets Knight Frank