Now is the opportune time to enter the strata office market - Colliers

Contact

Now is the opportune time to enter the strata office market - Colliers

The report finds that now is the opportune time to acquire strata-title office and provides recommendations for investors and end-users to leverage the price and rental corrections to enter the strata-market.

Leading diversified professional services and investment management firm Colliers Hong Kong SAR (NASDAQ and TSX: CIGI) has today released its latest Colliers Flash, ‘Calling the bottom of the office market in 2021’. The report finds that now is the opportune time to acquire strata-title office and provides recommendations for investors and end-users to leverage the price and rental corrections to enter the strata-market.

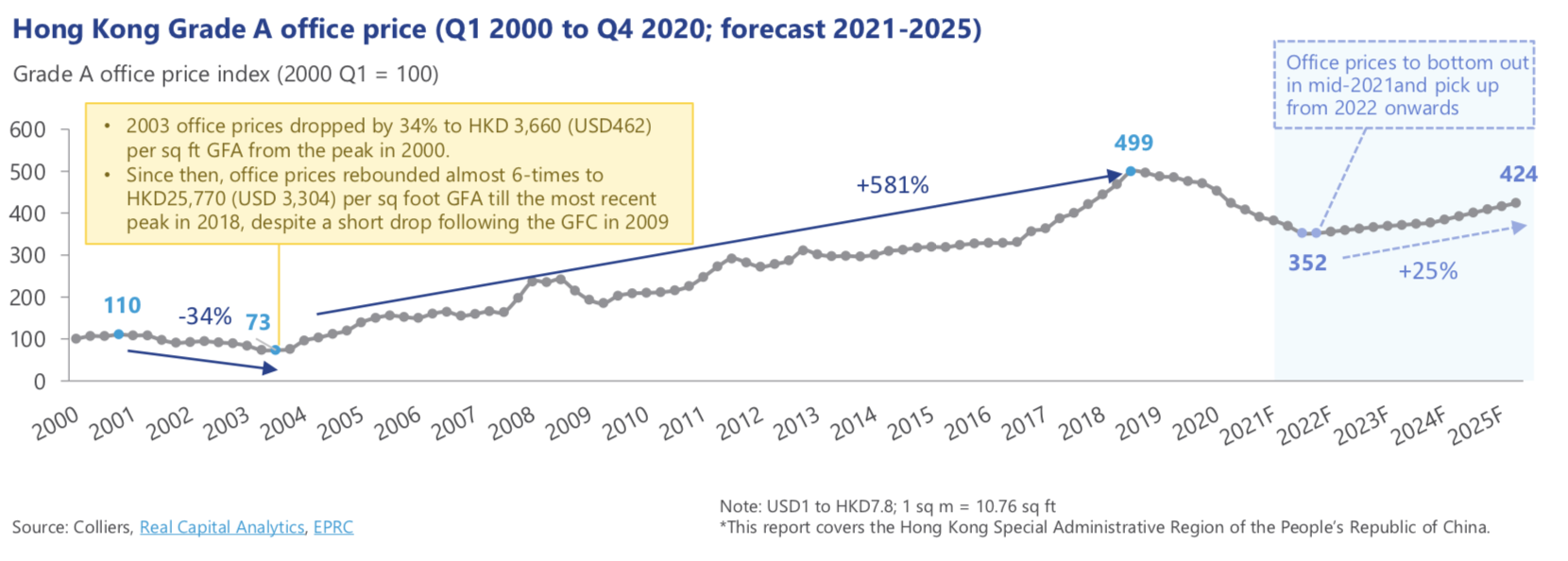

Since the US-China trade tension in 2018, investment sentiment in the office market has been dampened, which has seen overall office prices fall by a total of 23% between the last peak in Q3 2018 and Q1 this year. Transactions rates have slowed down over the past two years, as buyers pushed for more discounts in the price correction cycle, which further widened the bid-ask spread.

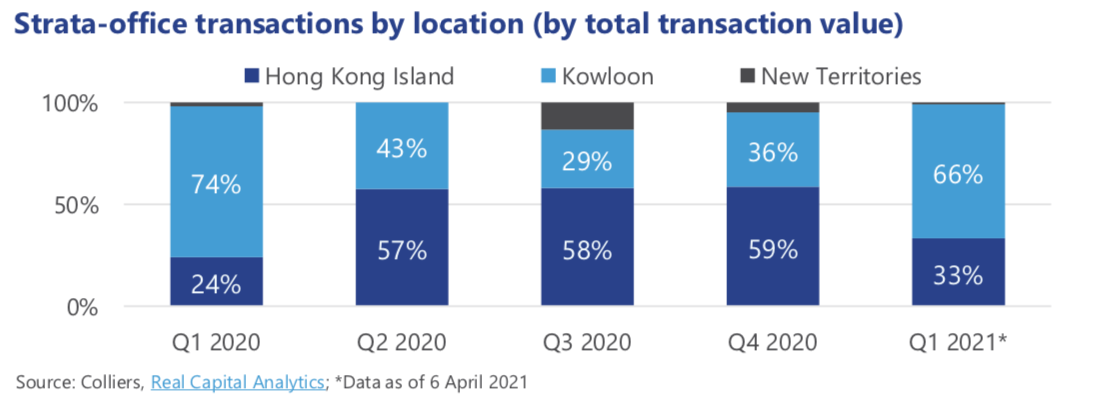

However, since the removal of the double stamp duty on non-residential property acquisitions in November 2020, there has been an uptick of strata-title office transactions. The current adjustment of office prices should attract long-term investors and occupier-owners, who are seeking capital gain but previously found Hong Kong market too expensive to enter.

“We expect the overall investment volume and strata-title office transaction to increase in 2021, as the market sees more liquidity due to a higher level of investment capital, sustained expectation of low-interest rates, and closer business opportunities with the Greater Bay Area,” said Stanley Wong, Senior Executive Director, Capital Markets & Investment Services.

Seizing the current timing to enter the strata-market

Amid the lingering economic uncertainties, we expect office prices and rents to remain under pressure in the first half of this year and bottom out during mid-year. For 2021, Grade A strata-title office prices will have a 10% YOY correction, and rents to drop by another 7% YOY.

“Assuming the availability of vaccines could contain the pandemic within H1 2021 which leads to the gradual pick-up of economic activities in H2 2021, we forecast both office rents and prices to rebound in 2022 by 3.0% YOY and 4.0% YOY respectively. Office price will also rebound by around 25% between 2022 and 2025. This suggests by leveraging the rental and price corrections in 2021, now is the good time to explore opportunities in the strata-title office market,” said Rosanna Tang, Head of Research, Hong Kong and Greater Bay area.

High investment potential in Hong Kong Island’s CBD Grade A office

Grade A office in Hong Kong Island’s CBD areas has experienced one of its biggest price corrections since the last peak in July 2018. However, we expect to see a greater rebound in CBD price among all key submarkets in the office sector from 2022 onwards once the market picks up, because of the limited Grade A office supply in Hong Kong Island’s CBD areas and the areas’ long-term promising prospects.

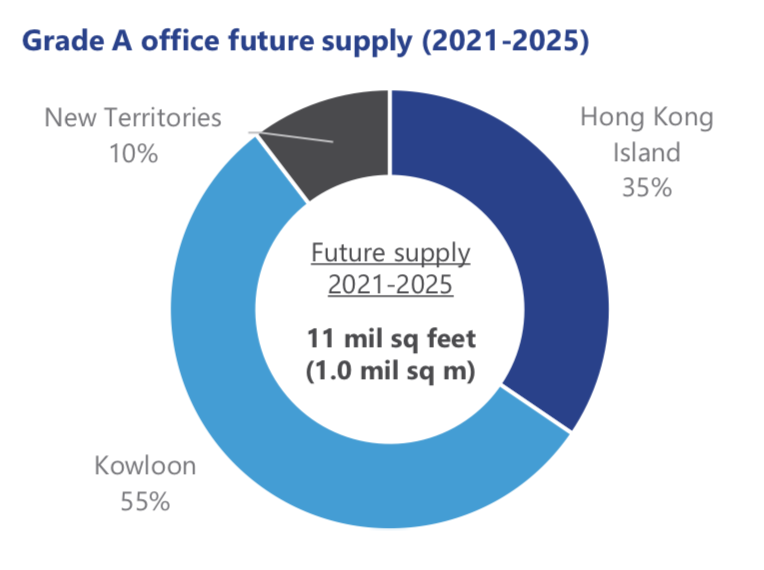

“Among the 11 million sq. ft. of new office supply between 2021 and 2025, only around one-third will be on Hong Kong Island, where most space will likely be leased out rather than offering for strata sales. Moreover, the new Grade A office supply resulting from the future Site 3 development together with the Hutchison House and Murray Road Car Park redevelopment, will bring in vibrancy into the CBD areas, which will support the long-term pricing level,” said Thomas Chak, Executive Director of Capital Markets & Investment Services.

Kowloon offers more attractive pricing options

As of end of February this year, Kowloon has recorded a high vacancy rate at 13%, with vacancy rates of Tsim Sha Tsui and Kowloon East stood at 12% and 15% respectively. We believe that high vacancy should enable owners to be more negotiable on their asking prices, as they are eager to sell their strata-title offices.

Click here to download the full report to read more about the prospects of entering the strata-market.

Similar to this:

Colliers appoints new head of Industrial Advisory for Asia Lynus Pook