Industrial market sees recovery says Savills

Contact

Industrial market sees recovery says Savills

Industrial activity was observed to be relatively robust as strata sales and vacancy rates improve gradually but uncertainties remain accoring to Savills Singapore.

"The pandemic accelerated e-commerce and stockpiling activities, turning around the fortunes of the logistics sector," says Alan Cheong of Savills Research.

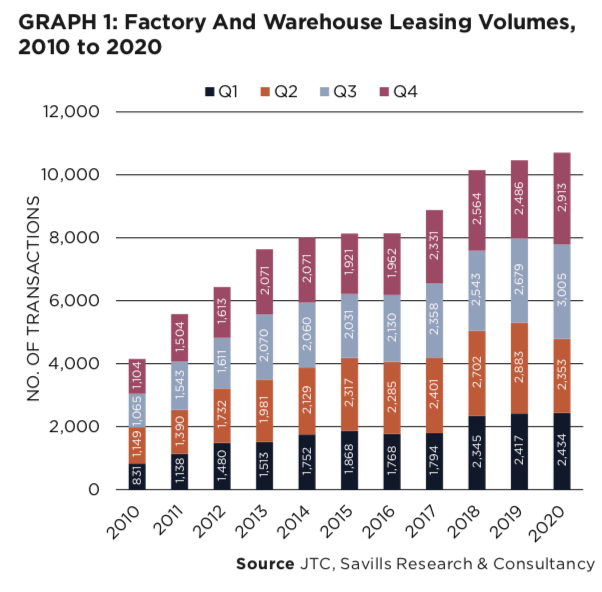

Leasing volumes continued to grow in Q4/2020, increasing 17.2% year-on-year (YoY).

The average monthly rent for Savills’ basket of multiple-user factories fell for a fifth consecutive quarter by 0.9% quarter-on-quarter (QoQ) to S$1.70 per sq ft, while that for warehouses and logistics continued to grow, rising by 1.1% QoQ to S$1.43 per sq ft.

After a spike of strata sales in Q3/2020, total strata sales volume in the fourth quarter inched up marginally to 369 transactions.

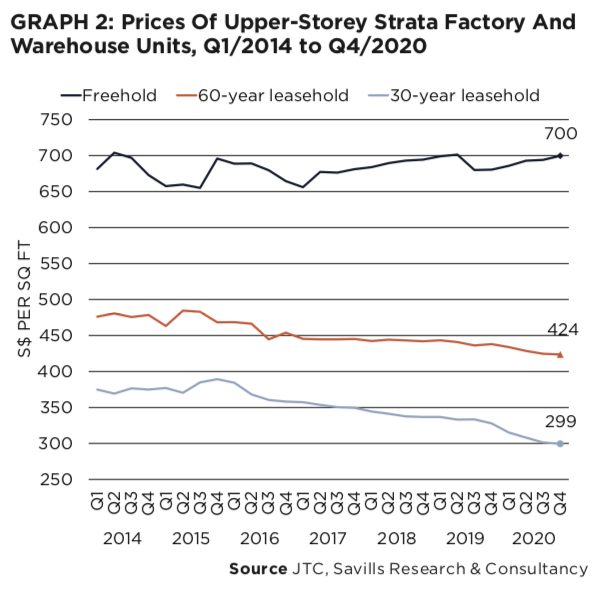

Due to the limited supply of freehold industrial properties, prices of such properties rose for a fifth consecutive quarter by 0.8% QoQ to S$700 per sq ft.

Average prices for Savills’ basket of 60-year and 30-year leasehold properties declined further in Q4, albeit at a slower pace, by 0.2 and 0.6% QoQ to S$424 per sq ft and S$299 per sq ft respectively.

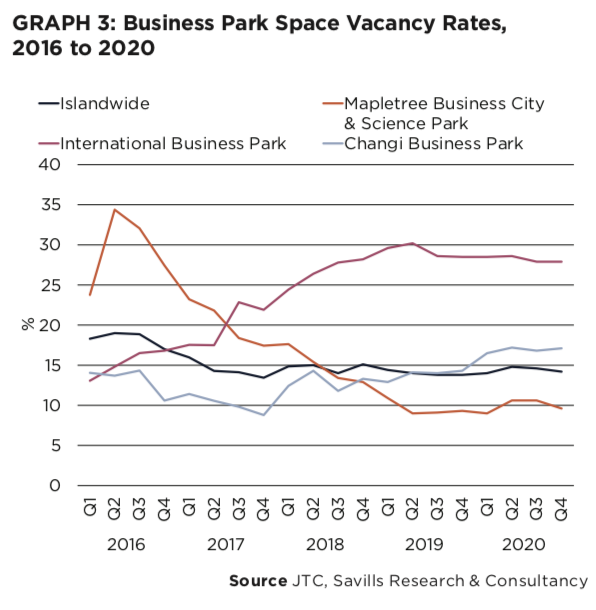

The average monthly rent in Savills’ basket of prime business park properties remained unchanged at S$5.81 per sq ft. However, that of standard business parks fell for a third consecutive quarter by 1% to S$4.01 per sq ft as landlords are required to be more realistic with their rental expectations to maintain occupancy.

After two quarters of decline, the average monthly rent for Savills’ high-spec industrial basket rose by 0.9% QoQ to S$3.50 per sq ft in Q4.

In 2021, the rental forecast for multiple-user factories is expected to be between -3% and 0% while that for warehouses is projected to increase by between 1% and 3%. Multiple-user factories are faced with a surge in the pipeline supply in the near term as the backlog from 2020 (due to construction delays) gets completed. On the other hand, the growth in warehouse rents continues to be supported by the logistics sector.

To view the full report by Savills click here.

This research report was published by Savills.

Similar to this:

Ascott Residence Trust is the first hospitality Trust in Singapore to secure a green loan

Dusit Thani Maldives announces a packed programme in celebration of Easter and beyond