Singapore and Hong Kong have been identified among the top ten markets for capital in 2021 in Knight Frank's Active Capital 2020 report, placed at fourth and eighth, respectively

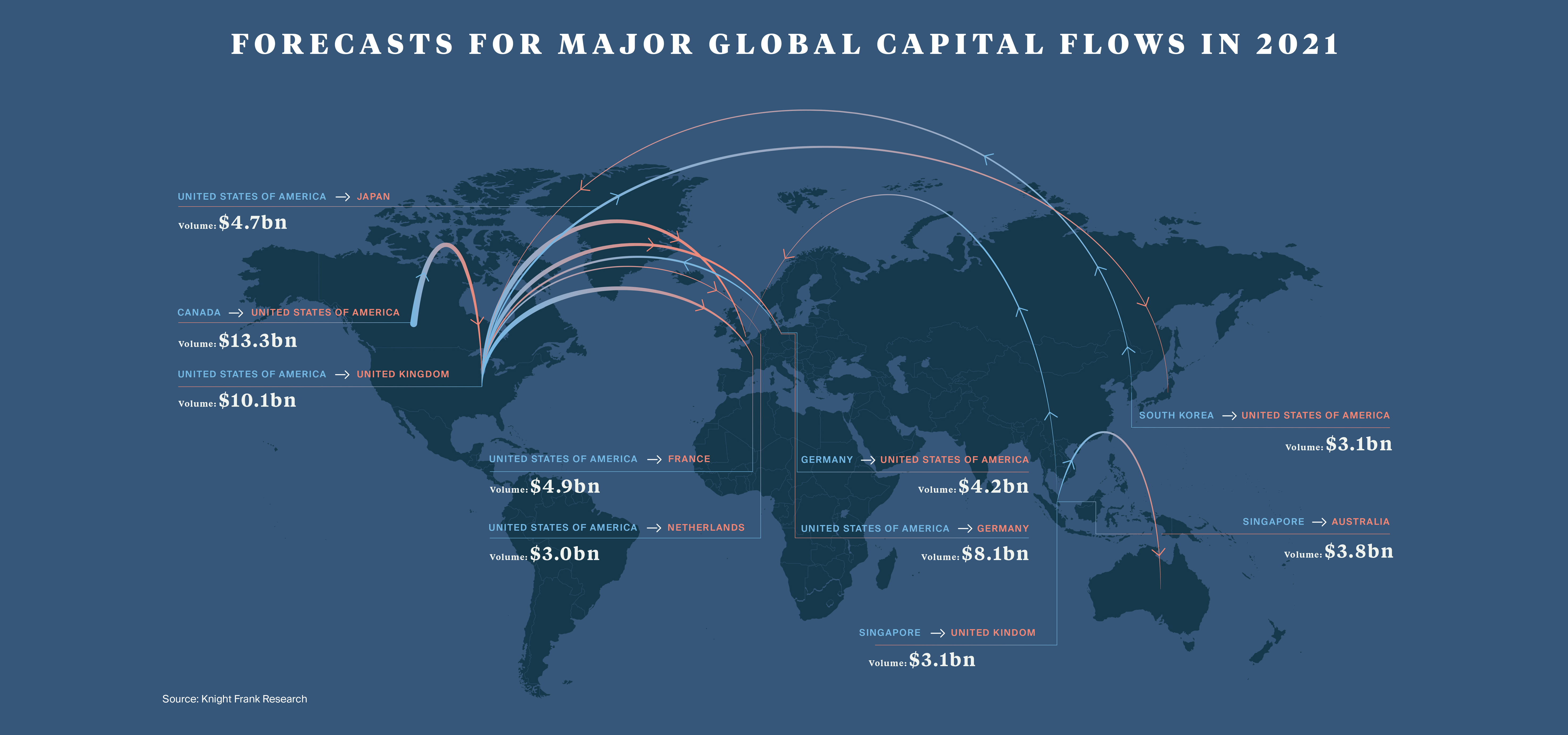

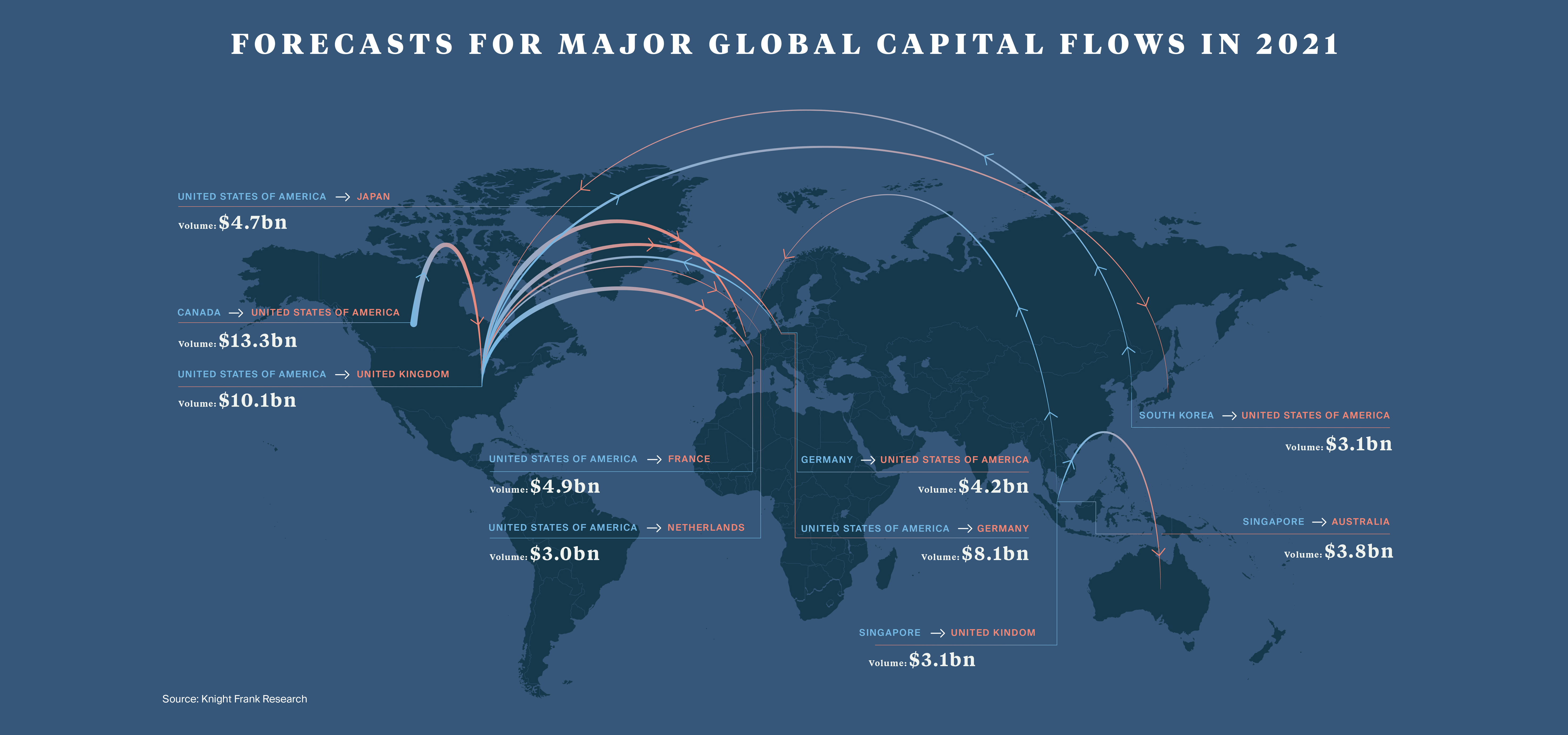

Using a proprietary ‘capital gravity’ model which forecasts likely flows of capital between countries and their estimated size for 2021, the research predicts that outbound investment from Singapore into Australia will reach US$3.82billion in the next year, 28 per cent above the 5-year average of US$2.98 billion.

This is despite transaction volumes from Singapore to Australia falling 10.4 per cent year-on-year (Real Capital Analytics) compared to the same timeframe in 2019, as travel restrictions and the protracted lockdown in some Australian states stalled investment activity.

The top 10 sources of capital in 2021:

- United States

- Canada

- Germany

- Singapore

- United Kingdom

- Switzerland

- France

- Hong Kong

- Sweden

- Israel

Knight Frank Asia Pacific Head of Capital Markets Neil Brookes said while Covid-19 had dampened investor appetite in the short-term, a reversal was expected in the last part of 2020 heading into the new year.

"By any yardstick, capital flows from Asia to Australia has gained momentum – increasing by up to 31 per cent even during the pandemic as investors focus on resilient markets and assets.

"With stable long-term growth prospects, Australia will continue to attract strong cross-border interest from Asian investors.”

Daniel Ding, Head of Capital Markets for Land & Building, International Real Estate & Industrial, Knight Frank Singapore, said Singapore investors are focusing on a barbell strategy of defensive stable income on one end, and hunting for high returns from deemed irreversible growth trends and themes on the other amidst the low interest rate environment.

"Despite the uncertainty surrounding the pandemic and international travel restrictions, we have worked with our clients to come up with solutions to get around underwriting acquisitions," he said.

Hong Kong outbound capital

Knight Frank’s model forecasts outbound capital from Hong Kong to rebound in 2021, as investors eye key investment markets like the UK, US and Japan.

In the last quarter, year-on-year transaction volumes from Hong Kong to the UK rose 35 per cent, suggesting pent-up demand from Hong Kong-based investors.

Emily Relf, Head of Outbound Capital, Asia Pacific, said with the ongoing challenges on both the economic and social front, domestic investors would increasingly look to hedge their risk by diversifying their portfolios through cross-border investments.

"Even with travel and lockdown restrictions, there remains pent-up demand for UK office assets from many territories in Asia," she said.

"We’ve already seen evidence of this in the form of The Cabot sale in Canary Wharf for £380 million – the largest deal of 2020 so far – acquired by Hong Kong’s Link REIT.

“Historically, the UK remains one of the most resilient office locations, which has been in the top five destinations for global cross-border capital in every quarter but two since before the Global Financial Crisis.

"With some of the highest office yields in the world, we expect interest from Asian capital not only to be sustained but to grow in the coming year."

Knight Frank Greater China Executive Director and Head of Commercial, Paul Hart, said investors in Hong Kong investors in Hong Kong - including many Chinese Mainland investors with a presence in Hong Kong - continued to show an appetite to diversify their investment portfolio overseas.

"The pandemic has only deferred but not deterred outbound investment and therefore we expect the capital flowing into overseas real estate properties will become active again when the situation improves," he said.

"Hong Kong remains the gateway city for Chinese Mainland capital going abroad.”

Source: Knight Frank

Focus on resilience

At a time of heightened uncertainty, Active Capital finds real estate investors are increasingly positioning their portfolios for resilience.

This includes identifying assets with strong tenant demand – underpinning capital values and ultimately returns – as well as assets which are best placed to weather shocks and benefit from the recovery and broader structural changes.

Data from Real Capital Analytics indicates the office sector was the most active in the first half of 2020, attracting 45 per cent of all transaction volumes in the first nine months of 2020 within the Asia Pacific

Mr Brookes said while recovery to pre-Covid volumes may not happen soon, capital flows between liquid and trusted global safe-havens would continue.

"The notion of positioning for resilience will be at the heart of any investment decision," he said.

“For investors, cross-border property investment offers true diversification and more options to meet revenue targets.

"In a period where physical travel remains subject to restrictions, intra-regional investment into ‘near neighbour’ locations will become ever more compelling."

Click here to download a copy of the report.

Similar to this:

Manila office market continues to persist despite trying times - Santos Knight Frank

Knight Frank launches dedicated Asia Transactions Team

Covid-19 likely to impact near-term supply and long-term design of housing around the world - Knight Frank