Bright spots for Japan hospitality market despite disruption of 'landmark' year - Savills

Contact

Bright spots for Japan hospitality market despite disruption of 'landmark' year - Savills

A short-term rebalancing of assets could help mitigate some of the damage to Japan's hotel sector, according to Savills.

New research from Savills suggests all is not lost for Japan's hospitality sector despite the pandemic's impact on what would have been a significant year for tourism in the country.

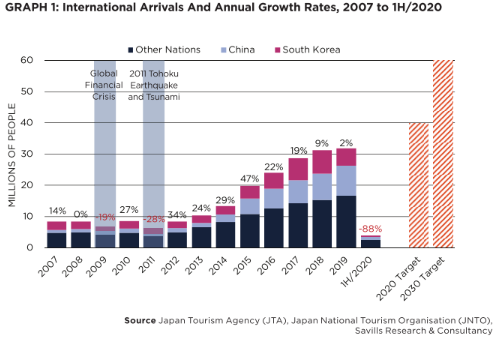

The scheduled Tokyo Olympics and rapid growth of tourism since 2013 meant the national government had originally aimed for 40 million overseas visitors for the year.

These expectations were hit hard by COVID-19, with just four million visitors entering the country in the first half of the year – a 76.3 per cent decline over the first half of 2019.

As would be expected, the vast majority of these visitors entered the country in January and February, prior to any significant border closures, with only 2,600 recorded entries in June.

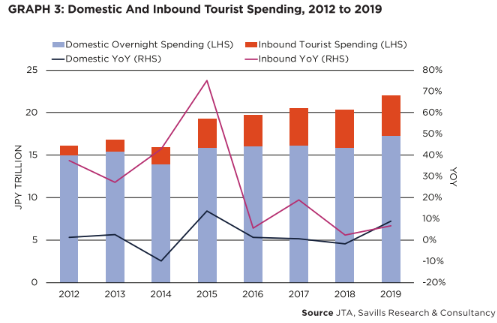

But Savills notes there are bright spots for the market, with domestic tourists accounting for 84 per cent of overnight stays in 2019 and spending amongst this group growing at a higher rate than overseas tourists during the year.

In its Spotlight report on the country's hospitality sector, the firm noted there had been some recovery in domestic recovery since the easing of the lockdown in May, which should be further bolstered by the government’s “Go To” travel campaign implemented on 22 July.

"In the end, hoteliers are in for a long slog to get through the crisis and there have already been some casualties within the budget hotel subsector, with weakly-capitalised, newer operators such as WBF and First Cabin filing for bankruptcy," the report reads.

"Larger, more-established players appear to be faring better and some have even doubled down on the current market.

"APA Group, for instance, has indicated that it would aim to more than double their hotel market share.

"We can therefore expect to see further consolidation in the hospitality market, which should present lower-risk opportunities to investors once the market recovers."

Click here to download a copy of the report.

Similar to this:

Majority of Asia Pacific employees eyeing office return - JLL report