The Metro Manila Office Sector "was challenged to remain buoyant" in the second quarter amidst the threat of COVID-19 with no new buildings completed during the three month period, Santos Knight Frank says.

The firm's Metro Manila Market Update Q2 2020 reveals the implementation of Enhance Community Quarantine and strict government requirements concerning construction March caused sluggish office take-up and a lack of new supply.

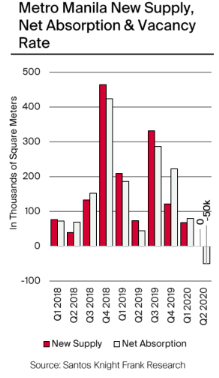

According to the report, the Metro Manila vacancy level rose to 4.73 per cent from 3.95 per cent in the preceding quarter, with leasing transactions were mostly put on hold as companies took a wait-and-see approach towards new offices.

At a glance:

- Santos Knight Frank's Metro Manila Market Update Q2 2020 reveals the implementation of Enhance Community Quarantine and strict government requirements concerning construction March caused sluggish office take-up and a lack of new supply.

- The low levels of new office take-up led to a net loss of 50,047 sqm leased for the quarter.

- Santos Knight Frank estimates more than 472,000 square metres of Prime and Grade A office spaces are expected to operate by the end of the year 2020.

While the low levels of new office take-up led to a net loss of 50,047 sqm leased for the quarter, Knight Frank Santos said the market's well-built foundation and longevity had allowed it to withstand some of the challenges of the pandemic climate.

"There was also an increase in the number of sub-leases being offered for the quarter, as tenants looked to lessen their real estate costs by giving up office space," the report read.

"These sub-lease opportunities, while not counted in official vacancy figures, do suggest a further softening of the office market during the quarter.

"Notwithstanding the growing vacancies, office developers remained steadfast with respect to their asking rents.

"Thus, there was a quarterly increase of 0.79 per cent and an annual increase of 5.75 per cent in the weighted average lease rate in Metro Manila."

Santos Knight Frank estimates more than 472,000 square metres of Prime and Grade A office spaces are expected to operate by the end of the year 2020, while 2.7 million square metres is anticipated to come online in the next five years.

Looking ahead, the firm believes development and expansions will be set aside by most companies, given there may be no new office pipeline launches until "at least the office market recovers and stabilize again".

"The office rents in Metro Manila will be further exposed to demand pressures," the report read.

"Numerous landlords are still under- negotiation with their existing tenants.

"Although the forfeited cash deposits from pre-terminations may curb their loss of revenues in the initial months, the overall decrease in office demand for the rest of the year will still be felt by the lessors.

"However, the shift to a tenant-favourable market is anticipated to uplift the medium to long-term situation."

Click here to download a copy of the report.

Similar to this:

How Philippine real estate can adapt in the COVID-19 climate - Knight Frank

Secondary Asian cities 'creep back' into top ten of Knight Frank Prime Global Cities Index

Traditional demand drivers stoke Philippines' property amid slumping GDP