Asia Pacific logistics sector maturing as investors and occupiers reimagine strategies - JLL report

Contact

Asia Pacific logistics sector maturing as investors and occupiers reimagine strategies - JLL report

Investors and occupiers are reimagining logistics strategies in Asia Pacific to take advantage of ongoing structural shifts in the sector’s real estate landscape, according to a new report from JLL.

Increasing capital allocation into the Asia Pacific logistics sector, combined with an accelerated shift towards e-commerce and strong exposure to fast-growth industries, have "rapidly" changed how logistics real estate functions and operates, new research has found.

JLL reports that COVID-19 has influenced both the investment flow and leasing demand of logistics in the region, with uncertainty around underwriting assumptions, including rent and vacancy forecasts, costs of capital, travel restrictions, and lack of pricing visibility, leading to a 32 per cent decline year-on-year in first half of 2020.

Despite these headwinds, JLL Head of Industrial and Logistics for Southeast Asia, Stuart Ross, said investor sentiment towards the Asia Pacific logistics sector remained positive.

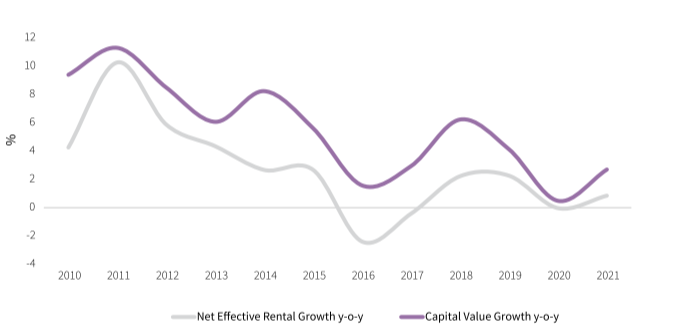

Asia Pacific prime logistics and capital value growth. Source: JLL

“Logistics remain firmly on the radar of investors and although a moderation in deal activity has been observed, recent signs show the market becoming increasingly sophisticated," he said.

"The inflow of capital into logistics has resulted in more complex transactions and greater participation by both established and new investors into the sector, which we expect to continue."

As investors continue to reimagine their Asia Pacific logistics strategies, JLL forecasts several key themes to gather momentum and reinforce the structural shift occurring in the sector.

- Pursuit of platform deals: There is an increasing trend towards acquiring logistics platforms rather than individual assets. Investors gain captive tenant networks and achieve scale quickly through this sophisticated transaction route. Platform acquisitions, potentially via mergers or privatisations, also provide additional ways to access and expand into the logistics sector.

- Rapid institutionalisation: The world’s largest investors are investing more into logistics real estate. Additionally, a sizeable portion of new supply is large-scale modern logistics assets of institutional grade, which are expected to draw more institutional capital.

- Value upside: While growth in values is likely to slow between 2020 and 2023, investors’ confidence in the structural drivers for the logistics sector is expected to remain intact. Capital values are forecast to stay relatively firm, with modest yield compression expected in some markets across the region.

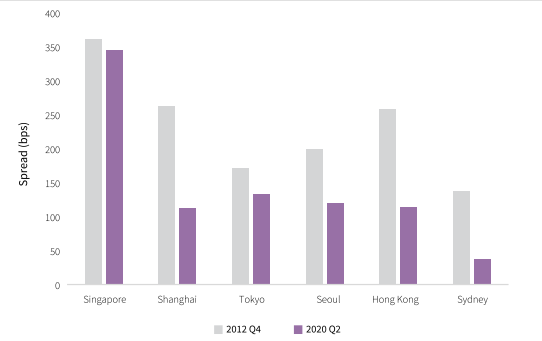

Spread between logistics and office capitalisation rates in the Asia Pacific. Source: JLL

Overall leasing demand has inevitably slowed during the first half of 2020, with net absorption around 700,000 square metres lower in the first h (2.2 million sqm) than in 1H19 (2.9 million sqm).

However, JLL Asia Pacific Research Director Peter Guevarra said there had been a spike in short-term demand, particularly from grocery retailers and health service firms, while the continued impact of the pandemic on supply chains had resulted in a greater focus on supply chain risk mitigation and resilience.

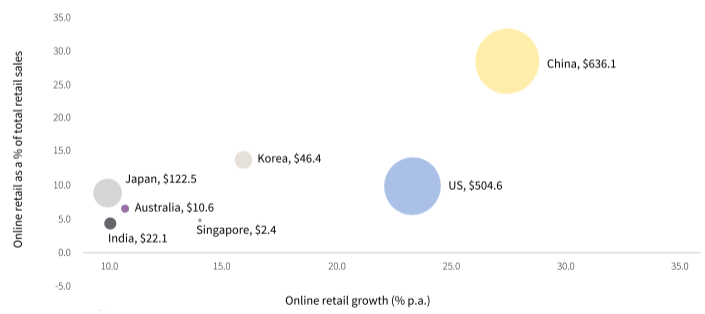

“The pandemic will accelerate trends already in play across the sector, such as increased internet penetration rates, expansion of online grocery, omnichannel retailing and the integration of technology into logistics and warehousing. However, led by occupier and investor commitments, the sector is well placed to respond to the post-COVID-19 recovery.

E-commerce growth and penetration rates. Source: JLL

Key shifts influencing occupier decision-making, which JLL expects to accelerate, include:

- Multi-storey logistics developments: Densely populated cities, limited logistics land availability, and relatively high land prices have supported multi-storey logistics developments in many markets in the region, with demand now emerging in Australia and India.

- The evolution of last mile logistics: Expect to see more conspicuous shifts to urban logistics, delivery optimisation, cross docking centres, and the use of autonomous vehicles.

- Rise of third-party logistics: Tenants are upgrading from outdated, often small and owner-occupied facilities to newer facilities in premium locations to support growth in the food and beverage, healthcare and pharmaceuticals, and office and technology equipment industries.

Click here to download a copy of the report.

Similar to this:

Greater China hotels sector well-positioned to lead APAC recovery - JLL

$715 million Singapore CBD high-rise site for sale through JLL