Greater China hotels sector well-positioned to lead APAC recovery - JLL

Contact

Greater China hotels sector well-positioned to lead APAC recovery - JLL

New data from JLL has shown Sanya and Shanghai experienced an acceleration in occupancy levels from June, with owners and investors now reimagining business models and guest experiences to capture the rebound in travellers.

Prospects for the Greater China hotel market remain positive with new research showing the sector is relatively well-positioned to recover from the COVID-19 pandemic.

According to JLL, major Chinese markets such as Sanya and Shanghai have already recorded a meaningful rebound in hotel occupancy owing to the resumption of both domestic leisure and business travel.

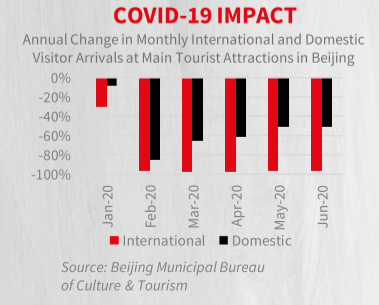

Mainland China responded swiftly to the COVID-19 pandemic, instituting a broad lockdown in January, which immediately impacted the hotel market but more recently, has allowed for faster recovery than other regional markets.

JLL Hotels and Hospitality Greater China Hotels Recovery Guide - At a glance:

- More distressed opportunities surfacing in the market. However, properties are less likely to trade in the short-term due to the complex capital structures. Furthermore, it is likely that higher-level corporate distress and/or restructuring may drive asset sales instead of asset-specific distress.

- Assets that can bring stabilised or quick returns such as rental apartments, serviced apartments, or properties with conversion or strata-sale potential, will likely be preferred by investors looking at Mainland China opportunities.

- Domestic players will continue to dominate Mainland China hotel transactions market, but there is a growing number of foreign funds pairing up with local partners to acquire hotel assets and execute conversion and localisation plans.

- As the Hong Kong market struggles with the near-term challenges of COVID-19 and geopolitical uncertainty, conversion opportunities have potential to drive transactions.

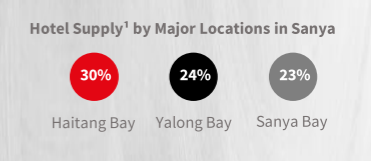

The impact of COVID-19 on upscale hotels’ occupancies in Sanya was considerably lower than in Beijing and Shanghai, with June (61.2 per cent) and July (78.6 per cent) rates higher than pre-COVID-19 occupancy levels.

Month-on-month occupancy Shanghai upscale hotels were more robust than Beijing, registering continuous occupancy increases since March and accelerating in June (37.2 per cent) and July (55.3 per cent).

JLL Hotels and Hospitality Group Vice President of Investment Sales for Greater China, Ling Wei Tan, said Chinese domestic demand in the near- term was expected to be further supported by constraints on international leisure travel.

“Greater China saw a more pronounced decline in hotel occupancy in the earlier parts of the first half," she said.

"However, in the second quarter of the year, green shoots began to emerge, particularly in Sanya, with pent up travel demand driving the resumption of domestic-led leisure travel, providing owners and investors with a sense of optimism heading into 2021.

“As international travel remains constrained, Chinese travellers who previously vacationed internationally are now taking their holidays domestically, which has resulted in the unique outcome of select Chinese leisure markets recording year-on-year growth in occupancies.”

JLL Hotels and Hospitality Group Vice President of Investment Sales for Greater China, Ling Wei Tan. Source: JLL

According to JLL, Greater China has the advantage of a large domestic pool of demand and robust 2019 investment activity.

Mainland China was the second most active hotel transaction market in the Asia Pacific in 2019, recording RMB 14.3bn in transaction volume, or around 15 of the total hotel regional volume.

Hotel transaction activity in Hong Kong increased by 17 per cent year-on-year in 2019 mainly due to several landmark transactions but faced challenges in the second half of 2019.

Following on from robust 2019 activity, JLL data shows investors continued to display confidence in the Shanghai market in the first half of 2020, which totalled RMB 4.1 billion, representing a nearly a 60 per cent year-on-year increase and offsetting a transaction volume decline in Beijing of over 80 per cent.

However, given the robust fundamentals of Beijing, JLL believes investor interest is expected to remain strong and transaction activities are anticipated to bounce back in early 2021.

JLL Hotels and Hospitality Group Vice President for Strategic Advisory and Asset Management in Greater China, Angel Chen said Hotel operators and investors were now faced with a new operating environment to analyze market and consumer trends.

"In Mainland China, the dynamics of domestic travel have changed, and the wants, needs and consumer spending patterns have subsequently changed with it," she said.

"Hotels will need to adapt to this reimagined reality to meet the experiential and health and safety demands of guests and consumers."

Click here to view the full report.

Similar to this:

Optimism building as Thailand’s hotel industry enters COVID-19 recovery phase - JLL

JLL names Shanghai, Beijing, Guangzhou and Bangkok as Rising Giants of growth cities.

How Asia hotels are navigating an unprecendented cash crunch