The luxury end of Singapore's residential market is so far holding up against the backdrop of COVID-19, with new data from Savills showing only a marginal decline in rents during the second quarter.

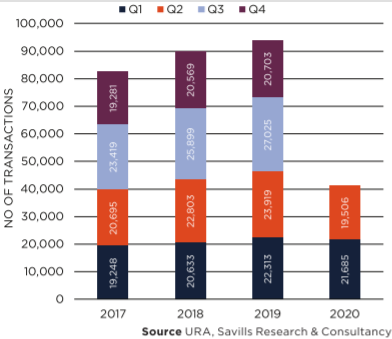

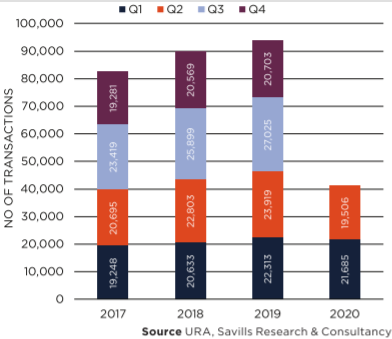

The firm's Residential Leasing Briefing Q2 2020, released this week, revealed A total of 19,506 leases for private residential properties started island-wide in Q2/2020, down 10 per cent quarter-on-quarter and 18.4 per cent year-on-year.

In line with shrinking leasing volumes, rents for private residential properties island-wide were down 1.2 per cent QoQ in Q2/2020, in contrast to the 1.1 per cent increase recorded in the preceding quarter.

Savills Residential Leasing Briefing Q2 2020 - At a glance:

- A total of 19,506 leases for private residential properties started island-wide in Q2/2020, down 10.0 per cent quarter-on-quarter (QoQ) and 18.4 per cent year-on-year (YoY).

- In line with shrinking leasing volumes, rents for private residential properties island-wide were down 1.2 per cent QoQ in Q2/2020, in contrast to the 1.1 per cent increase recorded in the preceding quarter.

- Rents for luxury homes softened marginally, with the monthly rents of high-end condominiums and private apartments tracked by Savills edging down by 0.4 per cent QoQ to S$4.17 per sq ft in Q2/2020.

Leasing transaction volumes of private residential units Q1 2017 - Q2 2020

But the report indicates a lesser decline in rents for luxury homes, with the monthly rents of high-end condominiums and private apartments tracked by Savills edging down by 0.4 per cent QoQ to S$4.17 per sq ft in Q2/2020.

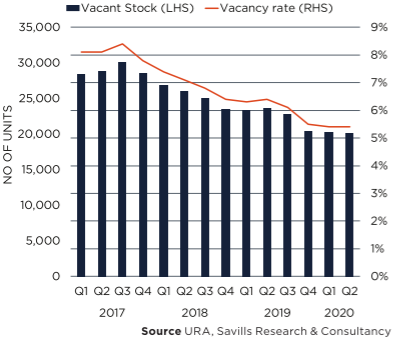

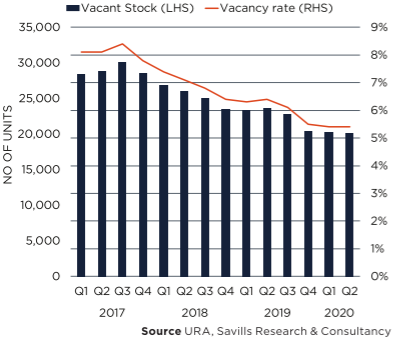

On a brighter note for landlords, the research shows a much lower rate of new completions has helped to offset the impact of weaker leasing demand which, coupled with some withdrawals of existing stock, meant island-wide vacancy rate for private residential properties remained flat at 5.4 per cent at the end of June.

Vacant stock and vacancy rates of private residential units Q1 2017 - Q2 2020

Savills Singapore Executive Director for Research, Alan Cheong, said although leasing transactions showed some improvement after Singapore began to progressively reopen the economy from June 2nd, increasing retrenchments and cross border travel restrictions were creating an uncertain outlook of the private residential leasing market in the short to medium term.

"Luxury rents are holding up for now, partly supported by limited new supply, while rents for lower entry-leve options are having to adjust faster as demand dwindles," he said.

Click here to download a copy of the report.

Similar to this:

Singapore industrial rents face pandemic pressure - Savills report

Singapore Fortitude Budget 'sufficiently generous' - Colliers International

Climate change and food security set to dominate real estate strategies - Savills