Mainland Chinese demand to stimulate opportunities for Hong Kong real estate sector - Colliers report

Contact

Mainland Chinese demand to stimulate opportunities for Hong Kong real estate sector - Colliers report

A new report from Colliers International has examined the growing interest from mainland Chinese firms in Hong Kong’s real estate as the city becomes a focal point to establish a footprint.

Recent market uncertainties and rising economic risks may have weighed on the sentiment of Hong Kong’s investment market in the first half of this year, but new research has shown a rise in interest from Chinese firms to find opportunities and increase their operational footprint in the region.

Colliers' latest flash report, Mainland Chinese demand to stimulate opportunities for Hong Kong SAR’s real estate sector indicates there is growin demand from mainland firms and capital in Hong Kong’s real estate amidst early signs of recovery in China’s economy, cross-border financial initiatives and the large pool of capital for fund-raising.

Mainland Chinese demand to stimulate opportunities for Hong Kong SAR’s real estate sector - At a glance:

- China’s economy sees Q2 2020 YOY growth of 3.2 per cent as other major economies experience negative movement.

- There is rising demand from mainland firms and capital in Hong Kong’s real estate amidst early signs of recovery in China’s economy, cross-border financial initiatives and the large pool of capital for fund-raising.

- According to Colliers, landlords should target mainland firms as potential future occupiers, especially those in the finance, fintech and insurance sectors.

Colliers Head of Research for Hong Kong and Southern China, Rosanna Tang, told WILLIAMS MEDIA that while occupiers and investors had remained cautious in the first half of the year, with Hong Kong's transaction volume slowing by almost 70 per cent YOY in H1 2020, the fact that China's GDP increased by 3.2 per cent YOY in Q2 2020 would create more activity among Chinese firms, a trend that would be further enforced by the introduction of the cross-border financial initiatives in stock and wealth management.

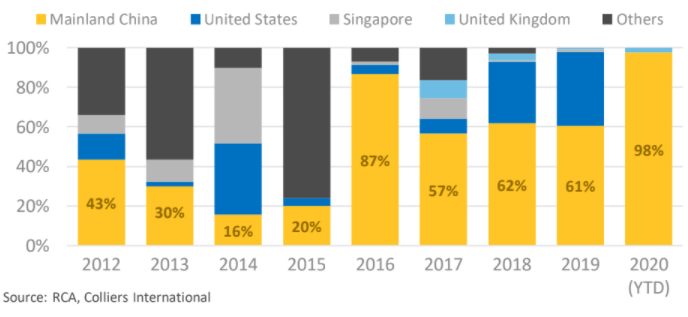

Cross-border investment transactions into Hong Kong.

"We are seeing a resurfacing of interest from Mainland Chinese occupiers in Hong Kong, specifically from those sectors that are connected to the IPO market such as banking and finance, legal and accounting," she said.

"Also, occupiers looking to use Hong Kong as a base of operations to conduct business in the Greater Bay Area include finance, fintech and insurance sectors."

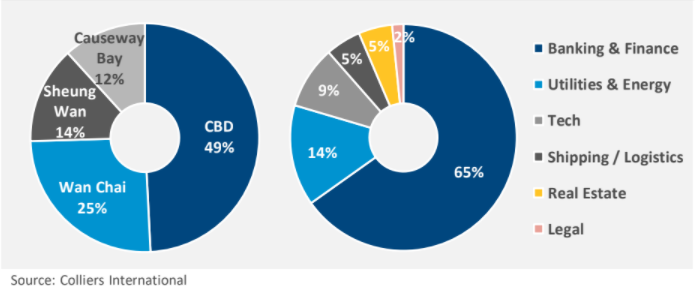

Leasing deals from PRC firms by location and sector in the first half of 2020.

Colliers Deputy Managing Director of Capital Markets and Investment Services Antonio Wu said asset owners in Hong Kong looking to dispose should pay attention to mainland Chinese capital, as more enquiries were coming in from mainland investors looking for end-user purchase or private residential site development opportunities.

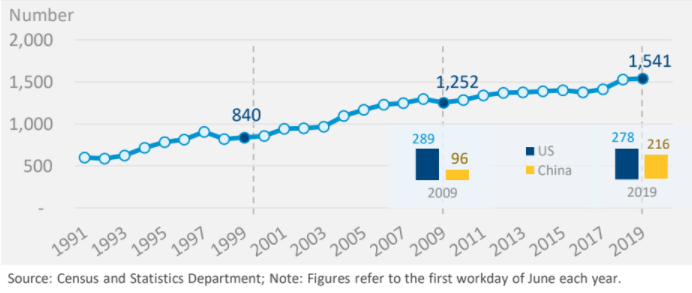

Number of regional headquarters in Hong Kong.

"The demand in the market from Chinese organisations is evident, especially when you consider six of the last 13 tendered sites in the Government land sale programme since July 2019 were awarded to mainland Chinese developers, accounting for almost 60 per cent of the total considerations," he said.

"This demonstrates the strong confidence of mainland developers on the longer-term prospects of the city.”

Click here to download copy of the report.

Similar to this:

'Nike swoosh' recovery expected for Asia Pacific hotel industry - Colliers International

'Unprecedented' times to explore hotel opportunities in Hong Kong - Colliers International