The unwavering presence of COVID-19 has led to a shift towards short-term leases among Singapore industrial tenants, a new report has found.

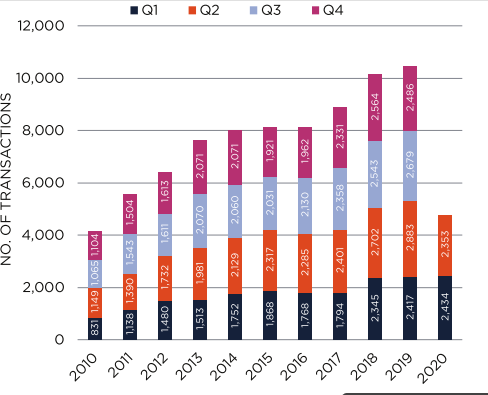

Savills Singapore Industrial Briefing Q2 2020 indicates leasing volumes fell by 18.4 per cent from a year ago to 2,353 transactions in Q2/2020, a trend the firm attributes to the ban on in-person property viewings during the lockdown.

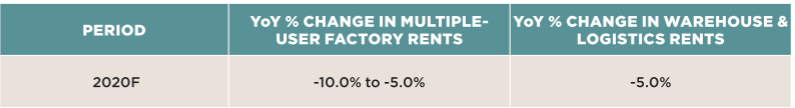

According to the report, Savills average monthly rent for multiple-user factories slipped by -1.0 per cent quarter-on-quarter (QoQ) to S$1.73 per square foot, while for warehouse and logistics, it fell 0.7 per cent QoQ to S$1.47 per square foot.

Singapore Industrial Briefing Q2 2020 - At a glance:

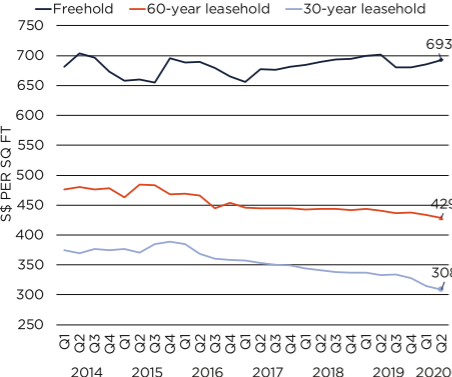

- Owing to their scarcity and the large pool of interested buyers, the average price in Savills’ basket of freehold industrial properties rose by 1.0 per cent QoQ to S$693 per square foot in Q2/2020.

- Savills’ basket of industrial properties showed that the average price for 60-year leasehold industrial units trended downwards by 1.2 per cent QoQ to S$429 per square foot in Q2/2020, while for 30-year leasehold industrial properties prices fell by 2.2 per cent QoQ to S$308 per square foot.

- The average monthly rent in Savills basket of prime business park properties edged down by 0.4 per cent QoQ to S$5.81 per square foot as some landlords lowered their asking rents amid weaker sentiment.

Factory and leasing volumes from 2010 to Q2 2020. Source: JTC, Savills Research and Consultancy

The strata industrial market also experienced a further slowdown in sales activity, with the data revealing another decline of over 30 per cent QoQ to 114 transactions.

Savills Research and Consultancy Executive Director, Alan Cheong, said with the end of the pandemic nowhere in sight, uncertainty levels remained high in the sector.

"Heightened levels of uncertainty have increased interest in short-term leases," he said.

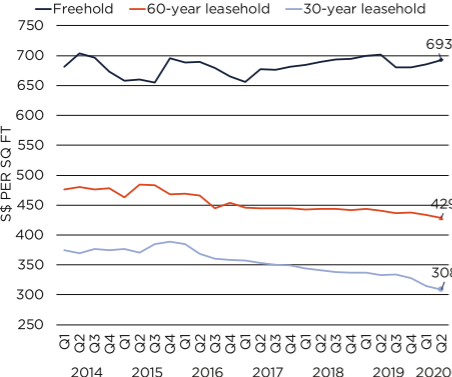

Business Park Space Vacancy Rates Q12014 to Q22020. Source: JTC, Savills Research and Consultancy.

Savills’ basket of industrial properties showed that the average price for 60-year leasehold industrial units trended downwards by 1.2 per cent QoQ to S$429 per square foot in Q2/2020, while for 30-year leasehold industrial properties, prices fell by 2.2 per cent QoQ to S$308 per square foot.

Owing to their scarcity and the large pool of interested buyers, the average price in Savills’ basket of freehold industrial properties rose by 1.0 per cent QoQ to S$693 per sq ft in Q2/2020.

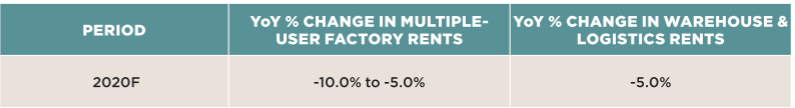

Rental forecast for general industry and factory space. Source: Savills Consultancy and Research

The report shows the average monthly rent in Savills basket of prime business park properties edged down by 0.4 QoQ to S$5.81 per square foot as some landlords lowered their asking rents amid weaker sentiment.

Research from Savills indicates the older business parks bore the brunt of the downturn, with the average monthly rent in Savills basket of standard business park properties slipping by 0.7 per cent QoQ to S$4.07 per square foot.

Based on Savills basket of properties, the average monthly rent for high-spec industrial space was down by 0.3 per cent QoQ to S$3.48 per sq ft, marking its first decline in three years.

Click here to view the full report.

Similar to this:

What COVID-19 means for the Singapore real estate market

Singapore industrial investment 'beats expectations' in 2019 - Savills

"Singapore’s slow economy has no effect on the rental properties market" Savills