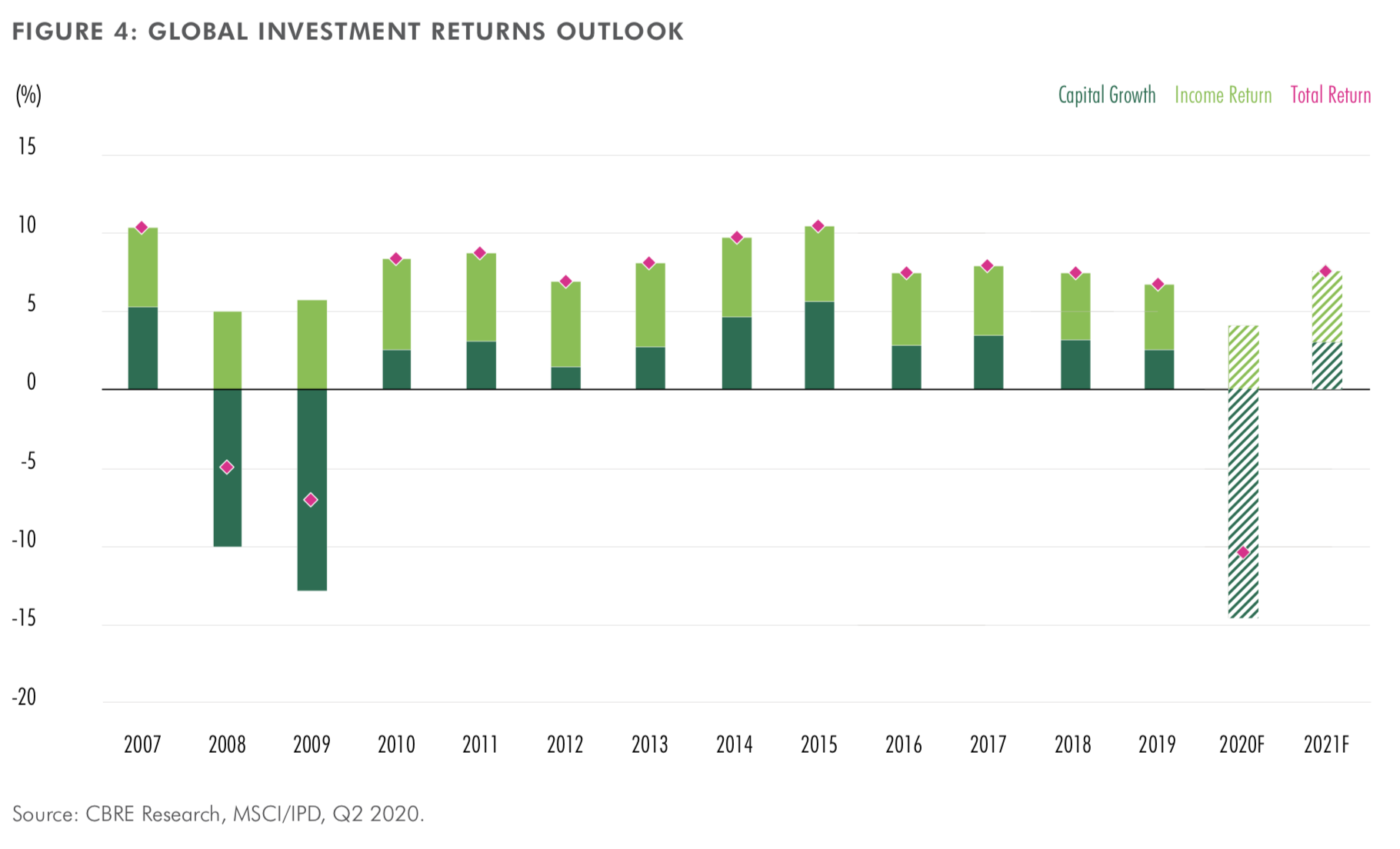

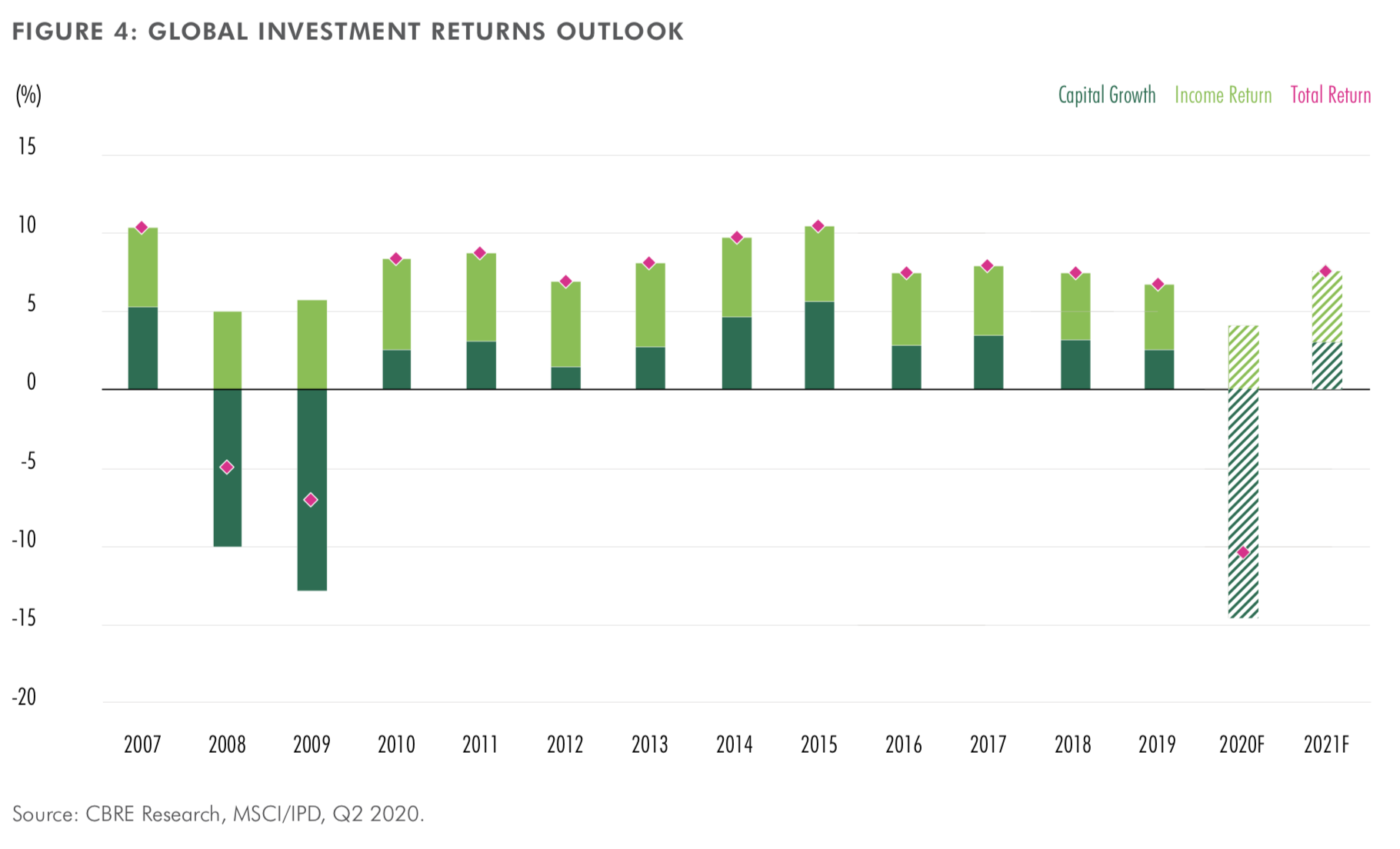

The possibility of a strong rebound in the economy is becoming more of a certainty, according to CBRE's Global Real Estate Market Outlook 2020 Mid-Year Review report.

The rebound for commercial real estate will lag that of the overall economy, with recovery in most sectors expected to start this year and continue through 2021.

CBRE foresees that globally, the industrial and logistics and multifamily sectors making the quickest comebacks from the pandemic-induced recession.

Global investment returns. Source: CBRE

The former will benefit from the acceleration of e-commerce, and the latter from demographic trends that favor renting.

Other sectors will take longer to absorb fundamental shifts:

- Offices will accommodate a more hybrid workforce that operates from both workplaces and remote locations;

- Hotels must wait for corporate and group travel to resume before a full recovery

- Retail properties will have to adapt to the accelerated rise of e-commerce and fewer but higher-spending trips to brick-and-mortar stores.

According to the Asia Pacific Real Estate Market Outlook 2020 Mid-Year Review, a resilient tech sector continues to underpin overall office demand in Asia Pacific.

Growing requirements from the life-sciences/pharmaceutical sector and signs of a pick-up in mainland China are providing hope for a broader Asia Pacific recovery.

In the industrial & logistics sector, warehousing demand remains robust as e-commerce grows at an unprecedented rate.

Retail and hotels are the main laggards but affirmation of the role of physical stores and a boom in “staycations” are providing the foundation for an eventual recovery.

On the investment front, a need for resilient portfolios is prompting investors in the region to adjust their weighting towards structural opportunities, with institutional buyers deploying capital into the logistics sector via joint ventures and/or private equity funds; and defensive plays led by overseas institutional groups targeting prime office assets in core gateway cities of markets such as Japan, China and Singapore.

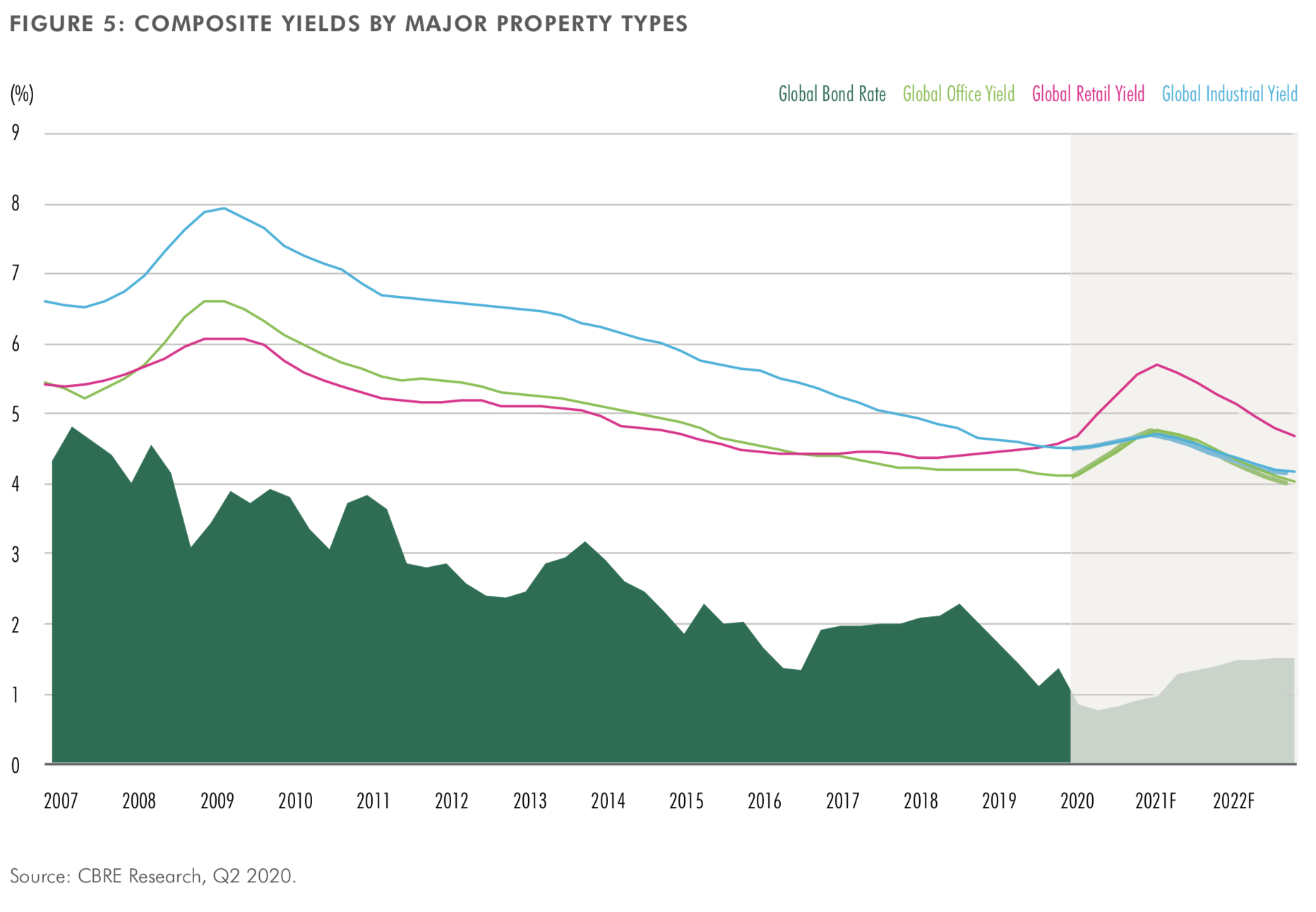

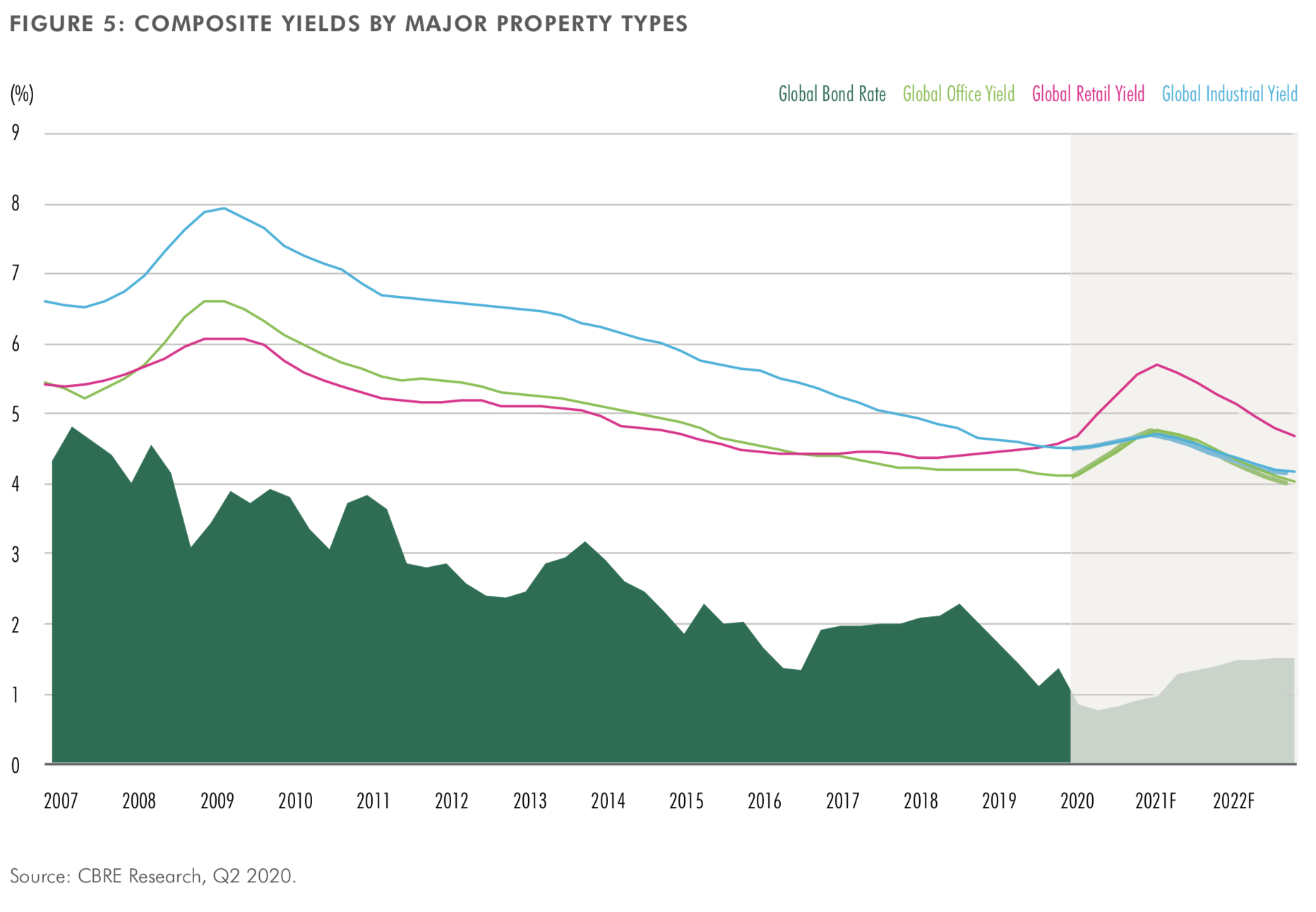

Composite yields for major property types Source: CBRE

Dr Henry Chin, CBRE APAC/EMEA Head of Research said the pandemic has dealt a swift and significant blow to the global economy.

"However, Asia Pacific is now set for a strong recovery starting later this year and extending through 2021," said Dr Chin.

"While lockdowns and other restrictions in most Asia Pacific markets have been lifted and economic activity is resuming, the depth and breadth of the recovery is uneven, with North Asia and New Zealand ahead of the curve.

“The recession likely will keep interest rates low for the foreseeable future, increasing the appeal of commercial real estate in Asia Pacific amid widening cap rate spreads.

"Investors remain interested in commercial real estate despite travel restrictions and are pursuing a range of opportunities including debt, stabilized assets and greenfield logistics

development.”

CBRE’s Asia Pacific Real Estate Market Outlook 2020 published at the beginning of the year identified de-globalization, disinflation and demographics as the key trends that will impact commercial property sectors this year and beyond.

In the mid-year update, CBRE maintains its view of these broad trends but has updated them to account for the impact of the pandemic.

Industrial & Logistics

The continued surge in e-commerce usage will solidify industrial & logistics as a top-performing commercial real estate sector worldwide, with modern warehouses attracting most of the demand.

Additional requirements will result from retailers adding more inventory to handle demand fluctuations and from manufacturers diversifying their supply chains to reduce

dependence on China.

In Asia Pacific, demand for cold storage facilities has risen substantially as more consumers shop online for fresh food and other groceries.

Buoyant leasing demand from e-commerce platforms and third-party logistics (3PL) firms continues to attract investors to the sector.

Office

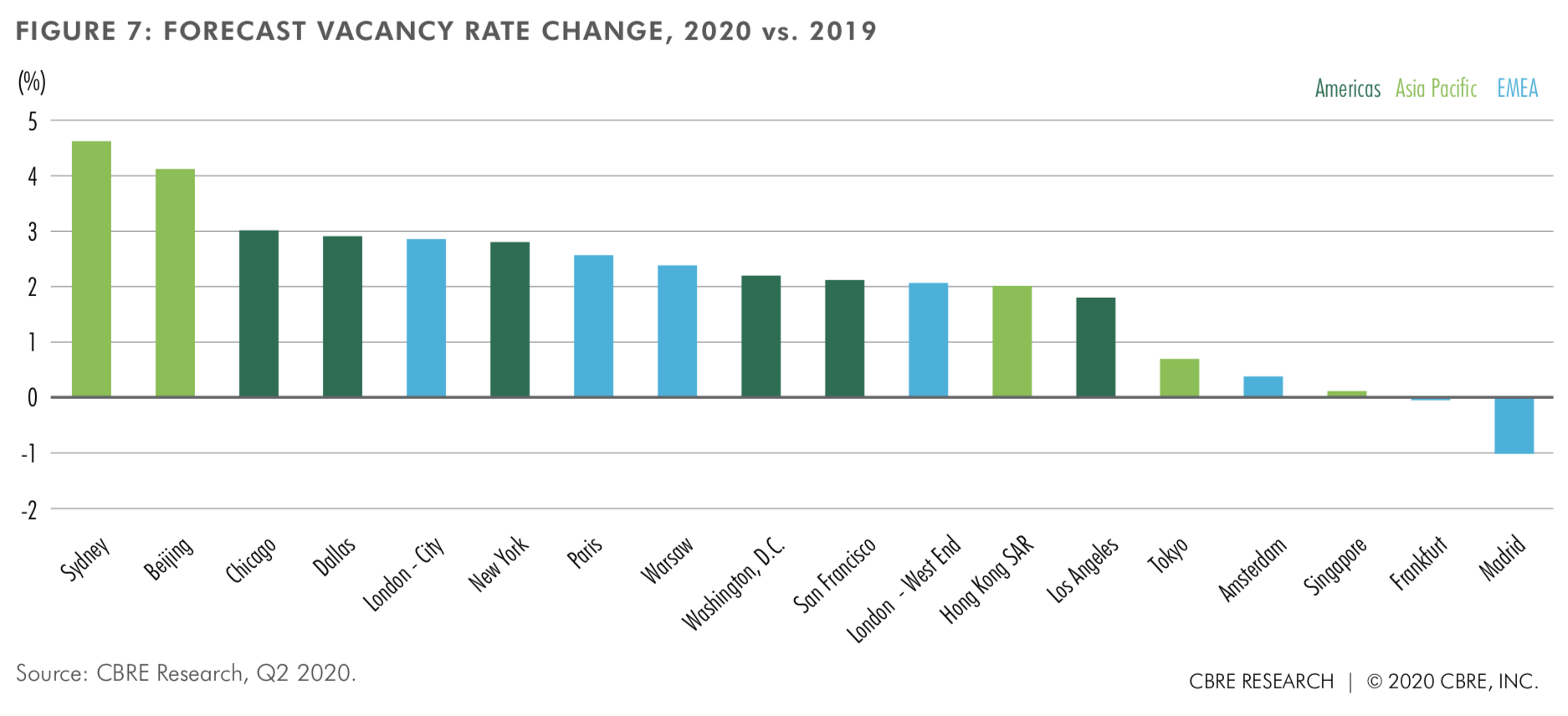

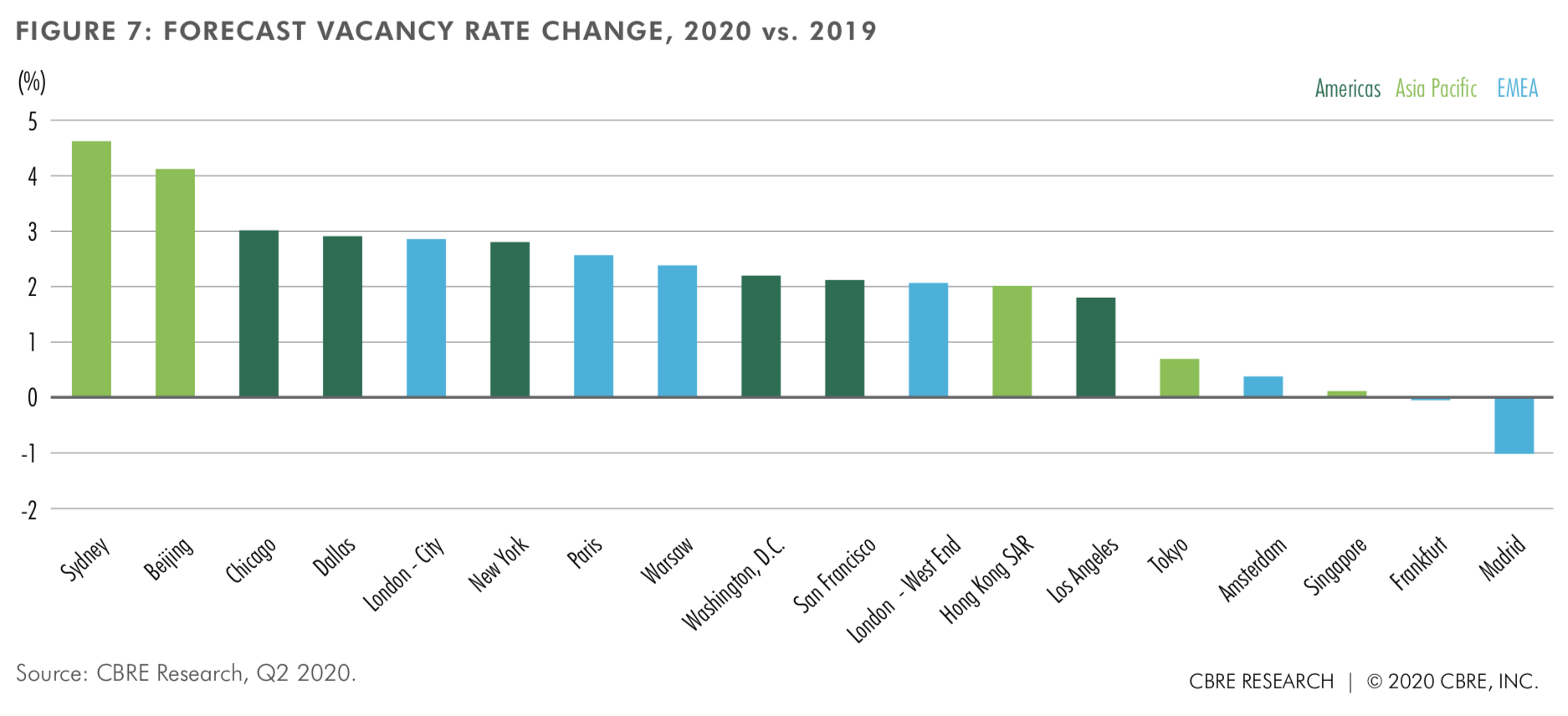

CBRE sees negative net absorption for office space globally this year, and a modest rise of 1 percentage point in the global vacancy rate, before an improvement occurs next year.

Headline rents are likely to fall 3 percent to 6 percent in most markets in 2021.

Forecast vacancy rate change 2020 vs 2019 Source:CBRE

Many companies are adapting by giving more employees a choice of how often to work from home or from the office.

Most intend in the short term to equip their offices for counter-virus efforts such as social distancing by adding signage, closing common areas and limiting capacity rather than more expensive initiatives such as remodeling or moving to less-dense, suburban locations.

Office demand in Asia Pacific has improved in recent months, with relative strength in Taipei and some Japanese regional cities, along with indications of a strong recovery in leasing activity in Mainland China, pointing to a rebound in enquiries towards the beginning of Q4 2020.

Retail

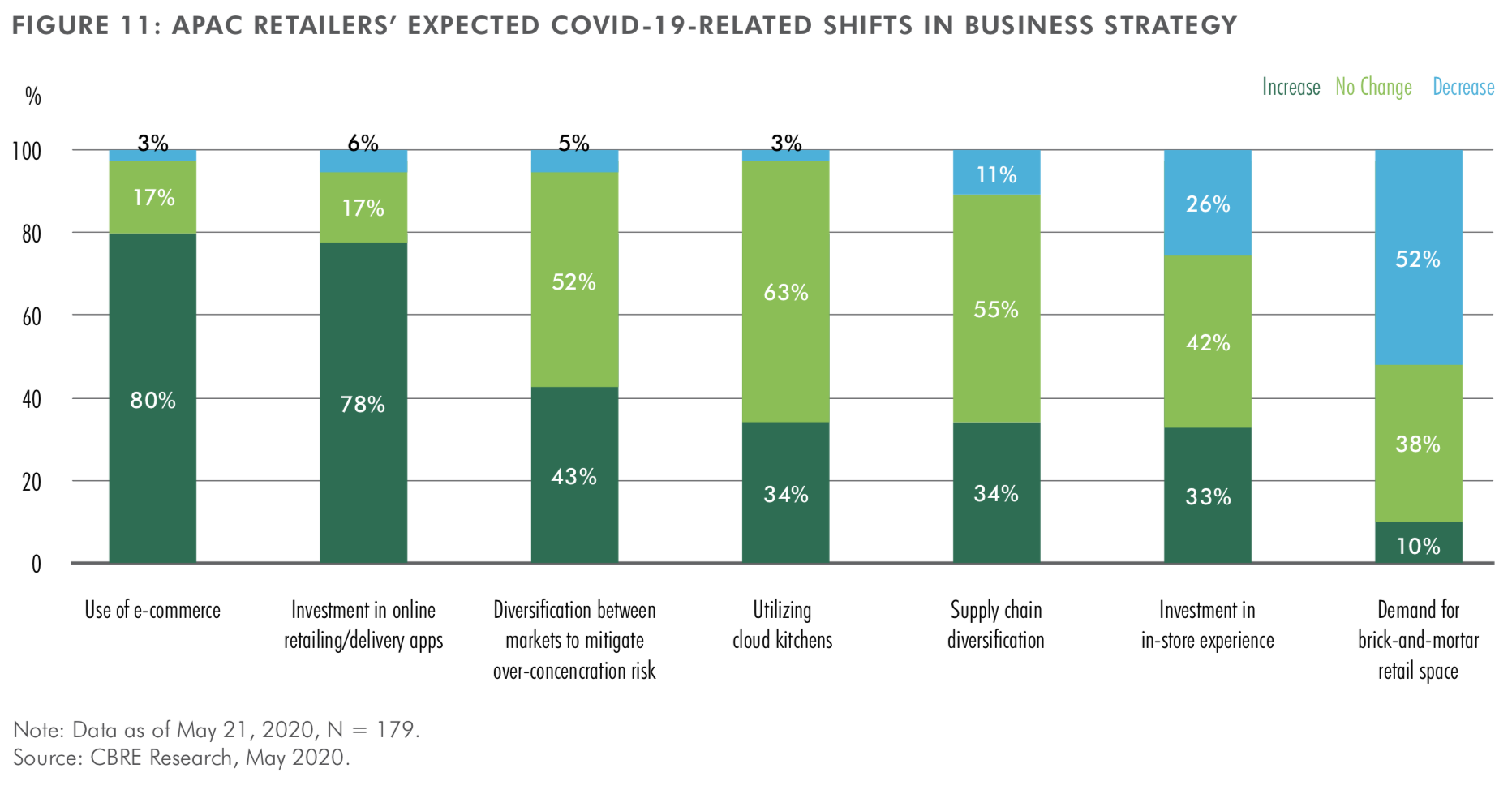

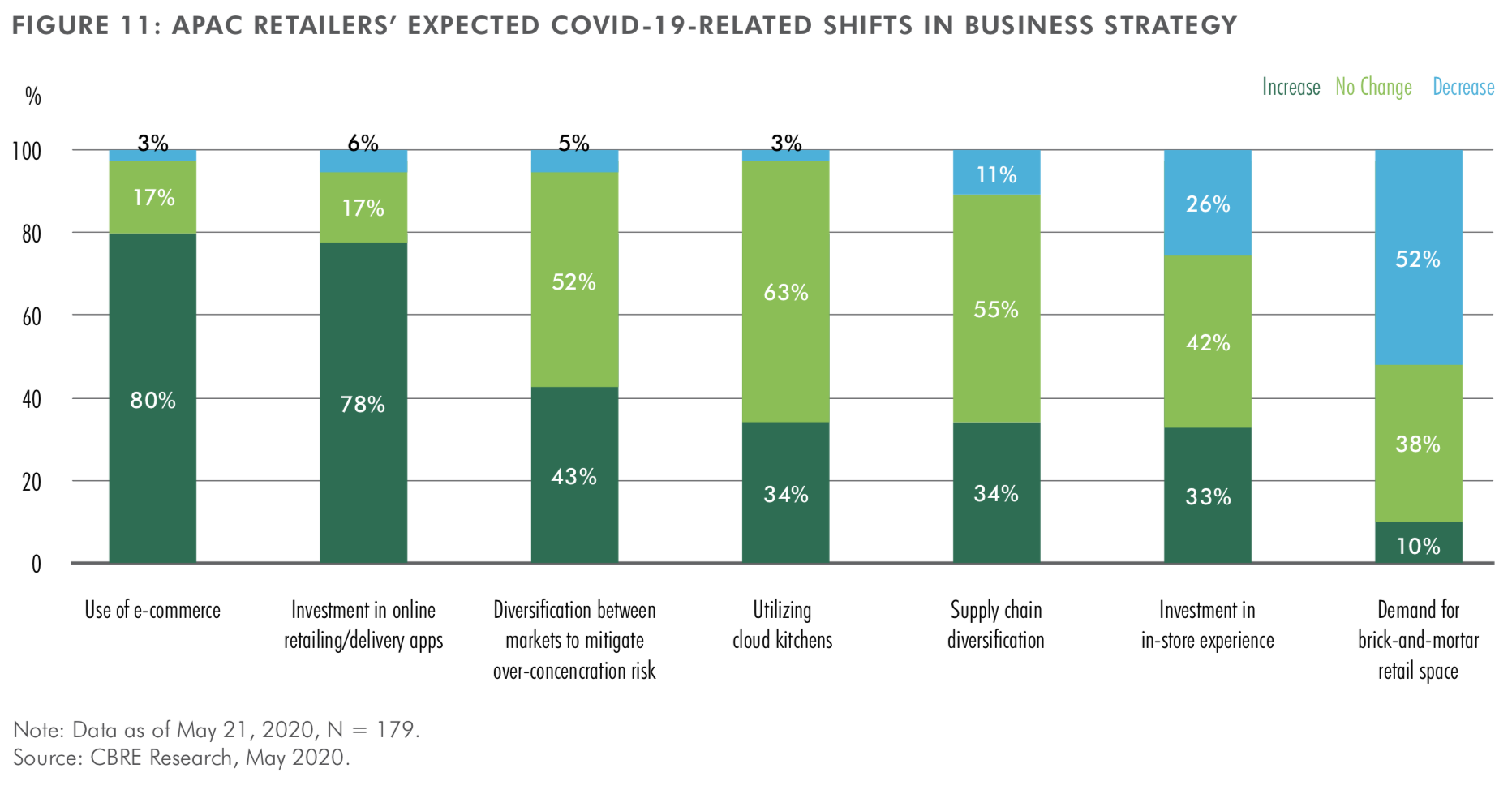

The role of the physical store remains important for customers despite the rapid uptake in e-commerce usage since the onset of the pandemic.

Shoppers have transitioned to visiting stores less frequently but spending more on each visit.

They are also demonstrating a preference for open-air centers and retail parks over enclosed malls.

Retailers' expected COVID-19 related shifts in business strategy Source: CBRE

Curbside-pickup services will become permanent offerings for many retailers.

In Asia Pacific, consumer sentiment has been improving since May, along with the gradual relaxation of lockdowns and other restrictions.

However, leasing activity will remain subdued over the remainder of the year, despite landlords offering relief measures and other incentives.

As in other regions, while the shift towards online channels will continue, bricks-and-mortar stores offering entertainment and experience will remain front and centre in consumer

engagement, once the pandemic subsides and the necessary safety precautions are put in place.

Hotels

Leisure travel will drive the first leg of the recovery for hotels but a full recovery will not occur until corporate and group travel resume.

The hotel industry took roughly 2.5 years to recover from 9/11 and from the Global Financial Crisis.

The pandemic’s deep hit to hotel revenue will lead to the repositioning, sale and closure of a sizable number of properties.

Hotels in Asia Pacific cities with large domestic markets such as Mainland China, Korea, Japan and Taiwan have seen a gradual recovery in recent months as “staycations” become the new normal.

Corporate travel and mass tourism are likely to resume in 2021.

Selected investors are looking at opportunities to convert hotels into co-living spaces by taking advantage of price dislocation.

Multifamily

CBRE expects the average rental rate in the U.S. to decline by 8.8 percent this year and vacancy to rise by more than 3 percentage points.

However, falling unemployment, strong underlying demographic trends and active lenders will fuel a steady recovery through 2021 and 2022.

While investment remains on hold, activity is expected to gradually regain momentum in the U.S. and Europe as rents and occupancy start to recover.

While Japan remains the key multifamily investment market in Asia Pacific, recent policy changes in New South Wales in Australia and regulatory support in Mainland China could create investment opportunities this year and beyond.

Click here for further information on the Asia Pacific Rea lEstate Market Outlook 2020 Mid Year Review

Click here for more information on the Global Real Estate Market Outlook 2020 Mid-Year Review

Similar to this:

New CBRE report shows COVID-19 is 'accelerating' the evolution of Korea's office market

Asia Pacific commercial sentiment improving despite drop in investment volume - CBRE

Leasing and investment activity in Seoul 'remains stable' despite pandemic impact - CBRE