New research has revealed the role of COVID-19 in transforming Korean workspaces, with an increase in space requirements identified as one of the likely by-products of the pandemic.

CBRE Korea's The Future is Flexible: The Evolution of Work and the Office in Korea covers the effects of accelerating changes in the office market due to COVID-19 and a significant increase in new Grade A supply on demand for flexible space, remote working and activity-based working (ABW) environments.

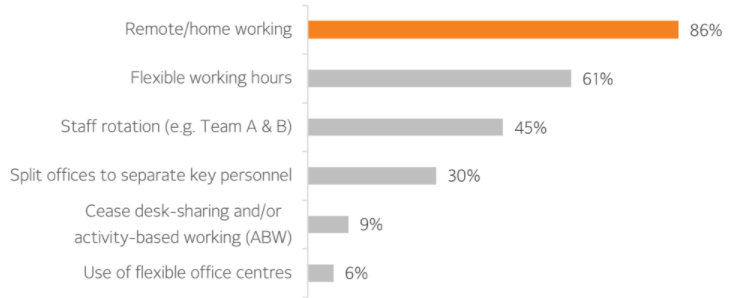

With the transmission of the virus frequently occurring among groups of people in enclosed spaces, CBRE notes it is necessary to revise the space utilization standards of flexible work environments to reduce close interaction between employees, adding companies will have to create a balance between employee health and safety, cost and space efficiency.

At a glance:

- New research has COVID-19 pandemic is accelerating the evolution of work and the office market in Korea

- CBRE predicts increased workplace flexibility, higher space requirements, and demand for sustainability and wellness features expected in the office market going.

- According to the firm, there have been no major cases of corporate tenants cancelling memberships or returning space, with H1 2020 instead signalling an increase in leasing and membership enquiries from potential tenants seeking short-term office space.

Source: CBRE Research

CBRE Managing Director Don Lim said there were concerns that the shift in the workplace may lead to a decline in footprint requirements in the long term.

“The nature of business for most companies means they will retain a strong need for physical office space," he said.

"Companies need to comprehensively consider a variety of aspects besides cost savings from reducing the office area.

"In the future, companies will need to rethink the balance between office work and remote work considering what the office does for efficiency as well as take into account the recent trend of using the office as a means of corporate branding and collaboration.”

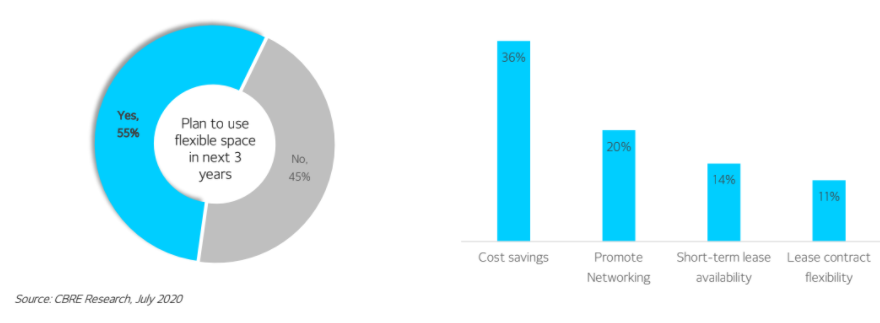

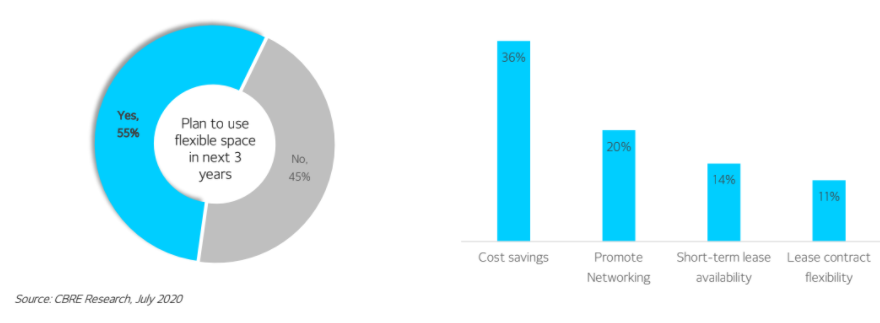

Occupiers’ willingness to use flexible space in the next three years (left) and their objectives for doing so (right).

Occupiers’ willingness to use flexible space in the next three years (left) and their objectives for doing so (right).

CBRE Research conducted interviews with four major coworking operators in May to identify the status of the flexible space market and its prospects, finding that the coworking market has been largely unaffected by COVID-19.

According to the firm, there have been no major cases of corporate tenants cancelling memberships or returning space, with H1 2020 instead signalling an increase in leasing and membership enquiries from potential tenants seeking short-term office space as a solution to social distancing and as a consequence of needing to locate staff across different locations to mitigate risk.

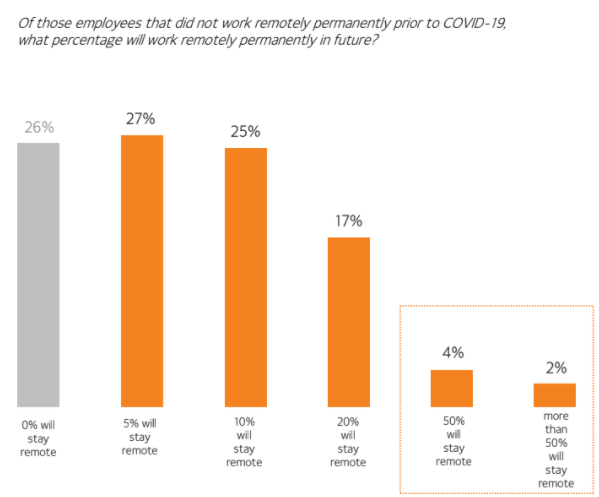

CBRE Korea Head of Research Claire Choi said as large occupiers make greater use of flexible space and workplace design solutions in the coming years, demand for coworking space in Seoul was expected to remain robust, while the city's experiment with remote working due to COVID-19 had proved to be largely successful, with higher employee satisfaction and increased cost savings and similar productivity.

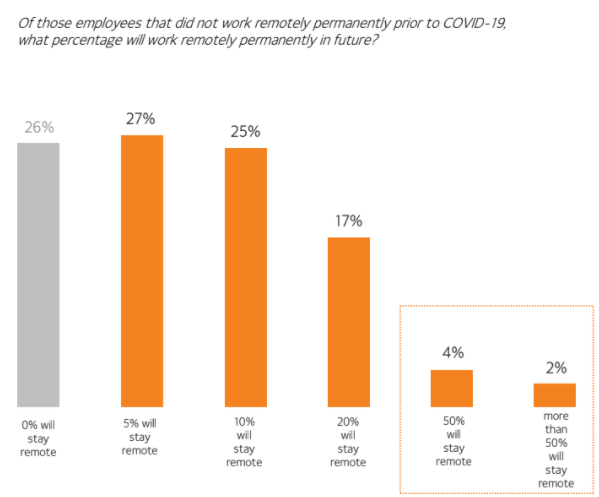

Source: CBRE Research

“It will take some time for remote working practices to be permanently adopted in Korea," she said.

"Companies will adopt remote working selectively as needed.

"As more companies review the efficiency of space with implementation of remote work, it will lead to changes in the size, role and features of the office.”

Despite the anticipated shift to remote working and an increase in companies reconsidering the efficiency of their existing office space, CBRE forecasts that employees will continue to demand ABW environments providing a variety of different settings to facilitate different working styles, with the companies prepared to invest in and manage this transformation – as well as in augmenting hygiene and safety measures in response to the pandemic – able to "reap a myriad of benefits" from a more productive, inspired and loyal workplace.

Click here to view the report.

Similar to this:

Asia Pacific commercial sentiment improving despite drop in investment volume - CBRE

Leasing and investment activity in Seoul 'remains stable' despite pandemic impact - CBRE

Digital transformation of retail in the Asia Pacific accelerating due to COVID-19 -CBRE Survey

Occupiers’ willingness to use flexible space in the next three years (left) and their objectives for doing so (right).

Occupiers’ willingness to use flexible space in the next three years (left) and their objectives for doing so (right).