Bangkok may be continuing to enhance its appeal as a tourist destination by adding a growing number of attractions but the recovery of the city's hospitality sector will be subject to to the control of the coronavirus situation, especially in the largest feeder markets to hotels in Thailand, Knight Frank says.

Data from the firm indicates the number of international tourists decreased 61 per cent Y-o-Y from 14,757,448 to 5,781,091 in the first five months of 2020.

The Chinese market, the largest market feeder, declined as the Chinese government imposed outbound travel restrictions in January 2020.

Carlos Martinez, Director of Valuation and Advisory for Knight Frank Thailand, told WILLIAMS MEDIA the demand for accommodation in Bangkok had subsequently weakened following a "sharp decline" in tourist arrivals.

"The COVID-19 outbreak at the end of 2019 dealt a serious blow to the hotel market," he said.

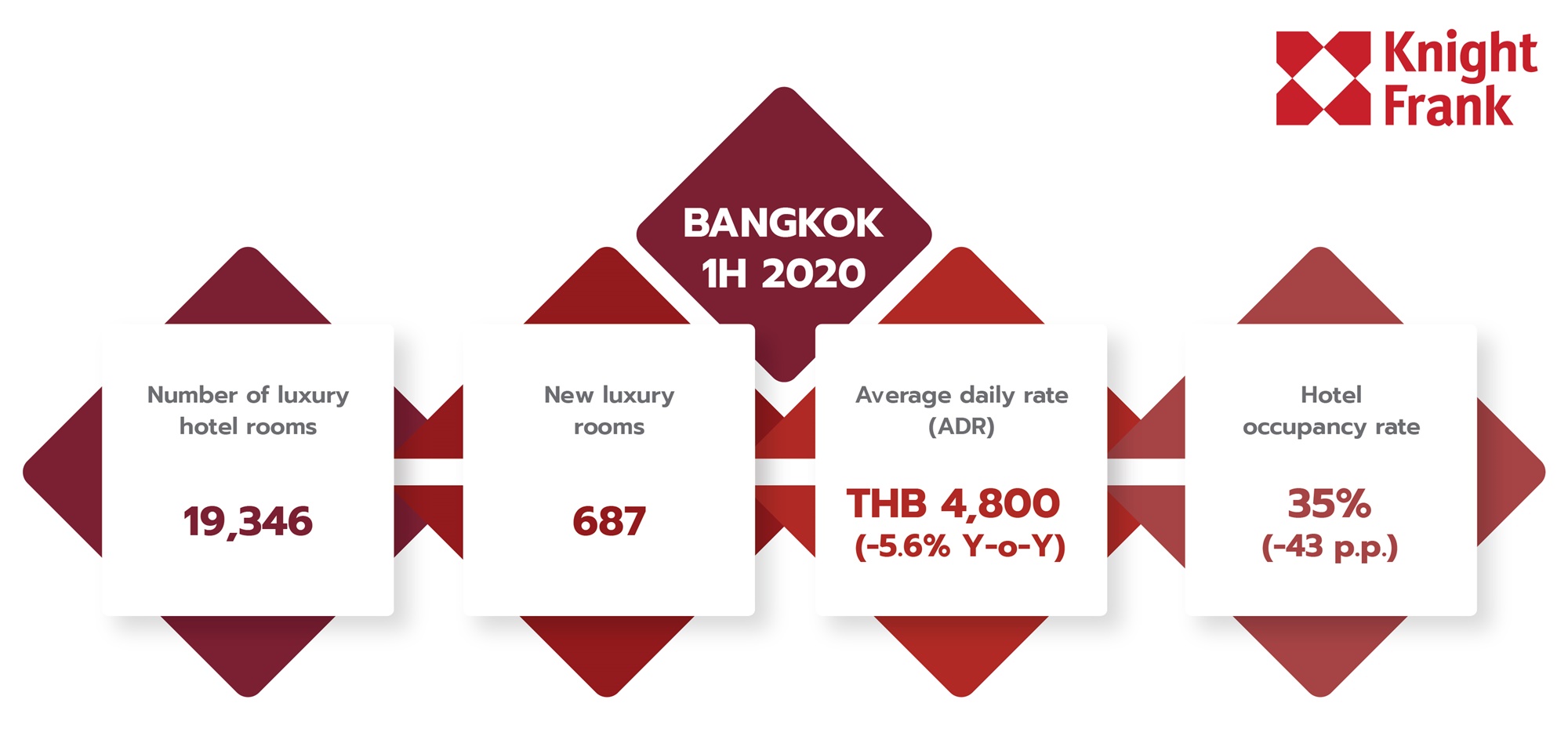

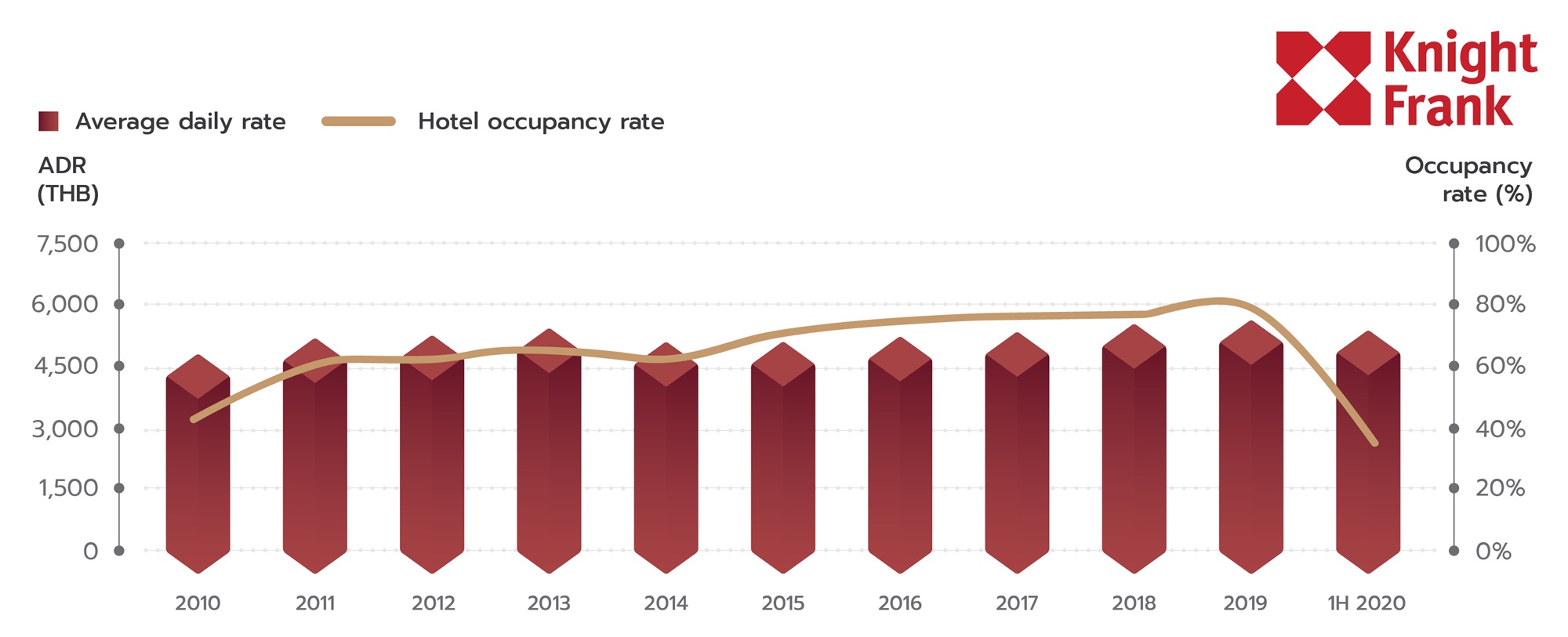

"The occupancy rate of luxury hotels in Bangkok was only 35 per cent in 1H 2020.

"The hospitality sector is expected to face tremendous challenges in the short term."

Director of Valuation and Advisory, Knight Frank Thailand Carlos Martinez. Source: Knight Frank Thailand

Supply and Demand

According to research conducted by Knight Frank Thailand, the Early Sukhumvit area comprised the majority of the luxury hotel supply with just under 40 per cent, followed by Lumpini (22 per cent), Silom/Sathorn (15 per cent) and Riverside (16 per cent).

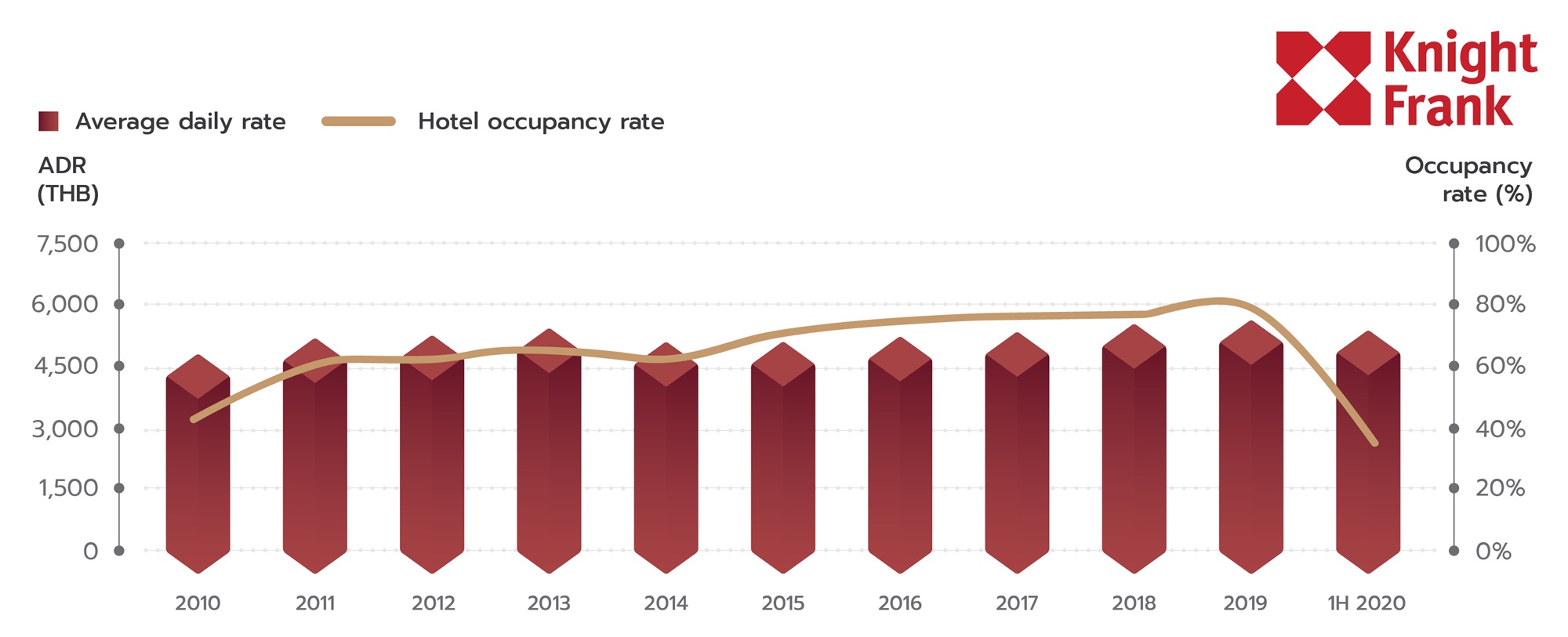

As a result of the COVID-19 outbreak at the end of 2019, the occupancy rate of luxury hotels in Bangkok was only 35 per cent in the first half of 2020.

Figured from Knight Frank indicate occupancy was over 50 per cent in the first quarter of 2020 and reached the lowest level at 25 per cent in the second quarter as travel bans accelerated.

As at the end of 1H 2020, the Average Daily Rate (ADR) of luxury hotels fell by 5.6 per cent to THB 4,800.

Knight Frank believes this decline was affected by the discounts offered to local customers stemming from the drop of international travellers.

Source: Knight Frank Thailand

Due to the low level of occupancy, some hotel operations were suspended until signs of market recovery.

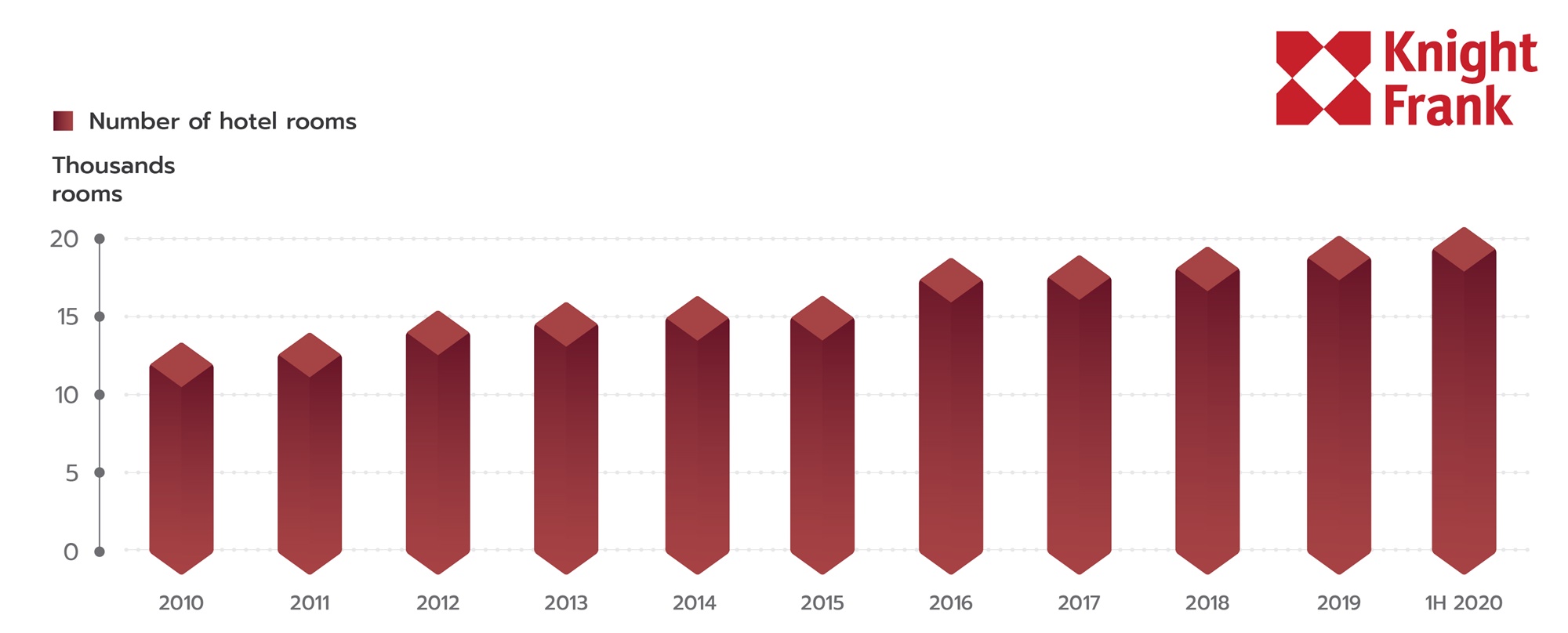

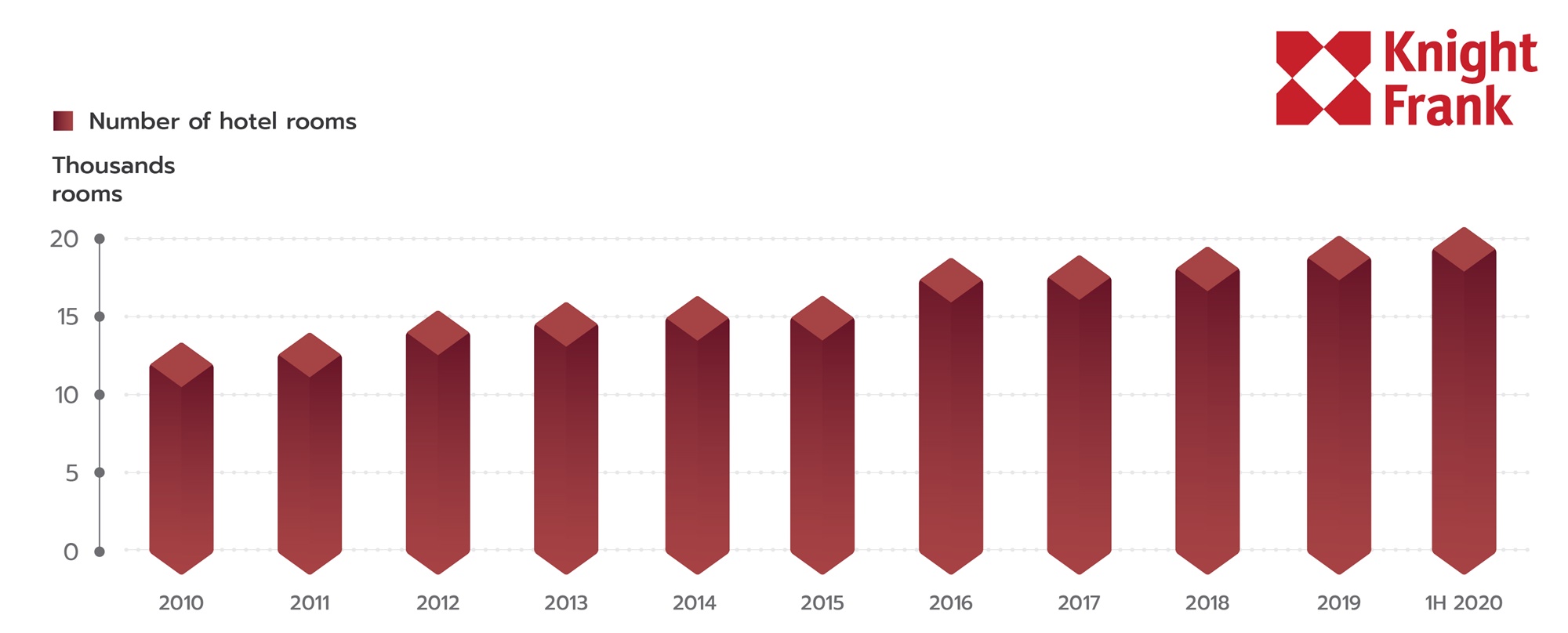

In 1H 2020, two new luxury hotels opened in Bangkok, providing an additional 687 rooms.

They included the Carlton Hotel Bangkok (338 rooms) in early Sukhumvit and Kimpton Maa-Lai Bangkok (349 rooms) in Lumpini, both located in the CBD district.

Other hotel openings totalling 1,005 rooms in the upscale and midscale segment were Staybridge Suites Bangkok Thonglor (303 rooms), Solaria Nishitetsu Hotel Bangkok (263 rooms), Oakwood Suites Bangkok (228 rooms), Villa De Pranakorn (47 rooms), The Quarter at Phrom Phong (120 rooms) and Ashley Hotel (44 rooms).

According to Knight Frank, there were 19,346 luxury hotel rooms in Bangkok at the end of 1H 2020.

Source: Knight Frank Thailand

Outlook

Mr. Martinez said while Knight Frank expected the average occupancy rate in Bangkok to decrease sharply below 50 per cent and the ADR to drop as operators compete to attract a lower number of visitors in 2020, there was some improvement expected in the second half of the year.

"We expect to see local tourism picking up in the third quarter, with international travel returning slowly in the fourth quarter," he said.

"Some hotel operators are expected to temporarily keep their businesses suspended to reduce losses until clear signs of market recovery, especially from international visitors.

Source: Knight Frank Thailand

"They may take this opportunity to renovate their hotels, which would allow them to raise their ADR in the long term, or at least attract a higher number of customers in the Bangkok’s competitive hotel market."

Five hotels totaling 1,575 rooms that had planned to open in 2020, however, some will likely delay their openings.

These hotels include Sindhorn Midtown Hotel (475 rooms), Sindhorn Kempinski Hotel (285 rooms), Orient Express King Power Mahanakhon (154 rooms), Four Seasons hotel (301 rooms), The Capella Bangkok (101 rooms) and Steigenberger Hotel Riverside (259 rooms).

Mr Martinez said the amount of new hotel supply would "put further pressure" on Bangkok’s hotel market.

Similar to this:

How Thai hotels have transformed under the 'new normal' - CBRE

Bangkok office market approaching the end of 'expansionary period' - Knight Frank

Knight Frank Thailand reveals Hua Hin condominium market in state of equilibrium