Asia-Pacific real estate markets show signs of improving real estate transparency -JLL

Contact

Asia-Pacific real estate markets show signs of improving real estate transparency -JLL

Asia Pacific’s emerging markets have made the most significant gains in improving real estate transparency, according to JLL's biennial Global Real Estate Transparency Index.

A greater emphasis on corporate social responsibility and the wider adoption of new technologies has allowed Asia-Pacific real estate markets to improve their transparency internationally, new research has found.

JLL's biennial Global Real Estate Transparency Index has indicated higher levels of transparency were observed in India, Southeast Asia and Mainland China, but globally the slowest rate of improvement was observed since the period directly following the Global Financial Crisis.

The backdrop of COVID-19 is also ensuring that transparency within Asia-Pacific’s real estate legal and regulatory systems is more important than ever to global investors, as they look to deploy approximately $40 billion in dry powder capital into the region.

JLL Global Real Estate Transparency Index - At a glance:

- JLL’s latest Global Real Estate Transparency Index reveals solid improvement in India, Southeast Asia and Mainland China.

- Australia and New Zealand remain the region’s most transparent real estate markets.

- Regional transparency improvement was driven by increased focus on corporate social responsibility and adoption of new technology.

According to JLL, pressure exists from investors, businesses and consumers to further improve real estate transparency to compete with other asset classes and meet heightened expectations about the industry’s role in providing a sustainable and resilient built environment in the age of COVID-19.

Furthermore, innovative new property technology (proptech) is changing how real estate data is gathered and analyzed and influencing industry transparency at a regulatory level.

Asia Pacific Chief Research Officer Roddy Allan said the 2020 Index was being launched at a time of massive economic and societal disruption where the need for transparent processes, accurate and timely data and high ethical standards were in closer focus.

“While investment into commercial real estate has inevitably paused during the pandemic, the overarching trend toward rising allocations to this asset class will continue," he said.

"As investors look to allocate more capital into Asia-Pacific real estate, transparency becomes fundamentally more important, as will the enforcement of robust regulatory frameworks."

Source: JLL

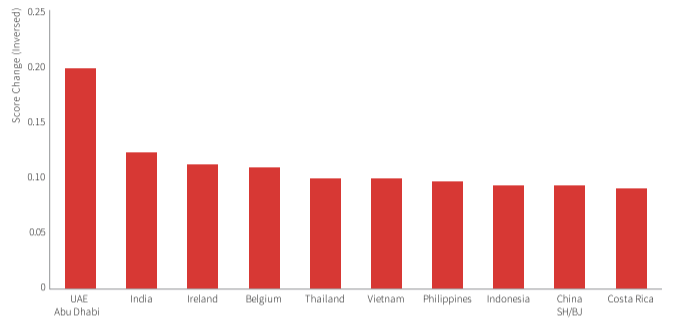

Emerging markets have once again shown the greatest advancement in the Index, with six Asia Pacific markets – Mainland China (32nd), Thailand (33rd), India (34th), Indonesia (40th), Philippines (44th) and Vietnam (56th) – among the top 10 biggest improvers globally. Mature markets such as Australia (3rd) and New Zealand (6th) have maintained their positions near the top of the global ranking.

In both the Asia-Pacific and outside of the region, JLL’s research concludes that sustainability commitments have become the biggest single driver of real estate transparency globally since 2018.

An increased focus on corporate social responsibility and acknowledgement of the need to create sustainable buildings bring environment, social and governance (ESG) considerations into the mainstream.

The markets in South East Asia, Western Europe and MENA to show the biggest improvement in real estate transparency from 2018-2020. Source: JLL

Additionally, green building certification systems and energy efficiency standards are widespread in the region’s most transparent markets and the most improved national real estate sectors.

Another key driver of transparency is the volume of real estate market data now available due to the growing adoption of Proptech platforms, digital tools and “big data” techniques.

Although real estate markets have historically faced challenges when implementing new technology, the COVID-19 pandemic is leading to an acceleration in new types of non-standard and high-frequency data – especially relating to health, mobility and space usage – being collected and disseminated in near-real-time.

Mr Allan said the fast-tracking of sustainability initiatives and wider-spread adoption of Proptech underlined that transparency gains would be driven by both an evolving regulatory landscape and the collective actions for national real estate industries.

"Spurred by the influence of the COVID-19 pandemic, it will become crucial for the real estate industry to work more collaboratively with governments and civil society to achieve greater transparency and meet the changing expectations of investors,” he said.

Similar to this:

Optimism building as Thailand’s hotel industry enters COVID-19 recovery phase - JLL

Hongo central to driving innovation and technology in Tokyo - JLL