Japanese lenders who provide financing for real estate firms and funds have been asked to share their outlook on the property market and their lending policy as part of a CBRE survey.

Conducted from late-April to end-May, the 2020 Japan Lender Survey reflects the views of 25 companies across the country.

CBRE Research Director Asuka Honda said the results showed lenders feared a decline in investment due to the uncertainty surrounding COVID-19.

"The survey results indicate that lenders are becoming more selective and are likely to adopt a more cautious stance towards lending in future," she said.

Source: CBRE

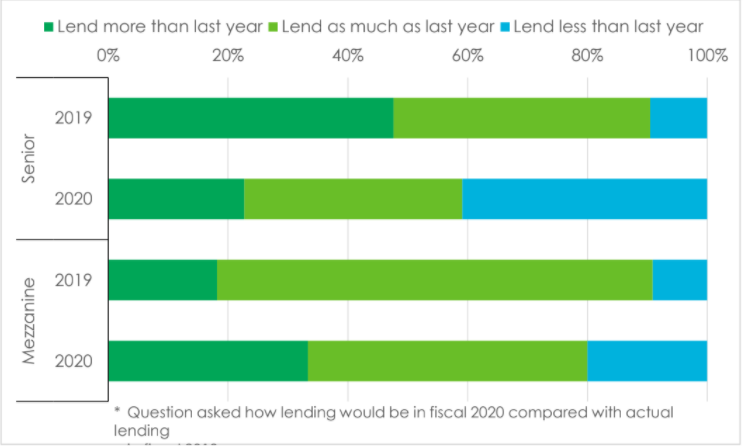

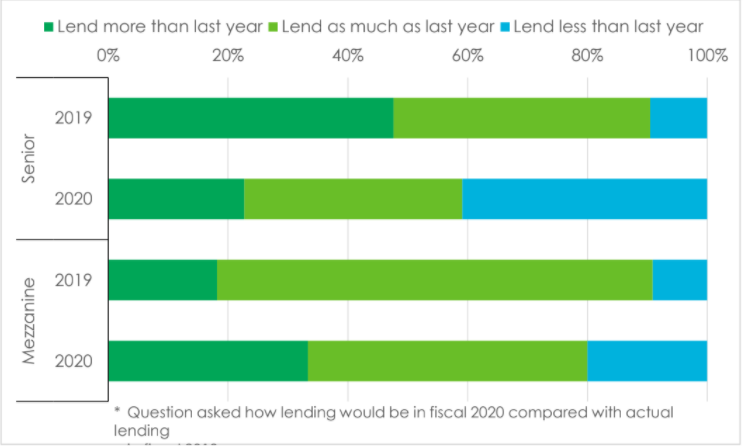

New non-recourse lending for real estate expected to decrease in fiscal 2020

According to the 25 lenders that participated in the survey, new non-recourse lending to the real estate sector is expected to decrease in fiscal 2020. Forty-one per cent of lenders in the case of senior loans (+31pt y-o-y) and 20 per cent of lenders in the case of mezzanine loans (+11pt y-o-y) said that their lending volume in fiscal 2020 would "decrease" compared with fiscal 2019.

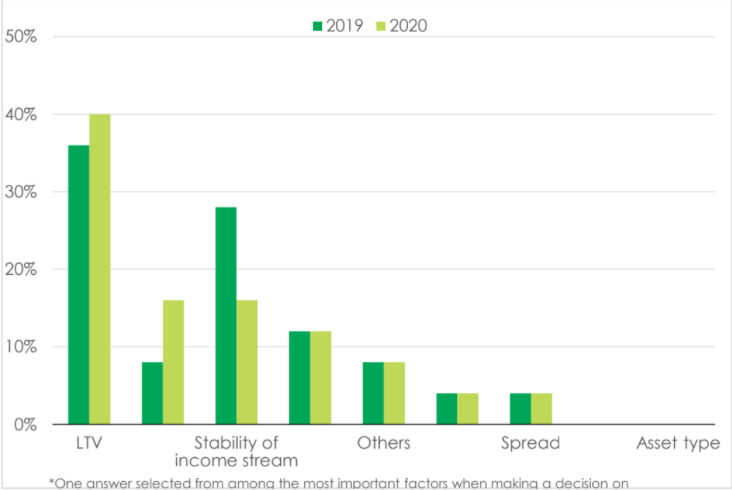

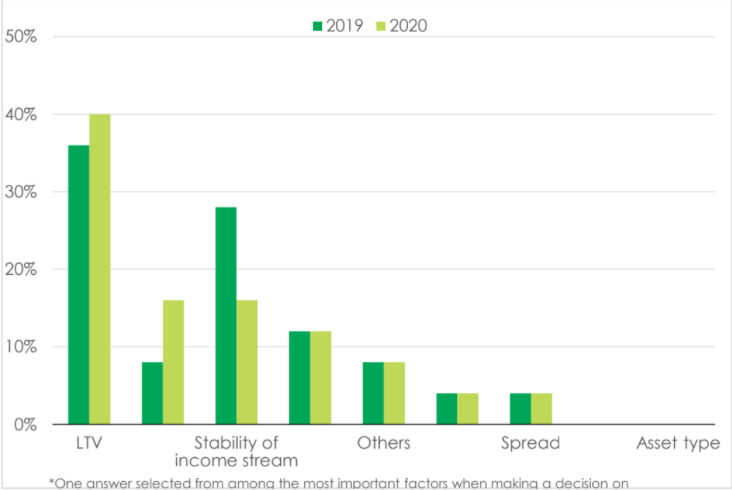

Probability of loan recovery seen as most important factor in lending decisions

The survey indicated that lenders are focused on future real estate price movements and appear to be looking to increase the probability of exit/loan recovery. When asked to identify the most important factors they consider when deciding whether to extend a non-recourse loan for real estate, the most cited factor was "LTV" (40 per cent, +4pt y-o-y), followed by "sponsor" (16 per cent) and "stability of income stream" (16 per cent), a similar finding to last year’s survey.

Source: CBRE

Logistics identified as most attractive asset type for lending

In comparison to last year, this year’s survey noted sharp decreases in "retail" (cited by 79 per cent of respondents; –23pt y-o-y) and "hotel" (58 per cent; –32pt y-o-y) – asset types that have been severely impacted by COVID-19. The results of the survey revealed an increasingly selective approach on the part of lenders. When asked to identify the most attractive asset type for investment in fiscal 2020, "logistics" came top (cited by 55% of respondents), a substantial increase of 37 points y-o-y. This was followed by "offices" (23%) and "residential" (18%). Lenders’ positive view towards logistics is likely due to the strong growth in the sector, supported by the expansion of e-commerce, and the stability of profits from long-term contracts.

Source: CBRE

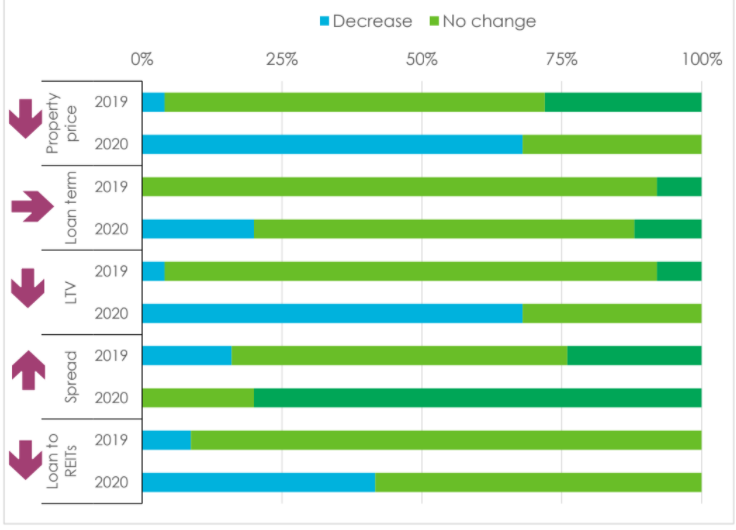

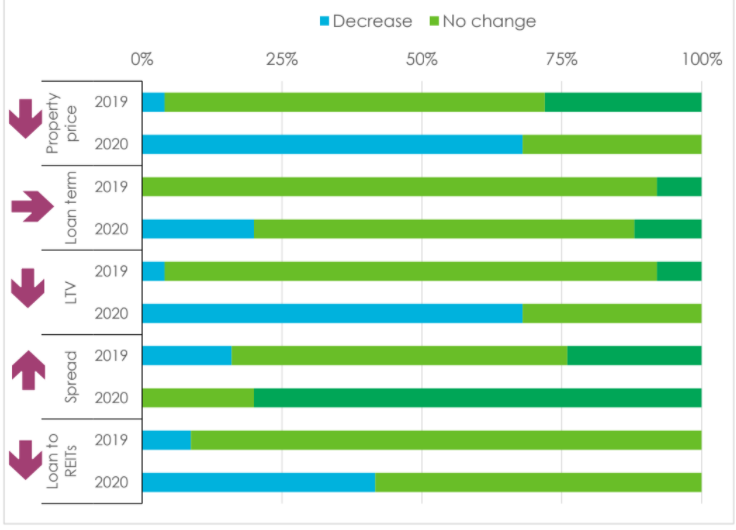

Lenders turn more selective due to the economic impact of COVID-19

The biggest threat to the real estate finance market in fiscal 2020 is seen as "domestic and global economic shock" (48 per cent). As many as 36 per cent of those respondents cited COVID- 19 in their comments, reflecting fears that the pandemic will lead to the deterioration of the domestic and global economy. Regarding the outlook for the debt market over the next year, “spreads will widen” (80 per cent) was the most cited answer, followed by "real estate prices will fall" (68 per cent) and "LTV ratios will decrease" (68 per cent). With COVID-19 likely to take some time to be eradicated, the outlook for the real estate market is unclear, prompting greater caution on the part of lenders.

Click here to view the full report.

Similar to this:

Japanese logistics sector hoping automation will 'improve margins' in the face of rising labour costs: CBRE

COVID-19 Implications for Flexible Space: What’s Next? – CBRE Report

Japan's largest hotel welcomes Covid-19 patients