Flexibility will be key for Thailand's serviced apartment owners if they are to weather the effects of COVID-19, CBRE Thailand says.

Research from the firm indicates a slowdown in the economy, which was further exacerbated by the outbreak of COVID-19, has negatively both long-stay and short-stay demand.

But CBRE believes the nature of the long-stay rental market has so far shown much more resilience to the effects of COVID-19 due to ongoing yearly contracts that are often covered by expatriates’ companies.

At a glance:

- New research from CBRE Thailand has shown how COVID-19 has negatively impacted both short and long-stay demand for serviced apartments within the country.

- The firm notes that the long-stay rental market has so far demonstrated more resilience due to ongoing yearly contracts.

- CBRE believes serviced apartments will need to demonstrate greater flexibility to accommodate short and long stay guests in the future.

CBRE Thailand Head of Advisory & Transaction Services for Residential Leasing Theerathorn Prapunpong said the exponential growth of Thailand's tourism industry in the years preceding the pandemic had contributed to a greater focus on short-stay revenue.

“The amount of people visiting Thailand annually has grown from 10 million in 2003 to almost 40 million tourists in 2019, causing serviced apartment operators to gradually focus more on the daily rate market to maximize revenue," he said.

"Long-stay guests provide consistent occupancy at a lower average rate per night, whereas short-stay guests provide variable occupancy but at a higher average rate per night.

"This explains why most new serviced apartments now apply for a hotel license to access into both markets and diversify risk.”

Mr Theerathorn said COVID-19 had highlighted the need for adaptation in being able to tap into more diversified markets, noting not all service apartments would be able to offer the flexibility required.

"Older serviced apartments often have structural limitations that legally prevent a hotel license from being granted," he said.

"Even after a hotel license is granted, there is no guarantee that all serviced apartments will benefit from having both short- and long-stay guests.

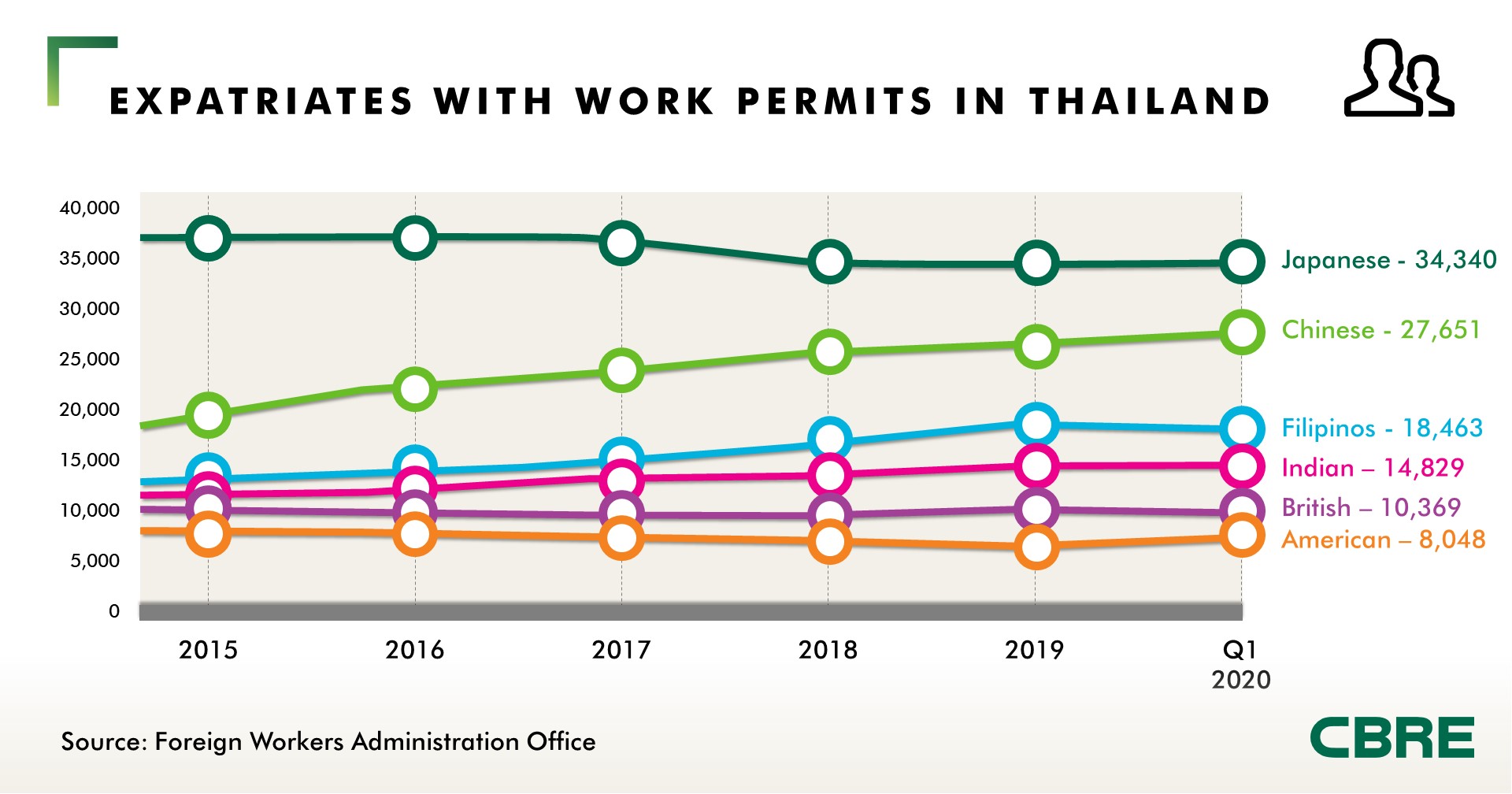

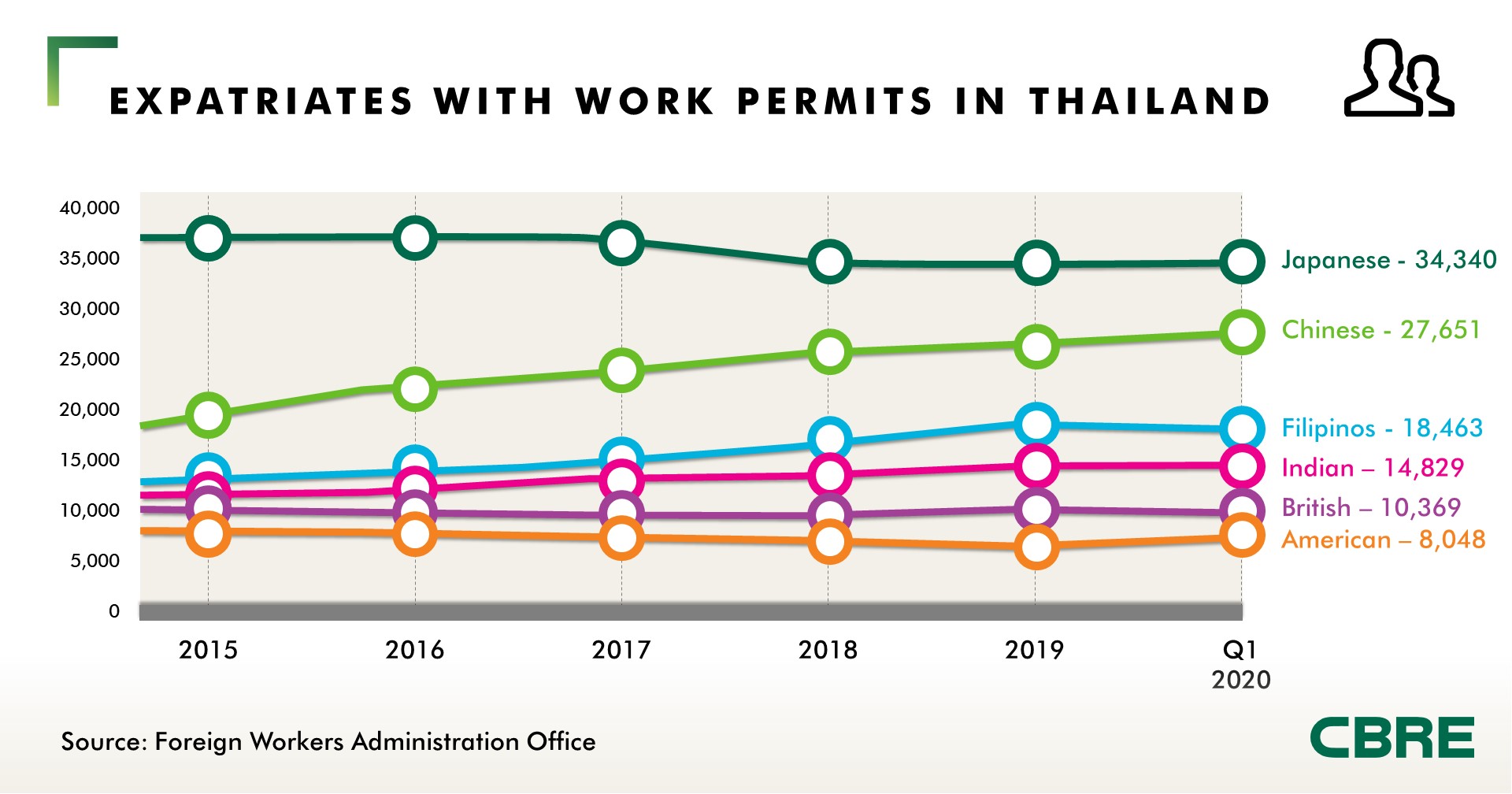

"Many serviced apartments that were specially designed for Japanese expatriates are also less flexible to changes.

"These serviced apartments only allow Japanese long-stay guests and have unique services and amenities to please their clientele, such as having Japanese toilets and room interior."

Similar to this:

Continued demand and the new normal in the Thai residential market - CBRE

Increase in real estate-led developments for Phuket's Layan Beach area

CBRE named top real estate brand in Lipsey Survey for 19th consecutive year