CBRE's latest Asia Pacific Flash Survey has revealed the impact of the pandemic on the region's retail sectors, with operators now focusing more on their online presence.

CBRE’s survey of 179 retailers in Asia Pacific region was conducted from April 28 to May 21.

Respondents came from food & beverage (30 per cent); fashion and apparel (20 per cent); other experiential retail (13 per cent); lifestyle (10 per cent); grocery (7 per cent); sporting goods/athleisure (6 per cent); health and beauty (6 per cent); and luxury (6 per cent).

At a glance:

- CBRE releases Asia Pacific Retail Flash Survey of 179 retailers.

- 78 per cent of retailers plan to increase investment in online retailing and delivery apps.

- 31 per cent of respondents stated that the pandemic led to digital sales becoming their core business.

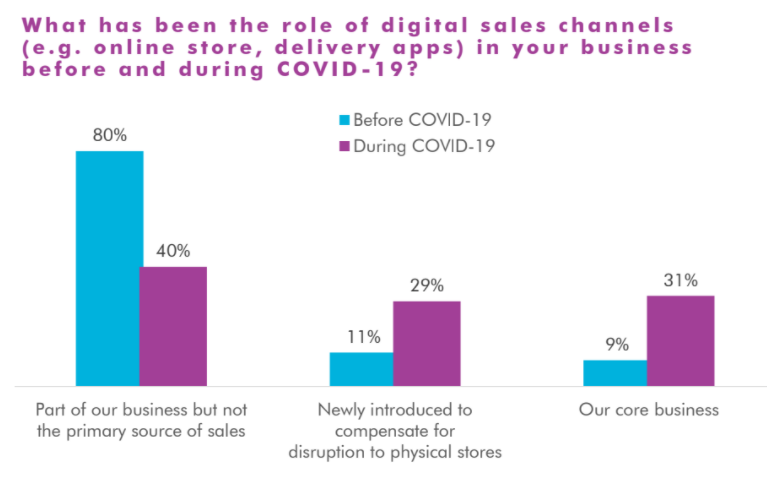

According to the survey, 78 per cent of respondents said that they plan to increase investment in online retailing/delivery apps and 80 per cent of them also responded that they will increase their use of social commerce.

In addition, 31 per cent of respondents stated that the pandemic led to digital sales becoming their core business.

Source: CBRE

A total of 70 per cent of luxury and sports brands responded that they will focus on growing online sales.

CBRE Retail Advisory & Transaction Services Director, Ryan Kim, said although overall consumption has decreased due to social distancing campaigns, purposeful purchases in areas such as home furnishings, home entertainment and food delivery, which are needed in daily life, have increased.

"Retail companies that built channels to connect online and offline were relatively less affected by COVID-19 and were able to be more flexible in dealing with the pandemic," he said.

"In the future, having a variety of sales channels, such as online and mobile (including food delivery app) platforms, will be an especially important strategy for retail companies.”

Source: CBRE

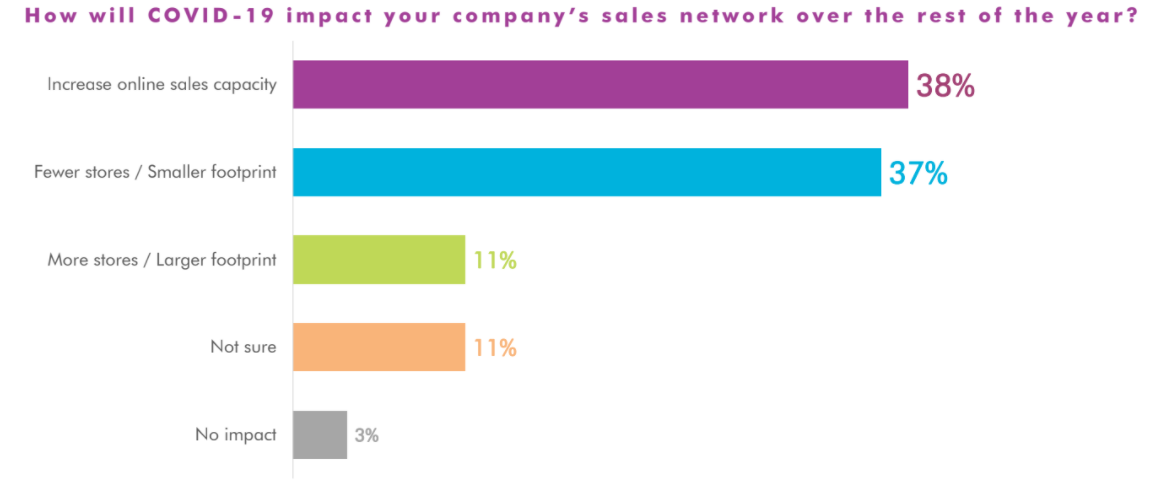

Most retailers (95 per cent) said that COVID-19 has impacted their leasing decision making.

Notably, 37 per cent of the respondents intend to consolidate their brick and mortar store networks this year, although 22 per cent of them either plan to open new stores or are still uncertain.

Meanwhile, 75 per cent of retailers said that they have a plan to increase or maintain investment in their in-store experience.

Additionally, about 38 per cent of retailers plan to focus on increasing their online sales capacity.

The survey also found that 52 per cent of the respondents answered that they expect to resume business within the next three months and 61 per cent expect it will take six months or more for sales to return to pre-COVID-19 levels after business resumes.

Click here to view the report.

Similar to this:

Japanese logistics sector hoping automation will 'improve margins' in the face of rising labour costs: CBRE

Continued demand and the new normal in the Thai residential market - CBRE

CBRE Korea signs Memorandum of Understanding with design and engineering firm