Asian countries are behind the likes of their North American and European counterparts when it comes to food security, a new report has found.

Savills has examined the effects of climate change on various aspects of real estate activity in a series of articles and interviews as part of its Impacts research programme, where the international real estate advisor has studied the various social, environmental, demographic and technological ‘tipping points’ immediately facing global real estate.

Savills Impact research - At a glance:

- Environmental, Social and Governance (ESG) led and climate-change mitigation still leading investor strategies, despite Covid-19.

- Given real estate is responsible for almost 40 per cent of energy and process-related emissions across the globe, and global building stock is set to double by 2050, Savills says a proactive approach at every stage of building is the only option.

- Food security will drive future real estate activity: Savills highlights New Zealand as the most secure country followed by Australia in fifth position, with large variations between European and American nations.

Alongside the threat of flood and wildfire, the research determined that one of the key climate change risks was food security.

Savills concluded that with real estate being determined by the location of people, and those people dependent on being able to access food, examining food security would become a crucial part of real estate investment and development activity.

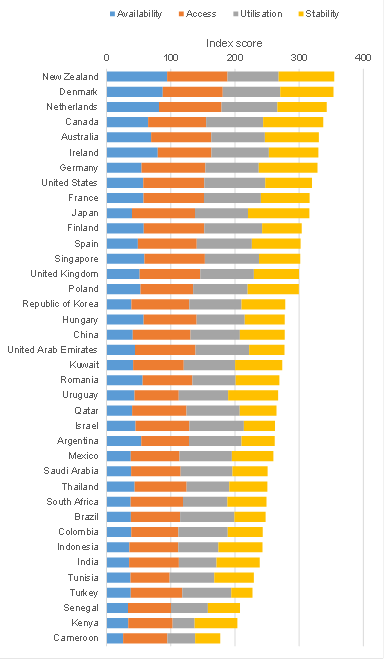

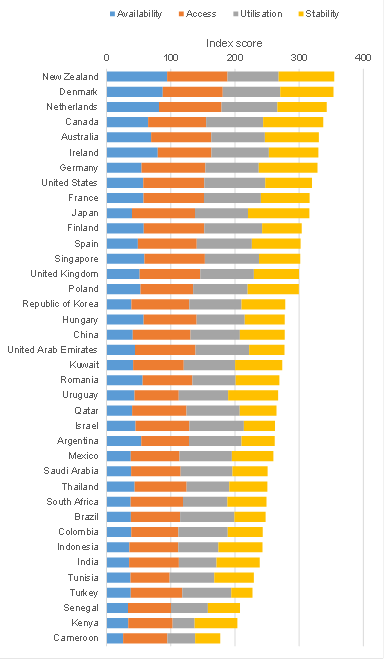

The company has therefore analysed and ranked 38 countries around the world on four pillars of food security (availability, access, stability and utilisation) in its first Food Security Index, published as part of Impacts.

Of the Asian countries, Japan was the highest placed at 10th, followed by Singapore (13th) and the Republic of Korea (16th).

New Zealand was named the most food secure country overall.

International investors, including Oxford Properties and Nuveen Real Estate, have confirmed to Savills that even in the light of the Covid-19 pandemic they remain fully committed to ESG-led strategies to tackle climate change given the long-term threats it poses to the future performance of assets.

Paul Brundage, Executive Vice President, Senior Managing Director Europe & Asia Pacific, at Oxford Properties told Savills the world was "past the tipping point" when it came to climate change".

Savills World Research Director Sophie Chick said Covid-19 had shown how natural forces could affect the entire globe.

“For the largest investors in real estate, the impact of climate change is now not just about ‘doing the right thing’ and recognising that assets with strong ESG-ratings tend to out-perform the market, it’s about the resilience of the location of assets due to the physical risk of environmental incidents," she said.

“Covid-19 has demonstrated that in the face of existential threats, governments and industry can take swift and decisive action which they would perhaps never have contemplated before in order to solve them.

"The innovation displayed by the real estate industry in recent weeks to deal with the pandemic now needs to be applied to tackling its rising carbon emissions and contribution to the climate crisis at every stage of a building’s lifecycle.

"Given government regulation in this area is only going to increase a proactive approach is the only option.”

Click here for more information.

Similar to this:

Savills triumph across Asia Pacific with $8.8bn worth of sales amidst pandemic

What COVID-19 means for the Singapore real estate market

Office space in Hanoi's Capital Place development available for lease