The Phillippines must capitalise on the "green shoots" coming out of the industrial and logistics sector if they are to lessen the economic damage of COVID-19, according to a new report from Santos Knight Frank.

In COVID-19 and Philippine Real Estate: Impacts, Opportunities and Strategies, the firm examines how the pandemic has affected various sectors of the country's property market, while also outlining ways forward for industry.

In the Philippines, the Enhanced Community Quarantine (ECQ) has put the country’s industries on a standstill except for key services that needed to go on.

Estimates on 2020 GDP growth is now expected to be between 4.3 per cent and —0.6 per cent according to the NEDA projections as consumption and production are anticipated to slow down.

At glance:

- Knight Frank Santos has released a report on how different sectors of the Filipino property market have been impacted by COVID-19.

- COVID-19 and Philippine Real Estate: Impacts, Opportunities and Strategies identifies retail as one of the worst hit sectors, while also noting positives for the country's industrial and logistics industry.

- In the Philippines, the Enhanced Community Quarantine (ECQ) has put the country’s industries on a standstill except for key services that needed to go on.

In addition, overseas remittances are also threatened. Overseas Filipino remittances accounted for 9.3 per cent of the gross domestic product (GDP) last year.

According to NEDA, around 100,000 potential job losses in the tourism and tourism-related services are expected and approximately PhP5.7 billion remittance will be foregone because of this.

However, not all industries have suffered as a result of COVID-19 with e-commerce experiencing a boost as people become more reliant on online transactions for their daily necessities

According to the Department of Trade and Industry, the e-commerce sector is projected to account for 25 per cent of GDP growth this year, a forecast which Knight Frank believes is "well on its way" to being fulfilled.

Strategies suggested for the sector, as outlined in the report, include repurposing underutilized real estate assets as storage space for last-mile logistics, pivoting the economy to capture forthcoming demand in industrial logistics, and expanding industrial parks and ports.

Source: Knight Frank Santos

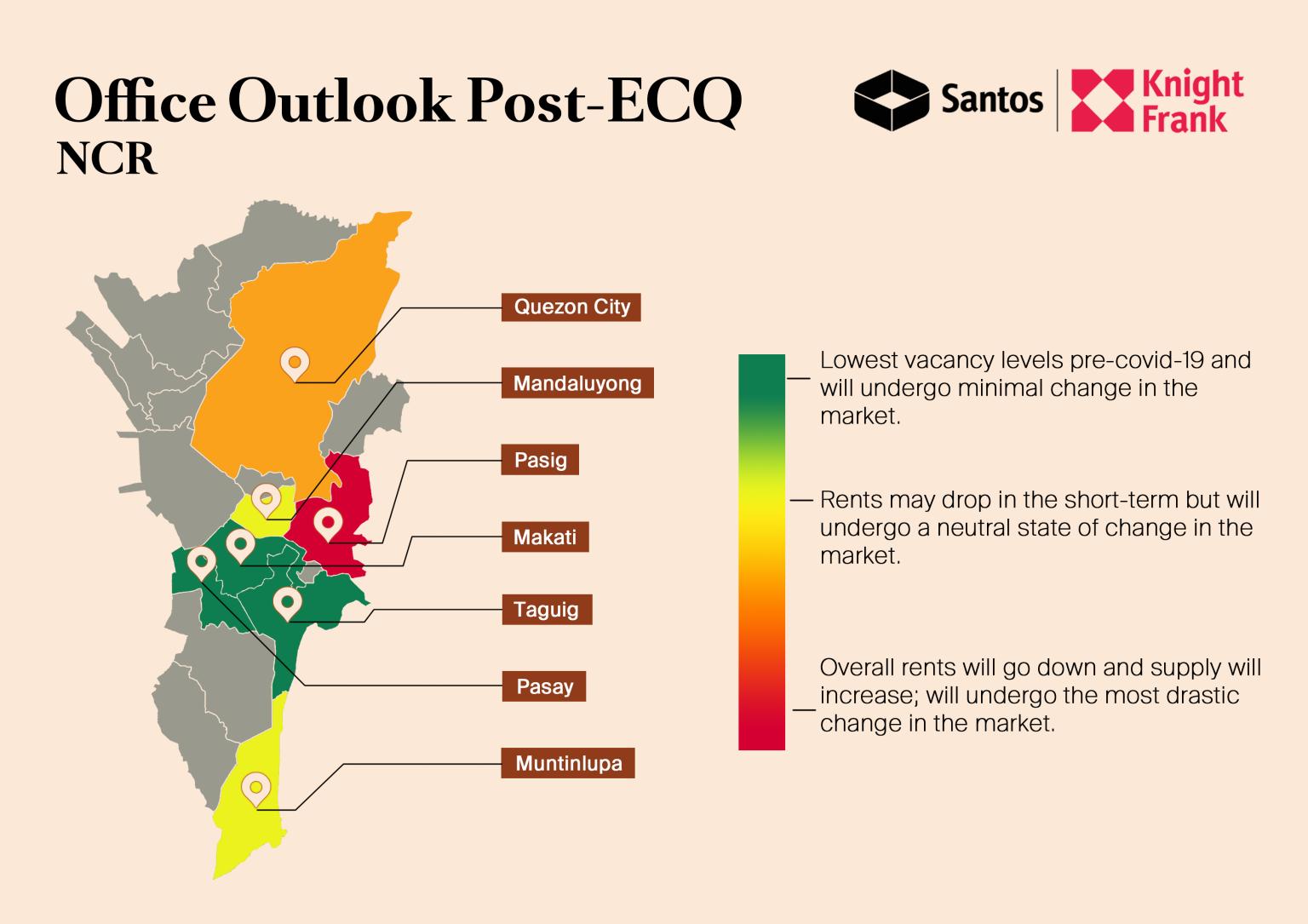

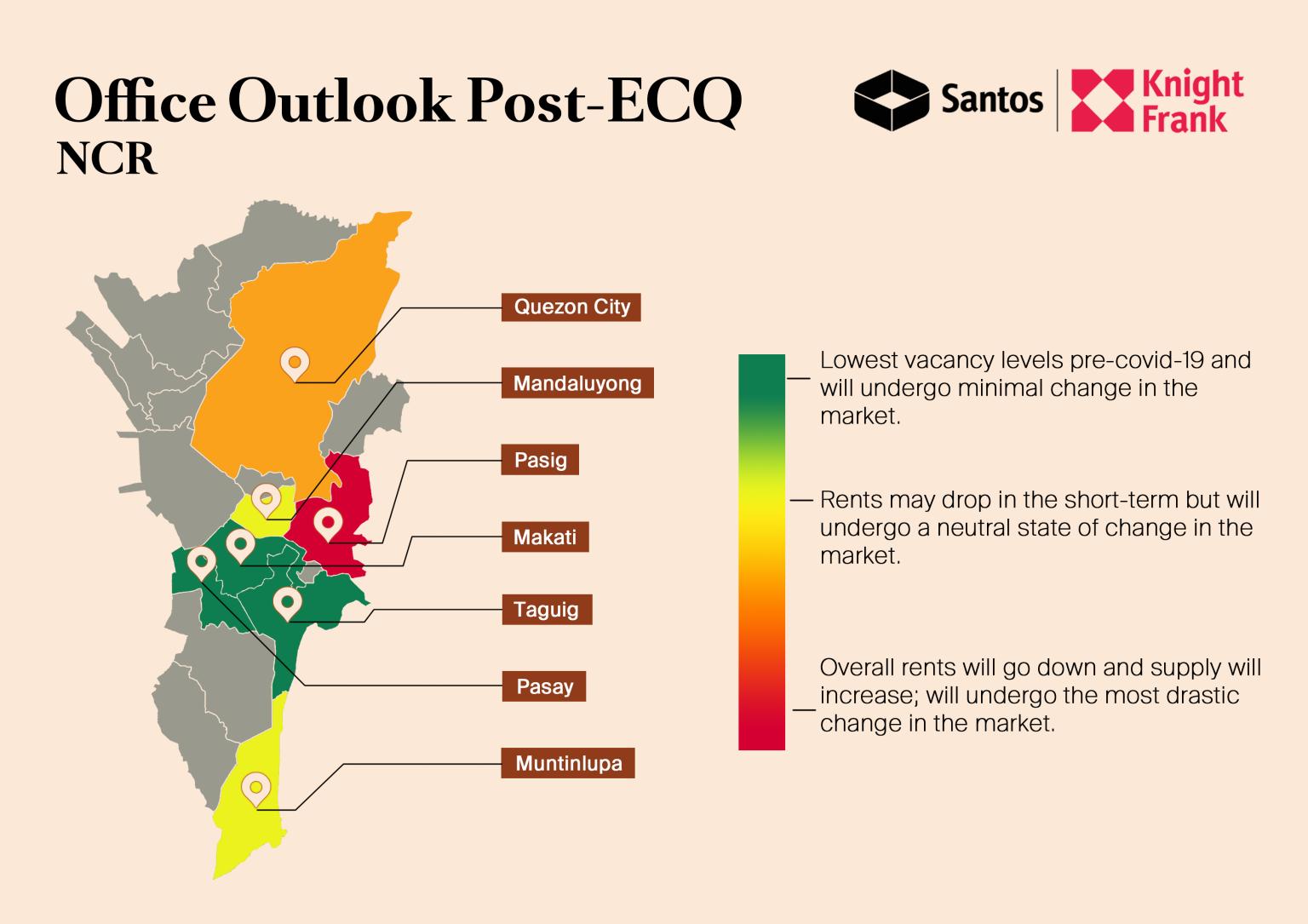

Office sector

According to Knight Frank Metro Manila’s office sector grew by about 700,000 sqm while overall vacancy remained below 5 per cent in 2019.

Work stoppages and disruptions were caused by the implementation of an enhanced community quarantine (ECQ) to curb the spread of COVID-19.

As a result, projected office supply for 2020 is at 810,000 sqm, down from its initial projection of around 1.18 million sqm. Vacancy level is projected to be at around 10 per cent as office expansions are expected to be put on hold coupled with the limited take-up of new spaces.

This would translate to an office space demand of about 354,000 sqm.

Knight Frank indicates flexibility will be the global trend and key for office landlords in securing tenants, while landlords should consider offering abatements, deferments and consolidations to retain existing tenants.

The firm also believes the retention of international and global tenants (large space occupiers and strong covenants) should be prioritized, and that landlords and other businesses should incorporate their experiences to better improve and institutionalize their respective Business Continuity Plans and Phased “Back to Office” Plans.

Residential sector

Metro Manila’s residential sector finished strong in 2019, with 97 per cent of the total floated units absorbed by the market.

As of Q4 2019, indicative weighted average selling prices of residential units have reached more than PhP200,000 per sqm equivalent to an appreciation of 4.8 per cent quarter-on-quarter.

In light of the crisis, Knight Frank believes payment terms are expected to be more flexible to minimize defaults, with pricing strategies are also expected to be reconsidered to sell the remaining inventory.

The report advises a re-evaluation of project launches and realistic market demand, as well as a revisiting of pricing structures and payment terms for new opportunities

Knight Frank also believes there is opportunity for buyers with liquidity

Retail sector

In the Philippines, domestic consumption drives more than 70 per cent of the economy.

The retail real estate segment has been one of the strongest yielding assets and top performers with about 5 per cent vacancy in Metro Manila.

However, due to the COVID-19, Knight Frank has identified it as one of the most badly hit asset classes.

The firm believes landlords should engage with tenants to address their lease concerns for a win-win situation, and that retailers should aim to strike a balance between physical and online retail.

Click here to view the full report.

Similar to this:

Majority of Asia Pacific office markets record drops in activity during April - Knight Frank

How agents across the world are adapting to COVID-19- Survey

Why south-east Asia could hold the key for investors in 2020