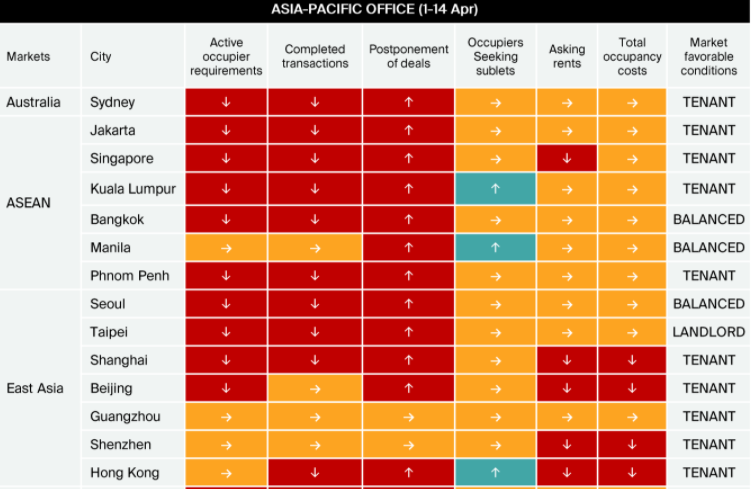

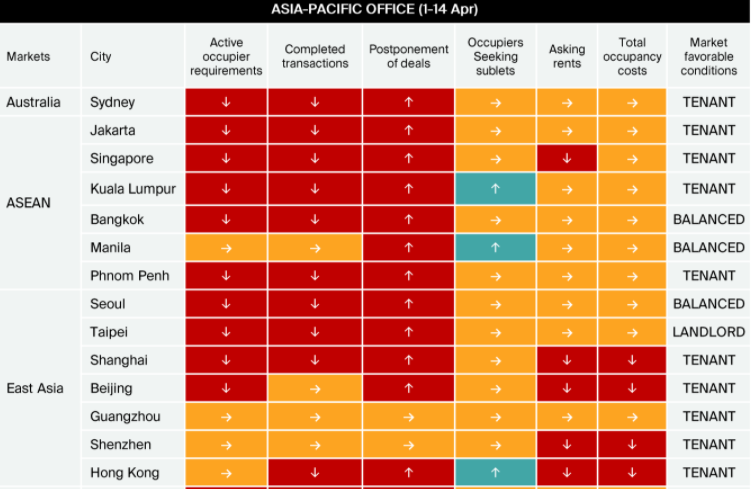

Manila, Guangzhou, Shenzhen and Hong Kong were the only four markets in the Asia Pacific to register stable office leasing activity in the first half of April, a new report has found.

The Knight Frank Asia-Pacific April 2020 Market Bulletin: COVID-19 and its impact on real estate revealed that in the first two weeks of April, almost three-quarters (or 73 per cent) of the region’s 15 major office markets recorded a drop in leasing activity.

The sentiment survey, which was conducted with Knight Frank brokers, revealed 11 out of 15 markets reporting slower leasing activity within their markets since April 1st.

Knight Frank Asia-Pacific April 2020 Bulletin - At a glance:

- Many corporate occupiers now postponing leasing deals across Asia-Pacific.

- 11 of the region’s 15 major office markets recorded a drop in leasing activity since the start of April.

- Mainland China has seen an uptick in activity, while Taipei’s office market is still tilted in favour of landlords.

Tim Armstrong, Head of Occupier Services and Commercial Agency for Knight Frank, Asia Pacific, said it was important to note that some markets were on their way back.,

“The need to preserve cash and reduce capital expenditure is inevitably putting a hold on corporate real estate decisions such as strategic relocations or fit-out projects which require significant capital outlay," he said.

“However, we expect occupiers to pause rather than cancel such activities.

"Already, we are witnessing steady demand from food retailing, telecommunications, online education, and some manufacturing firms in some markets.

"The markets seeing an uptick in activity over the last two weeks are mainland China - which is firmly in recovery - and South Korea."

According to the report, the e-commerce logistics sector continues to be active in Southern China, while Taipei still sees market balances in favour of landlords.

Source: Knight Frank

Taiwan office demand continues to outstrip supply, and a flight to quality trend indicates rents can be expected to continue growing.

Although companies have been forced to participate in the world’s largest work-from-home experiment, the demise of the office is an unlikely outcome.

Mr Armstrong said wouldn't eliminate the need for office space but instead "help us appreciate its social value".

“A physical office – one that is separate from our homes – creates a much-needed barrier between work and home life," he said.

“In fact, the current situation has expedited a trend we have identified in the last few years, namely, the move towards offices as social hubs of creativity and innovation rather than centres for administration."

Click here to download Knight Frank Asia Pacific April 2020 research.

Similar to this:

Climate causing 'hesitation' among Hong Kong investors

Bangkok office market approaching the end of 'expansionary period' - Knight Frank

Kuala Lumpur's Tun Razak Exchange identified as investment 'hot spot' by Knight Frank