Hong Kong real estate professionals need to look beyond short-term market turbulence and focus on longer-term strategies, Colliers International says.

The firm's quarterly update indicates the current climate has resulted in occupiers undergoing cost-saving exercises, landlords targeting retention and long-term occupancy, and investors exploring acquisition opportunities in a buyers’ market with low interest rates expected to persist in 2020.

According to Colliers, these findings are not just the direct result of COVID-19, but the compounding impact of prolonged global, regional and local trends as economic growth and leasing momentum are expected to slow further with overall Grade A office rents likely fall by 14 per cent YOY in 2020.

Source: Colliers

Commenting on the activity, Colliers Head of Office Services, Fiona Ngan, said occupiers were reacting to the market to ensure they remained resilient in the face of uncertainty.

"They are taking essential steps to protect their position, but this doesn’t mean opportunities are drying up," she said.

"Well-established firms with stable capital flow could look to relocate into a traditionally competitive space in the CBD as growth in vacancy rates and greater rental corrections in 2020 provide more options.”

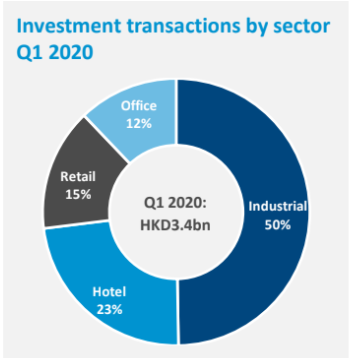

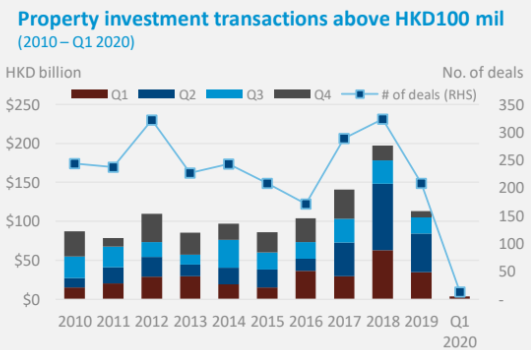

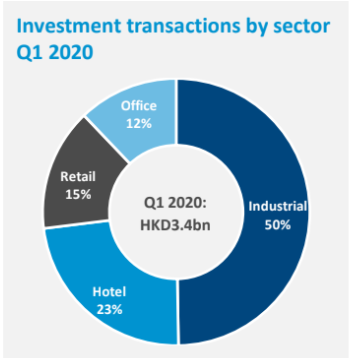

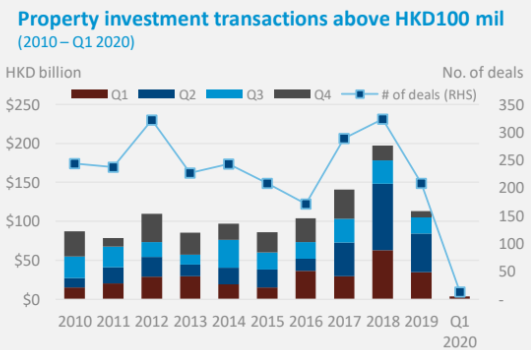

Colliers notes that from a Capital Market perspective, there is hesitation from institutional investors as Hong Kong investment sales declined 58 per cent QOQ and 90 per cent YOY to HKD3.4 billion in Q1 2020.

Source: Colliers

The firm expects the current market conditions to persist throughout the remainder of the year which will see property prices come under pressure across different sectors providing investors with ranging opportunities.

Colliers Deputy Managing Director of Capital Markets, Antonio Wu, said the majority transactions that took place in Q1 were done by local private investors that are well-established with strong local knowledge.

"These individuals will continue to be active as they seek to diversify and consider alternative opportunities, but it can be expected that there will be misalignment on price expectations which could see an extension in negotiations for discounted assets," he said.

"Institutional investors need to take this into consideration as they start to become more active in the market.”

Click here to download a copy of the report.

Similar to this:

Asian economies on the rise in the midst of US-China trade war - Knight Frank

Hong Kong commercial real estate market expected to 'walk out of the shadows' in 2020

Colliers International appoint industry leader CK Lau as Head of Valuations and Advisory Services