The outbreak of Covid-19 is not expected to have a long term effect on Bangkok's office market but will likely signal an end to an extended period of growth for the sector, Knight Frank says.

The company has released its Bangkok Office Review for the fourth quarter of 2019, indicating signs of a slow down had begun creeping into the market towards the end of last year as the country's economy became more subdued.

Knight Frank Thailand Executive Director for Head of Occupier Services and Commercial Agency, Marcus Burtenshaw, said while 2020 had so far provided further challenges, it was important to consider the context of the office market's current position.

“As 2019 came to an end, we can look back upon a decade of growth in Bangkok’s office market," he said.

"Over the past ten years, demand outstripped supply by over 100,000 square meters, and prime rents soared by more than 50 per cent to rival those seen in markets like Chicago, Madrid and Melbourne.

"As 2020 begins, the new decade has been greeted with face masks and temperature screening.

"The outbreak of Covid-19 is a black swan event that will undoubtedly leave its mark on the charts of the global markets for future economists to study, but for occupiers today, it poses significant challenges."

Despite the current climate, Mr Burtenshaw said the Bangkok office sector still had the potential for growth moving forward.

"Both the new property tax law to be implemented in 2020 and the relatively poor grade C performance could incentivize landlords of such properties to withdraw and refurbish stock," he said.

"This will add a positive dampening effect to the future supply growth, allowing demand to keep pace.

"The weakness in rental growth is expected to persist for the time being.

"As more high-quality workspaces enter the market, landlords may have to compete on both rent and non-monetary incentives to secure tenants."

Knight Frank Thailand Executive Director for Head of Occupier Services and Commercial Agency, Marcus Burtenshaw. Source: Knight Frank

Supply

According to Knight Frank, the total supply of office space in Bangkok increased by 52,085 square metres to a total of 5,124,415 square metres in the fourth quarter of 2019.

Total supply has increased by 1.0 per cent Q-o-Q and 2.2 per cent Y-o-Y.

This marked the largest increase in the quarterly supply since Q1 2017.

One building was added to the CBD, increasing total supply by 27,555 square metres. Another completion added 24,830 square metres outside the CBD. There were no withdrawals of obsolete stock in this quarter. Over the past five years, supply has been increasing at a rate of 23,353 sq m quarterly.

Source: Knight Frank

Future Supply

In 2020, 10 new projects are expected to be completed, adding 210,868 square metres of office space to the market, according to the report.

Six of the new buildings will be located in the CBD.

From 2020 to 2023, the Bangkok office market is projected to grow by 1,236,069 sq m or an average of 309,017 sq m annually (accounting for only additions and not withdrawals).

In comparison, from 2015 to 2019, new supply entered the market at a rate of 138,911 sq m annually.

From around 5.1 million sq m today, total office market supply will likely exceed 6.3 million sq m by 2023. This is over a 20 per cent increase in size.

A greater volume of stock withdrawals due to the new property tax amendment commencing in 2020 may occur.

This will gradually offset some of the new supply over time.

For commercial properties, the amendment will introduce a marginal tax rate from 0.3 per cent to a maximum of 1.2 per cent on government appraised value.

It will replace the current household and land tax which charges 12.5 per cent on annual rental value.

Knight Frank believes the new tax will place a heavier burden on low grade or poorly performing properties that are located in prime areas, which may incentivize the landlords to make capital improvements to their buildings.

The developments to be completed this year in Bangkok. Source: Knight Frank

Demand

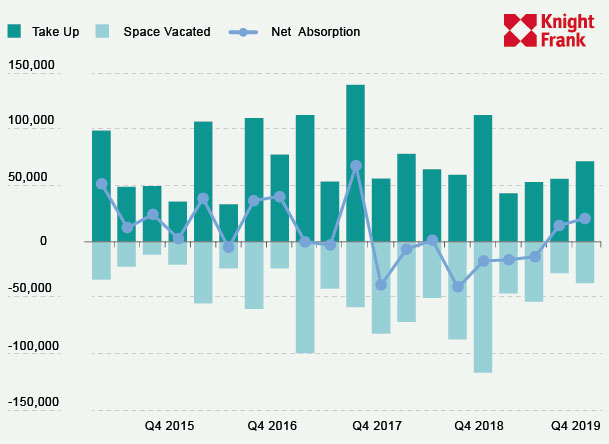

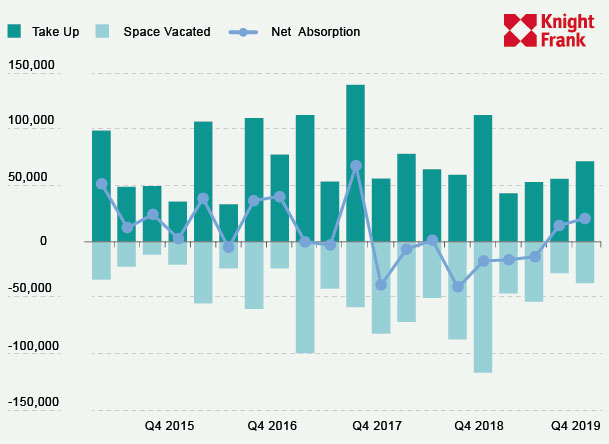

The report indicates the take-up of new and refurbished space only accounted for 19 per cent of the total in Q4 2019, representing a 17 per cent decline Q-o-Q.

Full-year numbers also reflect a decline in take-up of new and refurbished supply as a percentage of total take-up, declining to 22 per cent from 37 per cent in 2018.

Over the past five years, tenants have shown an increasing preference for higher quality buildings that offer a better experience.

Newer and refurbished buildings tend to meet these criteria and often attract higher demand than older buildings can. During this period, higher take-up levels also coincided with the increase in take-up of new and refurbished space.

It indicates that preference for such properties has become a driving factor for leasing activity.

Source: Knight Frank

On average, 33 per cent of take-up from 2015 onwards can be attributed to new and refurbished spaces, a contrast to a 13 per cent share during 2010 to 2014. The decline in economic conditions this year may have caused some current and potential tenants to act more conservatively on office relocation or expansion plans, resulting in a lower take up proportion for new and refurbished buildings and the overall level of take-up.

An artist's impression of the Vanissa building, which is set to be completed this year. Source: Knight Frank

For the entire year, take-up was at 222,372 sq m, falling for the second consecutive year from the peak level in 2017.

This is slightly below the 10-year annual average at 261,912 square metres.

Click here to download the full report.

Similar to this:

Why south-east Asia could hold the key for investors in 2020

CBRE Thailand provides support to school in Ayutthaya

Thailand cabinet approves land tax deductions