Slowing pace of Singapore private residential price growth indicates 'stabilised' environment - Colliers

Contact

Slowing pace of Singapore private residential price growth indicates 'stabilised' environment - Colliers

The Urban Redevelopment Authority has released the flash estimates for the private residential property price index for Q4 2019, showing subdued growth for Singapore's private residential property prices.

A slow down in the price growth of Singapore private residences at the end of 2019 has reduced the risk of the government imposing further cooling measures, Colliers International says.

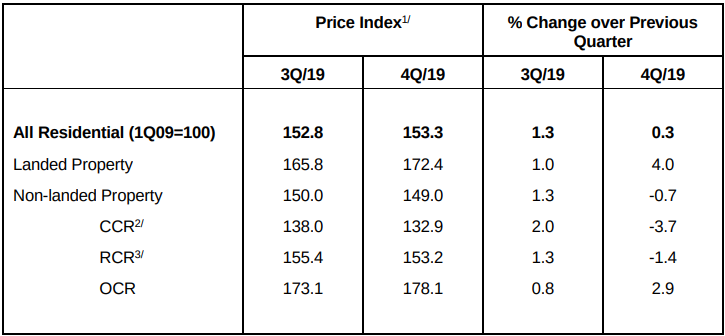

Flash estimates for the private residential property price index released by the Urban Redevelopment Authority show that while prices have risen for the third straight quarter in Q4 2019, the quarterly increase of 0.3 per cent is down from the previous uptick of 1.3 per cent.

According to the URA, house prices rose cumulatively by 2.5 per cent in 2019, with private home prices are now 2.4 per cent above the most recent peak in Q3 2018 (149.7) and 0.8 per cent below the all-time peak in Q3 2013 (154.6).

At a glance:

- The Urban Redevelopment Authority has released the flash estimates for the private residential property price index for Q4 2019.

- The data shows that while prices have risen for the third straight quarter in Q4 2019, the quarterly increase of 0.3 per cent is down from the previous uptick of 1.3 per cent.

- Colliers International believes the demand for private homes in Singapore has been relatively stable given the tight labour market, favourable interest rate environment, and relatively healthy household balance sheet.

Colliers International Singapore Head of Research Tricia Song said the full-year price increase was in line with expectations, adding the demand for Singapore private homes was still relatively stable given the tight labour market, favourable interest rate environment, and relatively healthy household balance sheet.

"With home prices highly correlated to household income and the economy, we expect private residential prices could grow 3.0 per cent in 2020, tracking a recovery in economic growth," she said.

"We expect a full-year takeup of 9,800 developer sales in 2020, similar to 2019."

Colliers International Singapore Head of Research Tricia Song. Source: Colliers International

Regional data from the URA indicates the overall slowdown in private residential price growth may have been led by the Core Central Region, where prices declined 3.7 per cent in Q4 from the previous quarter, after rising 2 per cent in Q3 2019 and 2.3 per cent in Q2 2019.

Ms Song said the decrease could be due to complete projects that still had inventory.

"Marina One Residences (completed in 2017) saw 43 units sold in Q4 2019, at a median price of SGD2,242 per square foot compared to 30 units in Q3 2019 at a median price of SGD2,503 per square foot, while South Beach Residences (completed in 2016) saw 9 units sold in Q4 2019, at a median price of SGD3,097 per square foot compared to 10 units in Q3 2019 at a median price of SGD3,349 per square foot," she said.

The comparison of property price index for Q3 2019 and Q4 2019. Source: Urban Redevelopment Authority.

The flash estimates revealed that home values for the rest of the Central Region declined 1.4 per cent in Q4, after rising 1.3 per cent in Q3.

Ms Song said the "unexpected" decrease could have been due to a lack of new project launches

"In Q3, a high base for new launches was achieved through Avenue South Residence, One Pearl Bank and Meyer Mansion," she said.

"In Q4, there were no new project launches in RCR. New sales, from earlier launched projects, were 849 units during the quarter, almost halved the 1,502 units sold in Q3 2019."

Prices for outside the Central Region rose the most among the market segments and remained at an all-time high, with non-landed home values increasing by 2.9 per cent in Q4, following an 0.8 per cent increase in Q3.

Ms Song said Colliers believed this was due to the good reception of the Sengkang Grand Residences, as well as "steady progressive takeup" at earlier launches.

Similar to this:

Increase in Singapore new home sales despite lack of launches

Opportunity areas remain amidst geopolitical and economic uncertainties in Asia