Colliers International has published its latest quarterly research report which showed that investment demand for Singapore real estate remained resilient in Q3 2019 despite the macroeconomic headwinds and heightened global uncertainties.

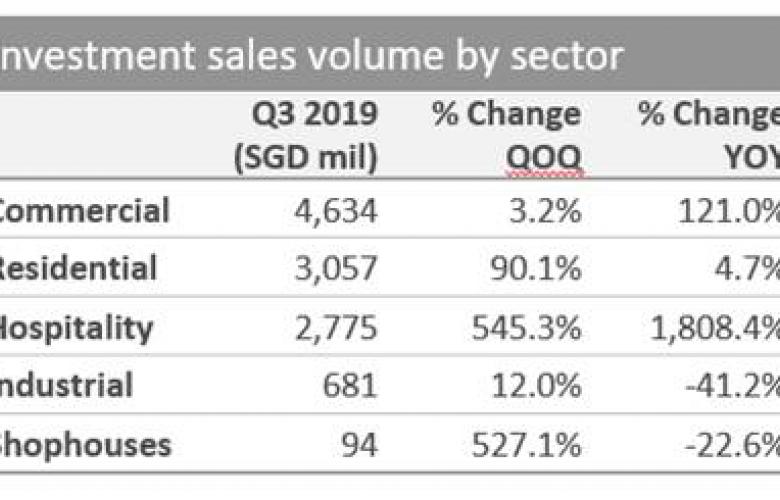

Based on data tracked by Colliers Research, real estate investment sales totaled SGD11.2 billion in Q3 2019 – representing a 53.7% increase from the previous quarter as well as the corresponding period a year ago. The growth was driven by stronger sales across all segments of the property market, as global capital continues to seek opportunities in safe and stable investment destinations.

Tricia Song (宋明蔚), Head of Research for Singapore at Colliers International, said, “Amid unprecedented levels of uncertainty in the global environment, Singapore remains firmly on investors’ radar owing to its growth potential, stable government, and pro-business policies. Therefore, we expect Singapore real estate – particularly commercial and hospitality assets - to continue to attract interest. Colliers Research projects that total investment sales could reach SGD33.8 billon for the full year 2019 – on par with that of 2018.”

*Colliers’ definition of “investment sales” include: a) all private property sales at transaction prices of SGD10 million and above; and b) all successfully awarded state land tenders.

Commercial

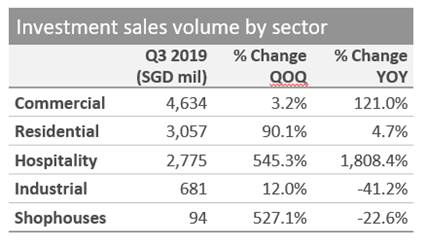

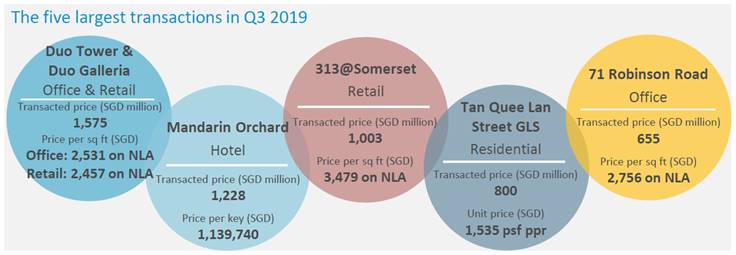

The commercial sector led investment sales growth, making up 41% of the total volume in Q3 2019. Commercial real estate investment sales came in at SGD4.6 billion in Q3 - up by 3.2% quarter-on-quarter (QOQ) and more than doubled year-on-year (YOY) – anchored by deals for Duo, 313@Somerset and 71 Robinson Road.

Supplied: Colliers International

This brought the commercial tally in the first nine months of 2019 (9M2019) to SGD10.3 billion, an increase of 174% YOY. In view of the strong investment interest, Colliers Research projects that commercial real estate investment sales could hit a record high for the whole of 2019, trumping the SGD12.5 billion achieved in 2007.

Jerome Wright, Director of Capital Markets at Colliers International, said, “There was strong demand for commercial (office and retail) properties in Q3, with increasing foreign interest. Given Singapore’s strong market fundamentals and the favourable interest rate environment, we should expect investors’ interest to remain elevated. In addition, incentives to redevelop older office buildings in the central business district, coupled with tight vacancies and a light new supply pipeline, should encourage more investments into the sector.”

Residential

In Q3 2019, residential investment sales increased by 90.1% QOQ and 4.7% YOY to SGD3.1 billion, accounting for 27% of total transactions. This took the 9M2019 overall volume to SGD5.8 billion, Colliers Research noted.

Public land sales contributed to the bulk of the residential sales, representing 62% of the total. During the quarter, four sites - Clementi Avenue 1, Tan Quee Lan Street, Bernam Street, and one-north Gateway - valued at a combined SGD1.9 billion were awarded to developers. In particular, Tan Quee Lan Street was among the five largest transactions posted in Q3 2019.

Supplied: Colliers International

Luxury homes sales, including Good Class Bungalows (GCBs) also boosted residential investment volume. Transactions in this segment jumped 62.4% QOQ and 53.8% YOY to SGD1.1 billion in Q3 2019. Notable deals in the quarter included James Dyson’s purchase of a GCB and a super-penthouse for over SGD100 million.

In the light of the weaker collective sale market, Colliers Research expects residential investment sales in 2019 to fall by 55% from the record level in 2018, before recovering from 2020 onwards.

Hospitality

Hospitality deals in Q3 surged by 545% QOQ and more than 18 times YOY to SGD2.8 billion, on several sizeable transactions including Bay Hotel, Mandarin Orchard and Crowne Plaza Changi Airport. Colliers Research observed that the SGD2.8 billion worth of transactions in Q3 2019 was the highest level ever recorded on a quarterly basis.

Factoring in the strong sales recorded in the first half of 2019, hospitality transactions in 9M2019 totaled SGD4.2 billion, higher than even all previous full-year figures in our database, which started from 2006.

Ms. Song added, “We believe the hospitality segment presents good prospects amid robust international visitor arrivals and generally healthy tourism outlook. Singapore continues to be an attractive destination and additional investments in the MICE and leisure sectors should attract both corporate and leisure travelers in the next three to five years. Additionally, the government’s ongoing efforts to revamp offerings and improve transport infrastructure should help to further drive tourism and support the hospitality sector.”

Industrial

Meanwhile, industrial investment sales in Q3 edged up 12.0% QOQ to SGD681 million, mainly on Keppel DC REIT’s acquisition of two data centres. On a YOY basis, the sales volume was down by 41.2%. Over the first nine months of the year, the sales tally for industrial properties remained modest at SGD1.8 billion.

Colliers Research expects more industrial assets to be transacted by by real estate investment trusts (REITs), and projects full year 2019 industrial sales to increase by 30% YOY on big-ticket transactions.

Source: Colliers International