The Colliers International quarterly research report Robust Commercial Transactions showed that real estate investment sales in Singapore recorded the first quarter-on-quarter (QOQ) increase in Q2 2019, after three straight quarters of QOQ declines.

At a glance:

- Total investment sales rose 56% to SGD8.2 billion in Q2 2019, first quarter-on-quarter growth post-cooling measures in July 2018

- Robust commercial transactions supported sales volume in Q2 2019

- Uptick in the number of high-end residential units sold during the quarter

- Colliers Research projects that investment sales could total SGD38.2 billion in 2019 – on par with 2018

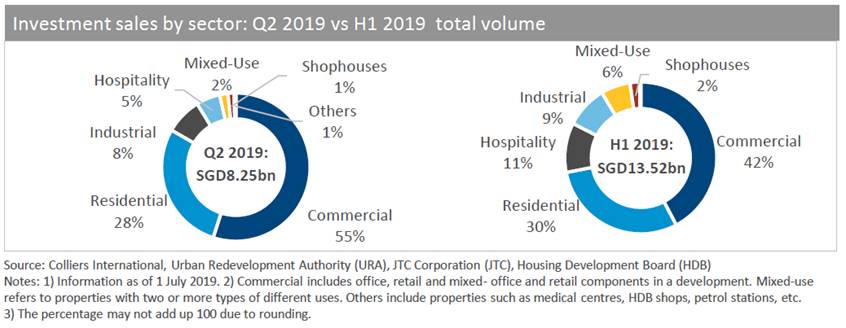

Based on data tracked by Colliers Research, total investment sales came in at SGD8.2 billion in Q2 2019 – representing a 56% QOQ growth - supported by the commercial and residential sectors. On a year-on-year (YOY) basis, investment sales still posted a 33% decline in Q2 2019 from the SGD12.4 billion in Q2 2018, which was driven partly by the stronger residential collective sales activity then.

Colliers’ definition of “investment sales” include a) all private property sales at transaction prices of SGD5 million and above; and b) all successfully awarded state land tenders.

This brought the total investment sales volume for the first half of 2019 (H1 2019) to SGD13.5 billion, a steep 42% decline from the SGD23.3 billion transacted in the corresponding period in 2018.

Ms. Tricia Song (宋明蔚), Head of Research for Singapore at Colliers International, said, “Singapore real estate investment sales saw improvements across all major sectors in Q2, and this growth momentum should carry into the second half of 2019, barring any unforeseen events. In particular, we expect the flurry of commercial investment activities to continue for the rest of the year and into 2020 as REITS and institutional investors consolidate or reconstitute their portfolios. Despite the global macroeconomic headwinds, we think the Singapore real estate sector has growth potential and remains an investment magnet for investors owing to its strong fundamentals, such as transparent regulatory framework, good infrastructure, and stable political environment.”

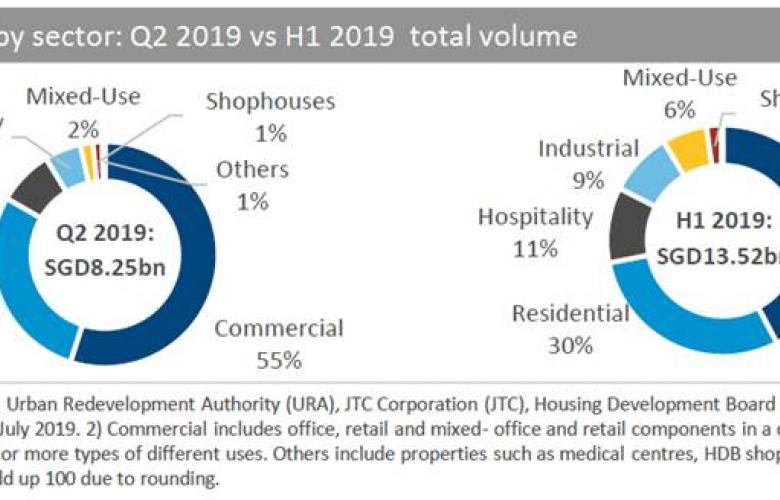

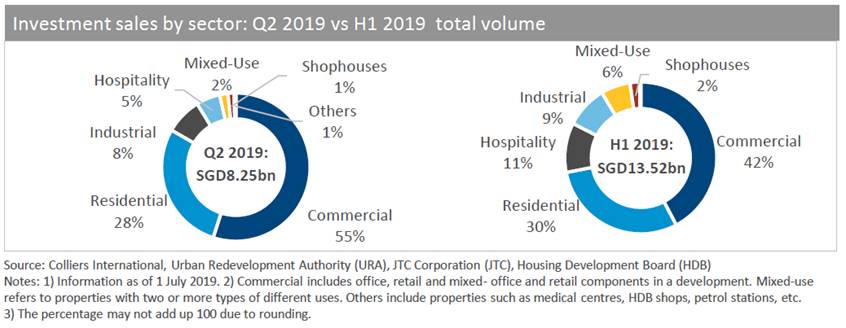

Commercial and residential sectors remained the main drivers of investment sales in Singapore during the quarter, accounting for 83% of the total volume with the commercial sector increasing its share of the total from 22% in Q1 to 55% in Q2 2019. Contributions from the residential sector, however, trimmed from 32% in Q1 to 28% of the total volume in Q2 2019.

Commercial

Commercial investment sales in Q2 surged by 283% QOQ and 211% YOY to SGD4.5 billion, boosted by big-ticket deals. This took H1 2019 volume to SGD5.7 billion, up 27.4% half-on-half (HOH) and 232% YOY.

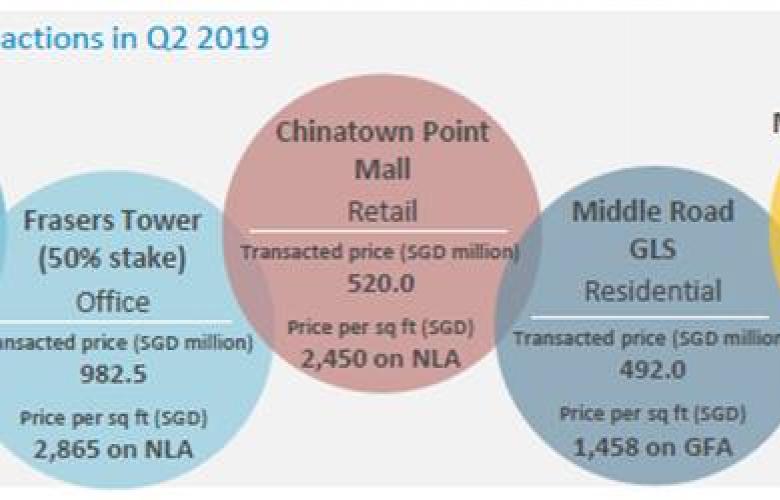

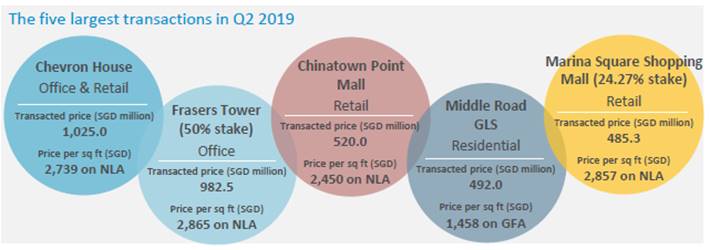

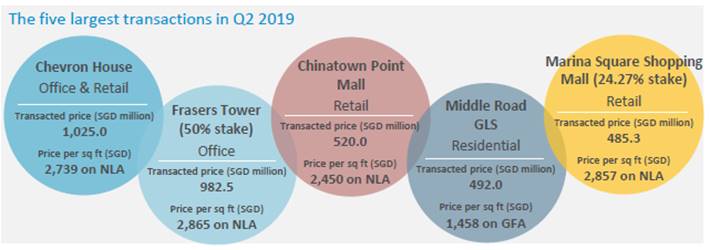

Commercial properties made up four out of the five largest transactions in Q2 2019, including the sale of Chevron House and Chinatown Point mall, as well as the sale of equity stakes in Frasers Tower and Marina Square Shopping Mall.

Given Singapore’s status as a global financial hub, Colliers Research forecasts investible office assets will garner stronger demand in the next 3-5 years, supported by healthy CBD Grade A office rental growth of 8% in 2019 and 5% in 2020, tight vacancy and limited new supply.

Residential

Colliers Research notes that Q2 residential investment sales improved across all sub-segments to SGD2.3 billion, up 40.0% QOQ, with high-end condominium segment more than doubling QOQ and accounting for 37% of Q2 residential sales. However, H1 2019 overall residential investment sales were down by 15.3% HOH and 77.1% YOY, compared to pre-cooling measures in July 2018.

As inventory wears down, developers will continue to replenish land, whether through public tenders or the collective sale market. Colliers has announced (on 29 July 2019) the sale of a row of apartments and shops in Phoenix Road via collective sale for SGD42.6 million to a subsidiary of Qingjian Realty (South Pacific) Group – a sign that developers are still keen to tap suitable en bloc opportunities to continue to build their development pipeline.

Industrial

Another key sector that achieved QOQ growth in sales volume in Q2 was industrial real estate. Investment sales rose 18.2% QOQ to SGD656 million, mainly on Poh Tiong Choon Logistics Hub and StorHub’s self-storage portfolio. Colliers Research expects industrial assets to remain attractive to investors as they can offer stable incomes and accretive yields. In addition, it adds that investors’ demand should improve in the longer term as the underlying leasing market stabilises.

Outlook

Colliers Research has maintained its forecast for investment sales to reach SGD38.2 billion in 2019, matching the transaction volume in 2018. The commercial sector is expected to continue to power ahead, picking up the slack in the residential segment.

Mr. Jerome Wright, Director of Capital Markets & Investment Sales, Colliers International, said, “We recommend investors to stay focused on commercial assets, supported by favorable fundamentals and outlook in their underlying markets. For qualified investors, industrial assets in niche segments such as data centres, high-specification facilities, food factories and cold stores can offer rewarding returns.”

Other factors that could support real estate investment sales in the coming quarters include the more favorable interest rate outlook and rising capital allocation among global investors to Asia Pacific property assets.

Source: Colliers International

Similar to this:

Relaunch of collective sale tender for Braddell View estate, Singapore’s largest private residential site

Lady Hill Bungalow a Singapore urban oasis retreat

Vacuum billionaire James Dyson buys Wallich Residences penthouse in Singapore