London development industry confident in overseas investment market despite Brexit uncertainties

Contact

London development industry confident in overseas investment market despite Brexit uncertainties

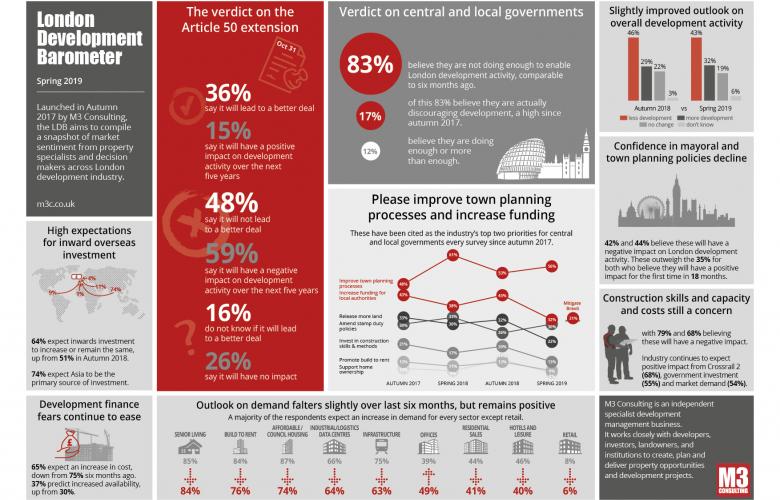

74% of London Development Barometer survey respondents believe largest source of inward investment will be from Asia, with China expected by most to be the primary investment source while others have cited Singapore, Japan, Malaysia and India.

The bi-annual London Development Barometer survey (LDB) by London-based development managers M3 Consulting has revealed the London development industry’s confidence in the inward overseas investment market, despite further uncertainties created by the Brexit impasse. Overseas investment is predicted to stay the same or increase over the next five years according to 64% of respondents, up from 51% six months ago. This includes a high of 32% who believe there will an increase, against of a low of 30% who believe it will decrease, improving on the 25% and 36% respectively in autumn 2018.

At a glance:

- 32% believe there will be more development in the capital

- 6 in 10 believe Brexit extension will have a negative impact on development activity

- 65% predict the cost of finance to increase, down from 75% six months ago

- Market demand is high across offices, Build to Rent, senior Living in particular

- 83% believe the government aren’t doing enough to encourage development

- 79% believe the cost of construction will have a negative impact on development

- 42% believe the same of the global economy

The United Kingdom (UK) had been slated to exit the European Union (EU) on March 29. This was extended to April 12 in an unsuccessful attempt to establish parliamentary consensus on the Brexit deal. The spring 2019 LDB was administered after the EU agreed to extend the Brexit date to October 31.

One third of the respondents (36%) believe the extension will produce a better deal, while 48% believe it will not and 16% say they do not know. Almost 6 in 10 believe the Brexit extension will have a negative impact on London’s development activity while just 15% believe the impact will be positive.

Source: M3 Consulting

The industry has grown more wary of the impact of the global economy, up from 42% predicting a negative impact on development activity one year ago to 52% today. The impact of other factors like construction skills and capacity (79%) and construction costs (68%) continue to cause concern, but a little less so than six month ago.

Despite the scepticism, 32% of the respondents now believe there will be more development activity in the capital over the next five years, steadily increasing from 29% six months ago, and 19% in autumn 2017. Similarly while 57% predicted less development activity in the capital in the autumn 2017 survey, that figure has fallen to 43% in the latest survey.

74% of respondents believe the largest source of inward investment will be from Asia, with China expected by most to be the primary investment source while others have cited Singapore, Japan, Malaysia and India. In second place is the Middle East with 11% of the vote. The Americas is in third place with 9%, up from 5% six months ago.

The industry is more positive about the development finance climate too. While a majority of 65% of the respondents predict an increase in the cost of finance, this compares to 75% six months ago. Meanwhile, 37% believe there will be an increase in availability of finance, compared to 30% six months ago.

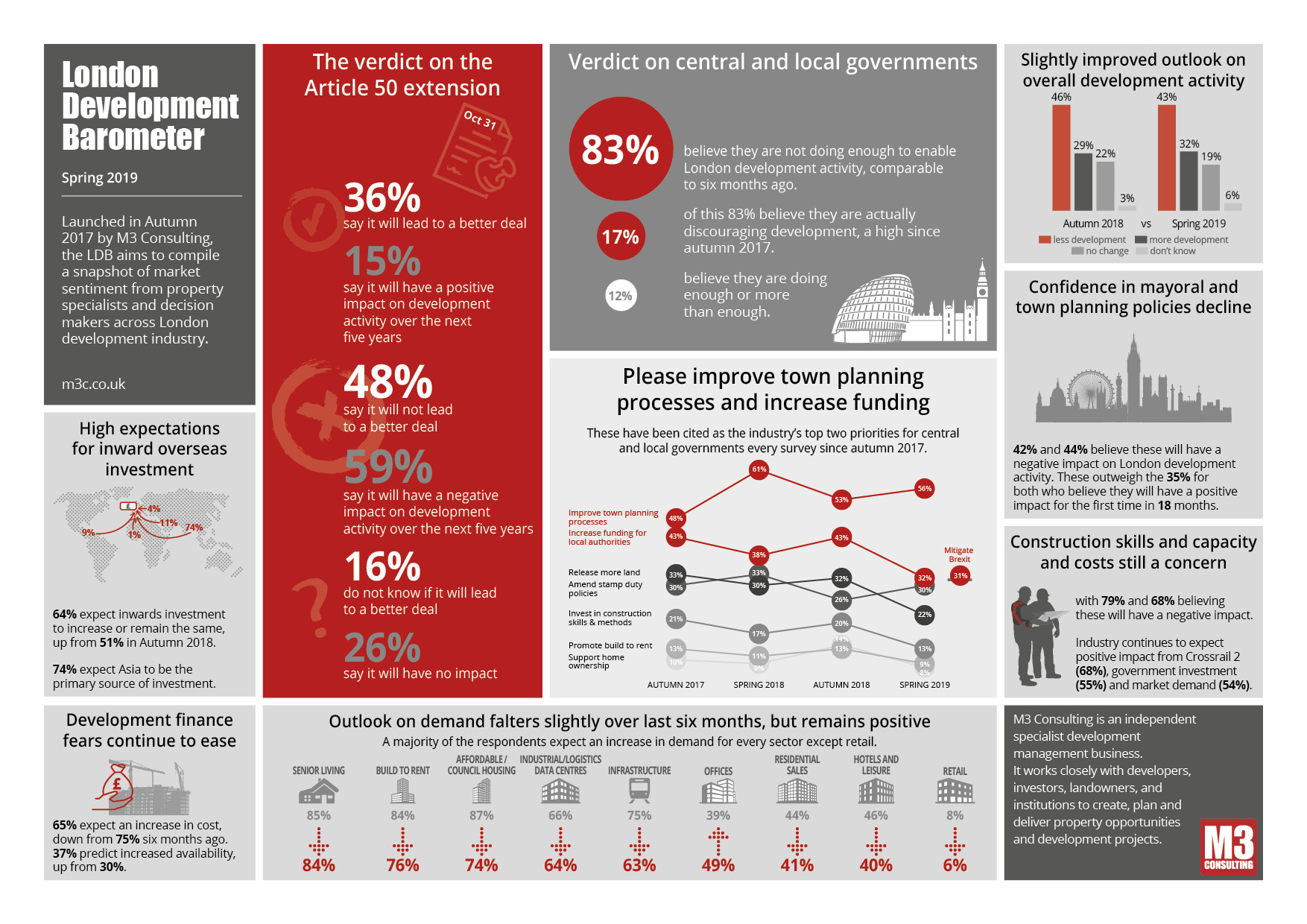

Generally, the industry continues to have a positive outlook on market demand for all sectors except retail, although the last six months have seen confidence in market demand falter. Those predicting increases in demand for affordable / council housing fell 13% to 74%; infrastructure fell 12% to 63%; built-to-rent fell 9% to 75%, and hotel and leisure fell 7% to 40%.

Confidence in offices however improved with 49% of the respondents foreseeing an increase in demand compared to 39% six months ago, and the senior living sector has taken over at the top, with 84% predicting an increase. The industry is undecided on the for-sale residential sector, with 41% predicting an increase compared to a 38% decrease. Retail again is the only sector where more predict a decrease than increase, at 79%.

The level of dissatisfaction with central and local governments remains above 8 in 10, with 83% believing central and local governments are not doing enough to enable development activity in the capital. This includes a high of 17% of the respondents believing that they are discouraging development activity. The industry’s key priorities for the central and local governments to help enable development activity to improve town planning processes and improve funding for local authorities, infrastructure and housing delivery, as they have been for every survey since autumn 2017.

The bi-annual LDB was launched by M3 Consulting in autumn 2017 to track the changes in market sentiment from property specialists and decision-makers involved in London development activities. 229 industry professionals took part in the spring 2019 edition, with almost 65% of respondents at director level or above and an average of 21 years’ industry experience.

Gavin Kieran, director, M3 Consulting told WILLIAMS MEDIA “The industry has understandably raised its concerns with the ongoing Brexit drama, but seems to be of the opinion that it will be business as usual in the medium to long term, Brexit or not. It’s signaled its confidence in the underlying pull factors which make London an attractive place to invest and told the government that it needs to be making more of an effort on the funding and policy front. It will be interesting to see how things develop over the next six months assuming the picture is a bit clearer, which is far from certain.”

Source: M3 Consulting

Similar to this:

Interest in London real estate remains high

Asian Investors sticking to core London markets in times of uncertainty