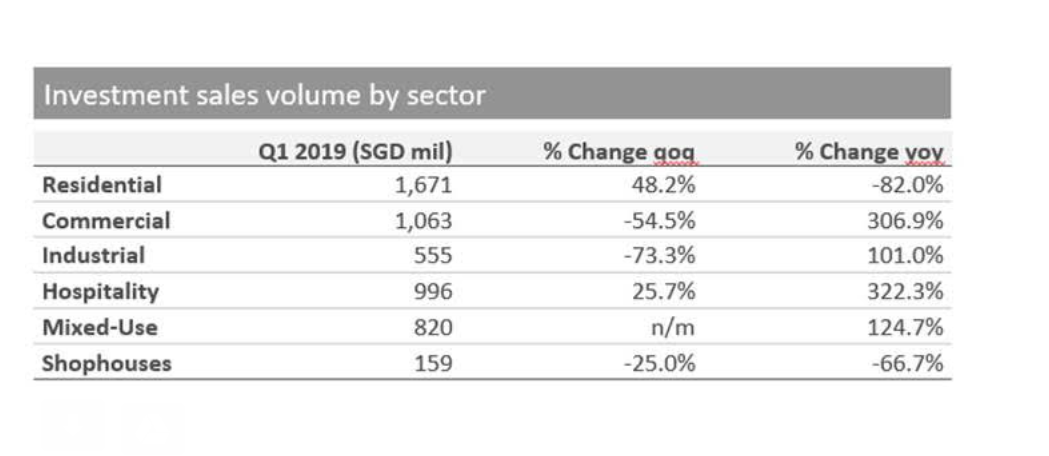

Real estate investment sales in Singapore got off to a slow start in Q1 2019, racking up SGD5.3 billion worth of deals across all property sectors - representing a 21% quarter-on-quarter (QOQ) decline. On a year-on-year (YOY) basis, investment sales fell 52% in Q1 2019 as the corresponding period in 2018 saw record level of residential collective sales.

At a glance:

- Investment sales fell 52% YOY to SGD5.3 billion in Q1 2019 on weaker commercial and industrial volumes

- Public land sales amounting to SGD2.1 billion boosted volumes in Q1

- Potential upside ahead as Draft Master Plan 2019 incentives could spark more investors’ interest in redevelopment of older buildings in the CBD

Colliers Research expects investment activity to pick up in the coming quarters, including potentially more commercial (office and retail) deals to be concluded towards the end of the year. For the whole of 2019, total investment sales volume is estimated to be SGD38 billion, on par with 2018’s level.

Ms. Tricia Song (宋明蔚), Head of Research for Singapore, Colliers International, said, “During the quarter, major private investment sales in Singapore continued to be dominated by institutional investors, which included the acquisitions of Manulife Centre by ARA Asset Management and British group Chelsfield, Rivervale Mall by local private equity firm SC Capital Partners, and warehouse facilities on Jurong Island by SGRE Banyan. These deals, together with a bumper quarter for government land sales, helped to prop up investment sales in Q1 2019.”

Residential

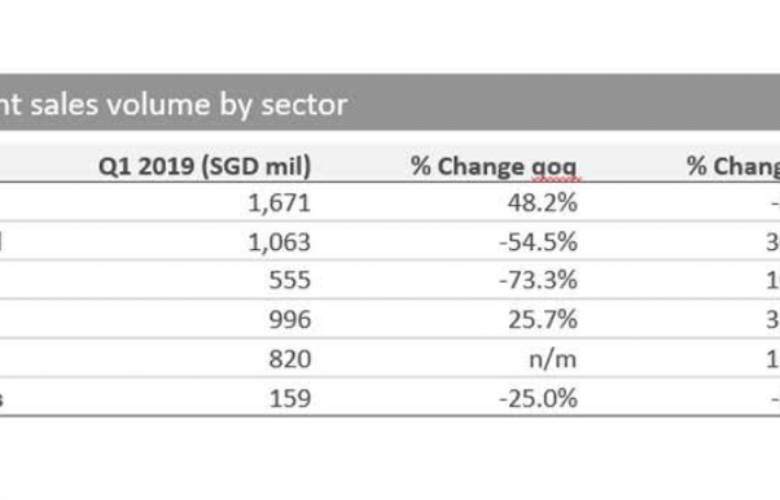

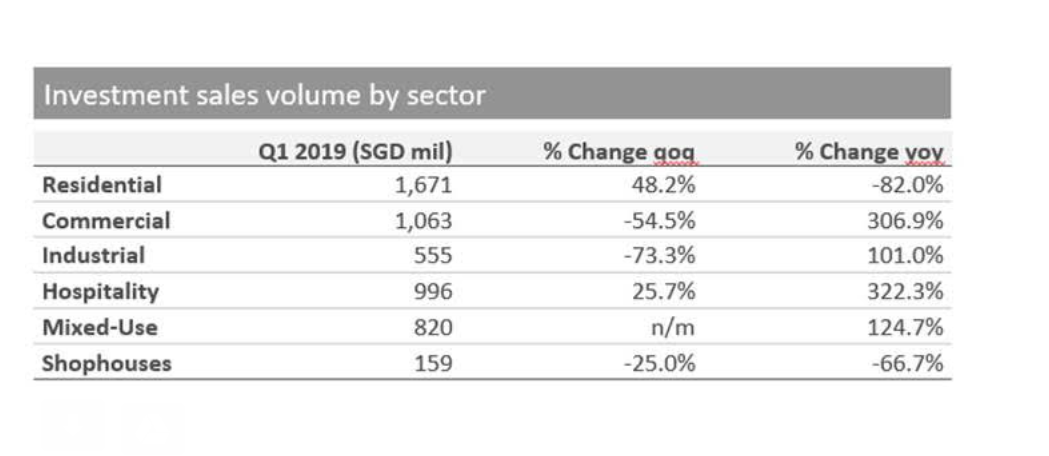

Overall, the residential sector accounted for SGD1.7 billion or 32% of the total investment sales in Q1 2019 – plunging by 82% YOY on declines across all sub-segments, including collective sales and Good Class Bungalows, as the July 2018 cooling measures continued to bite.

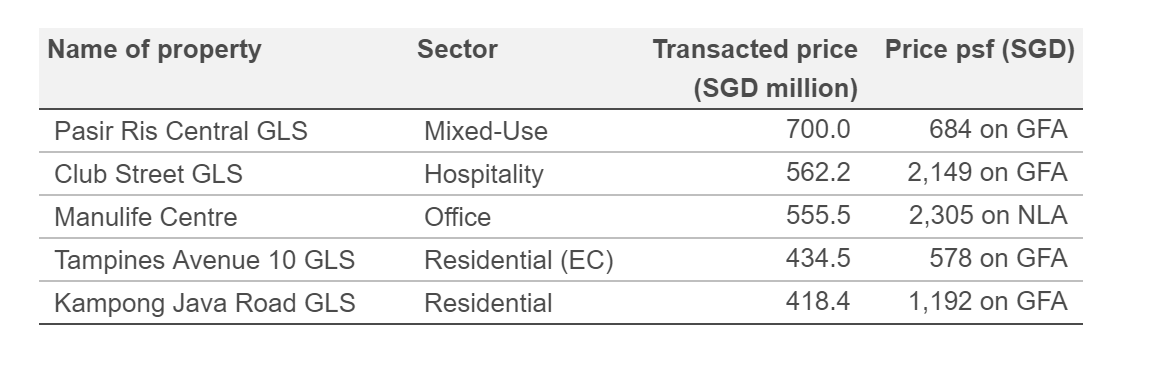

On a QOQ basis, residential investment sales in Q1 2019 rose by 48.2%, thanks to healthy public land sales. Two residential Government Land Sales (GLS) sites – Tampines Avenue 10 (EC) and Kampong Java Road – were among the top five largest transactions during the quarter.

Despite the more sluggish private residential investment sales, Colliers Research predicts that volumes could start picking up from the middle of 2019, including possibly more activity in the collective sale market towards the end of the year as sentiment improves.

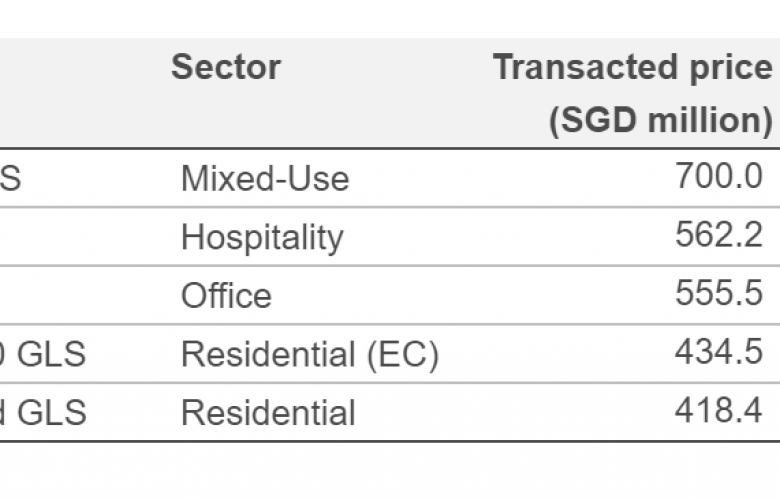

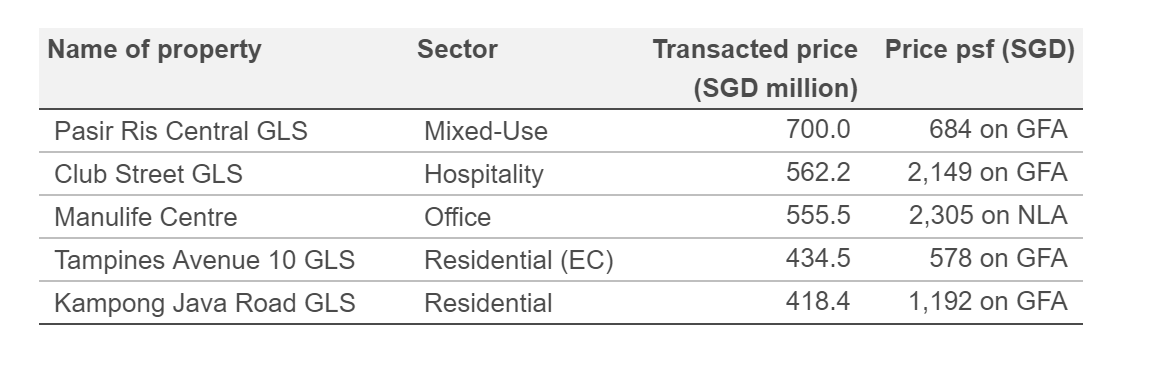

The five largest transactions in Q1 2019

Source: Colliers International

Public land sales

Among the top five largest transactions in Q1 2019, four were GLS deals. Public land sales booked a bumper quarter, surging 17-fold QOQ and 32% YOY to SGD2.1 billion. They accounted for 40% of total investment sales in Q1 2019.

A total of seven GLS sites were awarded in the quarter, with the largest being the Pasir Ris Central site which was tendered for SGD700 million. The winning bid for the Club Street GLS site also set the record price for a 99-year leasehold hotel site.

Overall, the conservative bid prices and number of bids at public land tenders in Q1 reflected developers’ measured approach to land banking. Colliers Research expects public land sales to maintain its momentum as attractive sites garner healthy interest.

Commercial

The commercial sector slowed down from a strong Q4 2018, which was boosted by big-ticket office acquisitions such as Robinson 77 and 78 Shenton Way. As a result, total commercial investment sales dropped by 54.5% QOQ to SGD1.1 billion in Q1 2019. On a YOY basis, commercial investment sales were up by 307% in Q1 2019 on a low base. The commercial sector accounted for 20% of total investment volume in the quarter.

Colliers Research forecasts that more commercial deals could be transacted in the coming quarters, potentially taking investment sales to SGD7.9 billion for the full-year 2019 - up 27% from 2018.

Mr. Jerome Wright, Director of Capital Markets & Investment Services, Colliers International, said, “We expect favorable fundamentals in Singapore office market, steady office rental growth and supply shortfall over 2019-2021 to support investors’ interest for commercial properties. Institutional investors and REITs should remain active in commercial investment sales through their strategic acquisitions and divestments in the next few years.”

Source: Colliers International

Hospitality

Total hospitality investment sales continued its surge from Q4 2018, increasing 25.7% QOQ and more than quadrupled YOY to SGD996 million in Q1 2019. The GLS site along Club Street in the CBD attracted eight bids with Midtown Development eventually awarded the plot for SGD562 million, or SGD2,149 per square foot per plot ratio. This is a record price for 99-year leasehold hotel GLS land, reflecting the investor’s confidence amidst a general return of interest in the hotel sector.

Mr. Govinda Singh, Executive Director of Valuation & Advisory Services, Colliers International, said, “Singapore remains a mature and popular destination in the region, with healthy growth in tourist arrivals likely supporting investors’ interest into hospitality assets. We expect the current momentum to sustain in the next few years as more potential conversion projects and major hospitality deals materialise. In addition, the incentive schemes unveiled in the government’s Draft Master Plan 2019 could also spark more investors’ interest in redeveloping older office buildings in the CBD into mixed developments with hotel and residential components.”

Industrial

Total industrial investment sales value doubled YOY to SGD555 million in Q1 2019, mainly attributed to SGRE Banyan’s acquisition of warehouse facilities on Jurong Island for SGD228 million. On a QOQ basis, however, industrial investment sales volume was 73.3% lower as Q4 2018 was boosted by ESR-REIT’s acquisition of Viva Industrial Trust’s properties following their merger.

Apart from institutional investors and REITs, Colliers Research also anticipates a rising interest from manufacturers looking to acquire industrial properties for business expansion plans. The attractive yields of industrial assets will remain appealing to qualified investors as the underlying leasing market bottoms out.

Similar to This:

Broad-based increase in Singapore CBD Premium & Grade A office rents in Q1 2019

Corals at Keppel Bay Singapore

Bastiaan van Beijsterveldt lead business development Occupier Services business in Singapore