New York tops world order in 2028 - Tokyo second

Contact

New York tops world order in 2028 - Tokyo second

Savills Research has undertaken an in-depth analysis of emerging themes among cities, examining them for resilience, those challenging today’s order and growing mega-regions.

The world order of top global cities may feel as though it is set in stone. But with disruption on the menu through technology, demographics and leadership, all that is set to change in the next decade.

For traditional leaders such as London, New York and Tokyo, the battle will be about resilience. How can they continue to harness favourable qualities such as strong economies and demographics to maintain their position?

Emerging locations in China and the Middle East are snapping at their heels, challenging the status quo with rising personal wealth and fast-growing economies. They are joining an increasingly crowded field. In the past decade, the number of cities with gross domestic product (GDP) of more than $50 billion has grown from 177 to 248, under scoring the vital role that cities will continue to play in these disruptive times. By 2028, this number is expected to jump to 317. Those cities with GDP over $50 billion accounted for 83% of global GDP in 2018, an increase from 79% a decade ago. This is forecast to increase to 89% over the next 10 years as the importance of cities continues to accelerate.

Their geographical distribution has shifted significantly over the past decade, too, and is expected to change again. In 2018, Asia-Pacific had the largest share of cities with GDP over $50 billion, overtaking the Americas. By 2028, more than half of these influential cities are expected to be in this region.

A second threat to the traditional order is cities working together. The creation of mega-regions has seen cross-border collaboration in the US and Mexico and across Europe. China can do this all on its own by linking populous metropolises.

Savills Research has undertaken an in-depth analysis of these emerging themes among cities, examining them for resilience, those challenging today’s order and growing mega-regions.

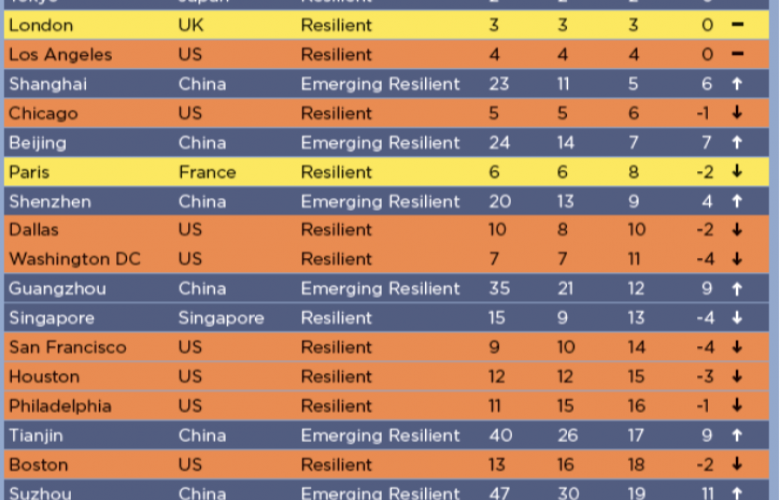

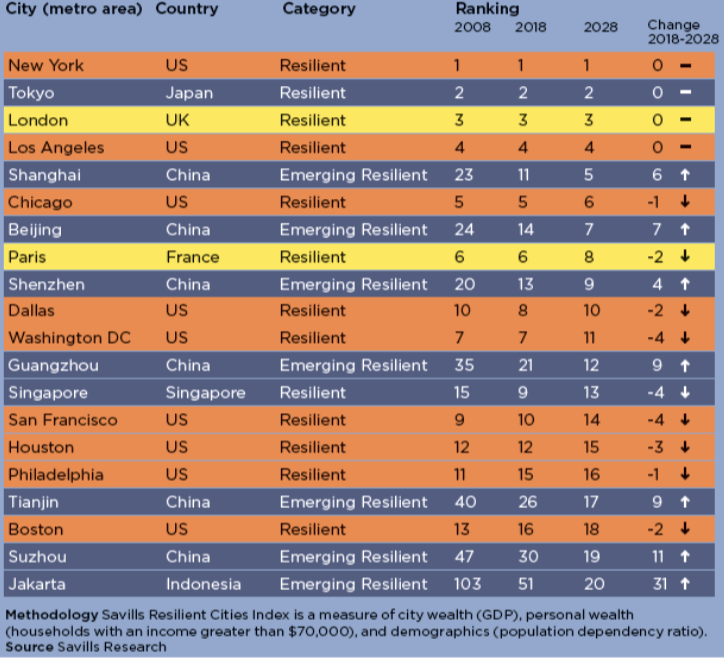

Top 20 world cities in 2028

Resilient Cities

Our definition: These cities have been in the top 20 for at least the last decade and are forecast to remain so over the next 10 years. They are well-placed to withstand or embrace the many disruptive forces facing global real estate today and in the future.

The top 20 ranking for 2028 includes familiar names alongside some of the US’s economic powerhouses. The leading four are forecast to be New York, Tokyo, London and Los Angeles, unchanged for the past two decades. These continue to have an inbuilt advantage from their position as world-class cities and are expected to remain resilient over the next decade.

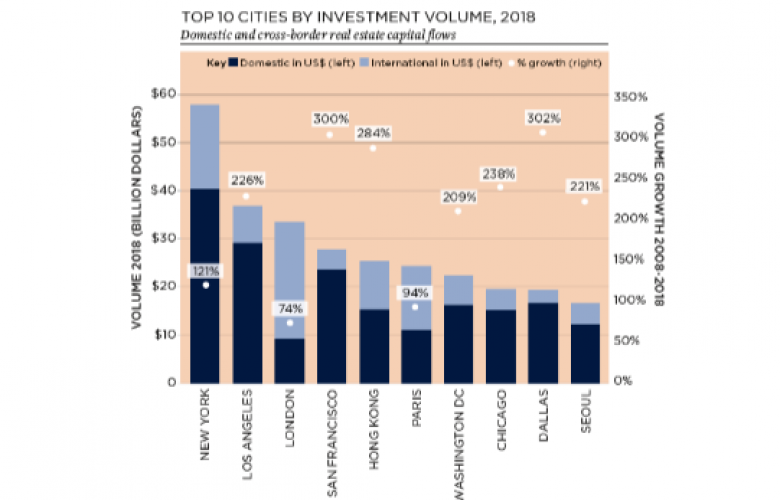

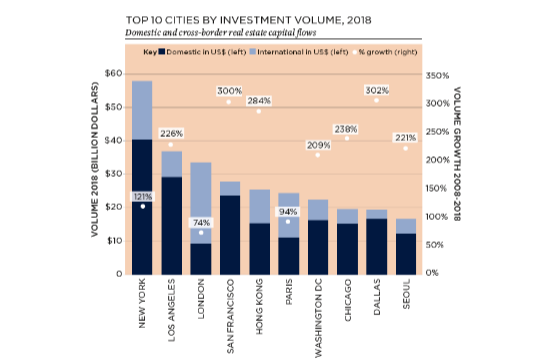

While Resilient Cities make attractive propositions from a short and long-term economic and demographic perspective, it is interesting to see how this aligns with current real estate capital flows. This demonstrates whether investors are finding the appropriate risk/return profile in each market, and the size and liquidity of the investible real estate universe.

Source: Savills

The top 10 cities for investment by volume ranks New York, Los Angeles and London in the first three places: each is in the top four in the Resilient Cities Index. Other US cities in the Resilient Cities top 20 and the top 10 investment volumes globally are Chicago, Washington DC, San Francisco and Dallas.

Emerging Resilient Cities

Our definition: The new entrants to the top 20, either in the past decade or forecast to be so in the next. Although they’re not currently as well-established on a global stage, we expect them to match the status of the Resilient Cities by 2028 as they continue their dramatic rise in economic and wealth terms.

The greatest change during the next 10 years will be the rise of Asian cities. From 2008 to 2028, there are seven new cities from Asia breaking into the top 20. Of these, six are Chinese cities, with Jakarta, Indonesia, taking the final place. These Emerging Resilient Cities have risen dramatically in economic and wealth terms in the past decade, and are expected to cement their position on the back of increasing middle-class wealth.

Despite the changes to the make-up of the top 20, the global percentage of GDP that these cities account for in 2028 is forecast to remain stable at around 25%, compared with 26% in 2018.

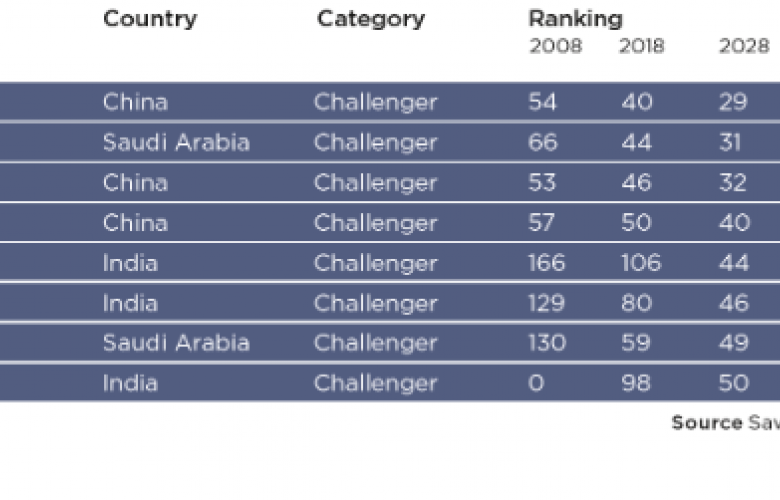

Challenger Cities

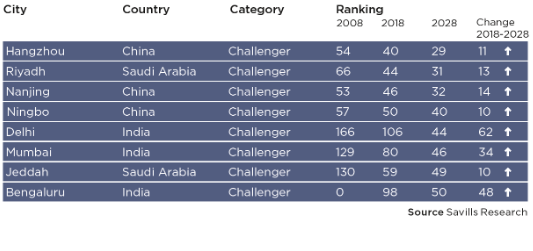

Our definition: Cities that are forecast to make the top 50 by 2028 by jumping at least 10 places. They are poised to rise and challenge the established cities by using disruption to their advantage. For real estate investors with a long-term view, these are the cities to watch.

The distribution of these cities contrasts with those in the top 20, with no contenders from the US or Europe. Instead, China, India and the Middle East make up the eight. From India and the Middle East, these are well-known international cities such as Delhi, Mumbai and Bengaluru (Bangalore), and Riyadh and Jeddah in Saudi Arabia. However, the Challengers from China come from a second-tier league of large, but less internationally recognised, cities such as Hangzhou, Nanjing and Ningbo.

Simon Hope, Head of Global Capital Markets at Savills, comments: “The list of the world’s top global cities may feel like it is almost set in stone, but, as is becoming apparent, disruption is on the menu and we are set to see some sweeping changes to the way society functions and how businesses operate in the next 10 years. For real estate investors, our Resilient Cities Index shows that the long-established global cities will withstand much in the next decade, which is why they’ve seen high levels of investment as they are perceived as ‘safe havens’ for capital, with the top 10 global destinations for both domestic and cross-border capital in 2018 reflecting this old world order. However, as a result, their real estate assets have become correspondingly expensive and highly sought after.

“As such, our eight ‘challenger cities’ may offer alternative investment destinations. While not without risk, these cities are set to accelerate up the ranks as they demonstrate their resilience to the challenges ahead and investors should start investigating how to secure a footing in these markets if they’re willing to sit tight and take a long-term view. One in five people in the world are Chinese and as their economy continues to grow they will through the effluxion of time become the world’s largest economy, so in particular our Chinese ‘challenger cities’ will offer a wealth of opportunity.”

Source: Savills

Similar to this:

Colliers International in Vietnam releases the Vietnam Quarterly Knowledge Report Q1 2019.

Jostling for pole positions as Myanmar market liberalises

CBRE appoints Reeves Yan as Head of Capital Markets in Hong Kong