Total real estate investment sales in Singapore finished the year on a weaker note, falling by 17% quarter-on-quarter (QOQ) and 47% year-on-year (YOY) to SGD6.7 billion in Q4 2018. This came on the back of a slump in residential investment sales and a lack of public land sales across all sectors.

At a glance:

- Overall real estate investment sales in Singapore declined 5.1% YOY to SGD38.0 billion in 2018

- Residential deals accounted for lion’s share of total investment sales in 2018 at SGD22.1 billion – an all-time high residential investment sale on an annual basis

- Commercial, hospitality and industrial investment sales were boosted in Q4 2018 and should see further upside in 2019

- Investment sales expected to hold up in 2019, as stronger non-residential deals mitigate the slower residential market

Cumulatively, total investment sales came in at SGD38.0 billion for the whole of 2018, down 5.1% from the stellar SGD40.1 billion achieved in 2017, according to Colliers International’s latest research report. For 2019, Colliers Research expects property investment sales to rise slightly to SGD38.3 billion – up by 0.7% from 2018.

Ms. Tang Wei Leng (邓慧玲), Managing Director, Colliers International, said, “Singapore will remain attractive to investors as the yield spread continues to be one of the more attractive across markets. Other key considerations such as talent pool, strong regulators, pro-business government, technology and the smart nation push continue to attract businesses, driving demand for real estate across office, industrial and hospitality. In particular, hospitality will be an interesting sector to watch in 2019.”

Residential

In Q4 2018, residential investment sales plunged by 67% QOQ and 86% YOY to SGD1.1 billion. Despite the sharp decline, overall residential investment sales – boosted by the strong showing in the first half of the year - still notched a 1.4% YOY growth for the whole of 2018 at SGD22.1 billion, the highest residential investment volume on a yearly basis. Of the SGD22.1 billion, collective sale accounted for 45% of the volume with 35 deals valued at SGD10.012 billion.

Ms. Tricia Song (宋明蔚), Head of Research for Singapore, Colliers International, said, “We expect residential investment sales to remain subdued in the first half of 2019 as developers adopt a cautious approach and focus on their new launches instead. Facing a quiet collective sales market, owners of some en bloc projects with the potential to be sold have become more measured recently, adjusting their asking prices down. With healthy takeup at new launches, we believe the private residential investment volume and sentiment will eventually pick up towards the middle of 2019.”

Two of the top five largest transactions in 2018 were from the residential segment: a government land sale (GLS) site in Silat Avenue which was sold for SGD1.04 billion, and the SGD980-million collective sale of Pacific Mansion.

Meanwhile, Good Class Bungalows (GCBs) which accounted for 5% of the residential investment sales in 2018 also had a strong year. Although volumes decreased by 28% QOQ and 15% YOY to SGD256 million in Q4 2018, the full year GCB investment sales value still recorded a 16% increase from 2017 to SGD1.0 billion from 42 transactions in 2018. This is the highest level since 2012 where 50 GCBs were sold for SGD1.1 billion.

Commercial

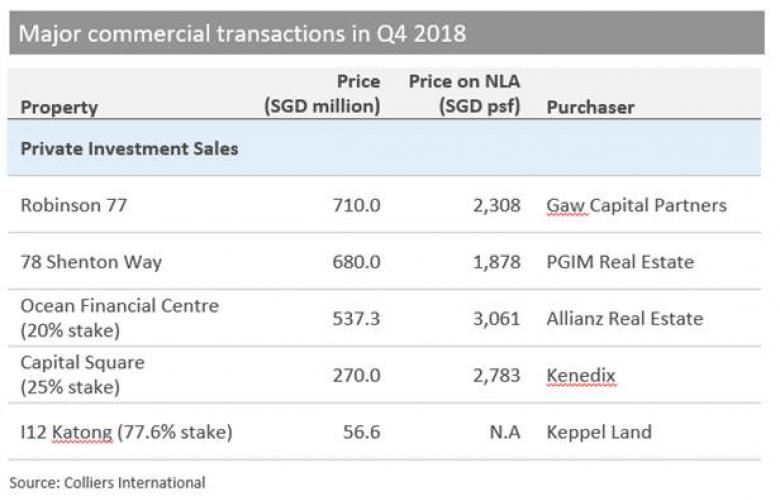

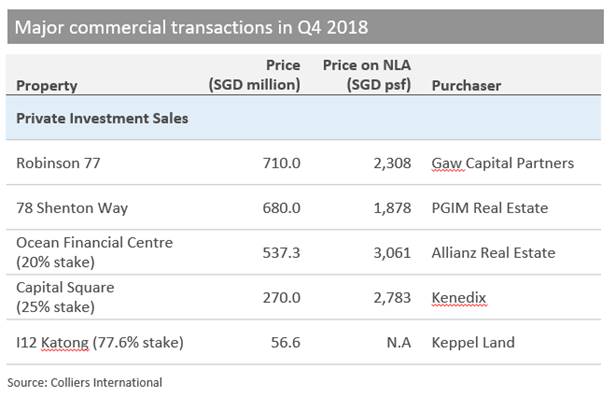

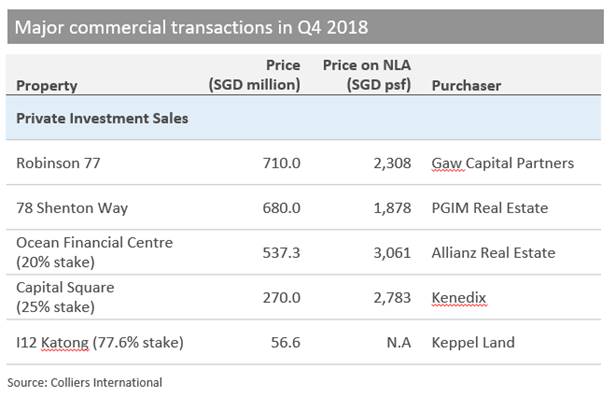

The commercial sector continued its strong momentum in Q4 2018, with total commercial investment sales rising by 8.6% QOQ to SGD2.3 billion - the highest volume on a quarterly basis in 2018. The increase was driven mainly by a few big-ticket office transactions during the quarter, including the SGD 710-million Robinson 77 deal, and the sale of 78 Shenton Way – which was co-brokered by Colliers – for SGD 680 million.

For the full year 2018, overall commercial investment sales in 2018 came in at SGD6.2 billion, a 47% drop from a very strong 2017 which saw landmark transactions such as Asia Square Tower 2 and the Beach Road GLS site.

Mr. Jerome Wright, Director, Capital Markets & Investment Services, Colliers International, said, “We expect the momentum to continue and more major commercial deals to materialise in 2019. Leasing demand for office space should remain firm from the finance, tech, flexible workspace and professional services sectors. As a result, commercial properties should continue to attract investors, supported by steady office rental growth which is forecast to average around 5% over 2018-2023, tightening new office supply in the next three to five years, and Singapore’s status as a global business hub.”

Industrial

Total industrial investment sales value jumped 70% QOQ and 229% YOY to SGD2.1 billion in Q4 2018, mainly due to ESR-REIT’s acquisition of Viva Industrial Trust’s properties following their merger. This brought full-year industrial investment sales in 2018 to SGD4.4 billion, up by 5.8% from 2017. According to Colliers Research, this is the highest volume achieved since 2011, which also saw a total of SGD4.4 billion worth of industrial investment sales.

As Singapore’s industrial market bottoms, the attractive yields of these assets offer diversification and accretive returns to qualified investors. In what could be seen as a vote of confidence for the sector, CapitaLand announced on 14 January the SGD11 billion acquisition of Ascendas-Singbridge, to gain access to industrial developments in Singapore as well as those in emerging markets.

Hospitality

The hospitality sector booked the strongest sales volume in four years at SGD1.2 billion in 2018, following a surge in investment in Q4 2018. During the quarter, hospitality investment sales rose by 445% QOQ and 421% YOY to SGD792 million, boosted by deals – Golden Wall Centre and Waterloo Apartment – where the investors had decided to redevelop residential and commercial properties for hotel use.

The growth momentum in the hospitality sector is expected to spill over into 2019. According to Colliers’ Asia Pacific Hotel Sector 2019, Singapore hotels’ revenue per available room (RevPAR) should grow at a pace of about 3.5% YOY in 2019 with tourism arrivals in the region reaching record level amid tightening room supply in the next few years. As such, interest for hotel assets should remain healthy and the hospitality sector is poised for further acceleration.

Shophouses

Based on Colliers International's research, shophouse transactions with a value of SGD5 million and above grew 7% QOQ and 23% YOY to SGD212 million in Q4 2018. As a result, total shophouse transactions in 2018 hit an all-time high of SGD1.2 billion, following a rising trend which started in 2015 and indicating strong demand for this class of asset in the aftermath of the cooling measures in the residential sector.

Colliers expects demand for shophouses - which are hybrids of the residential, commercial and hospitality sectors - to remain consistent in the next three years, especially from boutique investors due to the low capital quantum required.

Similar to this:

Singapore CBD Grade A office rents in 2018 post highest annual growth since 2010

ASEAN regional interest in Jakarta and Singapore round-table events

Tulip Garden collective sale site sold - Farrer Road