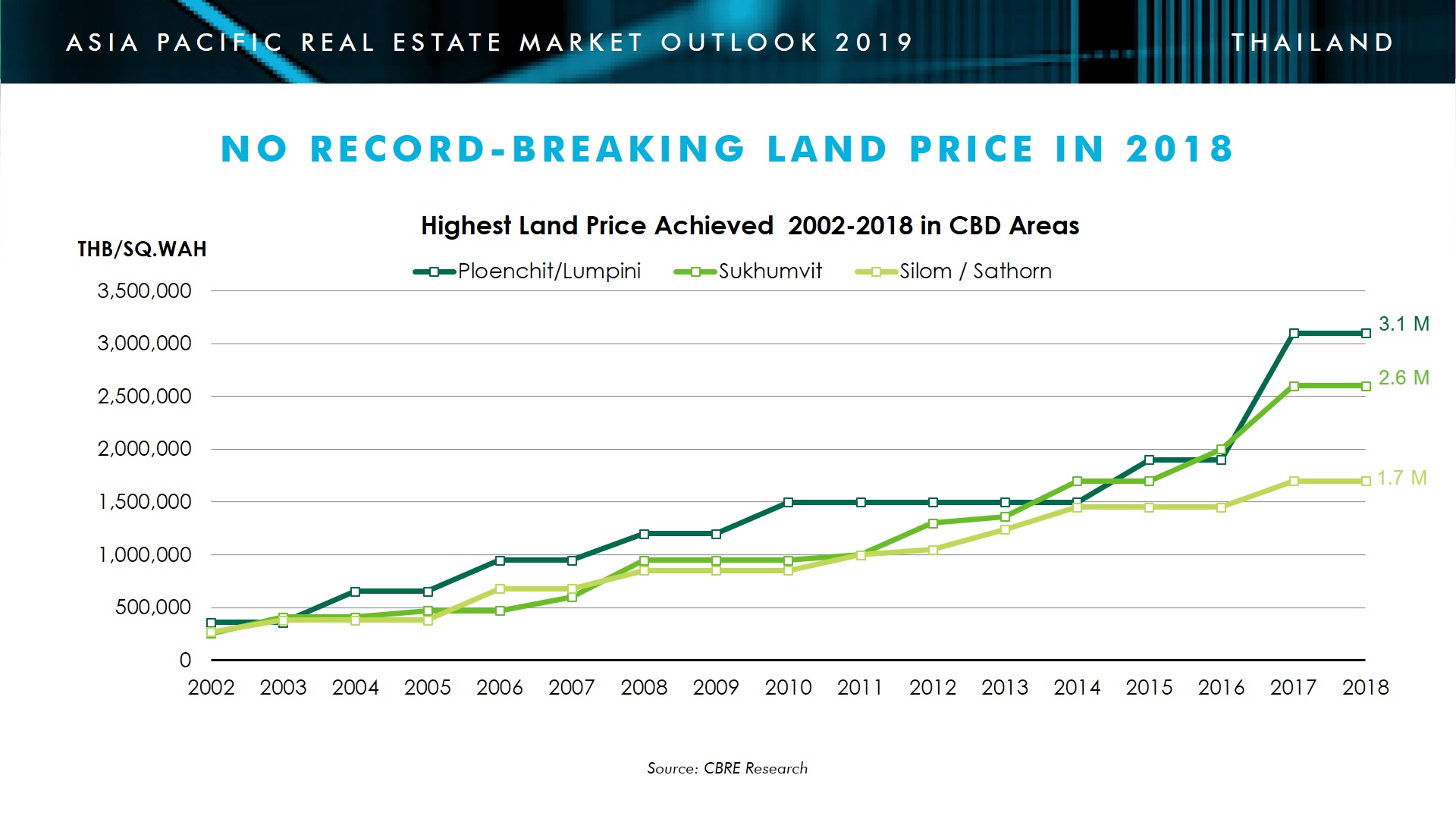

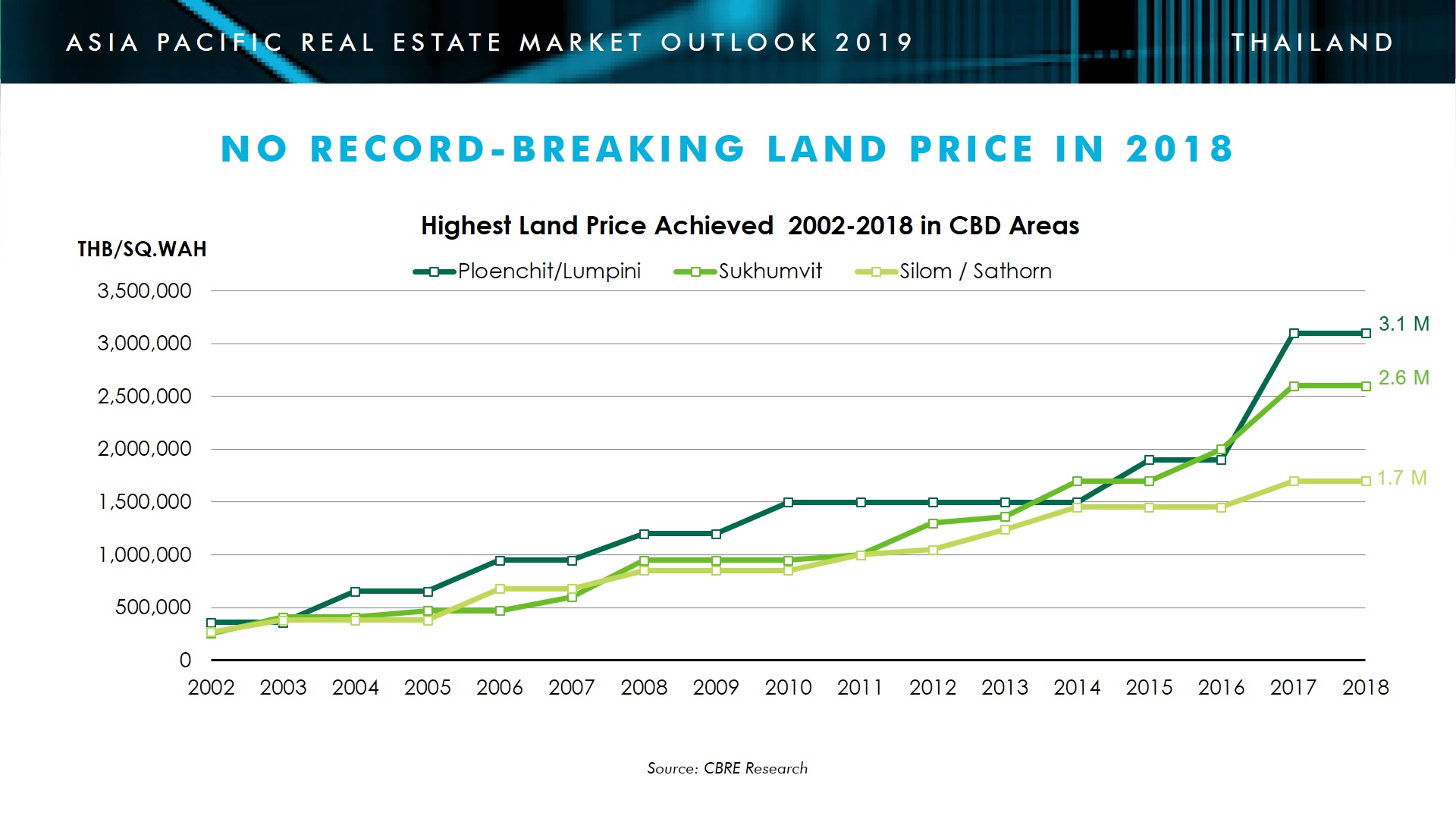

The race for quality sites is still hot with the increase in land price and scarcity of freehold land in prime locations according to CBRE. However, with new regulations on the horizon and new Bangkok City Plan scheduled for 2020, CBRE says developers are taking a step back to assess the situation.

New Regulation and Uncertainties

According to CBRE's Real Estate Market Outlook 2019 Thailand’s real estate market will be facing series of changes including an increased policy rate, tighter mortgage regulations and an upcoming general election in 2019 while new land and property tax and new Bangkok City Plan are expected to come into effect in 2020.

"The new Bangkok City Plan and New Land and Property Tax, both expected to be implemented within 2020, are also in the planning stages and have not yet been finalized. Changes are expected to be significant in areas where there are intersections of mass transit lines.

The upcoming election on 24 March 2019 will also have an effect on the economy and the progress of infrastructure projects across Thailand."

Source: CBRE

Challenges in Exports and Tourism

Two key economic drivers of Thailand’s economy, exports and tourism, are reported to be facing challenges this year. It is still uncertain whether the US-China Trade War will have a negative or positive impact on Thailand’s export industry. The turn up of Chinese tourists during the Chinese New Year period will indicate their sentiment towards Thailand.

CBRE believes that Bangkok’s tourism market is resilient and will recover quickly from the drop in Chinese tourists as it has shown its resiliency in many occasions, even bouncing back stronger after a series of political unrest in the past.

Higher Down Payments Cool Down Residential Market

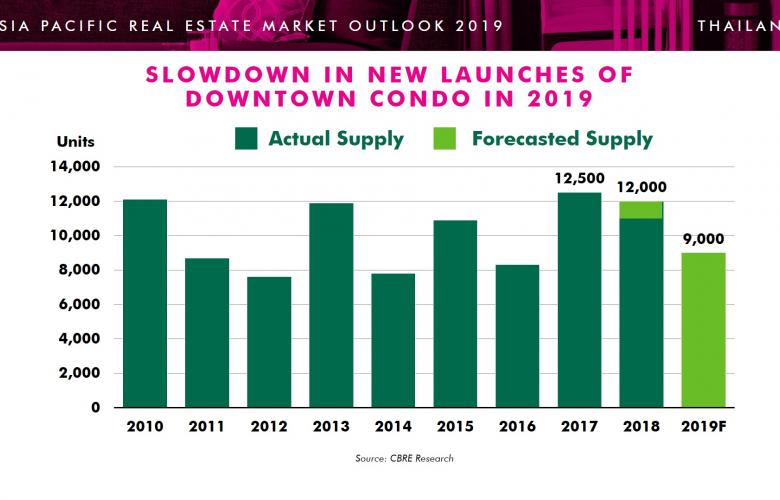

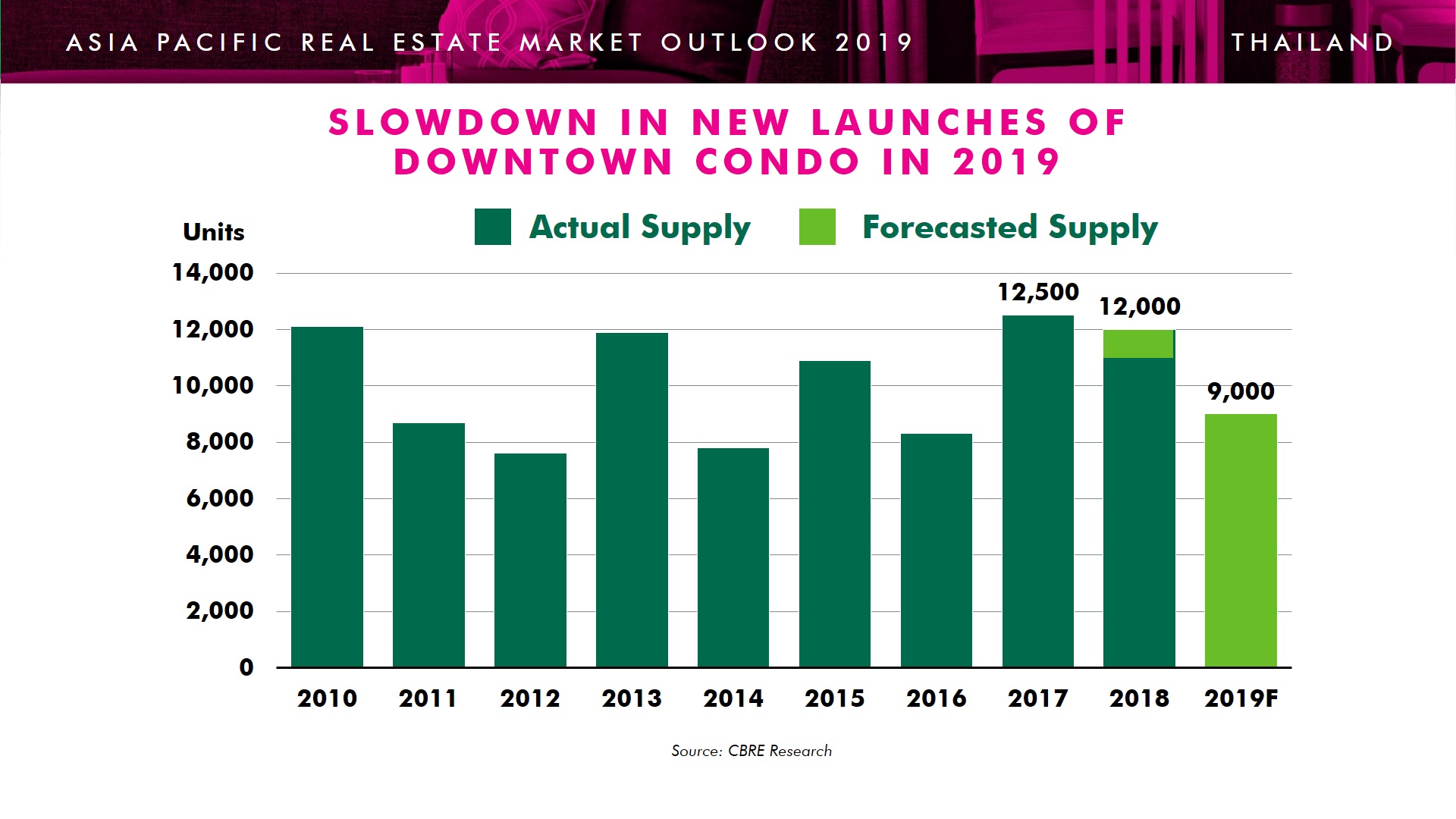

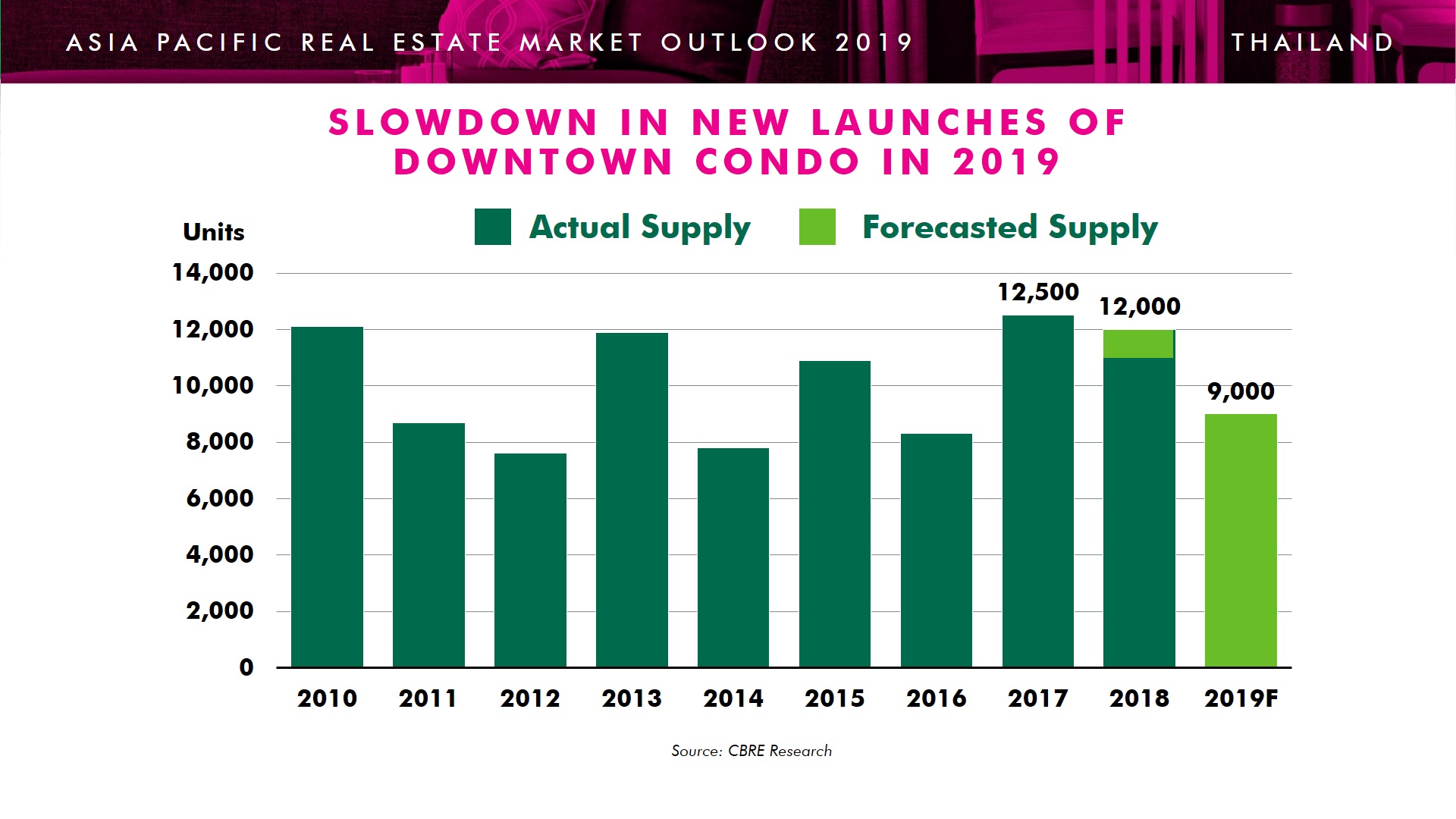

The demand from speculative buyers and buy-to-rent investors are expected by CBRE to be lower due to high prices from high land cost, interest rates and higher down payments required by the Bank of Thailand, making it harder profit from rental income or resell under construction units. The market will refocus on end-user buyers and clearance of unsold units in completed buildings.

"As domestic demand shrinks, developers will turn to foreign buyers who purchase condominium units using their own funds. However, there are uncertainties in the sustainability of high reliance on foreign sales over whether these buyers will transfer units upon project completion and who will be living in these units. Foreign demand is also sensitive to the economies of their home countries."

High Competition in the Upper End of Condominium Market

CBRE is seeing many developers launching condominium projects with asking prices of over THB 300,000 per square metre and the new norm seems to be THB 250,000 per square metre. However, there will be winners and losers in the market. With a lot of options in this segment for buyers to choose from, CBRE is seeing slow sales in many projects. Unsold units in completed projects are being offered at discounted prices to clear the inventory.

The new projects are not competing on price alone, developers have also been implementing other unique selling points in their projects to attract buyers. Home automation, rental management schemes, and mixed-use developments are some of the selling points in the market today. In this highly competitive market, CBRE believes that the winners will not be projects with the best room layouts or design, but those that can sell the right lifestyle at the right price.

Source: CBRE

Evolving Office Demand

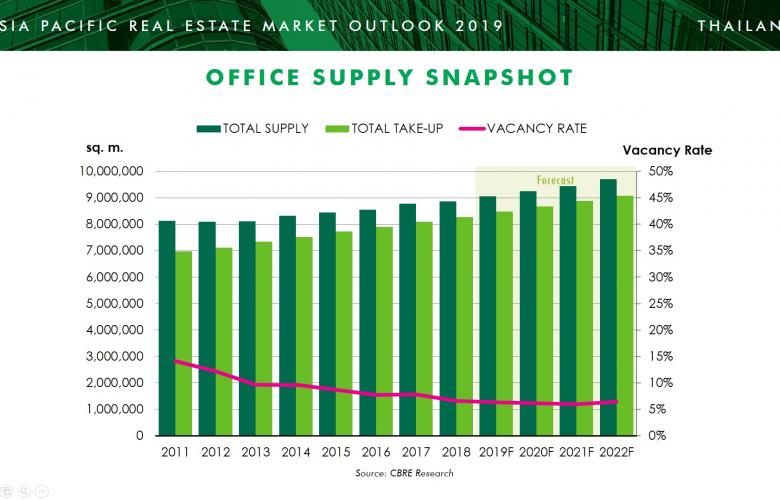

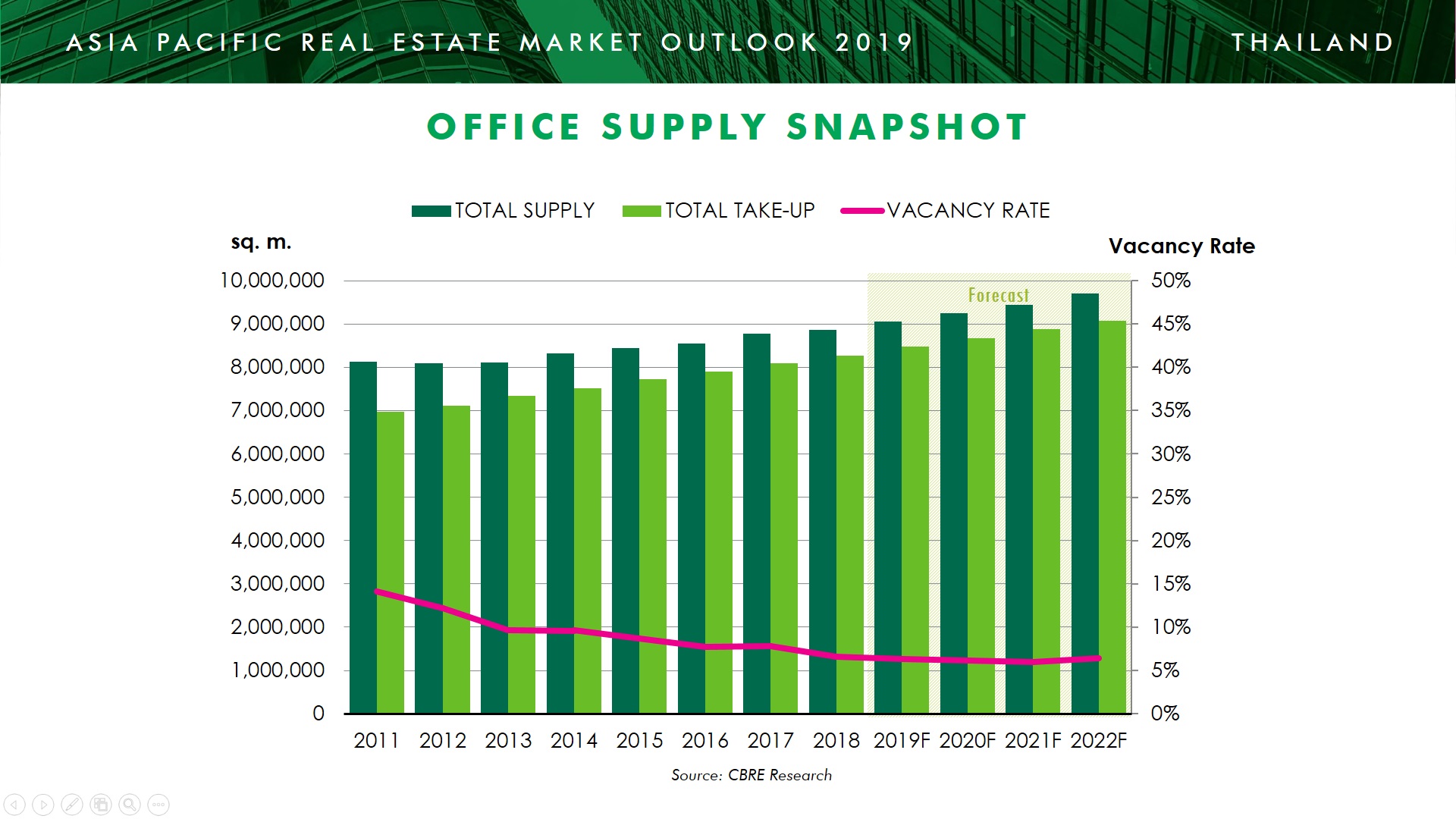

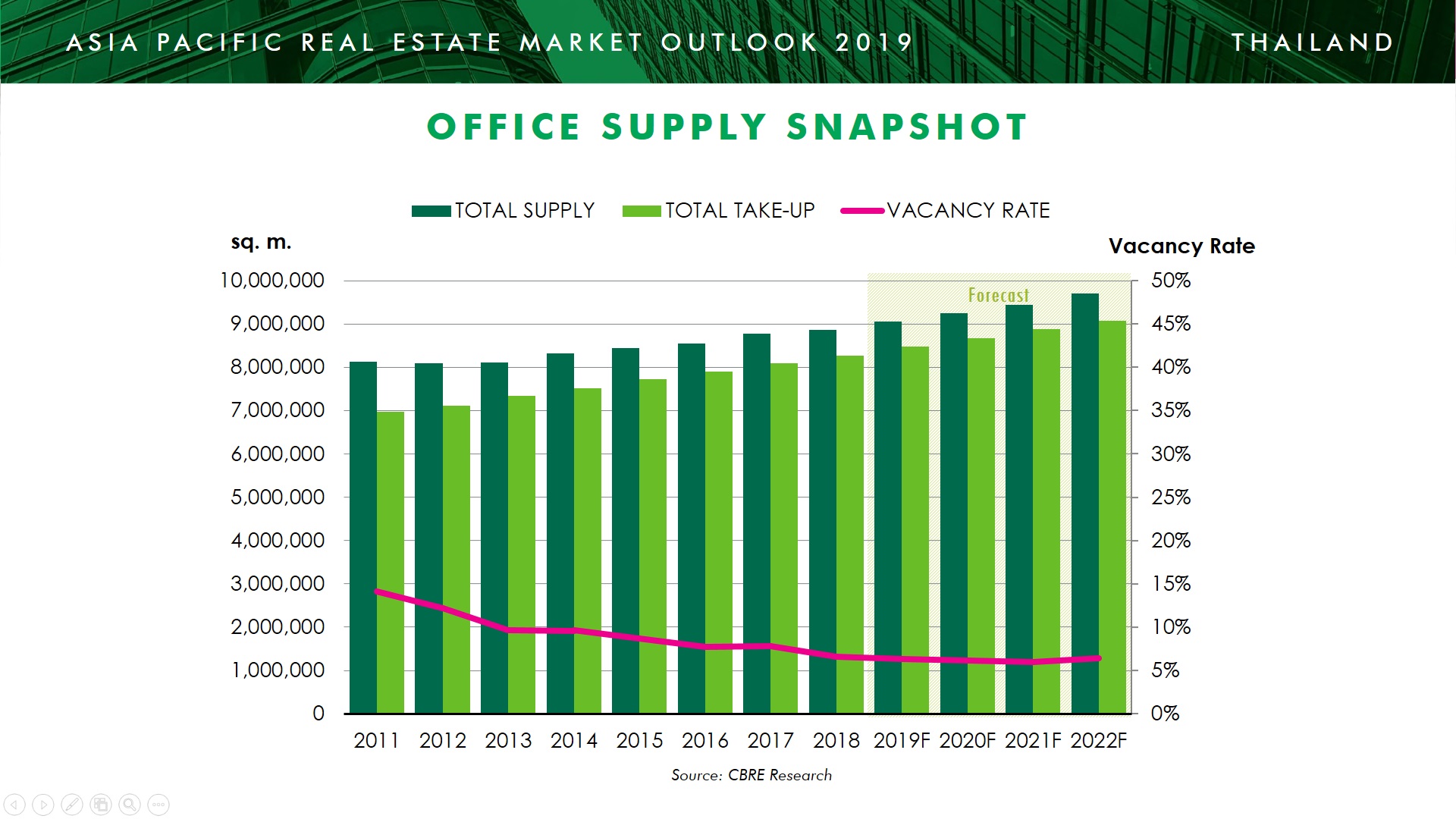

Following the global trend, the office market in Bangkok is changing with the trend of agile workplace and co-working space playing a major role in leasing large amounts of office space in Bangkok. The incoming new supply is reported to put pressure on older office buildings to renovate and upgrade their buildings to be competitive in the changing market.

CBRE has estimated that the absorption rate for Bangkok office space is approximately 200,000 square metres per year.

"In four years, Bangkok will have seen a change in the office market as over two million square metres of office space from under construction and planned projects enter the market."

Source: CBRE

Retail Reinvention

As the global retail landscape shifts towards e-commerce and online shopping, Bangkok’s retail market is "gradually following the trend" according to CBRE. "Bricks-and-mortar retailers are strategising to offer something that cannot be offered online, introducing the experience-rich shopping centres or the ‘retailtainment’ destinations. Adopting omni-channels of both offline and online sales will reduce the space needed for many retailers."

CBRE expects the retail market to be positive following the economic recovery. Occupancy rate will remain high, but there is a significant amount of future supply. Weaker centres will struggle to retain and attract tenants with the dual threat of e-commerce and future competing supply but rent will remain unchanged.

EEC: Industrial Incentives

The Eastern Economic Corridor (EEC) will have a much clearer picture this year when the bid for Transit Oriented Development (TOD) projects along the high-speed train routes to EEC is finalised. CBRE believes that this will jump start Thailand’s attractiveness to foreign manufacturers and investors in the EEC. The government is also offering financial incentives and tax exemptions within the Free Zone in industrial estates to foreign manufacturers.

It is too early to tell whether Thailand is benefitting from the Trade War between USA and China. However, CBRE has seen some interest from Chinese manufacturers who are looking to relocate their production base to Thailand in the EEC area.

Investment Slowdown

Thailand policy rate increased for the first time in seven years, from 1.50% to 1.75%, in 19 December 2018 according to CBRE.

"Rising interest rate will increase cost of development for property developers and slowdown domestic buyer’s activity in the property market.

Weaker domestic demand, rising land price, and incoming supply will make property developers more cautious to both launch new projects and acquire sites in 2019.

There will still be high demand for prime freehold sites in Bangkok, especially along the mass transit lines. Scarcity of prime sites in Bangkok’s central business district (CBD), where the record price is at THB 3.1 million per square wah on Langsuan Road, will drive up the price."

CBRE expects to see less joint ventures between local developers with foreign partners in 2019 for residential developments as demand weaken.

Source: CBRE

Similar to this:

Highest level of new condominium launches in Bangkok in past 10 Years - Knight Frank Thailand

Bangkok resale condo market continues to grow - CBRE

"Expat apartment rental still strong in prime areas" CBRE Thailand