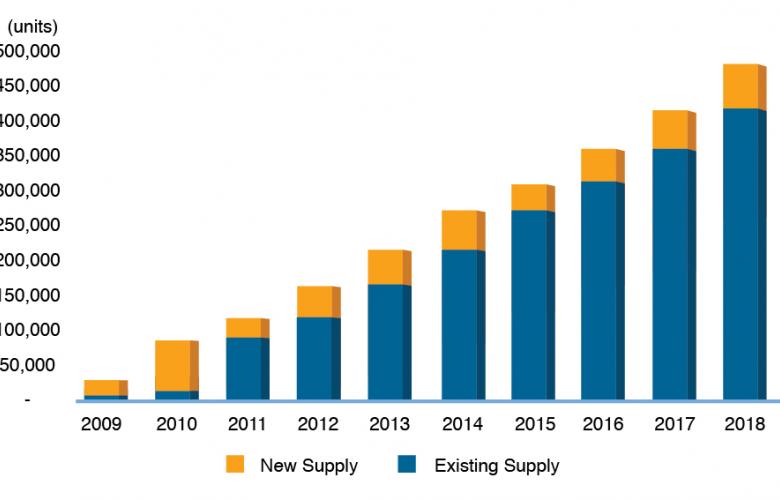

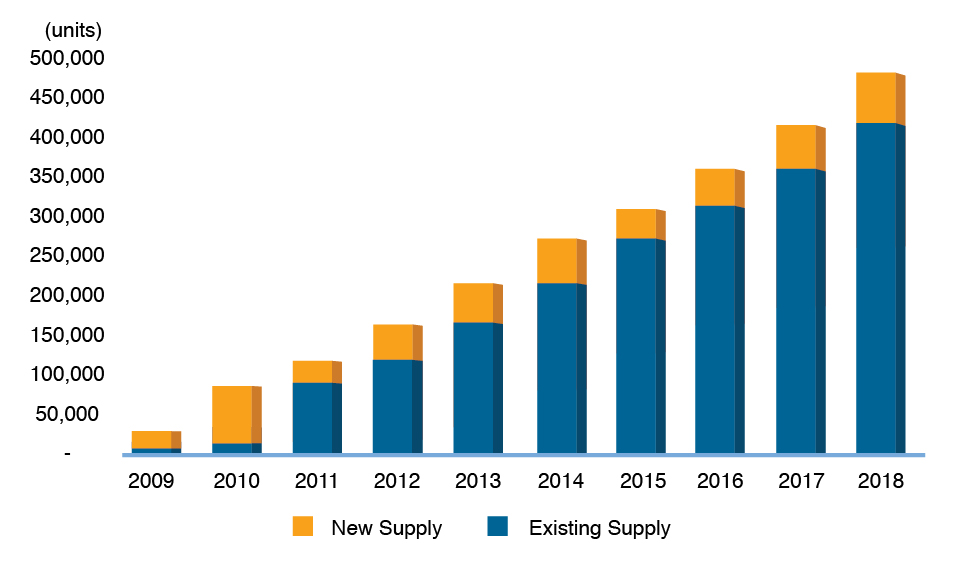

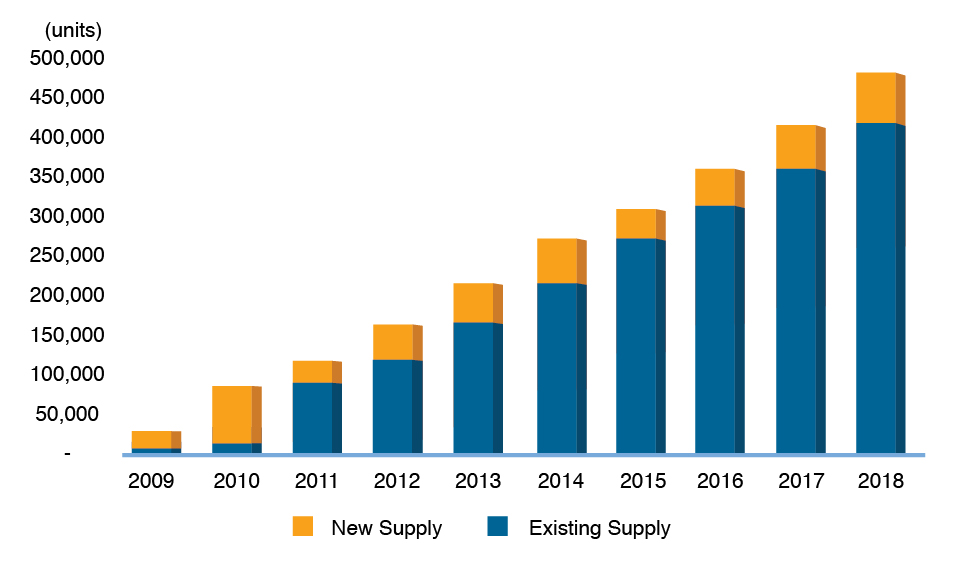

Mr. Phanom Kanjanathiemthao, Managing Director, Knight Frank Thailand Co., Ltd., said that The Bangkok Condominium Market in Bangkok in 2018 hits a new record with the largest number of new project launches in 10 years, with a new supply of approximately 65,000 units entering the market, an increase of 11% year-over-year. As a result, the accumulated supply of condominiums in Bangkok from 2009 to 2018 has been around 500,000 units.

From Knight Frank Thailand research, it was found that, in Q3/2018, there were up to 25,000 new unit launches, while the last quarter of the year experienced about 17,000 new units entering the market. A bulk of these launches was in the outskirts of the city, especially along the Green Line and Blue Line mass transit expansion. The new supply in those areas accounted for 57% of all new units launched in Q4/2018.

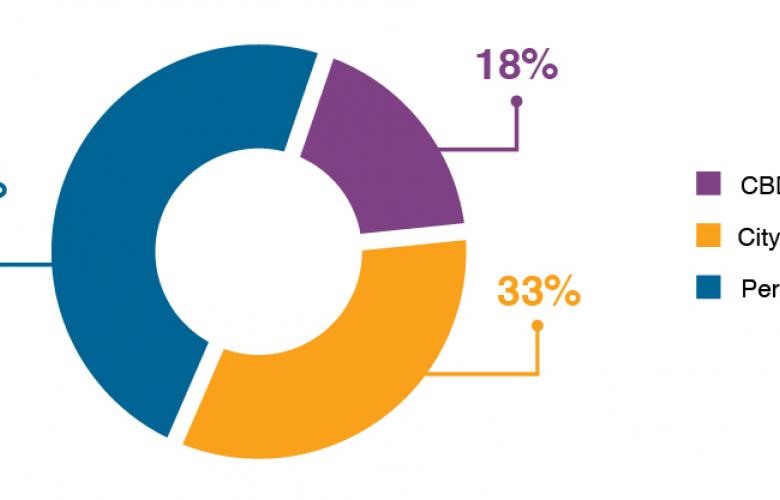

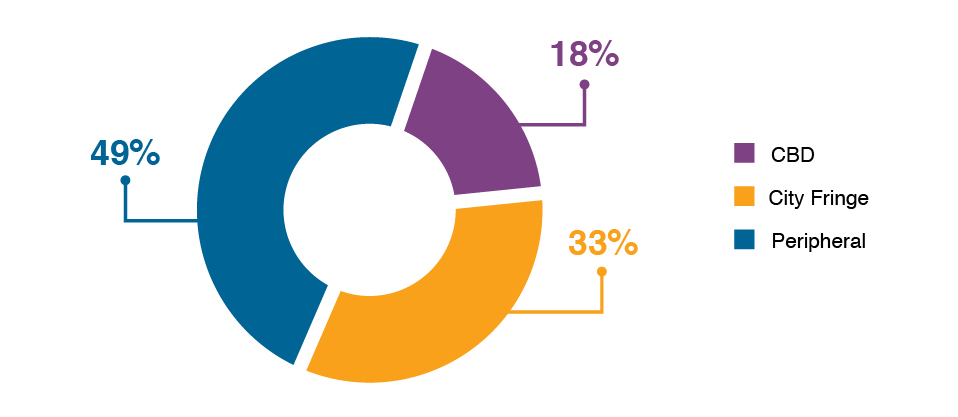

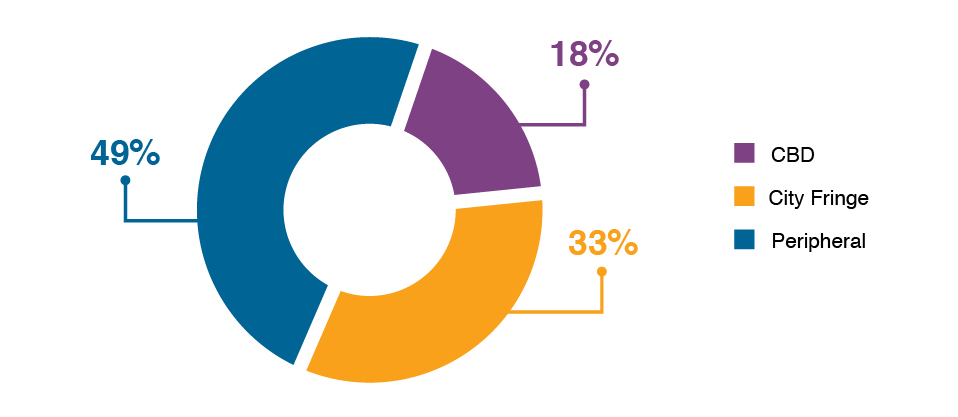

"Looking at the whole picture of 2018, it was found that the suburbs, especially along the mass transit expansion routes, still commanded continuous interest from developers. Meanwhile, a proportion of new supply in the CBD and its surrounding areas stood at 18% and 33%, respectively. The prominent locations that developers particularly focused on in 2018 included Sukhumvit Road, from Asoke to Ekamai; Phaholyothin Road along the BTS line extension (Morchit to Khu Khot); Rama 9 to Ratchadaphisek; Lat Phrao to Ramkhamhaeng; and Charansanitwong to Petchkasem," reports Knight Frank.

Bangkok Condominium Supply in 2009 - 2018

Source : Knight Frank Thailand

Bangkok New Supply by Area in 2018

Source : Knight Frank Thailand

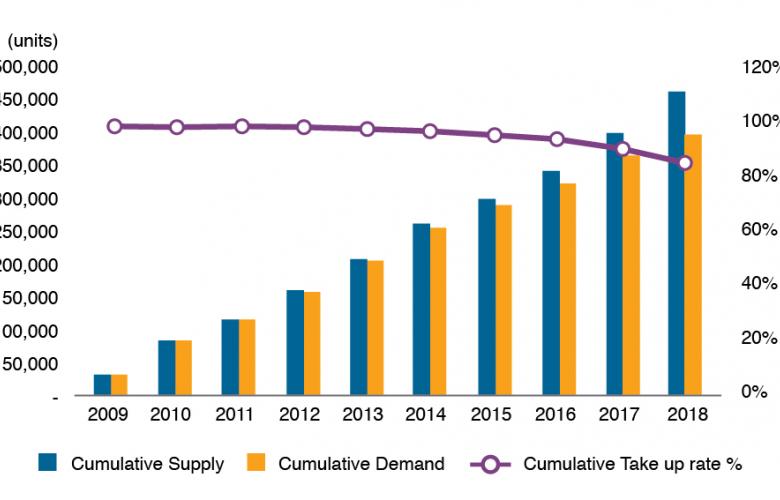

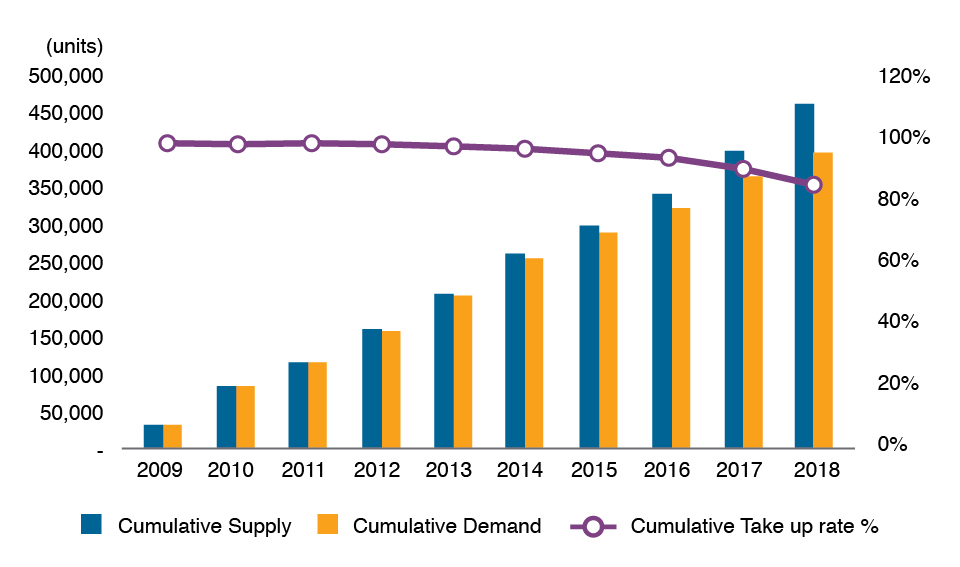

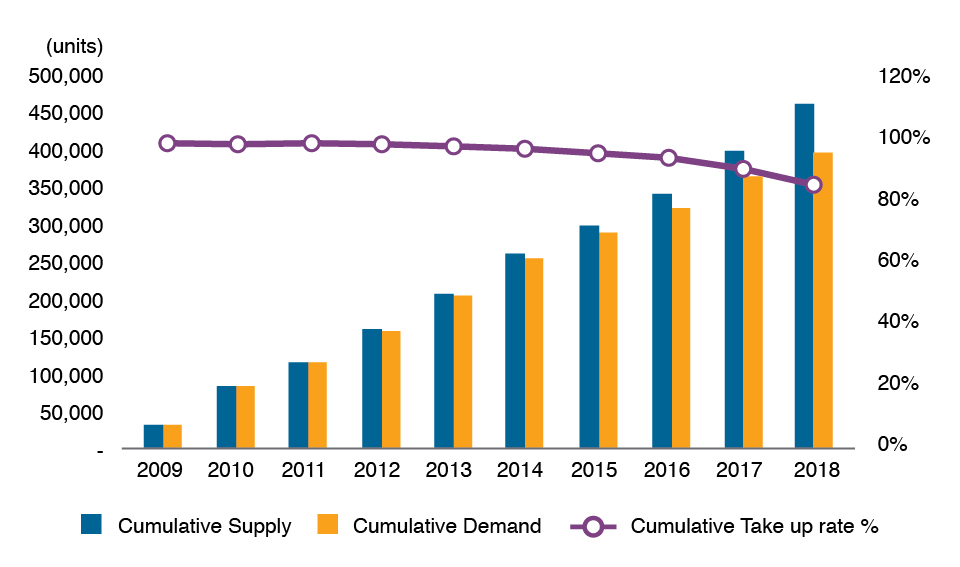

On the demand front, it was found that the average take up rate of new projects in Bangkok throughout the year was around 55%, with condos in the CBD and surrounding CBD zones selling particularly well; take up rate were around 51% and 64%, respectively. Meanwhile, new suburban condos enjoyed about a 50% sales rate, which is a good level considering the huge new supply that entered the market in this area.

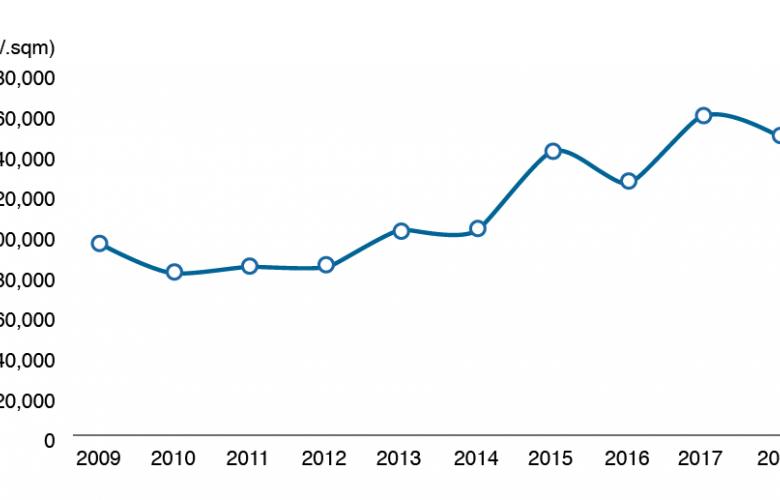

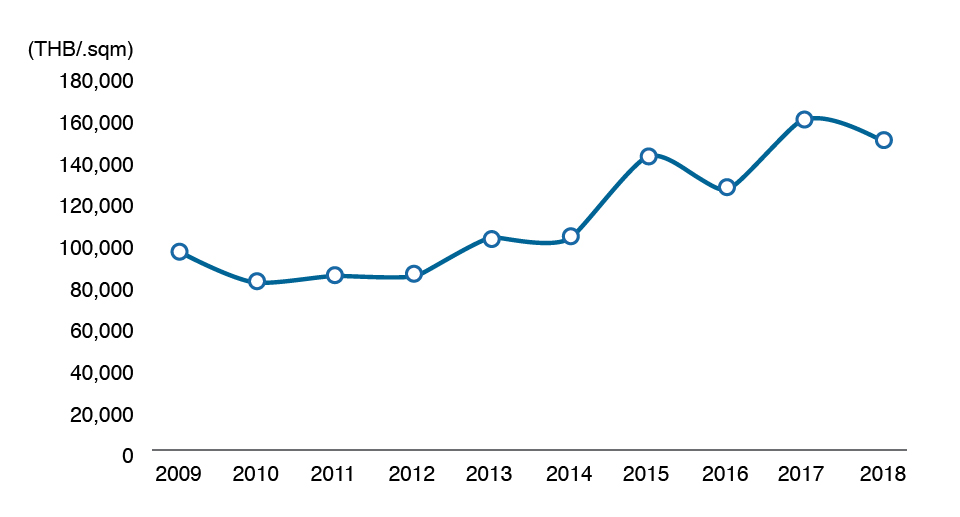

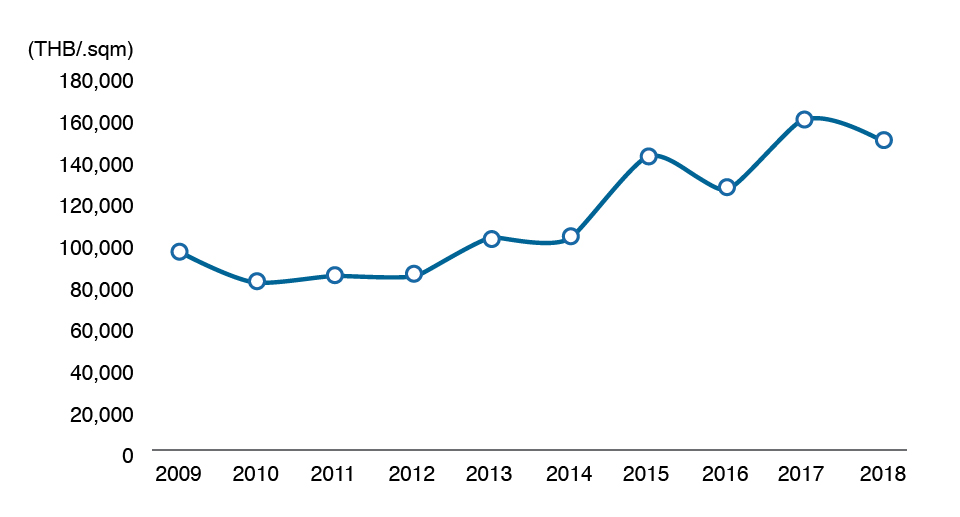

The most popular locations for buyers included Central Sukhumvit (Asoke to On Nut); late Sukhumvit (Udomsuk to Bearing); Rama 9 to Ratchadaphisek; Phaholyothin (Chatuchak to Phaholyothin 52); and Thonburi. The average selling prices per square metre of Bangkok new supply in 2018 stood at 150,641 baht, fell by 6% from the previous year.

The average selling prices per square meter of new developments in the CBD and surrounding CBD areas were 250,000 baht and 120,000 baht, dipped 8% and 7%, respectively, compared to 2017. However, Knight Franks says reports that "the average selling price per square metre of newly launched suburban units is likely to continue to increase; in 2018, the price was 85,000 baht per square metre, up 3%, 13% and 20% from 2017, 2016 and 2015, respectively."

Cumulative Supply, Demand, and Take up rate of Bangkok Condominium in 2019 - 2018

Source : Knight Frank Thailand

Average Asking Prices of New Projects Launched in Bangkok in 2019 – 2018

Source : Knight Frank Thailand

Looking forward, Knigt Frank believes the Bangkok property market in 2019 is expected to slow down due to the overall market situation, which includes the Bank of Thailand’s residential housing loan regulation policy, rising domestic interest rates, and the state of the global economy. The latter may affect purchasing power from abroad.

Knight Frank Thailand's research anticipated that, in the first quarter of this year, the average selling prices per square metre would likely to mount from that of last year, driven by the launch of several new developments in both CBD and surrounding CBD areas. In addition, in Q1/2018, the transfer rate is foreseen to grow, compared to the same period last year. This reflects buyers’ preferences to complete their transfers before the residential housing loan regulation policy comes into effect on 1 April 2019.

Similar to this:

Bangkok office sector continues strong performance: dynamics set to change post 2021 - Savills

Bangkok resale condo market continues to grow - CBRE

"Expat apartment rental still strong in prime areas" CBRE Thailand