Despite increased competition from rental units in condominiums, the prospects for the single ownership apartment market in the prime areas of Bangkok are still positive, according to CBRE. Most expatriates working in Bangkok rent rather than buy a property.

The expatriate rental market is competitive because the number of expatriates working in Bangkok is not growing. The only nationality where numbers are growing are Chinese and generally most Chinese expatriates have much lower housing budgets than Japanese, American and European expatriate tenants who have been the traditional source of demand for central Bangkok residential rental property.

Based on over 3,000 residential rental transactions over the last ten years completed by CBRE, rental budgets have not grown with the median monthly rental of around 90,000 baht for a three-bedroom unit and 80,000 baht for two-bedroom unit.

CBRE focuses on the upper end of the market, so these numbers are higher than the average achieved rents for the whole of the expatriate rental market.

Most expatriates only want to live in a limited number of locations with the preferred locations being between Asoke and Thonglor on Sukhumvit Road, Lumpini and parts of Sathorn.

The choice for most expatriates is to rent in an apartment where one entity owns the whole building or from an individual buy-to-rent investor in a multi-ownership condominium building.

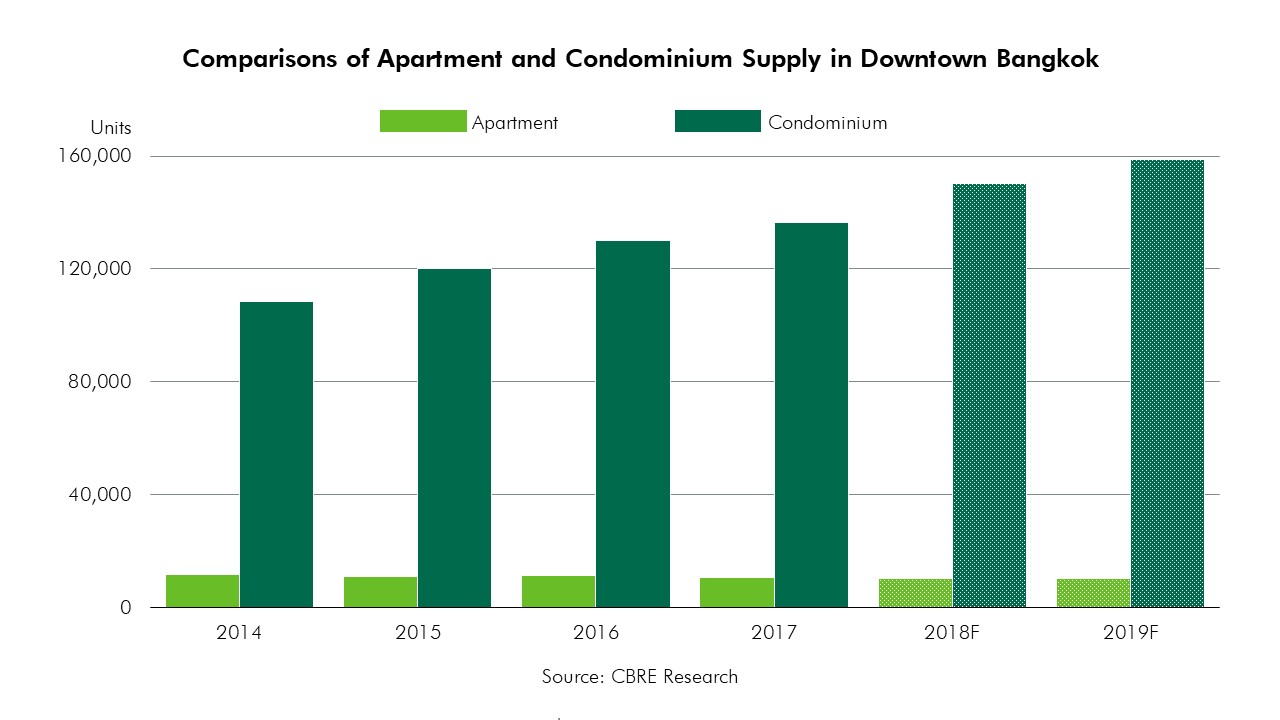

Based on the latest survey by CBRE Research, there are only around 10,000 units in expatriate standard single-ownership apartment buildings in downtown Bangkok. By comparison, there were 80,000 condominiums in the same preferred expatriate rental locations and CBRE estimates that 35-40% of these units are owned by buy-to-rent investors. There is limited new apartment supply, but continued growth in condominium supply.

Comparisons of Apartment and Condominium Supply in Downtown Bangkok

Source: CBRE Research

Many tenants, particularly Japanese expatriates, prefer to rent in apartment buildings where they have a single point of contact with the owners’ representative for all management and maintenance issues.

In a condominium, the building’s property manager is only responsible for the management of the common areas not the maintenance inside the units.

Mr. Theerathorn Prapunpong, Head of Advisory & Transaction Services CBRE Thailand

“Although expatriate tenant numbers and their rental budgets are not growing, there are still profitable opportunities for apartment developers despite increased competition from rental units in condominiums,” said Mr. Theerathorn Prapunpong, Head of Advisory & Transaction Services - Residential Leasing for more than twenty years at CBRE Thailand.

The key to success for renting out residential properties is not just the location but providing the optimum unit size maximising the utility of the space and providing a high standard of finishing, furnishing, facilities and appliances.

CBRE is the sole leasing agent and property manager for Jitimont Residence on Soi Thonglor 16, opposite J Avenue, recently completed.

The development is a good example of how single-ownership rental apartments can still compete with condominiums with a range of units from one to three bedrooms together with a design and specification that appeals to expatriate tenants.

Looking forward to 2019, Mr. Theerathorn does not expect that will be a big increase in the number of expatriate tenants or an increase in their housing budgets but the best quality apartment developments will still achieve high rentals and occupancy.

Similar to this:

CBRE volunteers hit the beach for Wellness Week

CBRE appointed as development consultant for Rajdamri Road Bangkok project

Hotel-inspired condominium for sale in Bangkok