To sustain this demand trend for flexible spaces, future flexible area take-up will increasingly require a high level of investor participation to meet evolving demands regionally, says CBRE Asia Pacific.

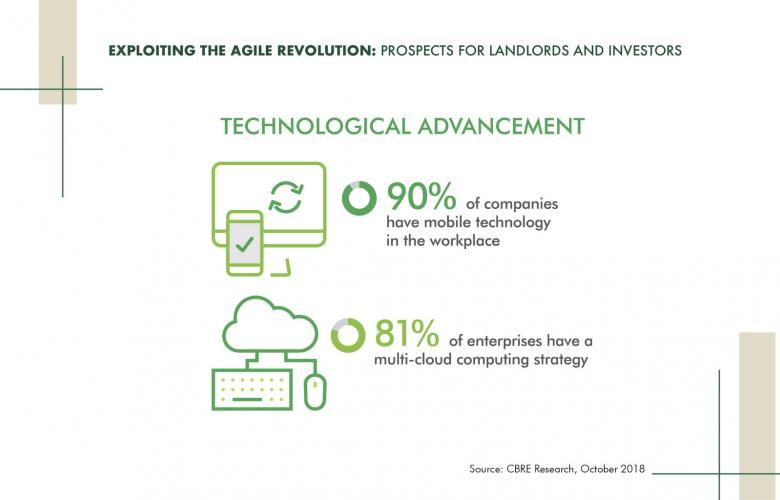

According to CBRE’s report, Exploiting the Agile Revolution: Prospects for Landlords and Investors, advances in technology, a more mobile workforce and unpredictable economic growth are reshaping the business environment for occupiers, prompting investors to treat agile-based space as a long-term investment class within real estate portfolios.

“Investors in Asia Pacific real estate are taking a long-term view of flexible space. Investors are approaching occupier market shifts more strategically and re-balancing portfolios to reflect higher demand for agile space across the region,” said Steve Swerdlow, CEO of Asia Pacific, CBRE.

Flexible space refers to the provision of office space that solves flexible, transient or short-term space requirements. It can range from traditional serviced offices to relatively newer, agile formats, such as turnkey locations. Flex space also includes is co-working, which is undoubtedly registering the strongest growth and attracting the most interest from occupiers.

Flexible space operators have grown rapidly in recent years, reaching a total footprint of just under 40 million sq. ft. in 14 major Asia Pacific cities tracked by CBRE. Growth between 2013-2017 stood at more than 50% year-on-year. With international players entering the region in 2016 and local operators expanding rapidly, the pace of overall growth has accelerated, reaching 57% year-on-year in 2017. China and India are the fastest growing markets for agile-based space, while mature markets like Australia, Hong Kong, Japan and Singapore host a smaller volume of agile space due to lack of vacant office supply.

Although the flexible space model continues to evolve, CBRE Research believes that the fundamental shift found in five macro trends will continue to underpin its solid growth. Workplace Technology, Liquid Workforces, Workplace Evolution, Cost Optimisation and New Accounting Rules will force both investors and occupiers to rethink corporate real estate strategies for the foreseeable future. Longer term, the more efficient use of space could lead to a reduction of space per capita. CBRE’s recent Tech Survey indicated that around 50% of occupiers expect to require less office space in five years, while seeking higher quality space capable of encouraging collaboration, innovation and employee wellbeing.

According to CBRE Research, other major considerations for investors include:

- Refinement of Investment Philosophy: Successful investments in flexible space will rely on attracting a highly diverse tenant mix, providing more flexible leasing terms and value-added services and amenities, especially those geared towards wellness.

- Optimal Allocation of Flexible Space: The majority of investors believe co-working will have a neutral to positive impact on building value when present in less than 40% of the building. As a result, landlords/investors are recommended to achieve an optimal balance of traditional and agile space in a building/portfolio. Creating an equilibrium reduces overdependence on a single occupier while generating synergy between agile space operators and other tenants in the property.

- Scalability and Efficiency Are Key: CBRE Research concludes that the profitability of agile space depends on several other factors including:

- Positioning corporate users to create more upscale locations.

- Allocating 30% or less space to hot desks while increasing allocation to private offices.

- Execution: sourcing suitable sites in competitive locations while maintaining cost control

Findings from the report rely heavily on demand dynamics of tenants. Major considerations for occupiers include:

- Addressing Existing Flexible Concerns: Occupiers are primarily concerned with the dilution of company culture and data security. Secondary concerns include environmental, health and safety requirements, quality of infrastructure and employee retention.

- Understanding in-market Agility Trends: Each Asia Pacific market is unique in its current and future adoption of flexible space, which is driving occupier decision-making.

- Pacific: 30% of Pacific occupiers currently use agile office solutions but 36% are not considering using in the future. Flexible space is preferred by occupiers, with finance and technology firms the most common end-users.

- China: 9% use co-working space due to sudden increases in staff; occupiers turning to higher space utilization and activity-based working as agile solutions.

- No One-size Fits All Strategy: The increasing use of flexible space means occupiers are turning to flexible strategies that allow for adaptation to sudden changes in business conditions.

- Centralized Strategy: Operations are centralized in a single office, with focus on privacy and data security and incorporation of agile solutions (Activity-based Working, provisions for expansion and event space/amenities).

- Hub and Spoke Strategy: Hub-to-host core functions and the inclusion of agile-based solutions like co-working or serviced offices for select project and sales offices, turnkey solutions for larger but short-term nodes, provisions for expansion and contraction in lease terms, and selecting buildings with event space and amenities.

- Dispersed Strategy: Operations that are highly dispersed with mobile workforces are considering co-working or serviced offices for select project and sales offices and plug and play solutions with multiple agile providers with multiple centers.

“Investors must not stand idly by as occupiers demand greater flexibility and the growth of agile space reshapes office demand. Regardless of the way in which investors opt to respond to the agile space revolution, ultimately the need for assets that combine traditional and agile space exists as the market transitions,” said Dr Henry Chin, Head of Research, Asia Pacific, CBRE.

For more information about the Exploiting the Agile Revolution: Prospects for Landlords and Investors report, email Henry Chin, Ph.D. Head of Research, Asia Pacific CBRE via the contact details below.

Similar to this:

How is urban tech driving investment in urban areas?

Services as a space: co-working and the revolution of real estate

Asia Pacific shows fastest growth worldwide in flexible office spaces