In recent years, the Beijing Municipal Government’s implementation of urban renewal measures targeting the decentralization of non-capital functions has caught the attention of both developers and investors.

CBRE recently published Transformation and Opportunities of Jing-Jin-Ji City Cluster, Series 2: Explore Opportunities from Beijing Urban Renewal Activities, which underpins how urban renewal presents opportunities and heightens standards for developers and investors.

The New Master Plan

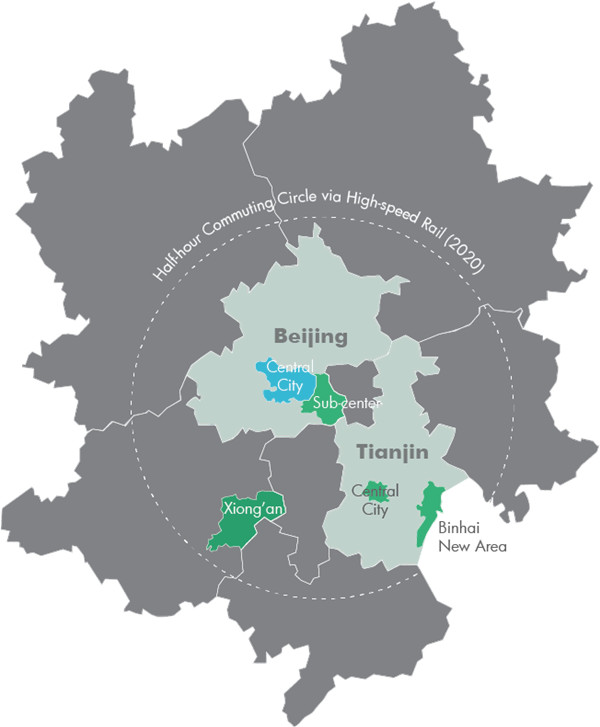

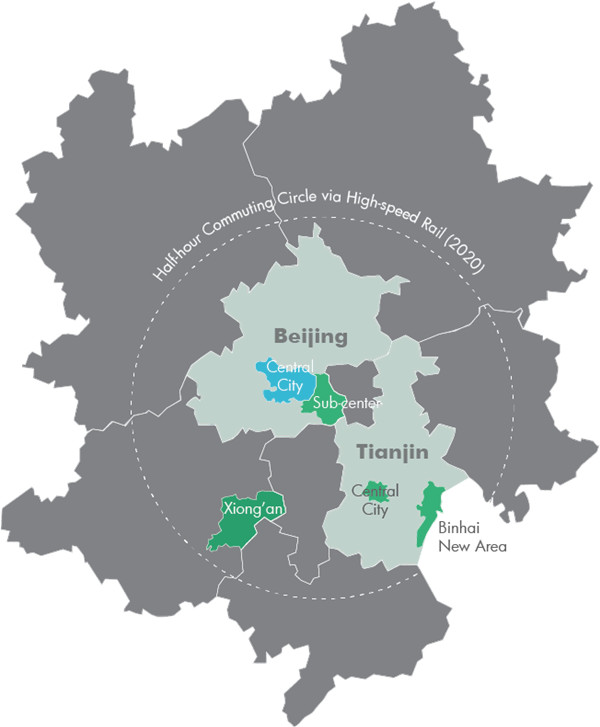

Issued by the central government in September 2017, the "Beijing Municipality Master Plan (2016–2035)"showcases a 20-year urban development framework for Beijing.

The master plan brings a control mechanism to the supply of new commercial real estate in emerging regions as core assets in developed regions become increasingly scarce. Thus, urban renewal and upgrades to inventory facilities will bridge the gap supply and demand in local areas.

While the implementation of urban planning and surrounding policies are expected to restrict the supply of office, logistics, residential and investment properties in the short term, CBRE expects other external market variables to alleviate the supply shortage in the long term.

Residential

Jane Deng, Head of Residential Services, CBRE Northern China, describes: “The new master plan clearly defines the restrictions on the residential supply within the areas of the 4th Ring Road in Beijing. As a result, long-leased apartments have become a popular channel for

investment in Beijing.”

“The diminished supply and strong demand of serviced apartments have driven the average rental increase since 2010. We believe that with the fierce competition to attract high-end talent, employers will increasingly lease these convenient and comfortable serviced apartments for senior employees to retain talent. Commercial properties situated around office submarkets, business parks in Haidian and Chaoyang District where high-tech enterprises are located, and around international schools in the Shunyi District are most suitable for transformation into serviced apartments.”

Office

Trend 1: Spillover and upgrading of existing office spaces

Eric Wang, Executive Director, Advisory & Transaction Services | Office, CBRE Northern China, highlights, “At present, over half of the office buildings in Beijing central city are more than 10 years old, indicating that there will be huge room for improvement for existing office buildings in Beijing.”

Source: CBRE

Trend 2: Retail Spaces converted for Office Use

Christina Liu, Regional Managing Director / Executive Director, Advisory & Transaction Services | Office, CBRE Northern China, believes: “As tenants pay more attention to the utilization of office space due to increasing rental prices, the activity-based workplace strategy will gain more traction. This strategy can be executed through re-designing and re-planning of office spaces, or the use of a third-party joint office...It is expected that traditional retail properties will increasingly complement traditional office buildings where leasable spaces are scarce."

Industrial

Rosemary Li, Head of Advisory & Transaction Services | Industrial, CBRE Northern China, pointed out: “High rentals and the upgrading of tenant structures will also pose higher demands on the refinement and specialization of existing logistics facilities...Intelligent warehousing will improve operating efficiency and reduce labour and storage costs. And, with upgrades in consumption, the rising demand for fresh food and high-end pharmaceuticals will also propel development in the cold-chain logistics segment.”

Investment

Grant Ji, Head of Capital Markets, CBRE Northern China, explains: “The implementation of the new master plan will not erode developers’ and investors’ sentiment toward Beijing’s urban renewal, rather, it will transform how they operate. There will be transformations across:

- Spatial operations: The scope of usage and end-users for governmental and industrial land and properties have been clearly defined, which will encourage developers and investors to seek closer cooperation with occupants. Cooperation will not only flow through areas relating to the construction and transformation of space but also through the entire asset management and operational process. Through maximizing the market value of governmental and industrial facilities, sustainable development will ensue.

- Profit models: The traditional profit-making mode dominated by property sales have reached a bottleneck. Developers and investors will instead seek to derive profits through property rental returns, the development of value-added services for end-users, with role transformation of industrial investors, industrial resource platform operators, construction and property management service providers;

- Financing: The traditional heavy-asset investment and development model has been challenged by regulatory limitations, such as deleveraging policies and property sales restrictions. The government’s gradual liberalization of asset-backed securities will encourage developers and investors to seek lower leverage and more transparent direct financing channels. The dual supervision imposed by the government also puts higher demands on urban areas. The government will incentivize the development of long-leased renewal planning and investment decision-making.”

For more information phone or email Andrew Peck of CBRE via the contact details listed below.

Similar to this:

Sales volume picked up in Singapore during Q2 despite price increases

Manila's office rents among APAC's most affordable - Santos Knight Frank

CBRE Thailand launches skyline photography contest in Bangkok